Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 6E

EXERCISE 3-6 Schedules of Cost of Goods Manufactured and Cost of Goods Sold; Income Statement

L03-3

The following data from the just completed year are taken from the accounting records of. Mason Company:

Required:

1. Prepare a schedule of cost of goods manufactured Assume all raw materials used in production were direct materials

2. Prepare a schedule of cost of goods sold. Assume that the company’s under applied or overapplied

3. Prepare an income statement.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Problem 3-13 (Algo) Schedules of Cost of Goods Manufactured and Cost of Goods Sold; Income Statement [LO3-3]

Superior Company provided the following data for the year ended December 31 (all raw materials are used in production as direct materials):

Selling expenses

$ 214,000

Purchases of raw materials

$ 268,000

Direct labor

?

Administrative expenses

$ 159,000

Manufacturing overhead applied to work in process

$ 373,000

Actual manufacturing overhead cost

$ 355,000

Inventory balances at the beginning and end of the year were as follows:

Beginning

Ending

Raw materials

$ 54,000

$ 40,000

Work in process

?

$ 24,000

Finished goods

$ 39,000

?

The total manufacturing costs added to production for the year were $670,000; the cost of goods available for sale totaled $730,000; the unadjusted cost of goods sold totaled $669,000; and the net operating income was $33,000. The company’s underapplied or overapplied overhead is closed to Cost of Goods Sold.…

EXERCISE 3-12 Applying Overhead; Cost of Goods Manufactured [LO3-2, L03-6, LO3-7] The following cost data relate to the manufacturing activities of Chang Company during the just completed year: $ 15,000 130,000 8,000 70,000 240,000 10,000 $473,000 Manufacturing overhead costs incurred: Indirect materials ....... Indirect labor Property taxes, factory ...... Utilities, factory Depreciation, factory ....... Insurance, factory ......... ........... ......... Total actual manufacturing overhead costs incurred ........ Other costs incurred: Purchases of raw materials (both direct and indirect) Direct labor cost ... Inventories: Raw materials, beginning ....... Raw materials, ending ....... Work in process, beginning ...... Work in process, ending ...... $400,000 $60,000 $20,000 $30,000 $40,000 $70,000 The company uses a predetermined overhead rate to apply overhead cost to jobs. The rate for the year was $25 per machine-hour. A total of 19,400 machine-hours was recorded for the year.…

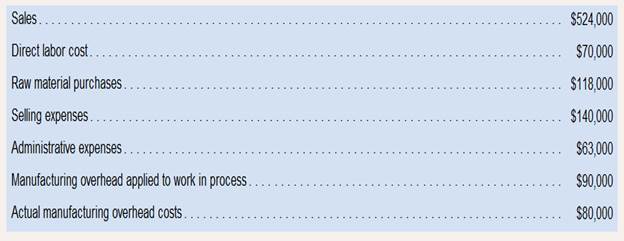

Exercise 3-6 (Static) Schedules of Cost of Goods Manufactured and Cost of Goods Sold; Income Statement [LO3-3]

The following data from the just completed year are taken from the accounting records of Mason Company:

Sales

$ 524,000

Direct labor cost

$ 70,000

Raw material purchases

$ 118,000

Selling expenses

$ 140,000

Administrative expenses

$ 63,000

Manufacturing overhead applied to work in process

$ 90,000

Actual manufacturing overhead costs

$ 80,000

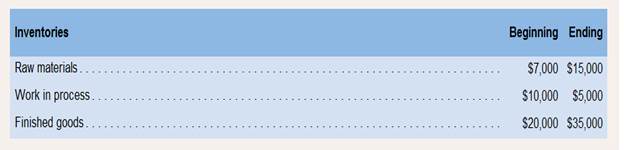

Inventories

Beginning

Ending

Raw materials

$ 7,000

$ 15,000

Work in process

$ 10,000

$ 5,000

Finished goods

$ 20,000

$ 35,000

Required:

1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials.

2. Prepare a schedule of cost of goods sold. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold.

3. Prepare an income statement.

Chapter 3 Solutions

Introduction To Managerial Accounting

Ch. 3.A - Carmen Company is a manufacturer that completed...Ch. 3.A - Transaction Analysis L03-5 Adams Company is a...Ch. 3.A - Transaction Analysis L03-5 Dixon Company is a...Ch. 3.A - A Transaction Analysis L03-5 Morrison Company uses...Ch. 3.A - Prob. 5PCh. 3.A - Transaction Analysis Brooks Corporation uses a...Ch. 3 - What is the link that connect the schedule of cost...Ch. 3 - What account is credited when overhead cost is...Ch. 3 - What is under applied overhead? Over applied...Ch. 3 - Provide two reason why overhead might be under...

Ch. 3 - What adjustment is made for under applied overhead...Ch. 3 - How do you compute the raw materials used in...Ch. 3 - How do you compute the total manufacturing cost...Ch. 3 - How do you compute the cost of goods manufactured?Ch. 3 - How do you compute the unadjusted cost of goods...Ch. 3 - How do direct labor costs flows through a...Ch. 3 - The Excel work sheet form that appears below is to...Ch. 3 - The Excel worksheet form that appears below is to...Ch. 3 - The Excel worksheet form that appears below is to...Ch. 3 - The Excel worksheet form that appears below is to...Ch. 3 - Bunnell Corporation is a manufacturer tint uses...Ch. 3 - Bunnell Corporation is a manufacturer tint uses...Ch. 3 - Bunnell Corporation is a manufacturer tint uses...Ch. 3 - Prob. 4F15Ch. 3 - Prob. 5F15Ch. 3 - Prob. 6F15Ch. 3 - Prob. 7F15Ch. 3 - Prob. 8F15Ch. 3 - Prob. 9F15Ch. 3 - Bunnell Corporation is a manufacturer tint uses...Ch. 3 - Prob. 11F15Ch. 3 - Prob. 12F15Ch. 3 - Prob. 13F15Ch. 3 - Prob. 14F15Ch. 3 - Prob. 15F15Ch. 3 - Prepare Journal Entries L03-1 Larned Corporation...Ch. 3 - Prepare Accounts L03-2, L03-4 Jurvin Enterprises...Ch. 3 - Schedules of Cost of Goods Manufactured and Cost...Ch. 3 - Under applied and Overapplied Overhead Osborn...Ch. 3 - Journal Entries and T-Accounts 103-1,103-2 The...Ch. 3 - EXERCISE 3-6 Schedules of Cost of Goods...Ch. 3 - Applying Overhead; Cost of Goods Manufactured...Ch. 3 - Applying Overhead; Journal Entries; Disposing of...Ch. 3 - Applying Overhead; T-Accounts; Journal Entries...Ch. 3 - Applying Overhead; Journal Entries; T-accounts...Ch. 3 - PROBLEM 3-11 T-Account Analysis of cost Flows...Ch. 3 - PROBLEM 3-12 Predetermined Overhead Rate;...Ch. 3 - Schedules of Cost of Goods Manufactured and Cost...Ch. 3 - Schedule of Cost of Goods Manufactured; Overhead...Ch. 3 - Journal Entries; T-Accounts; Financial Statements...Ch. 3 - Comprehensive problem L03-1, L03-2, L03-4 Gold...Ch. 3 - Cost Flows; T-Accounts; Income Statement L03-z...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cost of goods manufactured for a manufacturing company The following information is available for Fuller Manufacturing Company for the month ending October 31: Determine Fuller Manufacturings cost of goods manufactured for the month ended October 31.arrow_forwardStatement of cost of goods manufactured and income statement for a manufacturing company The following information is available for Shanika Company for 20Y6: Instructions 1. Prepare the 20Y6 statement of cost of goods manufactured. 2. Prepare the 20Y6 income statement.arrow_forwardStatement of cost of goods manufactured and income statement for a manufacturing company The following information is available for Robstown Corporation for 20Y8: Instructions 1. Prepare the 20Y8 statement of cost of goods manufactured. 2. Prepare the 20Y8 income statement.arrow_forward

- Brief Exercise 3-32 Absorption-Costing Income Statement Refer to the data for Beyta Company above. Required: 1. Calculate the cost of goods sold under absorption costing. 2. Prepare an income statement using absorption costing. Use the following information for Brief Exercises 3-32 and 3-33: During the most recent year, Beyta Company had the following data:arrow_forwardConstruct and interpret a product profitability report, allocating selling and administrative expenses Naper Inc. manufactures power equipment. Naper has two primary productsgenerators and air compressors. The following report was prepared by the controller for Napers senior marketing management for the year ended December 31: Generators Air Compressors Total Revenue 4,200,000 3,000,000 7,200,000 Cost of goods sold 2,940,000 2,100,000 5,040,000 Gross profit 1,260,000 900,000 2,160,000 Selling and administrative expenses 610,000 Income from operations 1,550,000 The marketing management team was concerned that the selling and administrative expenses were not traced to the products. Marketing management believed that some products consumed larger amounts of selling and administrative expense than did other products. To verify this, the controller was asked to prepare a complete product profitability report, using activity-based costing. The controller determined that selling and administrative expenses consisted of two activities: sales order processing and post-sale customer service. The controller was able to determine the activity base and activity rate for each activity, as follows: Activity Activity Base Activity Rate Sales order processing Sales orders 65 per sales order Post-sale customer service Service requests 200 per customer service request The controller determined the following activity-base usage information about each product: Generators Air Compressors Number of sales orders 3,000 4,000 Number of service requests 225 550 A. Determine the activity cost of each product for sales order processing and post-sale customer service activities. B. Use the information in (A) to prepare a complete product profitability report dated for the year ended December 31. Compute the gross profit to sales and the income from operations to sales percentages for each product. (Round to two decimal places.) C. Interpret the product profitability report. How should management respond to the report?arrow_forward2-30 Cost of Goods Manufactured Morning Smiles Coffee Company manufactures Stoneware French Press coffee makers. During the month of March, the company purchased 350,000 of materials. Also during the month of March, Morning Smiles incurred direct labor cost of 74,000 and manufacturing overhead of 190,000. Inventory information is as follows: Required: 1. Calculate the cost of goods manufactured for the month of March. 2. Calculate the cost of one coffee maker assuming that 8,100 coffee makers were completed during March.arrow_forward

- Question 1. Case 2. Book problem. Incomplete manufacturing costs, expenses and selling data for two different cases are shown below: Required: 1. Indicate the missing amount for each letter 2. Prepare a schedule of cost of goods manufactured 3. Prepare a schedule of cost of goods sold 4. Prepare an income statement (Optional) Case 1 Case 2 Raw materials used 9,600 g) Direct labor cost 5,000 8,000 Total Factory overhead 8,000 4,000 Total Manufacturing costs a) 16,000 Beginning work in process inventory 1,000 h) Ending work in process inventory b) 3,000 Sales revenue 24,500 i)…arrow_forwardProblem 2. Statement of Costs of Goods Manufactured and Income statement. The following information are gathered from the accounting records of Genet Inc. for the current month: Inventory information Beginning balance $ Ending balance $ Raw materials inventory $46,800 $43,600 Work-in-Process inventory $33,400 $35,700 Finished goods inventory $42,500 $31,800 Other information $ Revenue $800,000 Purchase of raw materials $72,100 Indirect materials costs $5,600 Indirect labor costs $20,000 Office staff salaries $28,000 Office equipment depreciation $2,000 Factory machinery maintenance costs $5,000 Environmental compliance costs - factory $1,200 Direct labor - Wages of production line workers $32,000 Sales staff salaries $12,000 Advertising costs $8,000 Miscellaneous manufacturing overhead costs $11,000 Required: a.…arrow_forwardExercise 2: Flow of Cost - Cost System You are required to compute for the unknowns in the following accounts: Materials Inventory 7,950 Purchase Returns 750 Purchases 27,500 Direct Materials ? Indirect Materials (e) Inventory, end 5,100 Work in Process Inventory 13,650 Cost of Goods Sold Completed (c) Direct Materials Cost 23,500 Direct Labor Cost (a) Factory Overhead Applied (100% of direct labor cost) (b) Inventory 11,750 62,150 Finished Goods Inventory 12,500 Cost of Goods Sold (d) Cost of Goods Sold Completed ? Inventory, end 11,250arrow_forward

- Exercise 2-27 Statement of comprehensive Income and schedule of cost of goods manufactured. The Howell Corporation has the following account balances (all in millions): For Specific Date Direct Materials, January 01, 2019 $18 Work in process, January 01, 2019 12 Finished Goods, January 01, 2019 84 Direct Materials, December 31, 2019 24 Work in Process, December 31, 2019 6 Finished Goods, December 31, 2019 66 For the Year 2019 Purchased of Direct Materials $390 Direct Manufacturing Labour 120 Depreciation, - Plant, Building, and Equipment 96 Plant Supervisory Salaries 6 Miscellaneous Plant Overhead 42 Revenues 1140 Marketing, Distribution and Customer Service Cost 288 Plant Supplies Used 12 Plant Utilities 36 Indirect Manufacturing Labour 72 Required: Prepare a statement of Comprehensive Income and a supporting schedule of goods manufactured for…arrow_forwardManufacturing income statement, statement of cost of goods Obj. 3 manufactured Several items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of May: Instructions 1. For both companies, determine the amounts of the missing items (a) through (f), identifying them by letter. 2. Prepare Yakima Company’s statement of cost of goods manufactured for May. 3. Prepare Yakima Company’s income statement for May.arrow_forwardProblem 1.b.: Computation of Costs of Goods Manufactured (COGM).Akari Inc. provided the following information for its work-in-process inventory account at the end of the current month.Work-in-process Inventory (WIP)Accounts $ Accounts $Beginning balance $19,500 COGM ?Direct materials (DM) $76,200Direct labor (DL) $120,000MOH allocated $72,000Ending Balance $24,300Required: Compute the Costs of Goods Manufactured (COGM) at the end of the current month.Solution: Formula:Beginning WIP+ TMC (total manufacturing costs) for the periodDM usedDL incurredMOH allocatedTMC in WIP- Ending WIP= COGMarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License