1.

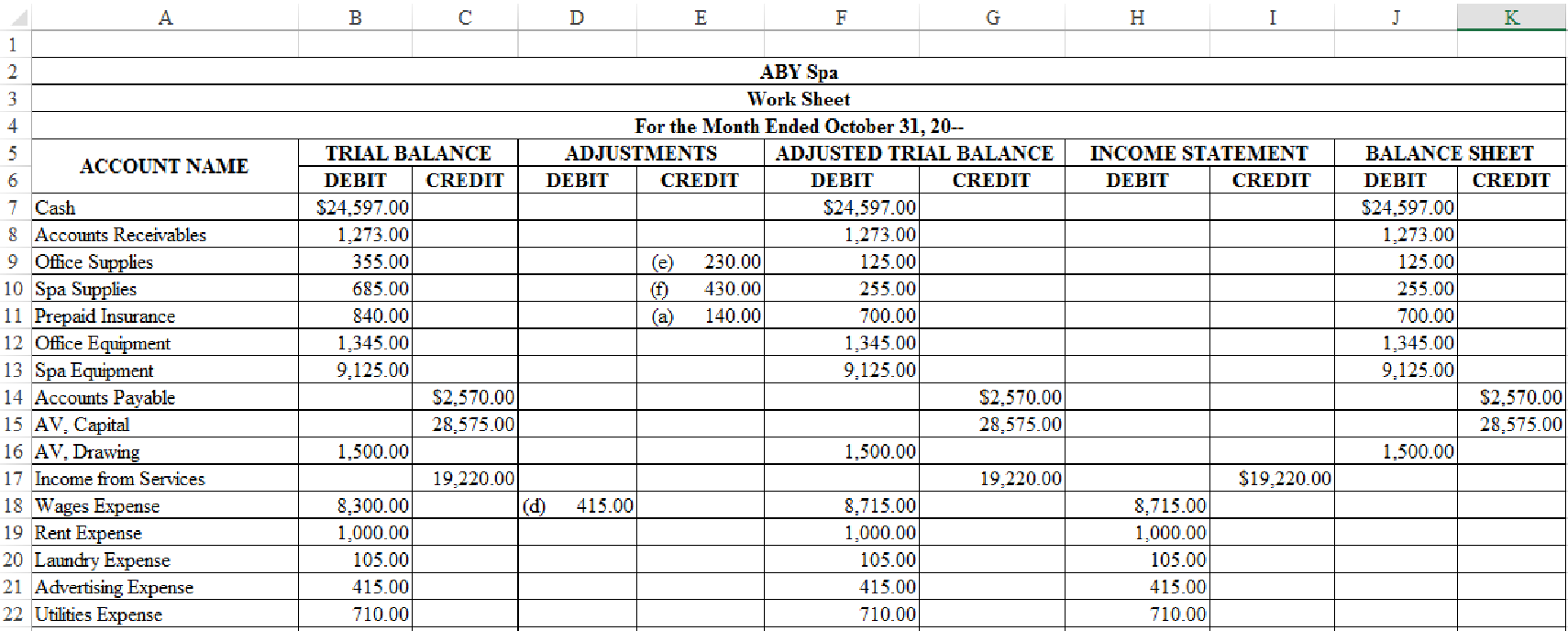

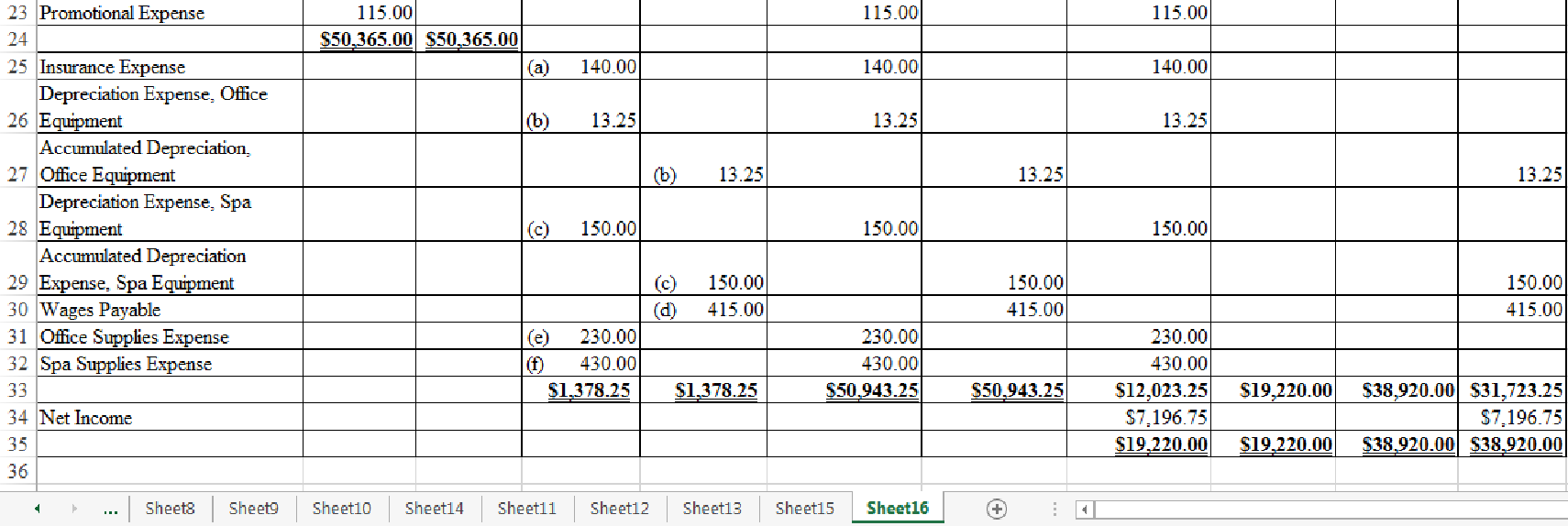

Indicate the given adjustments and complete the worksheet for ABY Spa for the month ended October 31, 20--.

1.

Explanation of Solution

Worksheet: Worksheet is an accounting tool that help accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where

Indicate the given adjustments and complete the worksheet for ABY Spa for the month ended October 31, 20--.

Figure-(1)

2.

Prepare adjusting journal entries for ABY Spa for the month ended October 31, 20--.

2.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare adjusting journal entries for ABY Spa for the month ended October 31, 20--.

Adjusting entry (a) for the prepaid insurance:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| October | 31 | Insurance Expense | 618 | 140 | ||

| Prepaid Insurance | 117 | 140 | ||||

| (Record part of prepaid insurance expired) | ||||||

Table (1)

Description:

- Insurance Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Insurance is an asset account. Since amount of insurance is expired, asset account decreased, and a decrease in asset is credited.

Working Note 1:

Calculate the value of insurance expense for 1 month.

Adjusting entry (b) for the

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| October | 31 | Depreciation Expense, Office Equipment | 619 | 13.25 | ||

| 125 | 13.25 | |||||

| (Record depreciation expense) | ||||||

Table (2)

Description:

- Depreciation Expense, Office Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Office Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Working Note 2:

Compute monthly depreciation expense for the office equipment.

Adjusting entry (c) for the depreciation expense for spa equipment:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| October | 31 | Depreciation Expense, Spa Equipment | 620 | 150 | ||

| Accumulated Depreciation, Spa Equipment | 129 | 150 | ||||

| (Record depreciation expense) | ||||||

Table (3)

Description:

- Depreciation Expense, Spa Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Spa Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Working Note 3:

Compute monthly depreciation expense for the spa equipment.

Adjusting entry (d) for the wages expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| October | 31 | Wages Expense | 611 | 415 | ||

| Wages Payable | 212 | 415 | ||||

| (Record accrued wages expenses) | ||||||

Table (4)

Description:

- Wages Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Wages Payable is a liability account. Since amount of payables has increased, liability decreased, and an increase in liability is credited.

Working Note 4:

Calculate the value of wages expense for 1 day.

Adjusting entry (e) for the office supplies expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| October | 31 | Office Supplies Expense | 613 | 230 | ||

| Office Supplies | 114 | 230 | ||||

| (Record part of supplies consumed) | ||||||

Table (5)

Description:

- Office Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Office Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

Working Note 5:

Calculate the value of office supplies expense for the month.

Adjusting entry (f) for the spa supplies expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| October | 31 | Spa Supplies Expense | 614 | 430 | ||

| Spa Supplies | 115 | 430 | ||||

| (Record part of supplies consumed) | ||||||

Table (6)

Description:

- Spa Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Spa Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

Working Note 6:

Calculate the value of spa supplies expense for the month.

3.

3.

Explanation of Solution

Post the adjusting entries journalized in Part (2) in the ledger accounts of general ledger.

| ACCOUNT Cash ACCOUNT NO. 111 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 1 | 1 | 25,000 | 25,000 | |||

| 3 | 1 | 840 | 24,160 | ||||

| 3 | 1 | 3,000 | 21,160 | ||||

| 3 | 1 | 1,000 | 20,160 | ||||

| 5 | 1 | 230 | 19,930 | ||||

| 5 | 1 | 115 | 19,815 | ||||

| 7 | 1 | 2,075 | 17,740 | ||||

| 7 | 1 | 3,465 | 21,205 | ||||

| 11 | 1 | 1,000 | 20,205 | ||||

| 14 | 1 | 3,307 | 23,512 | ||||

| 14 | 1 | 2,075 | 21,437 | ||||

| 18 | 1 | 1,200 | 20,237 | ||||

| 21 | 1 | 4,587 | 24,824 | ||||

| 21 | 1 | 2,075 | 22,749 | ||||

| 25 | 1 | 350 | 22,399 | ||||

| 28 | 1 | 2,075 | 20,324 | ||||

| 28 | 1 | 105 | 20,219 | ||||

| 31 | 1 | 6,588 | 26,807 | ||||

| 31 | 1 | 1,500 | 25,307 | ||||

| 31 | 1 | 325 | 24,982 | ||||

| 31 | 1 | 385 | 24,597 | ||||

Table (7)

| ACCOUNT Accounts Receivable ACCOUNT NO. 113 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 7 | 1 | 350 | 350 | |||

| 14 | 1 | 468 | 818 | ||||

| 21 | 1 | 345 | 1,163 | ||||

| 31 | 1 | 110 | 1,273 | ||||

Table (8)

| ACCOUNT Office Supplies ACCOUNT NO. 114 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 5 | 1 | 230 | 230 | |||

| 5 | 1 | 125 | 355 | ||||

| 31 | Adjusting | 230 | 125 | ||||

Table (9)

| ACCOUNT Spa Supplies ACCOUNT NO. 115 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 3 | 1 | 685 | 685 | |||

| 31 | Adjusting | 430 | 255 | ||||

Table (10)

| ACCOUNT Prepaid Insurance ACCOUNT NO. 117 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 3 | 1 | 840 | 840 | |||

| 31 | Adjusting | 140 | 700 | ||||

Table (11)

| ACCOUNT Office Equipment ACCOUNT NO. 124 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 5 | 1 | 520 | 520 | |||

| 5 | 1 | 825 | 1,345 | ||||

Table (12)

| ACCOUNT Accumulated Depreciation, Office Equipment ACCOUNT NO. 125 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 13.25 | 13.25 | ||

Table (13)

| ACCOUNT Spa Equipment ACCOUNT NO. 128 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 1 | 1 | 3,575 | 3,575 | |||

| 3 | 1 | 5,550 | 9,125 | ||||

Table (14)

| ACCOUNT Accumulated Depreciation, Spa Equipment ACCOUNT NO. 129 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 150 | 150 | ||

Table (15)

| ACCOUNT Accounts Payable ACCOUNT NO. 211 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 3 | 1 | 2,550 | 2,550 | |||

| 3 | 1 | 685 | 3,235 | ||||

| 5 | 1 | 520 | 3,755 | ||||

| 5 | 1 | 415 | 4,170 | ||||

| 5 | 1 | 825 | 4,995 | ||||

| 5 | 1 | 125 | 5,120 | ||||

| 11 | 1 | 1,000 | 4,120 | ||||

| 18 | 1 | 1,200 | 2,920 | ||||

| 25 | 1 | 350 | 2,570 | ||||

Table (16)

| ACCOUNT Wages Payable ACCOUNT NO. 212 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 415 | 415 | ||

Table (17)

| ACCOUNT AV, Capital ACCOUNT NO. 311 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 1 | 1 | 25,000 | 25,000 | |||

| 1 | 1 | 3,575 | 28,575 | ||||

Table (18)

| ACCOUNT AV, Drawing ACCOUNT NO. 312 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | 1 | 1,500 | 1,500 | |||

Table (19)

| ACCOUNT Income from Services ACCOUNT NO. 411 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 7 | 1 | 3,465 | 3,465 | |||

| 7 | 1 | 350 | 3,815 | ||||

| 14 | 1 | 3,307 | 7,122 | ||||

| 14 | 1 | 468 | 7,590 | ||||

| 21 | 1 | 4,587 | 12,177 | ||||

| 21 | 1 | 345 | 12,522 | ||||

| 31 | 1 | 6,588 | 19,110 | ||||

| 31 | 1 | 110 | 19,220 | ||||

Table (20)

| ACCOUNT Wages Expense ACCOUNT NO. 611 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 7 | 1 | 2,075 | 2,075 | |||

| 14 | 1 | 2,075 | 4,150 | ||||

| 21 | 1 | 2,075 | 6,225 | ||||

| 28 | 1 | 2,075 | 8,300 | ||||

| 31 | Adjusting | 415 | 8,715 | ||||

Table (21)

| ACCOUNT Rent Expense ACCOUNT NO. 612 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 3 | 1 | 1,000 | 1,000 | |||

Table (22)

| ACCOUNT Office Supplies Expense ACCOUNT NO. 613 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 230 | 230 | ||

Table (23)

| ACCOUNT Spa Supplies Expense ACCOUNT NO. 614 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 430 | 430 | ||

Table (24)

| ACCOUNT Laundry Expense ACCOUNT NO. 615 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 28 | 1 | 105 | 105 | |||

Table (25)

| ACCOUNT Advertising Expense ACCOUNT NO. 616 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 5 | 1 | 415 | 415 | |||

Table (26)

| ACCOUNT Utilities Expense ACCOUNT NO. 617 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | 1 | 325 | 325 | |||

| 31 | 1 | 385 | 710430 | ||||

Table (27)

| ACCOUNT Insurance Expense ACCOUNT NO. 618 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 140 | 140 | ||

Table (28)

| ACCOUNT Depreciation Expense, Office Equipment ACCOUNT NO. 619 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 13.25 | 13.25 | ||

Table (29)

| ACCOUNT Depreciation Expense, Spa Equipment ACCOUNT NO. 620 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 150 | 150 | ||

Table (30)

| ACCOUNT Promotional Expense ACCOUNT NO. 630 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 5 | 1 | 115 | 115 | |||

Table (31)

4.

Prepare an adjusted trial balance for ABY Spa as at October 31, 20--, based on the account balances derived in Part (3).

4.

Explanation of Solution

Adjusted trial balance: The trial balance which reflects the adjusting entries and incorporates the effect of all adjustments in the ledger accounts, is referred to as adjusted trial balance.

Prepare an adjusted trial balance for ABY Spa as at October 31, 20--, based on the account balances derived in Part (3).

| ABY Spa | ||

| Adjusted Trial Balance | ||

| October 31, 20-- | ||

| Account Title | Debit ($) | Credit ($) |

| Cash | $24,597 | |

| Accounts Receivable | 1,273 | |

| Office Supplies | 125 | |

| Spa Supplies | 255 | |

| Prepaid Insurance | 700 | |

| Office Equipment | 1,345 | |

| Accumulated Depreciation, Office Equipment | $13.25 | |

| Spa Equipment | 9,125 | |

| Accumulated Depreciation, Spa Equipment | 150 | |

| Accounts Payable | 2,570 | |

| Wages Payable | 415 | |

| AV, Capital | 28,575 | |

| AV, Drawing | 1,500 | |

| Income from Services | 19,220 | |

| Wages Expense | 8,715 | |

| Rent Expense | 1,000 | |

| Office Supplies Expense | 230 | |

| Laundry Expense | 105 | |

| Advertising Expense | 415 | |

| Utilities Expense | 710 | |

| Promotional Expense | 115 | |

| Depreciation Expense, Office Equipment | 13.25 | |

| Depreciation Expense, Spa Equipment | 150 | |

| Spa Supplies Expense | 430 | |

| Insurance Expense | 140 | |

| Total | $50,943.25 | $50,943.25 |

Table (32)

Hence, the debit and credit total of adjusted trial balance of ABY Spa at October 31, 20-- is $50,943.25.

5.

Prepare an income statement of ABY Spa for the month ended October 31, 20--, based on the account balances derived in Part (3).

5.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations, and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement of ABY Spa for the month ended October 31, 20--.

| ABY Spa | ||

| Income Statement | ||

| For the Month Ended October 31, 20-- | ||

| Revenues: | ||

| Income from Services | $19,220.00 | |

| Expenses: | ||

| Wages Expense | $8,715.00 | |

| Rent Expense | 1,000.00 | |

| Office Supplies Expense | 230.00 | |

| Laundry Expense | 105.00 | |

| Advertising Expense | 415.00 | |

| Utilities Expense | 710.00 | |

| Promotional Expense | 115.00 | |

| Depreciation Expense, Office Equipment | 13.25 | |

| Depreciation Expense, Spa Equipment | 150.00 | |

| Spa Supplies Expense | 430.00 | |

| Insurance Expense | 140.00 | |

| Total expenses | 12,023.25 | |

| Net income | $7,196.75 | |

Table (33)

6.

Prepare a statement of owners’ equity of ABY Spa, based on the account balances derived in Part (3), and net income computed in Part (5).

6.

Explanation of Solution

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owners’ equity. Additional capital, net income from income statement is added to, and drawings is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Prepare a statement of owners’ equity for ABY Spa for the month ended October 31, 20--.

| ABY Spa | ||

| Statement of Owners’ Equity | ||

| For the Month Ended October 31, 20-- | ||

| AV, Capital, October 1, 20-- | $0 | |

| Investments during October | $28,575.00 | |

| Net income for October | 7,196.75 | |

| 35,771.75 | ||

| Less: Withdrawals for October | 1,500.00 | |

| Increase in capital | 34,271.75 | |

| AV, Capital, October 31, 20-- | $34,271.75 | |

Table (34)

7.

Prepare a balance sheet for ABY Spa, based on the account balances derived in Part (3), and capital of the owner from the statement of owners’ equity prepared in Part (6).

7.

Explanation of Solution

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and owners (owners’ equity) over those resources. The resources of the company are assets which include money contributed by owners and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and owners’ equity.

Prepare the balance sheet for ABY Spa as at October 31, 20--.

| ABY Spa | ||

| Balance Sheet | ||

| October 31, 20-- | ||

| Assets | ||

| Cash | $24,597.00 | |

| Accounts Receivable | 1,273.00 | |

| Office Supplies | 125.00 | |

| Spa Supplies | 255.00 | |

| Prepaid Insurance | 700.00 | |

| Office Equipment | $1,345.00 | |

| Less: Accumulated Depreciation, Office Equipment | 13.25 | 1,331.75 |

| Spa Equipment | 9,125.00 | |

| Less: Accumulated Depreciation, Spa Equipment | 150.00 | 8,975.00 |

| Total assets | $37,256.75 | |

| Liabilities | ||

| Accounts Payable | $2,570.00 | |

| Wages Payable | 415.00 | |

| Total Liabilities | $2,985.00 | |

| Owners’ Equity | ||

| AV, Capital | 34,271.75 | |

| Total Liabilities and Owners’ Equity | $37,256.75 | |

Table (35)

Want to see more full solutions like this?

Chapter 4 Solutions

College Accounting (Book Only): A Career Approach

- The trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. Suppose you discover that an assistant in your department had misunderstood your instructions and had provided you with the wrong information on two of the adjusting entries. Cleaning supplies consumed during the year should have been 18,750, and insurance premiums unexpired at year-end were 1,800. Make the corrections on your worksheet and save the corrected file as F1WORK4. Reprint the worksheet.arrow_forwardThe trial balance for Wilson Financial Services on January 31 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 750. b. Depreciation expense on equipment, 300. c. Wages accrued or earned since the last payday, 1,055 (owed and to be paid on the next payday). d. Supplies used, 535. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. If using CLGL, prepare an adjusted trial balance. 4. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during January.arrow_forwardIf the Prepaid Insurance account had a balance of $12,000, representing one years policy premium, which was paid on July 1, what entry would be needed to adjust the Prepaid Insurance account at the end of December, before preparing the financial statements?arrow_forward

- Reviewing insurance policies revealed that a single policy was purchased on March 1, for one years coverage, in the amount of $9,000. There was no previous balance in the Prepaid Insurance account at that time. Based on the information provided, A. Make the December 31 adjusting journal entry to bring the balances to correct. B. Show the impact that these transactions had.arrow_forwardThe trial balance for Benner Hair Salon on March 31 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 300. b. Depreciation expense on equipment, 500. c. Wages accrued or earned since the last payday, 235 (owed and to be paid on the next payday). d. Supplies remaining at the end of the month, 65. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during March.arrow_forwardPrepare adjusting journal entries, as needed, for the following items. (a) The Supplies account shows a balance of $500, but a count of supplies reveals only $200 on hand at year-end. (b) The company initially records the payments of all insurance premiums as prepaid insurance. The unadjusted trial balance at year-end shows a balance of $500 in Prepaid Insurance. A review of insurance policies reveals that $100 of insurance is unexpired. (c) Employees work Monday through Friday, and salaries of $2,500 per week are paid each Friday. The company's year-end falls on Tuesday. (d) At year-end, the company received a utility bill for December's electricity usage of $200 that will be paid in early January.arrow_forward

- To reduce in accounting costs, a firm always expenses its routine operating expenditures immediately and then makes an adjusting entry at the end of the year if needed. For example, it received ₱1,200 for one year's rent from a tenant on August 1 and immediately recorded ₱1,200 of rent revenue. The rental period begins August 1. The adjusting entry required at December 31 would includearrow_forwardHere I am asked to, based off this unadjusted trial balance, make the necessary adjustments and then make an ADJUSTED trial balance. I can only use the accounts listed in the trial balance. Here's the adjustments needed: (a) A physical count of office supplies shows $490 of supplies on hand at year end. (b) The balance of the prepaid insurance account represents the payment of a one year policy which was paid on July 1. (c) Additional depreciation on the equipment for the year totals $2,780. (d) The bank account was changed to an interest bearing account in December. The amount of interest earned in December was $54. This amount was reported on the December bank statement which was received early in January and has not been recorded on the books. (e) It was discovered that additional wages for one employee of $540 had been earned by year end but will not be paid until the January 10 payroll. (f) The amount shown for rent expense represents a payment made on November 1 for 5 months’…arrow_forwardFor each separate case below, follow the three-step process for adjusting the prepaid asset account at December 31. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year. a. Prepaid Insurance. The Prepaid Insurance account has a $4,700 debit balance to start the year. A review of insurance policies shows that $900 of unexpired insurance remains at year-end. b. Prepaid Insurance. The Prepaid Insurance account has a $5,890 debit balance at the start of the year. A review of insurance policies shows $1,040 of insurance has expired by year-end. c. Prepaid Rent. On September 1 of the current year, the company prepaid $24,000 for two years of rent for facilities being occupied that day. The company debited Prepaid Rent and credited Cash for $24,000.arrow_forward

- Natalie had a very busy December. At the end of the month, after journalizing and posting the December transactions and adjusting entries, Natalie prepared the following adjusted trial balance. COOKIE CREATIONSAdjusted Trial BalanceDecember 31, 2019 Debit Credit Cash $900 Accounts Receivable 665 Supplies 270 Prepaid Insurance 920 Equipment 900 Accumulated Depreciation—Equipment $30 Accounts Payable 55 Salaries and Wages Payable 43 Interest Payable 10 Unearned Service Revenue 230 Notes Payable 1,500 Owner’s Capital 610 Owner’s Drawings 380 Service Revenue 3,442 Salaries and Wages Expense 765 Utilities Expense 95 Advertising Expense 125 Supplies Expense 780 Depreciation Expense 30 Insurance Expense 80 Interest Expense 10 $5,920 $5,920…arrow_forwardAnswer the following short questions. Why does the purchase of a one-year insurance policy four months ago give rise to insurance expense in the current month? If services have been rendered to customers during the current accounting period but no revenue has been recorded and no bill has been sent to the customers, why is an adjusting entry needed? What types of accounts should be debited and credited by this entry?arrow_forwardEvery time a company prepares financial statements, adjusting entries are required. Generally, financial statements are prepared at the end of each month, the end of each quarter and at the end of each year. Each adjusting entry affects a balance sheet account and an income statement account. For example, Adjusting Entries for Prepaid Assets or Fixed Assets involve decreasing the asset account and increasing the expense account. Adjusting entries are made in order properly follow GAAP. Based on your review of Chapter 3, describe an adjusting journal entry that is needed at the end of an accounting period. Why are adjusting entries important and how do they contribute to accurate financial reporting? Accrual accounting is required under U.S. GAAP. One of the main principles of accrual accounting is the Matching Principle, also known as the Revenue Recognition Principle and the Expense Recognition Principle. Consult a reliable resource online and in your own words, explain the…arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College