1.

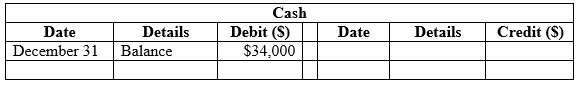

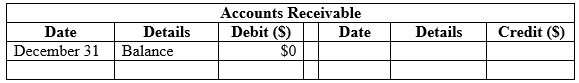

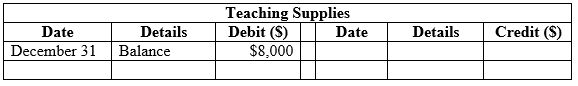

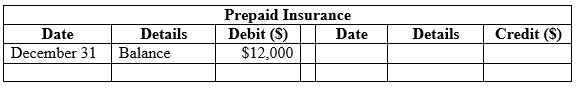

Set up T-accounts for the general ledger accounts with the unadjusted balances.

1.

Explanation of Solution

T-account: The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit, and the right hand side is known as credit.

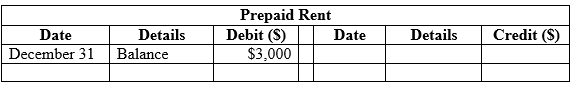

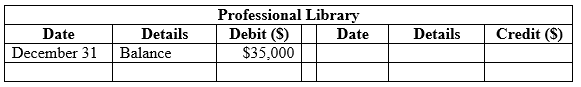

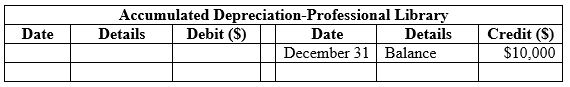

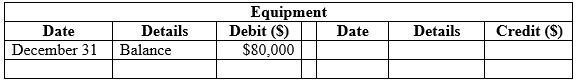

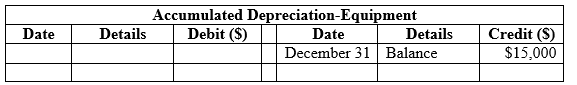

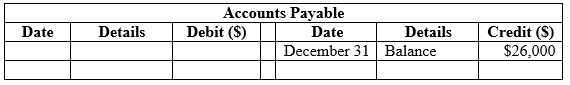

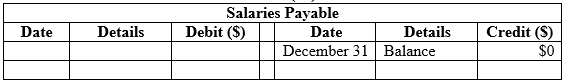

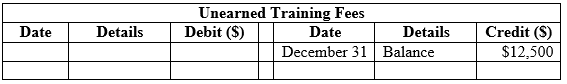

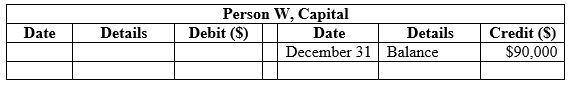

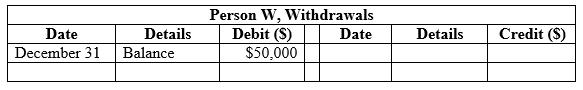

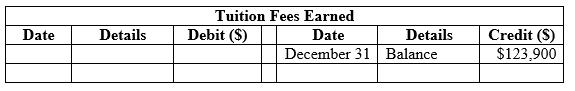

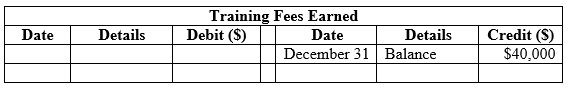

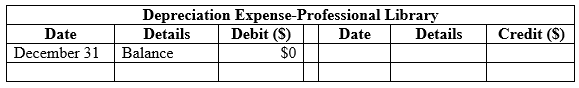

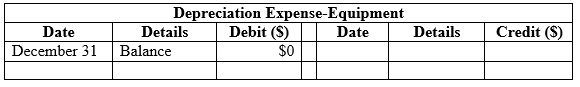

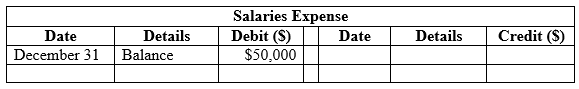

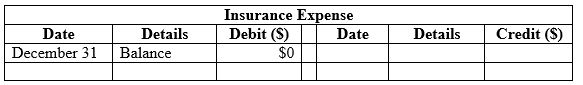

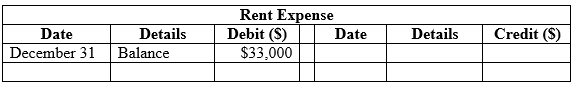

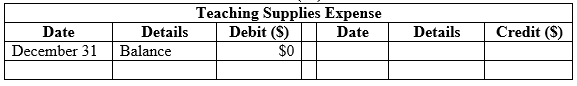

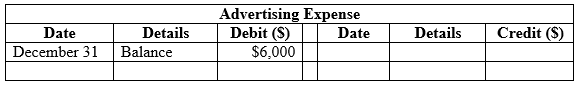

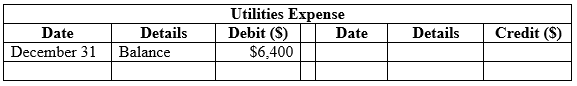

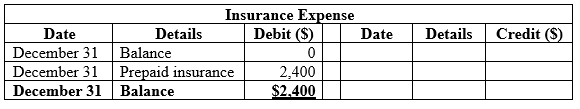

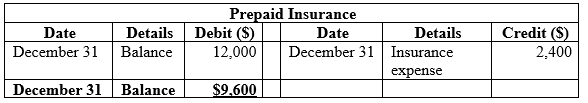

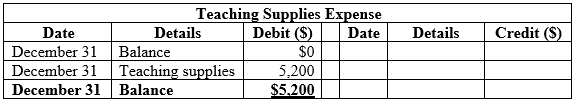

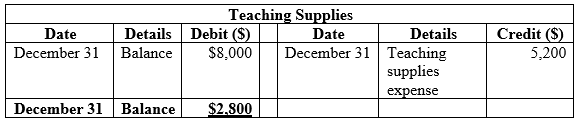

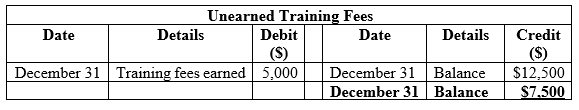

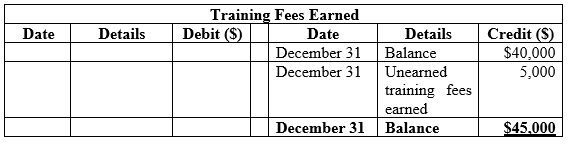

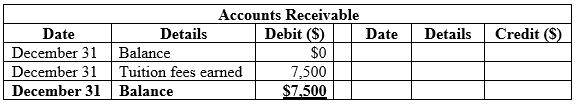

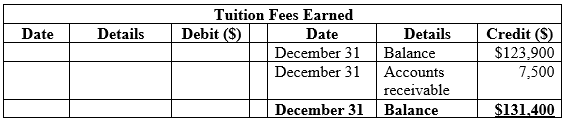

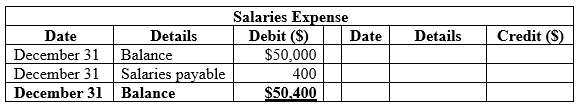

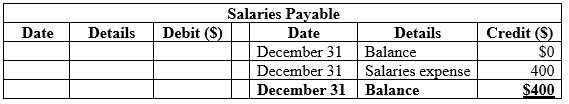

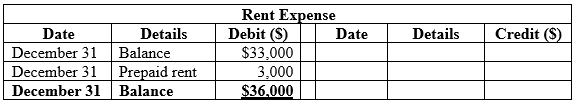

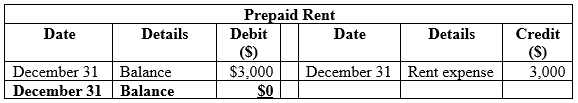

Table (1)

Table (2)

Table (3)

Table (4)

Table (5)

Table (6)

Table (7)

Table (8)

Table (9)

Table (10)

Table (11)

Table (12)

Table (13)

Table (14)

Table (15)

Table (16)

Table (17)

Table (18)

Table (19)

Table (20)

Table (21)

Table (22)

Table (23)

Table (24)

2.

Journalize the

2.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and

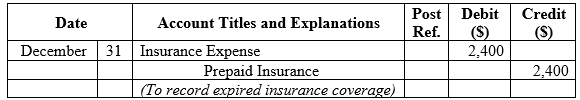

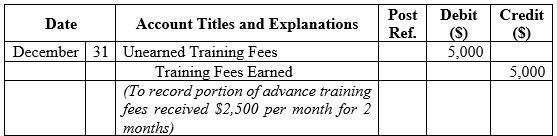

a.

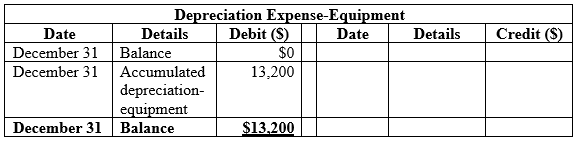

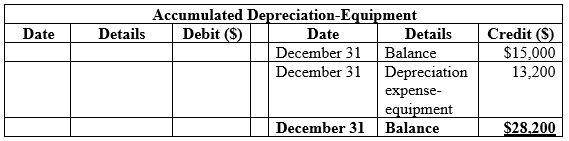

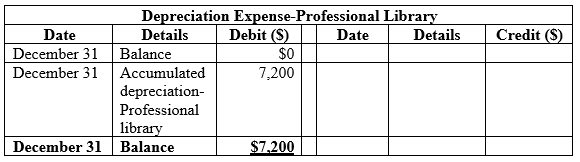

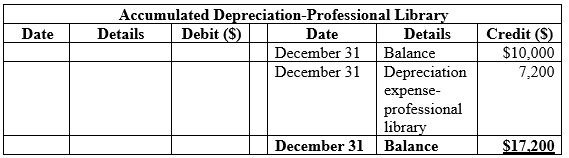

Table (25)

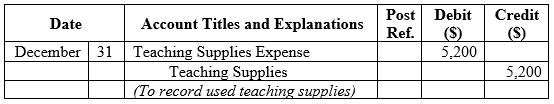

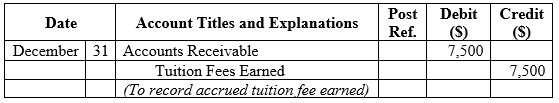

b.

Table (26)

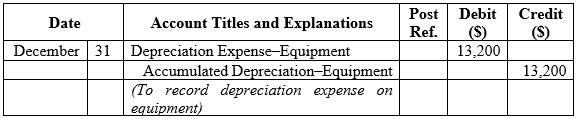

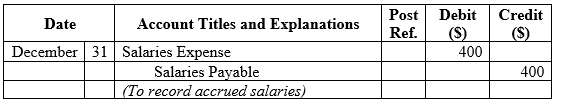

c.

Table (27)

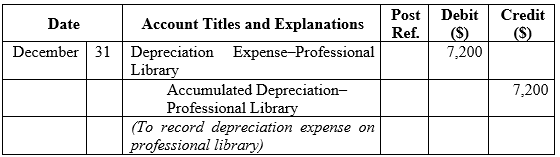

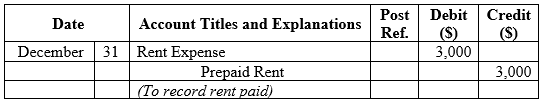

d.

Table (28)

e.

Table (29)

f.

Table (30)

g.

Table (31)

h.

Table (32)

Table (33)

Table (34)

Table (35)

Table (36)

Table (37)

Table (38)

Table (39)

Table (40)

Table (41)

Table (42)

Table (43)

Table (44)

Table (45)

Table (46)

Table (47)

Table (48)

3.

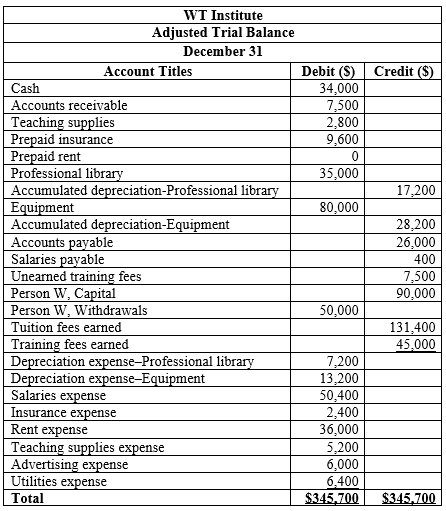

Prepare an adjusted

3.

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is that statement which contains complete list of accounts with their adjusted balances, after all relevant adjustments have been made. This statement is prepared at the end of every financial period.

Table (49)

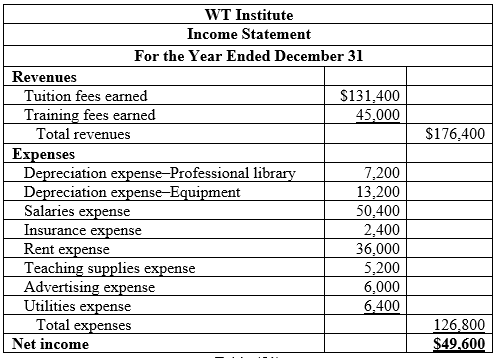

4.

Prepare income statement, owner’s equity and balance sheet of WT Institute for the year ended December 31.

4.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Table (50)

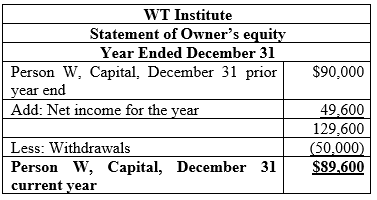

Statement of owner’s equity for WT Institute for the year ended December 31.

Table (51)

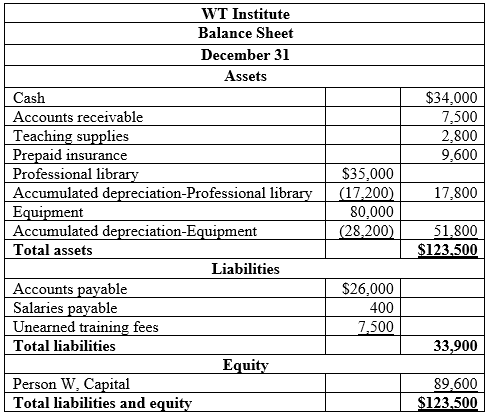

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Note: Refer to income statement for value and computation of net income.

Table (52)

Want to see more full solutions like this?

Chapter 3 Solutions

Principles of Financial Accounting.

- Reviewing insurance policies revealed that a single policy was purchased on August 1, for one years coverage, in the amount of $6,000. There was no previous balance in the Prepaid Insurance account at that time. Based on the information provided: A. Make the December 31 adjusting journal entry to bring the balances to correct. B. Show the impact that these transactions had.arrow_forwardThe account balances of Miss Beverlys Tutoring Service as of June 30, the end of the current fiscal year, are as follows: Required 1. Data for the adjustments are as follows: a. Expired or used up insurance, 470. b. Depreciation expense on equipment, 948. c. Depreciation expense on the van, 1,490. d. Salary accrued (earned) since the last payday, 574 (owed and to be paid on the next payday). e. Supplies remaining as of June 30, 407. Your instructor may want you to use a work sheet for these adjustments. 2. Journalize the adjusting entries. 3. Prepare an income statement. 4. Prepare a statement of owners equity. Assume that there was an additional investment of 3,000 on June 10. 5. Prepare a balance sheet 6. Journalize the closing entries using the four steps in the proper sequence. Check Figure Net income, 19,567arrow_forwardValley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 2019, follows: The following business transactions were completed by Valley Realty during August 2019: Aug. 1. Purchased office supplies on account, 3,150. 2.Paid rent on office for month, 7,200. 3.Received cash from clients on account, 83,900. 5.Paid insurance premiums, 12,000. 9.Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost, 400. Analyzing Transactions Aug. 17. Paid advertising expense, 8,000. 23.Paid creditors on account, 13,750. Enter the following transactions on Page 19 of the two-column journal: 29.Paid miscellaneous expenses, 1,700. 30.Paid automobile expense (including rental charges for an automobile), 2,500. 31.Discovered an error in computing a commission during July; received cash from the salesperson for the overpayment, 2,000. 31.Paid salaries and commissions for the month, 53,000. 31.Recorded revenue earned and billed to clients during the month, 183,500. 31.Purchased land for a future building site for 75,000, paying 7,500 in cash and giving a note payable for the remainder. 31.Withdrew cash for personal use, 1,000. 31.Rented land purchased on August 31 to a local university for use as a parking lot during football season (September, October, and November); received advance payment of 5,000. Instructions 1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for August in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of August 31, 2019. 5. Assume that the August 31 transaction for Cindy Getmans cash withdrawal should have been 10,000. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forward

- Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2019, follows: The following business transactions were completed by Elite Realty during April 2019: Apr. 1. Paid rent on office for month, 6,500. 2.Purchased office supplies on account, 2,300. 5.Paid insurance premiums, 6,000. 10.Received cash from clients on account, 52,300. 15.Purchased land for a future building site for 200,000, paying 30,000 in cash and giving a note payable for the remainder. 17.Paid creditors on account, 6,450. 20.Returned a portion of the office supplies purchased on April 2, receiving full credit for their cost, 325. 23.Paid advertising expense, 4,300. Enter the following transactions on Page 19 of the two-column journal: 27.Discovered an error in computing a commission; received cash from the salesperson for the overpayment, 2,500. 28.Paid automobile expense (including rental charges for an automobile), 1,500. 29.Paid miscellaneous expenses, 1,400. 30.Recorded revenue earned and billed to clients during the month, 57,000. 30.Paid salaries and commissions for the month, 11,900. 30.Withdrew cash for personal use, 4,000. 30.Rented land purchased on April 15 to local merchants association for use as a parking lot in May and June, during a street rebuilding program; received advance payment of 10,000. Instructions 1. Record the April 1, 2019, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 2019. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardAccruals and Deferrals For the following situations, indicate whether each involves a deferred expense (DE), a deferred revenue (DR), an accrued liability (AL), or an accrued asset (AA). Example: DE Office supplies purchased in advance of their use __________ 1. Wages earned by employees but not yet paid __________ 2. Cash collected from subscriptions in advance of publishing a magazine __________ 3. Interest on a customer loan for which principal and interest have not yet been collected __________ 4. One years premium on life insurance policy paid in advance __________ 5. Office building purchased for cash __________ 6. Rent collected in advance from a tenant __________ 7. State income taxes owed at the end of the year __________ 8. Rent owed by a tenant but not yet collectedarrow_forwardThe transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.arrow_forward

- The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.arrow_forwardThe unadjusted trial balance of Recessive Interiors at January 31, 2019, the end of the year, follows: The data needed to determine year-end adjustments are as follows: a. Supplies on hand at January 31 are 2,850. b. Insurance premiums expired during the year are 3,150. c. Depreciation of equipment during the year is 5,250. d. Depreciation of trucks during the year is 4,000. e. Wages accrued but not paid at January 31 are 900. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark () in the Posting Reference column. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed. 3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Recessive Interiors chart of accounts should be used: Wages Payable, 22; Depreciation ExpenseEquipment, 54; Supplies Expense, 55; Depreciation ExpenseTrucks, 56; Insurance Expense, 57. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owners equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 7. Prepare a post-closing trial balance.arrow_forward[The following information applies to the questions displayed below.]Wells Technical Institute (WTI) provides training to individuals who pay tuition directly to the school. WTI also offers training to groups in off-site locations. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Its unadjusted trial balance as of December 31 follows, along with descriptions of items a through h that require adjusting entries on December 31. Additional Information Items An analysis of WTI's insurance policies shows that $3,732 of coverage has expired. An inventory count shows that teaching supplies costing $3,235 are available at year-end. Annual depreciation on the equipment is $14,929. Annual depreciation on the professional library is $7,464. On September 1, WTI agreed to do five training courses for a client for $2,300 each. Two courses will start immediately and finish before the end of the year. Three courses will not begin until next year. The client paid…arrow_forward

- [The following information applies to the questions displayed below.]Wells Technical Institute (WTI) provides training to individuals who pay tuition directly to the school. WTI also offers training to groups in off-site locations. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Its unadjusted trial balance as of December 31 follows, along with descriptions of items a through h that require adjusting entries on December 31. Additional Information Items An analysis of WTI's insurance policies shows that $3,732 of coverage has expired. An inventory count shows that teaching supplies costing $3,235 are available at year-end. Annual depreciation on the equipment is $14,929. Annual depreciation on the professional library is $7,464. On September 1, WTI agreed to do five training courses for a client for $2,300 each. Two courses will start immediately and finish before the end of the year. Three courses will not begin until next year. The client paid…arrow_forward[The following information applies to the questions displayed below.] Wells Technical Institute (WTI) provides training to individuals who pay tuition directly to the school. WTI also offers training to groups in off-site locations. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Its unadjusted trial balance as of December 31 follows, along with descriptions of items a through h that require adjusting entries on December 31. Additional Information Items An analysis of WTI's insurance policies shows that $3,996 of coverage has expired. An inventory count shows that teaching supplies costing $3,464 are available at year-end. Annual depreciation on the equipment is $15,986. Annual depreciation on the professional library is $7,993. On September 1, WTI agreed to do five training courses for a client for $2,300 each. Two courses will start immediately and finish before the end of the year. Three courses will not begin until next year. The client paid…arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.]Wells Technical Institute (WTI) provides training to individuals who pay tuition directly to the school. WTI also offers training to groups in off-site locations. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Its unadjusted trial balance as of December 31 follows, along with descriptions of items a through h that require adjusting entries on December 31. Additional Information Items An analysis of WTI's insurance policies shows that $3,600 of coverage has expired. An inventory count shows that teaching supplies costing $3,120 are available at year-end. Annual depreciation on the equipment is $14,400. Annual depreciation on the professional library is $7,200. On September 1, WTI agreed to do five training courses for a client for $2,800 each. Two courses will start immediately and finish before the end of the year. Three courses will not…arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage