Concept explainers

1

To prepare: The T-accounts and enter the beginning balance from the

1

Explanation of Solution

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability,

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

The T-accounts of given item in trial balance are as follows:

| Cash | |||

| Jan. 1 | $20,000 | ||

| Bal. | $20,000 | ||

| Equipment | |||

| Jan. 1 | $15,000 | ||

| Bal. | $15,000 | ||

| Common stock | |||

| Jan. 1 | $25,000 | ||

| Bal. | $25,000 | ||

|

Accounts receivables | |||

| Jan. 1 | $8,000 | ||

| Bal. | $8,000 | ||

| Supplies | |||

| Jan. 1 | $4,000 | ||

| Bal. | $4,000 | ||

| Salaries payable | |||

| Jan. 1 | $7,500 | ||

| Bal. | $7,500 | ||

|

Accumulated | |||

| Jan. 1 | $5,000 | ||

| Bal. | $5,000 | ||

|

| |||

| Jan. 1 | $9,500 | ||

| Bal. | $9,500 | ||

2

To record: The

2

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

The journal entries for given transactions of Company R are as follows:

| Date | Account Title and Explanation | Debit($) | Credit($) |

| 2015 | Accounts receivable | 21,000 | |

| March 12 | Cash | 39,000 | |

| Service revenue | 60,000 | ||

| (To record the recognized service revenue on account and cash) | |||

| 2015 | Cash | 18,000 | |

| May, 2 | Accounts receivable | 18,000 | |

| (To record cash collection from customer) | |||

| 2015 | Cash | 6,000 | |

| June 30 | Common stock | 6,000 | |

| (To record the cash received from issuance of common stock) | |||

| 2015 | Salaries payable | 7,500 | |

| August 1 | Salaries expense | 18,500 | |

| Cash | 26,000 | ||

| (To record the payment of current and past salaries) | |||

| 2015 | Repairs and maintenance expense | 13,000 | |

| September 25 | Cash | 13,000 | |

| (To record the payment of repairs and maintenance expense) | |||

| 2015 | Equipment | 8,000 | |

| October 19 | Cash | 8,000 | |

| (To record purchase of equipment in cash) | |||

| 2015 | Dividends | 1,100 | |

| December 30 | Cash | 1,100 | |

| (To record the payment of dividends) | |||

Table (1)

3

To post: The transactions to T-accounts.

3

Explanation of Solution

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

T-accounts of above transactions are as follows:

| Cash | |||

| Jan. 1 | $20,000 | Aug. 1 | $26,000 |

| Mar. 12 | $39,000 | Sep. 25 | $13,000 |

| May 2 | $18,000 | Oct. 19 | $8,000 |

| Jun. 30 | $6,000 | Dec. 30 | $1,100 |

| Total | $83,000 | Total | $48,100 |

| Bal. | $34,900 | ||

| Equipment | |||

| Jan. 1 | $15,000 | ||

| Oct. 19 | $8,000 | ||

| Bal. | $23,000 | ||

| Jan. 1 | $25,000 | ||

| Jun. 30 | $6,000 | ||

| Bal. | $31,000 | ||

| Dividends | |||

| Jan. 1 | $0 | ||

| Dec. 30 | $1,100 | ||

| Bal. | $1,100 | ||

| Accounts receivables | |||

| Jan. 1 | $8,000 | ||

| Mar. 12 | $21,000 | May 2 | $18,000 |

| Total | $29,000 | Total | $18,000 |

| Bal. | $11,000 | ||

| Common stock | |||

|

Accumulated Depreciation | |||

| Jan. 1 | $5,000 | ||

| Bal. | $5,000 | ||

| Supplies | |||

| Jan. 1 | $4,000 | ||

| Bal. | $4,000 | ||

| Salaries payable | |||

| Aug. 1 | $7,500 | Jan. 1 | $7,500 |

| Bal. | $0 | ||

| Retained earnings | |||

| Jan. 1 | $9,500 | ||

| Bal. | $9,500 | ||

| Salaries expense | |||

| Jan. 1 | $0 | ||

| Aug. 1 | $18,500 | ||

| Bal. | $18,500 | ||

| Service revenue | |||

| Jan. 1 | $0 | ||

| Mar. 12 | $60,000 | ||

| Bal. | $60,000 | ||

| Repairs and maintenance expense | |||

| Jan. 1 | $0 | ||

| Sep. 25 | $13,000 | ||

| Bal. | $13,000 | ||

4

To prepare: The unadjusted trial balance of Company R.

