Activity-Based Absorption Costing and Pricing LO3—5

Java Source, Inc., (JSI) buys coffee beans from around the world and roasts, blends, and packages them for resale. Some of JSI’s coffees are very popular and sell in large volumes, while a few of the newer blends sell in very low volumes. JSI prices its coffees at

For the coming year, JSI’s budget includes estimated manufacturing overhead cost of $2,200,000. JSI assigns manufacturing overhead to products on the basis of direct labor-hours. The expected direct labor cost totals $600,000, which represents 50,000 hours of direct labor time.

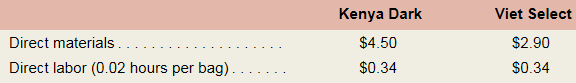

The expected costs for direct materials and direct labor for one-pound bags of two of the company’ s coffee products appear below.

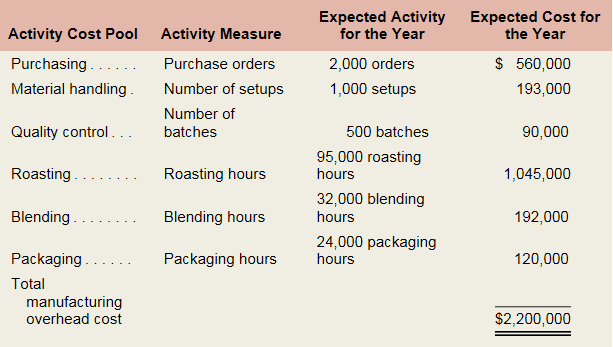

JSI’s controller believes that the company s traditional costing system may be providing misleading cost information. To determine whether or not this is correct, the controller has prepared an analysis of the year’s expected manufacturing overhead costs, as shown in the following table:

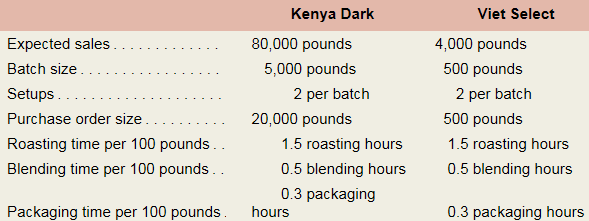

Data regarding the expected production of Kenya Dark and Viet Select coffee are presented below.

Required:

- Using direct labor-hours as the manufacturing overhead cost allocation base, do the following:

- Determine the plantwide predetermined overhead rate that will be used during the year.

- Determine the unit product cost of one pound of Kenya Dark coffee and one pound of Viet Select coffee.

- Using the activity-based absorption costing approach, do the following:

- Determine the total amount of manufacturing overhead cost assigned to Kenya Dark coffee and to Viet Select coffee for the year.

- Using the data developed in (2a) above, compute the amount of manufacturing overhead cost per pound of Kenya Dark coffee and Viet Select coffee.

- Determine the unit product cost of one pound of Kenya Dark coffee and one pound of Viet Select coffee.

- Write a brief memo to the president of ISI that explains what you found in (1) and (2) above and that discusses the implications of using direct labor-hours as the only manufacturing overhead cost allocation base.

Want to see the full answer?

Check out a sample textbook solution

- Exercise 3 The Bremer Co. manufactures cordless telephones Bremer is planning to implement a JIT production system, which requires annual tooling costs of $150,000. Bremer estimates that the following annual benefits would arise from JIT production. a. Average inventory will decline by $700,000 from $900,000 to $200,00 b. Insurance, space, materials handling, and setup costs, which currently total $200,00 would decline by 30% c. The emphasis on quality inherent in JIT system would reduce rework costs by 20% Bremer currently incurs $350,000 on rework. d. Better quality would eneble Bremer to raise the prices of its products by $3 per unit. Bremer sells $30,000 unit each year. Bremer required rate of return on inventory investment is 12% per year Required: Claculate the net benefit or cost to the Bremer Corporation From implementing a JIT production system. What other nonfinancial and qualitative factors should Brmeer Consider before deciding on whether it should implement a JIT…arrow_forwardExercise 11-3 (Algo) Transfer Pricing Basics [LO11-3] Sako Company’s Audio Division produces a speaker that is used by manufacturers of various audio products. Sales and cost data on the speaker follow: Selling price per unit on the intermediate market $ 120 Variable costs per unit $ 102 Fixed costs per unit (based on capacity) $ 8 Capacity in units 25,000 Sako Company has a Hi-Fi Division that could use this speaker in one of its products. The Hi-Fi Division will need 5,000 speakers per year. It has received a quote of $117 per speaker from another manufacturer. Sako Company evaluates division managers on the basis of divisional profits. Required: 1. Assume the Audio Division sells only 20,000 speakers per year to outside customers. a. From the standpoint of the Audio Division, what is the lowest acceptable transfer price for speakers sold to the Hi-Fi Division? b. From the standpoint of the Hi-Fi Division, what is the highest acceptable transfer price for speakers…arrow_forwardExercise 11-3 (Algo) Transfer Pricing Basics [LO11-3] Sako Company’s Audio Division produces a speaker that is used by manufacturers of various audio products. Sales and cost data on the speaker follow: Selling price per unit on the intermediate market $ 120 Variable costs per unit $ 102 Fixed costs per unit (based on capacity) $ 8 Capacity in units 25,000 Sako Company has a Hi-Fi Division that could use this speaker in one of its products. The Hi-Fi Division will need 5,000 speakers per year. It has received a quote of $117 per speaker from another manufacturer. Sako Company evaluates division managers on the basis of divisional profits. Required: 1. Assume the Audio Division sells only 20,000 speakers per year to outside customers. a. From the standpoint of the Audio Division, what is the lowest acceptable transfer price for speakers sold to the Hi-Fi Division? b. From the standpoint of the Hi-Fi Division, what is the highest acceptable transfer price for speakers…arrow_forward

- NUBD wishes to market a new product for P1.50 per unit. Fixed costs to manufacture this product are P100,000 for less than 500,000 units and P150,000 for 500,000 units or more. The contribution margin ratio is 20%. How many units must be sold to realize net income from this product of P100,000? A. 333,333 B. 500,000 C. 666,667 D. 833,333arrow_forwardProblem 5-25 (Algo) Changes in Fixed and Variable Costs; Break-Even and Target Profit Analysis [LO5-4, LO5-5, LO5-6] Neptune Company has developed a small inflatable toy that it is anxious to introduce to its customers. The company’s Marketing Department estimates that demand for the new toy will range between 15,000 units and 30,000 units per month. The new toy will sell for $9.00 per unit. Enough capacity exists in the company’s plant to produce 20,000 units of the toy each month. Variable expenses to manufacture and sell one unit would be $5.00 , and incremental fixed expenses associated with the toy would total $34,000 per month. Neptune has also identified an outside supplier who could produce the toy for a price of $4.00 per unit plus a fixed fee of $47,000 per month for any production volume up to 20,000 units. For a production volume between 20,001 and 45,000 units the fixed fee would increase to a total of $94,000 per month. Required: 1. Calculate the break-even point in…arrow_forwardQUESTION 4 An organisation manufactures a single product. The following information with regard to the raw material needed in the production process is supplied to you: Normal delivery time: 2.5 weeksMaximum delivery time: 3.5 weeksNormal usage: 52 000 units per yearPurchase price per unit: R8.50Cost of placing an order: R18.00Interest rate: 2% per yearStoring cost per unit: R2.50 Required: Calculate the EOQ. Calculate the re-order point if the organisation does not keep safety stock.arrow_forward

- ch7-45- I have asked this question earlier and i found a possible miscalculation for the total variable costs in step 3. Please check and confirm. ch7-Q#45 Texas-Q Company produces and sells barbeque grills. Texas-Q sells three models: a small portable gas grill, a larger stationary gas grill, and the specialty smoker. In the coming year, Texas-Q expects to sell 20,000 portable grills, 50,000 stationary grills, and 5,000 smokers. Information on the three models is as follows: Portable Stationary Smokers Price $90 $205 $252 Variable cost per unit 46 132 140 Total fixed cost is $2,219,240. Required: 1. What is the sales mix of portable grills to stationary grills to smokers? 2. Compute the break-even quantity of each product. 3. Prepare an income statement for Texas-Q for the coming year. What is the overall contribution margin ratio? Use the contribution margin ratio to compute overall break-even sales revenue. Enter the contribution…arrow_forwardProblem 4 (JIT Purchasing, Relevant Benefits, Relevant Costs) The Josefina Corporation is an automotive supplier that uses automatic turning machines to manufacture precision parts from steel bars. Josefina's inventory of raw steel averages P600,000. JC Tan, president of Josefina, and Patrick Argante, Josefina's controller, are concerned about the costs of carrying inventory. The steel supplier is willing to supply steel in smaller lots at no additional charge. Patrick Argante identified the following effects of adopting a JIT inventory program to virtually eliminate steel inventory: Without scheduling any overtime, lost sales due to stockouts would increase by 35,000 units per year. However, by incurring overtime premiums of P40,000 per year, the increase in lost sales could be reduced to 20,000 units. This would be the maximum amount of overtime that would be feasible for Josefina. Two warehouses presently used for steel bar storage would no longer be needed. Josefina rents one…arrow_forward3. Special-Order Decision, Alternatives, Relevant Costs Sequoia Paper Products, Inc., manufactures boxed stationery for sale to specialty shops. Currently, the company is operating at 85 percent of capacity. A chain of drugstores has offered to buy 27,000 boxes of Sequoia’s blue-bordered thank-you notes as long as the box can be customized with the drugstore chain’s logo. While the normal selling price is $6.70 per box, the chain has offered just $3.10 per box. Sequoia can accommodate the special order without affecting current sales. Unit cost information for a box of thank-you notes follows: Direct materials $2.05 Direct labor 0.36 Variable overhead 0.07 Fixed overhead 1.95 Total cost per box $4.43 Fixed overhead is $415,000 per year and will not be affected by the special order. Normally, there is a commission of 10 percent of price; this will not be paid on the special order since the drugstore chain is dealing directly with the company. The special order will…arrow_forward

- Nico sells a product for P6.25. The variable costs are P3.75. Janet's break-even units are 35,000. What is the amount of fixed costs? a.P 87,500 b.P 35,000 c.P131,250 d.P104,750arrow_forwardPlease do your own work, don't copy from the internet Q1) Break-even analysis (LO2) Eaton Tool Company has fixed costs of $255,000, sells its units for $66, and has variable costs of $36 per unit. Compute the break-even point. Ms. Eaton comes up with a new plan to cut fixed costs to $200,000. However, more labor will now be required, which will increase variable costs per unit to $39. The sales price will remain at $66. What is the new break-even point? Under the new plan, what is likely to happen to profitability at very high volume levels (compared to the old plan)?arrow_forwardH6. 18. Question Content Area Aquamarine Company sells one of its products, Product X, for $50 each. Sales volume averages 5,000 units per year. Recently, its main competitor reduced the price of its product to $30. Aquamarine expects sales to drop dramatically unless it matches the price offered by its competitor. In addition, the current profit per unit must be maintained. Information about Product X (for production of 5,000 units) follows: Standard QuantityActual QuantityActual CostMaterials (pounds)8,50010,00025,000Labor (hours)2,0002,50012,000Setups (hours)02,0004,000Material handling (moves)01,0002,500Warranties (number repaired)05008,000 The non-value-added cost per unit is (Round answer to two decimal places.): a. $3.17. b. $4.50. c. $4.13. d. $3.80. 24. Question Content Area Phillips Screw Company produces screw fittings. It is determined that T = 1 inch in diameter. Specification limits allow a variation of plus or minus 0.5 inches. Products produced at…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning