a.

Record the 10 events in general journal format of Company BC.

a.

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Record the 10 events in general journal format of Company BC as follows:

| Event | Account titles and Explanation | Debit | Credit |

| 1. | Office furniture | $12,000 | |

| Cash | $12,000 | ||

| (To record purchase of office furniture) | |||

| 2. | Prepaid insurance | $5,400 | |

| Cash | $5,400 | ||

| (To record cash paid for prepaid insurance) | |||

| 3. | Supplies | $1,800 | |

| Cash | $1,800 | ||

| (To record purchase of supplies for cash) | |||

| 4. | Cash | $39,000 | |

| Service revenue | $39,000 | ||

| (To record cash paid for service provided) | |||

| 5. | Salaries expenses | $9,000 | |

| Cash | $9,000 | ||

| (To record cash paid for salaries expenses) | |||

| 6. | Cash | $12,000 | |

| Unearned revenue | $12,000 | ||

| (To record cash received for service yet to provide) | |||

| 7. | $2,500 | ||

| Accumulated depreciation | $2,500 | ||

| (To record depreciation expenses incurred at the end of the accounting period) | |||

| 8. | Insurance expense (2) | $4,500 | |

| Prepaid insurance | $4,500 | ||

| (To record insurance expenses incurred at the end of the accounting period) | |||

| 9. | Supplies expense | $1,550 | |

| Supplies (3) | $1,550 | ||

| (To record supplies expenses incurred at the end of the accounting period) | |||

| 10. | Unearned revenue (4) | $9,000 | |

| Service revenue | $9,000 | ||

| (To record unearned revenue incurred at the end of the accounting period) |

Table (1)

Working notes:

Calculate depreciation expense.

Calculate insurance expense.

Calculate supplies.

Calculate unearned revenue.

(4)

(4)

b.

Prepare an income statement, balance sheet and statement of cash flows of Company BC.

b.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

Prepare an income statement of Company BC as follows:

| Company BC | ||

| Income Statement | ||

| For the Year Ended December 31, Year 2 | ||

| Particulars | Amount | Amount |

| Service revenue | $48,000 | |

| Less: Expenses: | ||

| Salaries expenses | $9,000 | |

| Depreciation expenses | $2,500 | |

| Insurance expenses | $4,500 | |

| Supplies expense | $1,550 | |

| Total expenses | $17,550 | |

| Net income | $30,450 | |

Table (1)

Balance sheet:

This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and

Prepare the balance sheet of Company BC as follows:

| Company BC | ||

| Balance Sheet | ||

| For the Year Ended December 31, Year 2 | ||

| Amount | Amount | |

| Assets: | ||

| Cash | $47,800 | |

| Prepaid insurance | $900 | |

| Supplies | $250 | |

| Office furniture | $12,000 | |

| Less: Accumulated depreciation | 2,500 | $9,500 |

| Total assets | $58,450 | |

| Liabilities: | ||

| Unearned revenue | $3,000 | |

| Total liabilities | $3,000 | |

| Stockholders' equity: | ||

| Common stock | $13,000 | |

| $42,450 | ||

| Total stockholders' equity | $55,450 | |

| Total liabilities and stockholders' equity | $58,450 | |

Table (2)

Statement of cash flows:

It is one of the financial statement that shows the cash and cash equivalents of a company for a particular period. It determines the net changes in cash through reporting the sources and uses of cash due to the operating, investing, and financing activities of a company.

Prepare the statement of cash flows of Company BC as follows:

| Company BC | ||

| Statement of Cash Flows | ||

| For the Year Ended December 31, Year 2 | ||

| Particulars | Amount | Amount |

| Cash flow from operating activities: | ||

| Received cash from customers (6) | $51,000 | |

| Less: Paid cash for expenses (7) | ($16,200) | |

| Net cash flow from operating activities | $34,800 | |

| Cash flows from investing activities: | ||

| Purchased office furniture | ($12,000) | |

| Net cash flow from investing activities | ($12,000) | |

| Cash flows from financing activities: | ||

| Net cash flow from financing activities | $0 | |

| Net change in cash | $22,800 | |

| Add: Opening cash balance | $25,000 | |

| Ending cash balance | $47,800 | |

Table (3)

Working note:

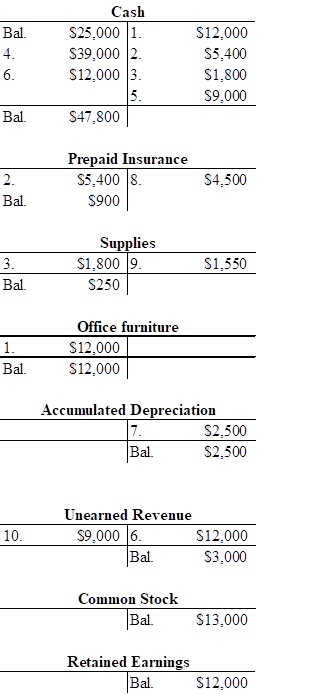

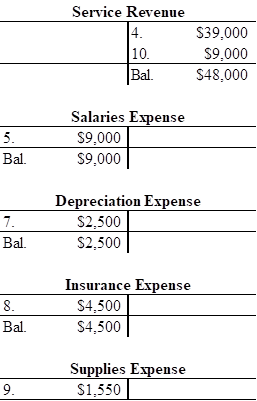

Calculate T- Accounts for 10 events.

Figure (1)

Figure (2) (5)

Calculate received cash from customers.

Calculate paid cash for expenses.

Want to see more full solutions like this?

Chapter 3 Solutions

FUND.FINANCIAL ACCT.CONCEPTS-ACCESS

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education