4

Explanation of Solution

Unadjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts before making adjusting journal entries at the end of the period.

| Company R | ||

| Unadjusted Trial Balance | ||

| December 31, 2015 | ||

| Accounts | Debit | Credit |

| Cash | $34,900 | |

| Accounts Receivable | 11,000 | |

| Supplies | 4,000 | |

| Equipment | 23,000 | |

| Accumulated depreciation | 5,000 | |

| Salaries payable | 0 | |

| Common stock | 31,000 | |

| Retained earnings | 9,500 | |

| Dividends | 1,100 | |

| Service revenue | 60,000 | |

| Salaries expense | 18,500 | |

| Repairs and maintenance expense | 13,000 | |

| Depreciation expense | 0 | |

| Supplies expense | 0 | |

| Totals | $105,500 | $105,500 |

Table (2)

Therefore, the total of debit, and credit columns of unadjusted trial balance is $105,500 and agree.

5

To record: The given

5

Explanation of Solution

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. The purpose of adjusting entries is to adjust the revenue, and the expenses during the period in which they actually occurs.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Adjusting entries of Company R are as follows:

Accrued salaries:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| December 31, 2015 | Salaries expense | 1,100 | ||

| Salaries payable | 1,100 | |||

| (To record the salaries expense incurred at the end of the accounting year) |

Table (3)

Following is the rule of debit and credit of above transaction:

- Salaries expense is an expense, and it decreased the value of stockholder’s equity. Therefore, it is debited.

- Salaries payable is a liability account. There is a decrease in liability, therefore it is credited.

Depreciation expense:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| December 31, 2015 | Depreciation Expense | 5,000 | ||

| Accumulated Depreciation | 5,000 | |||

| (To record the amount of depreciation for the year) |

Table (4)

Following is the rule of debit and credit of above transaction:

- Depreciation expense is an expense, and it decreased the value of stockholder’s equity. Therefore, it is debited.

- Accumulated depreciation is a contra-asset account. There is a decrease in assets, therefore it is credited.

Office supplies expense:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| December 31, 2015 | Supplies expense | 1,200 | ||

| Supplies | 1,200 | |||

| (To record the supplies expense incurred at the end of the accounting year) |

Table (5)

Following is the rule of debit and credit of above transaction:

- Supplies expense is an expense, and it decreased the value of stockholder’s equity. Therefore, it is debited.

- Supplies are an asset account. There is a decrease in assets, therefore it is credited.

6

To post: The adjusting entries to appropriate T-accounts.

6

Explanation of Solution

| Depreciation expense | |||

| Jan. 1 | $0 | ||

| Dec. 31 | $5,000 | ||

| Bal. | $5,000 | ||

| Accumulated Depreciation | |||

| Jan. 1 | $5,000 | ||

| Dec. 31 | $5,000 | ||

| Bal. | $10,000 | ||

| Salaries expense | |||

| Jan. 1 | $0 | ||

| Aug. 1 | $18,500 | ||

| Dec. 31 | $1,100 | ||

| Bal. | $19,600 | ||

| Supplies expense | |||

| Jan. 1 | $0 | ||

| Dec. 31 | $2,800 | ||

| Bal. | $2,800 | ||

| Supplies | |||

| Jan. 1 | $4,000 | Dec. 31 | $2,800 |

| Total | $4,000 | Total | $2,800 |

| Bal. | $1,200 | ||

| Salaries payable | |||

| Aug. 1 | $7,500 | Jan. 1 | $7,500 |

| Dec. 11 | $1,100 | ||

| Total | $7,500 | Total | $8,600 |

| Bal. | $1,100 | ||

7

To prepare: The adjusted trial balance of Company R.

7

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Adjusted trial balance of Company R is as follows:

| Company R | ||

| Adjusted Trial Balance | ||

| December 31, 2015 | ||

| Accounts | Debit | Credit |

| Cash | 34,900 | |

| Accounts Receivable | 11,000 | |

| Supplies | 1,200 | |

| Equipment | 23,000 | |

| Accumulated depreciation | 10,000 | |

| Salaries payable | 1,100 | |

| Common stock | 31,000 | |

| Retained earnings | 9,500 | |

| Dividends | 1,100 | |

| Service revenue | 60,000 | |

| Salaries expense | 19,600 | |

| Repairs and maintenance expense | 13,000 | |

| Depreciation expense | 5000 | |

| Supplies expense | 2,800 | |

| Totals | $111,600 | $111,600 |

Table (6)

Therefore, the total of debit, and credit columns of adjusted trial balance is $111,600 and agree.

8

To prepare: An income statement for 2015 and classified balance sheet as on December 31, 2015.

8

Explanation of Solution

Income statement:

This is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

Classified balance sheet:

This is the financial statement of a company which shows the grouping of similar assets and liabilities under subheadings.

Income statement:

Income statement of Company R is as follows:

| Company R | ||

| Income statement | ||

| For the year ended December 31, 2015 | ||

| $ | $ | |

| Service revenue (A) | 60,000 | |

| Expenses: | ||

| Salaries expense | 19,600 | |

| Repairs and maintenance expense | 13,000 | |

| Depreciation expense | 5,000 | |

| Supplies expense | 2,800 | |

| Total expense (B) | 40,400 | |

|

Net income

| 19,600 | |

Table (7)

Therefore, the net income of Company R is $19,600.

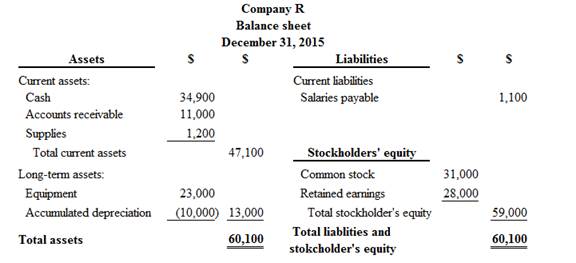

Classified balance sheet:

Classified balance sheet of Company R is as follows:

Figure (1)

Therefore, the total assets of Company R are $60,100, and the total liabilities and stockholders’ equity are $60,100.

Working note:

Calculation of ending balance retained earnings

9

To record: The necessary closing entries of Company R.

9

Explanation of Solution

Closing entries:

Closing entries are those journal entries, which are passed to transfer the final balances of temporary accounts, (all revenues account, all expenses account and dividend) to the retained earnings. Closing entries produce a zero balance in each temporary account.

Closing entries of Company R is as follows:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| 2015 | Service revenue | 60,000 | ||

| December 31 | Retained earnings | 60,000 | ||

| (To close all revenue account) | ||||

| 2015 | Retained earnings | 40,400 | ||

| December 31 | Salaries expense | 19,600 | ||

| Repairs and maintenance expense | 13,000 | |||

| Depreciation expense | 5,000 | |||

| Supplies expense | 2,800 | |||

| (To close all the expenses account) | ||||

| 2015 | Retained earnings | 1,100 | ||

| December 31 | Dividends | 1,100 | ||

| (To close the dividends account) | ||||

Table (8)

10

To

10

Explanation of Solution

| Depreciation expense | |||

| Jan. 1 | $0 | ||

| Dec. 31 | $5,000 | Dec. 31 | $5,000 |

| Bal. | $0 | ||

| Salaries expense | |||

| Jan. 1 | $0 | ||

| Aug. 1 | $18,500 | ||

| Dec. 31 | $1,100 | Dec. 31 | $19,600 |

| Bal. | $0 | ||

| Supplies expense | |||

| Jan. 1 | $0 | ||

| Dec. 31 | $2,800 | Dec. 31 | $2,800 |

| Bal. | $0 | ||

| Repairs and maintenance expense | |||

| Jan. 1 | $0 | ||

| Sep. 25 | $13,000 | Dec. 31 | $13,000 |

| Bal. | $0 | ||

| Dividends | |||

| Jan. 1 | $0 | ||

| Dec. 30 | $1,100 | Dec. 31 | $1,100 |

| Bal. | $0 | ||

| Service revenue | |||

| Jan. 1 | $0 | ||

| Dec. 31 | $60,000 | Mar. 12 | $60,000 |

| Bal. | $0 | ||

| Retained earnings | |||

| Dec. 31 | $40,400 | Jan. 1 | $9,500 |

| Dec. 31 | $1,100 | Dec. 31 | $60,000 |

| Total | $41,500 | Total | $69,500 |

| Bal. | $28,000 | ||

11

To prepare: A post-closing trial balance of Company R.

11

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Post-closing trial balance of Company R is as follows:

| Company R | ||

| Post-closing trial balance | ||

| December 31, 2015 | ||

| Accounts | Debit | Credit |

| Cash | $34,900 | |

| Accounts Receivable | 11,000 | |

| Supplies | 1,200 | |

| Equipment | 23,000 | |

| Accumulated depreciation | 10,000 | |

| Salaries payable | 1,100 | |

| Common stock | 31,000 | |

| Retained earnings | 28,000 | |

| Totals | $70,100 | $70,100 |

Table (9)

Therefore, the total of debit, and credit columns of post-closing trial balance is $70,100 and agree.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting With Connect Plus W/learnsmart

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education