MyLab Finance with Pearson eText -- Access Card -- for Corporate Finance (Myfinancelab)

4th Edition

ISBN: 9780134099170

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 30, Problem 12P

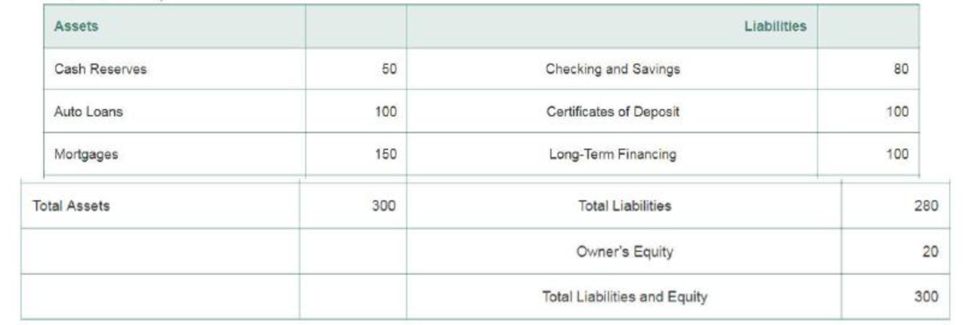

You have been hired as a risk manager for Acorn Savings and Loan. Currently, Acorn’s balance sheet is as follows (in millions of dollars):

When you analyze the duration of loans, you find that the duration of the auto loans is two years, while the mortgages have a duration of seven years. Both the cash reserves and the checking and savings accounts have a zero duration. The CDs have a duration of two years and the long-term financing has a 10-year duration.

- a. What is the duration of Acorn’s equity?

- b. Suppose Acorn experiences a rash of mortgage prepayments, reducing the size of the mortgage portfolio from $150 million to $100 million, and increasing cash reserves to $100 million. What is the duration of Acorn's equity now? If interest rates are currently 4% but fall to 3%, estimate the approximate change in the value of Acorn’s equity.

- c. Suppose that after the prepayments in part (b), but before a change in interest rates, Acorn considers managing its risk by selling mortgages and/or buying 10-year Treasury STRIPS (zero-coupon bonds). How many should the firm buy or sell to eliminate its current interest rate risk?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Let's say you are a credit analyst in the asset management department of a large bank or insurance company. The credit department is researching an investment in a syndicated loan made to a large firm. The loan is an “amortized loan” with a 7% interest rate payable semi-annually. The original term was 10 years. For analytical purposes, assume the loan trades in $1000 increments. What are the semi-annual payments on the loan?

* PLEASE USE EXCEL AND SHOW WHAT FUNCTIONS/FORMULAS YOU USED*

You want to invest $19,000 and are looking for safe investment options. Your bank is offering a certificate of deposit that pays a nominal rate of 4.00% that is compounded quarterly. Your effective rate of return on this investment is .

Suppose you decide to deposit $19,000 into a savings account that pays a nominal rate of 5.20%, but interest is compounded daily. Based on a 365-day year, how much would you have in your account after nine months? (Hint: To calculate the number of days, divide the number of months by 12 and multiply by 365.)

$19,160.48

$19,358.01

$19,753.07

$20,148.13

Your boss has asked you to evaluate the economic viability of refinancing a loan on your plant’s process equipment. The original loan of $500,000 was for six years. The payments are monthly and the nominal interest rate on the current loan is 6% per year. As of the present time, your company has had the loan for 24 months. The new loan would be for the current balance (i.e., the balance at the end of the 24th month on the old loan) with monthly payments at a nominal interest rate of 3% per year for four years. A one-time financing fee for the new loan is $10,000. Your company’s MARR is 12% per year on a nominal basis. Determine if the new loan iseconomically advantageous.

Chapter 30 Solutions

MyLab Finance with Pearson eText -- Access Card -- for Corporate Finance (Myfinancelab)

Ch. 30.1 - How can insurance add value to a firm?Ch. 30.1 - Prob. 2CCCh. 30.2 - Prob. 1CCCh. 30.2 - What are the potential risks associated with...Ch. 30.3 - How can firms hedge exchange rate risk?Ch. 30.3 - Prob. 2CCCh. 30.4 - How do we calculate the duration of a portfolio?Ch. 30.4 - How do firms manage interest rate risk?Ch. 30 - The William Companies (WMB) owns and operates...Ch. 30 - Genentechs main facility is located in South San...

Ch. 30 - Prob. 3PCh. 30 - Your firm faces a 9% chance of a potential loss of...Ch. 30 - BHP Billiton is the worlds largest mining firm....Ch. 30 - Prob. 6PCh. 30 - Prob. 7PCh. 30 - Prob. 9PCh. 30 - Prob. 10PCh. 30 - Prob. 11PCh. 30 - You have been hired as a risk manager for Acorn...Ch. 30 - Prob. 13PCh. 30 - Prob. 14P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You want to invest $25,000 and are looking for safe investment options. Your bank is offering you a certificate of deposit that pays a nominal rate of 4% that is compounded bimonthly (every two months). What is the effective rate of return that you will earn from this investment? 4.067% 4.188% 3.926% 4.152% Suppose you decide to deposit $25,000 in a savings account that pays a nominal rate of 4%, but interest is compounded daily. Based on a 365-day year, how much would you have in the account after six months? (Hint: To calculate the number of days, divide the number of months by 12 and multiply by 365.) $25,505.01 $26,015.11 $26,397.69 $24,739.86arrow_forwardYou are negotiating to make a 6-year loan of $40,000 to Breck Inc. To repay you, Breck will pay $5,000 at the end of Year 1, $10,000 at the end of Year 2, and $15,000 at the end of Year 3, plus a fixed but currently unspecified cash flow, X, at the end of each year from year 4 through Year 6. Breck is essentially riskless, so you are confident the payments will be made. You regard 8% as an appropriate rate of return on a low risk but illiquid 6-year loan. What cash flow must the investment provide at the end of each of the final 3years, that is, what is X?arrow_forwardHow do i calculate this corporate finance problem without using excel? You will be paying off a mortgage of $100,000 over the next 25 years. You have signeda loan agreement with the Toronto Dominion Bank to secure a rate of 15.4%, however youare planning to re-negotiate the loan at the end of 10 years, how much will your payments be over the first 10 years? What is the amount of principal that you paid off with the first payment?arrow_forward

- .You are negotiating to make a 7-year loan of $25,000 to Breck Inc. To repay you, Breck will pay $2,500 at the end of Year 1, $5,000 at the end of Year 2, and $7,500 at the end of Year 3, plus a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. Breck is essentially riskless, so you are confident the payments will be made. You regard 8% as an appropriate rate of return on a low risk but illiquid 7-year loan. What cash flow must the investment provide at the end of each of the final 4 years, that is, what is X?arrow_forward.You are negotiating to make a 7-year loan of $25,000 to Breck Inc. To repay you, Breck will pay $2,500 at the end of Year 1, $5,000 at the end of Year 2, and $7,500 at the end of Year 3, plus a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. Breck is essentially riskless, so you are confident the payments will be made. You regard 8% as an appropriate rate of return on a low risk but illiquid 7-year loan. What cash flow must the investment provide at the end of each of the final 4 years, that is, what is X? please provide a step by step solving on this problem, no excel sheet, please show the formulas and how the answers came about thank youarrow_forwardConsider this case: Gizmonic Institute Corp. needs to take out a one-year bank loan of $400,000 and has been offered loan terms by two different banks. One bank has offered a simple interest loan of 9% that requires monthly payments. The loan principal will be paid back at the end of the year. Another bank has offered 6% add-on interest to be repaid in 12 equal monthly installments. A. Based on a 360-day year, what will be the monthly payment for each loan for November? (Hint: Remember that November has 30 days.) Value Simple interest monthly payment Add-on interest monthly payment Choose the answer that best evaluates the following statement: B. Mall Toys Co1 always prefers simple interest loans over add-on interest loans because even if the interest rate is higher on the simple interest loan, its monthly payment is lower. (Options Below) The company needs to be sensitive to interest rate differences between loan types and take them…arrow_forward

- (Hard) You are negotiating to make a 7-year loan of $25,000 to Breck Inc. To repay you, Breck will pay $2,500 at the end of Year 1, $5,000 at the end of Year 2, and $7,500 at the end of Year 3, plus a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. Breck is essentially riskless, so you are confident the payments will be made. You regard 6% as an appropriate rate of return on a low risk but illiquid 7-year loan. What cash flow must the investment provide at the end of each of the final 4 years, that is, what is X?arrow_forwardYou are considering implementing a lockbox system for your firm. The system is expected to reduce the average collection time by 3 days. On an average day, your firm receives 430 checks with an average value of $91 each. The daily interest rate on Treasury bills is 0.015 percent. What is the anticipated amount of the daily savings if this system is implemented?arrow_forwardGrand Opening Bank is offering a one-time investment opportunity for its new customers. A customer opening a new checking account can buy a special savings bond for $600 today, which the bank will compound at 8.5% for the next ten years. The savings bond must be held for at least five years, but can then be cashed in at the end of any year starting with year five. What is the value of the bond at each cash-in date up through year ten? (Use an Excel spreadsheet to solve this problem.)arrow_forward

- Seeb Metals Inc. just decided to save OMR 1,395 a month for the next 5 years as a safety net for recessionary periods. The money will be set aside in a separate savings account which pays 7 percent interest compounded monthly. The first deposit will be made today. What would today's deposit amount have to be the firm opted for one lump sum deposit today that would yield the same amount of savings as the monthly deposits after 5 years?arrow_forwardFive years ago, you saved $5,000 in bank A that pays a compounding interest rate. You also saved $7,500 in bank B that pays a simple interest rate. Both accounts have $10,000 now. How much will you have in the two accounts at the end of year 5? The account balance in bank A will be $20,000. The account balance in bank B will be $15,000. The account balance in bank A will be $20,000. The account balance in bank B will be $12,500. The account balance in bank A will be $25,000. The account balance in bank B will be $15,000.arrow_forwardYou have recently completed your training contract and managed to save a small amount of money during the three years of your contract. You are thinking about investing the money and are considering investment opportunities which would maximize your return. A friend of yours has recently received a ‘hot tip’ from his uncle for HiFly Ltd, a share on the JSE, which is currently providing high returns. You are looking at investing 40% of your money in HiFly Ltd and the balance in Treasury Bills. The average rate of return on Treasury Bills next year will be 9%. You have been provided with the following relevant information: (Information attached in image below) ROUND ALL ANSWERS TO TWO DECIMAL PLACES REQUIRED: Calculate the expected return of HiFly Ltd. Answer% Calculate the expected return of the market. Answer% Calculate the standard deviation of HiFly Ltd. Answer% Calculate the standard deviation of the market. Answer% Calculate the covariance of returns between the market and HiFly…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

What is a mortgage; Author: Kris Krohn;https://www.youtube.com/watch?v=CFjY-58ooi0;License: Standard YouTube License, CC-BY

Topic 10 Accounting for Liabilities Mortgage Payable; Author: Accounting Thinker;https://www.youtube.com/watch?v=EPJOphrbArM;License: Standard YouTube License, CC-BY