• LO3–2, LO3–3

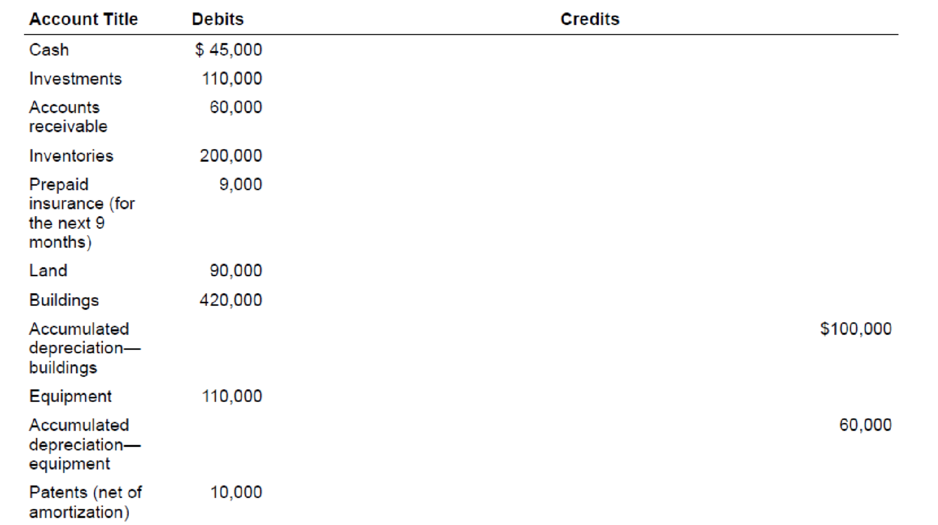

The following is a December 31, 2018, post-closing

Additional Information:

1. The investment account includes an investment in common stock of another corporation of $30,000 which management intends to hold for at least three years. The balance of these investments is intended to be sold in the coming year.

2. The land account includes land which cost $25,000 that the company has not used and is currently listed for sale.

3. The cash account includes $15,000 restricted in a fund to pay bonds payable that mature in 2021 and $23,000 restricted in a three-month Treasury bill.

4. The notes payable account consists of the following:

a. a $30,000 note due in six months

b. a $50,000 note due in six years

c. a $50,000 note due in five annual installments of $10,000 each, with the next installment due February 15, 2019

5. The $60,000 balance in accounts receivable is net of an allowance for uncollectible accounts of $8,000.

6. The common stock account represents 100,000 shares of no par value common stock issued and outstanding. The corporation has 500,000 shares authorized.

Required:

Prepare a classified balance sheet for the Almway Corporation at December 31, 2018.

Trending nowThis is a popular solution!

Chapter 3 Solutions

INTERMEDIATE ACCOUNTING(LL)-W/2 ACCESS

- Accounting principal 2 chapter-14 Q:- On April 1,2019 Cowell Company issued $3000000, 20 year year,ond at 95 so that investors would receive a 6% return their investments. Interest is payable semi-annually. A) Record the Journal entry April 11, 2019 B)Record the journal entry for September 30, 2019(straight-line method of amortization) C) same as B except use the effective interest method. D)Record the adjusting entry Dec. 31, 2019(straight-line method) E)Record the necessary closing entryarrow_forwardhi i need help with this questions with the last 3 questions Adams, Inc., acquires Clay Corporation on January 1, 2020, in exchange for $732,300 cash. Immediately after the acquisition, the two companies have the following account balances. Clay’s equipment (with a five-year remaining life) is actually worth $604,900. Credit balances are indicated by parentheses. Adams Clay Current assets $ 326,000 $ 290,000 Investment in Clay 732,300 0 Equipment 781,900 526,000 Liabilities (280,000 ) (170,000 ) Common stock (350,000 ) (150,000 ) Retained earnings, 1/1/20 (1,210,200 ) (496,000 ) In 2020, Clay earns a net income of $62,700 and declares and pays a $5,000 cash dividend. In 2020, Adams reports net income from its own operations (exclusive of any income from Clay) of $193,000 and declares no dividends. At the end of 2021, selected account balances for the two companies are as follows: Adams Clay Revenues $ (452,000…arrow_forwardhi i need help with this questions with the 3 question Adams, Inc., acquires Clay Corporation on January 1, 2020, in exchange for $732,300 cash. Immediately after the acquisition, the two companies have the following account balances. Clay’s equipment (with a five-year remaining life) is actually worth $604,900. Credit balances are indicated by parentheses. Adams Clay Current assets $ 326,000 $ 290,000 Investment in Clay 732,300 0 Equipment 781,900 526,000 Liabilities (280,000 ) (170,000 ) Common stock (350,000 ) (150,000 ) Retained earnings, 1/1/20 (1,210,200 ) (496,000 ) In 2020, Clay earns a net income of $62,700 and declares and pays a $5,000 cash dividend. In 2020, Adams reports net income from its own operations (exclusive of any income from Clay) of $193,000 and declares no dividends. At the end of 2021, selected account balances for the two companies are as follows: Adams Clay Revenues $ (452,000 ) $…arrow_forward

- PLEASE ANSWER ASAP Problem No. 1 AACA Corporation was incorporated on Dec. 1, 2021, and began operations one week later. Before closing the books for the fiscal year ended Nov. 30, 2022, the controller prepared the following financial statements: AACA Corporation Statement of Financial Position November 30, 2022 Assets Current assets Cash P150,000 Marketable securities, at cost 60,000 Accounts receivable 450,000 Allowance for doubtful accounts ( 59,000) Inventories 430,000 Prepaid insurance 15,000 Total current assets 1,046,000 Property, plant and equipment 426,000 Less accumulated depreciation ( 40,000) Property, plant and equipment, net 386,000 Research and development costs 120,000 Total assets P1,552,000 Liabilities and Shareholders' Equity Current liabilities Accounts payable and accrued expenses P 592,000…arrow_forwardQuestion 1 You are a newly employed finance manager for Finance Adventure Ltd. The following data is available for the company as of 31 June 2020: Current assets of $293,950 Current liabilities $68,700 Total assets $765,600 Equity $305,890 Required: a) The company’s Management Board required you to evaluate two alternative options of debt funding and equity funding for a new project. What is the job are you doing to complete the task? (referring to one out of 3 important questions of corporate finance for your answer) b) Calculate non-current assets, non-current liabilities and build a balance sheet for the company? c) Calculate the return on assets (ROA) of the company given that return on equity (ROE) is 35%? d) What is the price earnings ratio (PE) of the company, given total number of outstanding ordinary shares is 57,000 and market price of each share is $22?arrow_forwardcan you answer #4 Return on assets and #5 Shamrock Corporation was formed 5 years ago through a public subscription of common stock. Daniel Brown, who owns 15% of the common stock, was one of the organizers of Shamrock and is its current president. The company has been successful, but it currently is experiencing a shortage of funds. On June 10, 2021, Daniel Brown approached the Topeka National Bank, asking for a 24-month extension on two $34,920 notes, which are due on June 30, 2021, and September 30, 2021. Another note of $6,040 is due on March 31, 2022, but he expects no difficulty in paying this note on its due date. Brown explained that Shamrock’s cash flow problems are due primarily to the company’s desire to finance a $298,670 plant expansion over the next 2 fiscal years through internally generated funds.The commercial loan officer of Topeka National Bank requested the following financial reports for the last 2 fiscal years. Shamrock CorporationBalance SheetMarch 31…arrow_forward

- Problem 1 The property, plant and equipment section of Radiohead Corporation's statement of financial position at December 31, 2019 included the following items: Land Land improvements Building Machinery and equipment P2,500,000 560,000 3,600,000 6,600,000 During 2020, the following date were available to you upon the analysis of the accounts: Cash paid on purchase of land Mortgage assumed on the land bought, including interest at 16% Realtor's commission Legal fees, realty taxes and documentation expenses Amount paid to relocate persons squatting on the property Cost of tearing down an old building on the land Amount recovered from the salvage of the building demolished Cost of fencing the property Amount paid to a contractor for the building erected Building permit fees Excavation expenses Architect's fee Interest that would have been earned had the money used during the period of construction been invested in the money market Invoice cost of machinery acquired Freight, unloading and…arrow_forwardQuestion 1 of 5 Concord Corporation has income from continuing operations of $266,000 for the year ended December 31, 2022. It also has the following items (before considering income taxes). 1. 2 An unrealized loss of $84,000 on available-for-sale securities. A gain of $27,000 on the discontinuance of a division (comprised of a $16,000 loss from operations and a $43,000 gain on disposal). Assume all items are subject to income taxes at a 21% tax rate. > Prepare a partial income statement, beginning with income from continuing operations, and a statement of comprehensive income. (Enter loss using either a negative sign preceding the number eg. -2,945 or parentheses e.g. (2,945).) Income from Continuing Operations Discontinued Operations Gain from Disposal, Net of Income Taxes Net Income /(Loss) Loss from Operations, Net of Income Tax Savings Net Income /(Loss) Other Comprehensive Income CONCORD CORPORATION Income Statement (Partial) For the Year Ended December 31, 2022 Comprehensive…arrow_forwardQuestion 1 Please answer only letter D please. You are a newly employed finance manager for Finance Adventure Ltd. The following data is available for the company as of 31 June 2020: Current assets of $293,950 Current liabilities $68,700 Total assets $765,600 Equity $305,890 Required: a) The company’s Management Board required you to evaluate two alternative options of debt funding and equity funding for a new project. What is the job are you doing to complete the task? (referring to one out of 3 important questions of corporate finance for your answer) b) Calculate non-current assets, non-current liabilities and build a balance sheet for the company? c) Calculate the return on assets (ROA) of the company given that return on equity (ROE) is 35%? d) What is the price earnings ratio (PE) of the company, given total number of outstanding ordinary shares is 57,000 and market price of each…arrow_forward

- 41 Problem No. 1 AACA Corporation was incorporated on Dec. 1, 2021, and began operations one week later. Before closing the books for the fiscal year ended Nov. 30, 2022, the controller prepared the following financial statements: AACA Corporation Statement of Financial Position November 30, 2022 Assets Current assets Cash P150,000 Marketable securities, at cost 60,000 Accounts receivable 450,000 Allowance for doubtful accounts ( 59,000) Inventories 430,000 Prepaid insurance 15,000 Total current assets 1,046,000 Property, plant and equipment 426,000 Less accumulated depreciation ( 40,000) Property, plant and equipment, net 386,000 Research and development costs 120,000 Total assets P1,552,000 Liabilities and Shareholders' Equity Current liabilities Accounts payable and accrued…arrow_forwardJaez Corporation is in the process of going through a reorganization. As of December 31, 2020, the company's accountant has determined the following information although the company is still several months away from emerging from the bankruptcy proceeding. ts Book Value Fair Value Assets Cash $ 23,000 45,000 140,000 220,000 154,000 $ 23,000 47,000 210,000 260,000 157,000 eBook Inventory Land Buildings Equipment Print ferences Allowed Claims Expected Sett lement Liabilities as of the date of the order for relief Accounts payable Accrued expenses Income taxes payable Note payable (due 2023, secured by land) Note payable (due 2025) Liabilities since the date of the order for relief Accounts payable Note payable (due 2022) Stockholders' equity Common stock Deficit $ 123,000 $ 20,000 30,000 22,000 100,000 170,000 4,000 18,000 100,e00 80,000 $ 60,000 110,000 200,000 (233,000) Prepare the balance sheet for Jaez Corporation. (Neative amounts should be indicated bv a minus sian.) nc Graw lill…arrow_forwardProblem 10-4 (AICPA Adapted) Os December 31, 2020, Kale Company had the following balances in the accounts maintained st First Besk Checking account #201 out 201 Checking Time deponit 1,750,000 (200,000) 250,000 Money market placement 1,000,000 90-day treasury bill du February 28, 201 180-day treasury bill, due March 15, 2001 500,000 900.000 The entity classified investments with original maturities of three months or less as cash equivalents On December 31, 2020, what amount should be reported an cash and cash equivalents? 3,400,000 & 2,000,000 2,400,000 d. 3,200,000arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning