Financial Accounting-w/cd-package

3rd Edition

ISBN: 9780131060876

Author: REIMERS

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 60PA

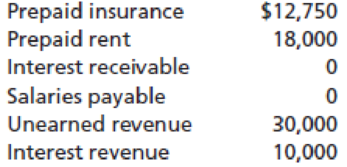

Following is a partial list of financial statement items from the records of Marshall’s Company at December 31, 2010, before any adjustments have been made:

Additional information includes the following:

- The insurance policy indicates that on December 31, 2010, only five months remain on the 24-month policy that originally cost $18,000 (purchased on June 1, 2009).

- Marshall’s has a note receivable with $2,500 of interest due from a customer on January 1, 2011. This amount has not been recorded.

- The accounting records show that one-third of the revenue paid in advance by a customer on July 1, 2010, has now been earned.

- The company paid $18,000 for rent for nine months starting on August 1, 2010, recording the total amount as prepaid rent.

- At year end, Marshall’s owed $7,000 worth of salaries to employees for work done in December 2010. The next payday is January 5, 2011. The salary expense has not been recorded.

Requirements

- 1. Use the

accounting equation to show the adjustments that must be made prior to the preparation of the financial statements for the year ended December 31, 2010. - 2. For the accounts shown, calculate the account balances that would be shown on Marshall’s financial statements for the year ended December 31, 2010; balance sheet at December 31, 2010.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Johnson company’s financial year ended on December 31, 2010. All thetransactions related to the company’s uncollectible accounts are can be found below:

The accounts receivable account had a balance of $114,630 and the beginning balance in the allowance for uncollectible accounts was $6,200.

Required:

Prepare the balance sheet extract as at Dec 31 to show the net realizable value for the Accounts Receivable.

Weldon Corporation's fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during

2024:

March 17 Accounts receivable of $2,600 were written off as uncollectible. The company uses the allowance method.

March 30 Loaned an officer of the company $33,000 and received a note requiring principal and interest at 7% to be

paid on March 30, 2025.

May 30 Discounted the $33,000 note at a local bank. The bank's discount rate is 8 %. The note was discounted without

recourse and the sale criteria are met.

June 30 Sold merchandise to the Blankenship Company for $21,000. Terms of the sale are

4/10/30 Weldon uses the

gross method to account for cash discounts.

July 8 The Blankenship Company paid its account in full.

August 31 Sold stock in a nonpublic company with a book value of $5,900 and accepted a $6,900 noninterest-bearing note

with a discount rate of 8%. The $6,900 payment is due on February 28, 2025. The stock has no ready market

value.…

Raintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only

at December 31, the company's fiscal year-end. The 2023 balance sheet disclosed the following

Current asseter

Receivables, set of allowance for uncollectible accounts of $32,000

During 2024, credit sales were $1760,000, cash collections from customers $1,840,000, and $37,000 in accounts receivable were

written off. In addition, $3,200 was collected from a customer whose account was written off in 2023. An aging of accounts receivable

at December 31, 2024, reveals the following:

Age Group

0-60 days

61-30 days

91-120 days

Over 120 days

Percentage of Year-

End Receivables in

Group

458

10

20

Percent

collectible

10

35

50

5442,000

Required:

1. Prepare summary journal entries to account for the 2024 write-offs and the collection of the receivable previously written off

2. Prepare the year-end adjusting entry for bad debts according to each of the following…

Chapter 3 Solutions

Financial Accounting-w/cd-package

Ch. 3 - Prob. 1YTCh. 3 - Prob. 2YTCh. 3 - Prob. 3YTCh. 3 - Prob. 4YTCh. 3 - Prob. 5YTCh. 3 - Prob. 6YTCh. 3 - Prob. 7YTCh. 3 - How does accrual basis accounting differ from cash...Ch. 3 - Prob. 2QCh. 3 - Prob. 3Q

Ch. 3 - Prob. 4QCh. 3 - What are accrued expenses?Ch. 3 - Prob. 6QCh. 3 - Prob. 7QCh. 3 - Name two common deferred expenses.Ch. 3 - What does it mean to recognize revenue?Ch. 3 - How does matching relate to accruals and...Ch. 3 - What is depreciation?Ch. 3 - Why is depreciation necessary?Ch. 3 - Prob. 13QCh. 3 - Prob. 14QCh. 3 - Prob. 1MCQCh. 3 - Prob. 2MCQCh. 3 - Prob. 3MCQCh. 3 - Prob. 4MCQCh. 3 - Prob. 5MCQCh. 3 - Prob. 6MCQCh. 3 - Prob. 7MCQCh. 3 - Prob. 8MCQCh. 3 - When prepaid insurance has been used, the...Ch. 3 - Prob. 10MCQCh. 3 - Prob. 1SEACh. 3 - Prob. 2SEACh. 3 - Account for interest expense. (LO 1, 2). UMC...Ch. 3 - Prob. 4SEACh. 3 - Account for insurance expense. (LO 1, 3). Catrina...Ch. 3 - Prob. 6SEACh. 3 - Account for unearned revenue. (LO 1, 3). Able...Ch. 3 - Prob. 8SEACh. 3 - Prob. 9SEACh. 3 - Prob. 10SEACh. 3 - Calculate profit margin on sales ratio. (LO 5)....Ch. 3 - Prob. 12SEBCh. 3 - Prob. 13SEBCh. 3 - Prob. 14SEBCh. 3 - Prob. 15SEBCh. 3 - Prob. 16SEBCh. 3 - Prob. 17SEBCh. 3 - Prob. 18SEBCh. 3 - Prob. 19SEBCh. 3 - Calculate net income. (LO I, 4). Suppose a company...Ch. 3 - Prob. 21SEBCh. 3 - Prob. 22SEBCh. 3 - Prob. 23EACh. 3 - Prob. 24EACh. 3 - Prob. 25EACh. 3 - Prob. 26EACh. 3 - Prob. 27EACh. 3 - Prob. 28EACh. 3 - Account for insurance expense. (LO 1, 3). Yodel ...Ch. 3 - Prob. 30EACh. 3 - Prob. 31EACh. 3 - Prob. 32EACh. 3 - Prob. 33EACh. 3 - Prob. 34EACh. 3 - Southeast Pest Control, Inc., was started when its...Ch. 3 - Prob. 36EACh. 3 - Prob. 37EACh. 3 - Prob. 38EACh. 3 - Prob. 39EACh. 3 - Prob. 40EBCh. 3 - Prob. 41EBCh. 3 - Prob. 42EBCh. 3 - TJs Tavern paid 10,800 on February 1, 2010, for a...Ch. 3 - Prob. 44EBCh. 3 - Prob. 45EBCh. 3 - Account for insurance expense. (LO 1, 3). All...Ch. 3 - Prob. 47EBCh. 3 - Prob. 48EBCh. 3 - Prob. 49EBCh. 3 - Prob. 50EBCh. 3 - Prob. 51EBCh. 3 - Prob. 52EBCh. 3 - From the following list of accounts (1) identify...Ch. 3 - Prob. 54EBCh. 3 - Prob. 55EBCh. 3 - Prob. 56EBCh. 3 - Prob. 57PACh. 3 - Prob. 58PACh. 3 - Prob. 59PACh. 3 - Following is a partial list of financial statement...Ch. 3 - Prob. 61PACh. 3 - Record adjustments. (LO 1, 2, 3). The Gladiator...Ch. 3 - Prob. 63PACh. 3 - Transactions for Pops Company for 2011 were as...Ch. 3 - Record adjustments and prepare financial...Ch. 3 - Prob. 66PACh. 3 - Prob. 67PACh. 3 - Record adjustments and prepare income statement....Ch. 3 - Prob. 69PBCh. 3 - Prob. 70PBCh. 3 - Following is a partial list of financial statement...Ch. 3 - Prob. 72PBCh. 3 - Record adjustments. (LO 1, 2, 3). Summit Climbing...Ch. 3 - Prob. 74PBCh. 3 - Prob. 75PBCh. 3 - Record adjustments and prepare financial...Ch. 3 - Prob. 77PBCh. 3 - Prob. 78PBCh. 3 - Identify and explain accruals and deferrals. (LO...Ch. 3 - Prob. 2FSACh. 3 - Prob. 3FSACh. 3 - Prob. 1CTPCh. 3 - Prob. 1IECh. 3 - Prob. 3IECh. 3 - Prob. 4IE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Weldon Corporation’s fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2024: March 17 Accounts receivable of $2,300 were written off as uncollectible. The company uses the allowance method. March 30 Loaned an officer of the company $30,000 and received a note requiring principal and interest at 5% to be paid on March 30, 2025. May 30 Discounted the $30,000 note at a local bank. The bank’s discount rate is 6%. The note was discounted without recourse and the sale criteria are met. June 30 Sold merchandise to the Blankenship Company for $18,000. Terms of the sale are 2/10, n/30. Weldon uses the gross method to account for cash discounts. July 8 The Blankenship Company paid its account in full. August 31 Sold stock in a nonpublic company with a book value of $5,600 and accepted a $6,600 noninterest-bearing note with a discount rate of 6%. The $6,600 payment is due on February 28, 2025. The stock has no ready market value.…arrow_forwardAt December 31, 2018, the Accounts Receivable balance of Solar Energy Manufacturing is $205,000. The Allowance for Bad Debts account has a $8,050 debit balance. Solar Energy Manufacturing prepares the following aging schedule for its accounts receivable: Journalize the year-end adjusting entry for bad debts on the basis of the aging schedule. Show the T-account for the Allowance for Bad Debts at December 31, 2018. Begin by determining the target balance of Allowance for Bad Debts by using the age of each account. Age of Accounts 1-30 31-60 61-90 Over 90 Total Days Days Days Days Balance Accounts Receivable $70,000 $85,000 $45,000 $5,000 Estimated percent uncollectible 0.5 % 5.0 % 7.0 % 46.0 % Estimated total uncollectible Journalize the year-end adjusting entry for bad debts on the basis of the aging schedule. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and…arrow_forwardWeldon Corporation's fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2021: Mar. 17 Accounts receivable of $3,600 were written off as uncollectible. The company uses the allowance method. 38 Loaned an officer of the company $42,009 and received a note requiring principal and interest at 5% to be paid on March 30, 2022. Hay 30 Discounted the $42,eee note at a local bank. The bank's discount rate is 6%. The note was discounted without recourse and the sale criteria are met. June 30 Sold merchandise to the Blankenship Company for $31,8ea. Terms of the sale are 2/10, n/30. Weldon uses the gross method to account for cash discounts. July 8 The Blankenship Company paid its account in full. Aug. 31 Sold stock in a nonpublic company with a book value of $6,900 and accepted a $7,900 noninterest-bearing note with a discount rate of 6%. The $7,980 payment is due on February 28, 2022. The stock has no ready market value. Dec. 31…arrow_forward

- The following notes receivable transactions occurred for Harris Company during the last three months of the Current year. (Assume all notes are dated the day the transaction occurred.) 1. Prepare the journal entries to record the preceding note transactions and the necessary adjusting entries on December 31. (Assume that Harris does not normally sell its notes and uses a 360-day year for the purpose of computing interest. Round all calculations to the nearest penny.) 2. Show how Harris' notes receivable would be disclosed on the December 31 balance sheet. (Assume these are the only note transactions encouutered by Harris during the year.)arrow_forwardWeldon Corporation’s fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2021: Mar. 17 Accounts receivable of $3,000 were written off as uncollectible. The company uses the allowance method. 30 Loaned an officer of the company $33,000 and received a note requiring principal and interest at 8% to be paid on March 30, 2022. May 30 Discounted the $33,000 note at a local bank. The bank’s discount rate is 9%. The note was discounted without recourse and the sale criteria are met. June 30 Sold merchandise to the Blankenship Company for $25,000. Terms of the sale are 2/10, n/30. Weldon uses the gross method to account for cash discounts. July 8 The Blankenship Company paid its account in full. Aug. 31 Sold stock in a nonpublic company with a book value of $6,300 and accepted a $8,000 noninterest-bearing note with a discount rate of 9%. The $8,000 payment is due on February 28, 2022. The stock…arrow_forwardJohnson company’s financial year ended on December 31, 2010. All the transactions related to the company’s uncollectible accounts are can be found below: The accounts receivable account had a balance of $114,630 and the beginning balance in the allowance for uncollectible accounts was $6,200. Prepare journal entries for each transaction. Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the information presented and balance off each account.arrow_forward

- At the end of the year, a company has a balance in Allowance for Uncollectible Accounts of $220 (credit) before any year-end adjustment. The balance of Accounts Receivable is $15,900. The company estimates that 14% of accounts receivable will not be collected over the next year. Record the adjustment for uncollectible accounts. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the adjustment for uncollectible accounts. Note: Enter debits before credits. Event General Journal Debit Credit 30 F3 888 F7 F9 F10 # 2$ % & 3 4 6 7 8 9. E R Y P { F K L < ? C V alt command option + || .. .. | Harrow_forwardIndigo Corporation had record sales in 2023. It began 2023 with an Accounts Receivable balance of $613,500 and an Allowance for Expected Credit Losses of $40,400. Indigo recognized credit sales during the year of $8,020,000 and made monthly adjusting entries equal to 0.5% of each month's credit sales to recognize the loss on impairment. Also during the year, the company wrote off $42,400 of accounts that were deemed to be uncollectible, although one customer whose $4,800 account had been written off surprised management by paying the amount in full in late September. Including this surprise receipt, $7,882,200 in cash was collected on account in 2023. To assess the reasonableness of the allowance for expected credit losses, the controller prepared the following aged listing of the receivables at December 31, 2023: Days Account Outstanding Less than 16 days Between 16 and 30 days Between 31 and 45 days Between 46 and 60 days Between 61 and 75 days Over 75 days (b) Amount $378,500…arrow_forwardAt the end of the year, a company has a balance in Allowance for Uncollectible Accounts of $220 (credit) before any year-end adjustment. The balance of ACcounts Receivable is $15,900. The company estimates that 14% of accounts receivable will not be collected over the next year. Record the adjustment for uncollectible accounts. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the adjustment for uncollectible accounts. Note: Enter debits before credits. Event General Journal Debit Credit 吕0 F3 888 4 F5 F6 F7 FB # 2$ & * 4 5 7 9 E R Y U P S F G J K C V alt mand command option *3arrow_forward

- Okay, I have everything else in the journal entry except for the last one. I'm attaching a picture of what I've got so you don't have to worry about explaining all of that. Here's the original (complete) problem: Weldon Corporation’s fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2018: Mar. 17 Accounts receivable of $1,700 were written off as uncollectible. The company uses the allowance method. 30 Loaned an officer of the company $20,000 and received a note requiring principal and interest at 7% to be paid on March 30, 2019. May 30 Discounted the $20,000 note at a local bank. The bank’s discount rate is 8%. The note was discounted without recourse and the sale criteria are met. June 30 Sold merchandise to the Blankenship Company for $12,000. Terms of the sale are 2/10, n/30. Weldon uses the gross method to account for cash discounts. July 8 The Blankenship Company paid its account in…arrow_forwardJohnson company's financial year ended on December 31, 2010. All the transactions related to the company's uncollectible accounts are can be found below: January 15 Wrote of $440 account of Miller Company as uncollectible Re-establish the account of Louisa Teller and record the collection of $1,050 as payment in full for her account which had been written off earlier Received 40% of the $700 balance owed by William John and wrote off the remainder as uncollectible Wrote off as uncollectible the accounts of Sherwin Company, $1,700 and V. Vasell $2,200 Received 25% of the $1,140 owed by Grant Company and wrote off the remainder as uncollectible Received $741 from M. Fuller in full payment of his account which had been written off earlier as uncollectible Estimated uncollectible accounts expense for the year to be 1.5% of net credit sales of $521,000 April 2d July 31 August 15 September 26 October 16 December 31 The accounts receivable account had a balance of $114,630 and the beginning…arrow_forwardOn September 1, 2011, Health Wise International acquired a 12 percent, nine-month note receivablefrom Herbal Innovations, a credit customer, in settlement of a $22,000 account receivable.Prepare journal entries to record the following:a. The receipt of the note on September 1, 2011, in settlement of the account receivable.b. The adjustment to record accrued interest revenue on December 31, 2011.c. The collection of the principal and interest on May 31, 2012arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY