Concept explainers

Magness Delivery Service completed the f<blowing tranuttions during De< ;mbei 2016:

Dec. 1 Magness Dp!' i, >ei ' < "' 'lions by receiving $10,000 cash and a truck with a fair value of $20,000 horn Robert Mugness The business gave Magness capital in exchange for this contribution

1 Paid $ 1,000 cash for a tour-month insurance policy The policy begins December 1 4 Paid $500 cash for office supplies.

12 Performed delivery services for a customer and received $2,000 cash

15 Completed a large delivery job, billed the customer, $2,500, and received a promise to collect the $2,500 within one week.

18 Paid employee salary, $1,000,

20 Received $15,000 cash for performing delivery services.

22 Collected $800 in advance for delivery service to be performed later.

25 Collected $2,500 cash from customer on account.

27 Purchased fuel for the truck, paying $300 on account (Credit Accounts Payable)

28 Performed delivery services on account, $700.

29 Paid office rent, $1,600, for the month of December.

30 Paid $300 on account.

31 Magness withdrew cash of $3,000.

Requirements

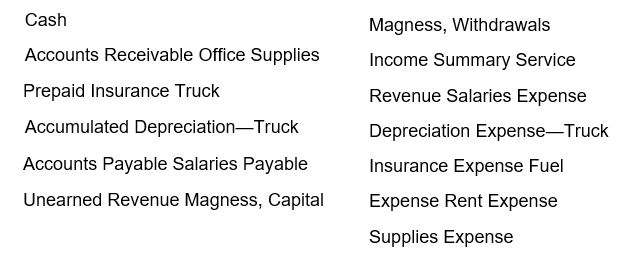

- jRecord each transaction in the journal using the following chart of accounts. Explanations are not required.

Adjustment data:

- Accrued Salaries Expense, $ 1,000.

Depreciation was recorded on the truck using the straight-line me' ul. Asstn^ a useful life of five years and a salvage value ol $5,000.- Prepaid Insurance for the month has expired.

- Office Supplies on hand, $100.

- Unearned Revenue earned during the month. $300.

- Accrued Service Revenue, $650.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

MyLab Accounting with Pearson eText -- Access Card -- for Horngren's Accounting, The Financial Chapters (My Accounting Lab)

- Unearned Revenue Jennifers Landscaping Services signed a $400-per-month contract on November 1, 2019, to provide plant watering services for Lola Inc.s office buildings. Jennifers received 4 months' service fees in advance on signing the contract. Required: 1. Prepare Jennifers journal entry to record the cash receipt for the first 4 months. 2. Prepare Jennifers adjusting entry at December 31, 2019. 3. CONCEPTUAL CONNECTION How would the advance payment (account(s) and amounts(s)] be reported in Jennifers December 31, 2019, balance sheet? How would the advance payment [account(s) and amount(s)] be reported in Lolas December 31, 2019, balance sheet?arrow_forwardBrief Exercise 2-2? Events and Transactions Several events are listed below. Paid $30,000 for land. Purchased office supplies for cash. Perfumed consulting services for a client with the amount to be collected in 30 days. Signed a contract to perform consulting services over the next 6 months. Required: For each of the events, identify which ones qualify for recognition in the financial statements. If an event does not qualify for recognition, explain why.arrow_forwardDuring May 2021 the following activities occurred: 2021/5/1 Jackson's Biking issued stock to Beff Jezos for his contribution of $200,000. 2021/5/1 Jackson's Biking purchased $75,000 of bikes (inventory) with cash. 2021/5/1 $24,000 was paid in advance for 1 year of rent. 2021/5/1 Jackson's Biking borrowed $30,000 on a 6 year, 6% annual interest loan from Wells Fargo. 2021/5/2 Purchased office supplies costing $4,000 on account. 2021/5/3 Received and paid a bill for running a newspaper advertisement for $225. 2021/5/4 Sold a one of a kind bike worth $800 to Matthew White for $12,500 cash. 2021/5/5 Purchased computers for business use with $10,000 cash. 2021/5/6 Purchased bike helmets (inventory) for $2,000 on account. 2021/5/8 Paid cash for half of supplies purchased on 5/2/21. 2021/5/9 Sold $3,000 of bikes to Emily Kim for $8,000 on account with terms 2/10, n/30. 2021/5/10 Jackson's Biking established a petty cash fund in the amount of $600. 2021/5/11…arrow_forward

- Miller Delivery Service completed the following transactions during December 2016: Dec. 1 Miller Delivery Service began operations by receiving $10,000 cash and a truck with a fair value of $20,000 from Robert Miller. The business issued Miller shares of common stock in exchange for this contribution. 1 Paid $1,000 cash for a four-month insurance policy. The policy begins December 1. 4 Paid $500 cash for office supplies. 12 Performed delivery services for a customer and received $2,000 cash. 15 Completed a large delivery job, billed the customer, $2,500, and received a promise to collect the $2,500 within one week. 18 Paid employee salary, $1,000. 20 Received $15,000 cash for performing delivery services. 22 Collected $800 in advance for delivery service to be performed later. 25 Collected $2,500 cash from customer on account. 27 Purchased fuel for the truck, paying $300 on account. (Credit Accounts Payable) 28 Performed delivery services on account, $700. 29 Paid office rent, $1,600,…arrow_forwardMiller Delivery Service completed the following transactions during December 2016: Dec. 1 Miller Delivery Service began operations by receiving $10,000 cash and a truck with a fair value of $20,000 from Robert Miller. The business issued Miller shares of common stock in exchange for this contribution. 1 Paid $1,000 cash for a four-month insurance policy. The policy begins December 1. 4 Paid $500 cash for office supplies. 12 Performed delivery services for a customer and received $2,000 cash. 15 Completed a large delivery job, billed the customer, $2,500, and received a promise to collect the $2,500 within one week. 18 Paid employee salary, $1,000. 20 Received $15,000 cash for performing delivery services. 22 Collected $800 in advance for delivery service to be performed later. 25 Collected $2,500 cash from customer on account. 27 Purchased fuel for the truck, paying $300 on account. (Credit Accounts Payable) 28 Performed delivery services on account, $700. 29 Paid office rent, $1,600,…arrow_forward. GymCo sells gym memberships and weight equipment. On 12/31/2014 customer C pays $250 cashfor a 3-year membership starting on 1/1/2015 (valued at $150) and weights (valued at S100) whichthe customer takes possession of on 12/31/2014. The weights cost GymCo $75, and it costs GymCo$25 to operate the gym in 2015, 2016, and 2017. GymCo prepares financial statements once a year,on 12/31. What are the 12/31/2014, 12/31/2015, 12/31/2016 and 12/31/2017 journal entries? What is2014 income? 2015 income? 2016 income? 2017 income?arrow_forward

- I need help figuring the last part of B. numbers 8 and 9 out. I underlined the ones I need help with. Roth Contractors Corporation was incorporated on December 1, 2019and had the following transactions during December:Part Aa. Issued common stock for $5,000 cashb. Paid $1,200 cash for three months’ rent: December 2019;January and February 2020c. Purchased a used truck for $10,000 on credit (recorded as anaccount payable)d. Purchased $1,000 of supplies on credit. These are expected tobe used during the month (recorded as expense)e. Paid $1,800 for a one-year truck insurance policy, effectiveDecember 1f. Billed a customer $4,500 for work completed to dateg. Collected $800 for work completed to dateh. Paid the following expenses in cash: advertising, $350; interest,$100; telephone, $75; truck operating, $425; wages, $2,500i. Collected $2,000 of the amount billed in f abovej. Billed customers $6,500 for work completed to datek. Signed a $9,000 contract for work to be performed in…arrow_forwardDate , Trasaction On January 2020 1 Dodong invest P200,000 in the business worth 50,000 2 purchase barber equipment worth 50,000 from PEWDIEPIE enterprises 4 bought furniture for barber shop from D'COP furniture ,P 84,000 on account 6 Dodong withdrew P 15,000 for personal use 7 paid D'COP furniture in full 8 Received the electricity bill worth P60,000 from Name 10 Paid salaries for the barber worth P20,000 12 Rendered barber service for cash P 50,000 14 Paid electricity bill P 60,000 15 Bought new Razors for 15,000 from MANG KANOR enterprises 16 purchased additional furniture from mang kanor worth P6,000 signed a note promising to pay in january 18 17 received water bill for the month worth P1,500 18 paid the purchased furniture from mang kanor worthh P6,000 20 rendered service to mang pacquiao and crew for cash worth P 10,000 21 acquired new air condition from FANatics enterprises worth P20,000 24 paid the…arrow_forwardCorp. open up a business with an investment of P50,300 on November 1, 2022 from his saving account to a business checking account and made payment for a small space month-rent, P20,000 and merchandise for presentation worth P20,000. During the operating month, the business incurred various expenses, P7,500 of which 25% remains to be paid next month. Mr. Hamon made all sales deposits directly to the bank and paid wages during the month amounting to P55,000 and P15,000, respectively. At the end of the month, a total of P3,250 for the water, electric and phone consumption bills were received but did not immediately pay it. At this point, the balance of business checking account increased to P43,200.How much is the November 30 Owner’s Equity balance if Mr. Hamon was able to withdraw cash during for the purchase of merchandise for trading amounting to P15,000?arrow_forward

- A) Received P11,500 cash advance from RM C. for the design of an extension. B) Received P5,550 cash for services completed for Pogi Q. C) paid P2,300 owed to Shoofy Supplies Ltd. D) Hired an assistant at a salary of P5,000 per month. Look for the ending balance of cash.arrow_forwardNEED ANSWER ASAP Super Dallas Recreation Inc. (“Super Dallas”) rents and sells boats and related water sports equipment. DuringJuly 2022 Super Dallas engaged in the following transactions:A. July 2: Received $ 31,800 in cash from customers for July rentals.B. July 3: Purchased on credit five new pairs of water skis for $ 180 each to replace inventory sold in July.C. July 6: Paid wages in July in cash to employees in the amount of $ 9,500. Of this amount, $1,500 had beenaccrued at the end of June.D. July 9: Paid August and July office rent in cash in the amount of $ 1,500 for each month.E. July 12: Purchased a new Ford truck for $ 38,700. Super Dallas paid $ 1,000 cash down and received a loanfrom Royal Bank for $ 37,700 to pay the balance.F. July 13: An amount of $ 1,100 was collected on an outstanding account receivable.G. July 16: Paid in cash an account payable outstanding at June 30 in the amount of $ 970.H. July 27: Super Dallas paid in cash the monthly telephone bill for July of…arrow_forwardConsider the following transactions for Huskies Insurance Company: 1. Equipment costing $42,000 is purchased at the beginning of the year for cash. Depreciation on the equipment is $7,000 per year. 2. On June 30, the company lends its chief financial officer $50,000; principal and interest at 7% are due in one year. 3. On October 1, the company receives $16,000 from a customer for a one-year property insurance policy. Deferred Revenue is credited.Required: For each item, record the necessary adjusting entry for Huskies Insurance at its year-end of December 31. No adjusting entries were made during the year.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT