a.

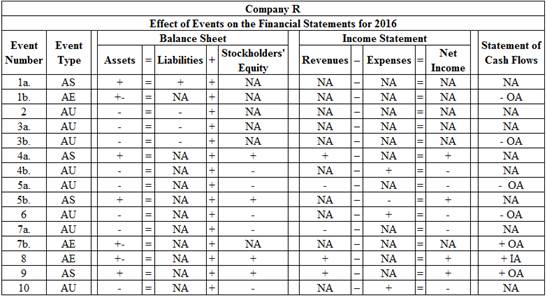

Assuming the perpetual inventory system, indicate the effect of events on the financial statements by placing a ‘+’ for increase and ‘–’ for decrease, and indicate the events as AS (asset source), or AU (asset use), or AE (asset exchange), or CE (claims exchange).

a.

Explanation of Solution

Perpetual inventory system: The method or system of maintaining, recording, and adjusting the inventory perpetually throughout the year, is referred to as perpetual inventory system.

Effect of events on the financial statements for Company R:

Table (1)

Description:

- Asset source: All the transactions which increase assets either by borrowing from creditors (increase liabilities), or by earning operating revenues (increase in

stockholders’ equity ) are referred to as asset source transactions. - Asset use: All the transactions which decrease assets either by paying off liabilities (decrease in liabilities), or by paying operating expenses (decrease in stockholders’ equity) are referred to as asset use transactions.

- Asset exchange: All the transactions which increase assets and decrease assets simultaneously, with no effect on the total assets value are referred to as asset exchange transactions.

- Claims exchange: All the transactions which include exchange of liabilities for equity are referred to as claims exchange transactions.

b.

Journalize the inventory transactions in the books of Company R, assuming the perpetual inventory system.

b.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Journalize the inventory transactions in the books of Company R.

Transaction 1a:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Merchandise Inventory | 5,200 | |||||

| Accounts Payable | 5,200 | |||||

| (Record purchase of merchandise on account) | ||||||

Table (2)

Description:

- Merchandise Inventory is an asset account. Since merchandise is purchased, asset value increased, and an increase in asset is debited.

- Accounts Payable is a liability account. Since amount owed increased, liability increased, and an increase in liability is credited.

Transaction 1b:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Merchandise Inventory | 190 | |||||

| Cash | 190 | |||||

| (Record purchase of merchandise for cash) | ||||||

Table (3)

Description:

- Merchandise Inventory is an asset account. Since merchandise is purchased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction 2:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Accounts Payable | 400 | |||||

| Merchandise Inventory | 400 | |||||

| (Record merchandise purchased on account returned) | ||||||

Table (4)

Description:

- Accounts Payable is a liability account. Since amount owed decreased, liability decreased, and a decrease in liability is debited.

- Merchandise Inventory is an asset account. Since merchandise purchased is returned, asset value decreased, and a decrease in asset is credited.

Transaction 3a:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Accounts Payable | 48 | |||||

| Merchandise Inventory | 48 | |||||

| (Record purchase discount received for merchandise purchased on account) | ||||||

Table (5)

Description:

- Accounts Payable is a liability account. Since sales discount is received, amount owed decreased, liability decreased, and a decrease in liability is debited.

- Merchandise Inventory is an asset account. Since cost of merchandise purchased is reduced by receiving discount, asset value decreased, and a decrease in asset is credited.

Working Notes:

Compute purchase discount.

Transaction 3b:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Accounts Payable | 4,752 | |||||

| Cash | 4,752 | |||||

| (Record cash paid for merchandise purchased on account) | ||||||

Table (6)

Description:

- Accounts Payable is a liability account. Since amount owed is paid, liability decreased, and a decrease in liability is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Working Notes:

Compute cash paid.

Note: Refer to Equation (1) for computation of purchase discount.

Transaction 4a:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| 12,100 | ||||||

| Sales Revenue | 12,100 | |||||

| (Record merchandise sold on account) | ||||||

Table (7)

Description:

- Accounts Receivable is an asset account. The amount is increased because amount to be received increased, and an increase in asset is debited.

- Sales Revenue is a revenue account. Since gains and revenues increase equity, and an increase in equity is credited, Sales Revenue account is credited.

Transaction 4b:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Cost of Goods Sold | 6,800 | |||||

| Merchandise Inventory | 6,800 | |||||

| (Record cost incurred for goods sold) | ||||||

Table (8)

Description:

- Cost of Goods Sold is an expense account. Since losses and expenses decrease equity and a decrease in equity is debited, Cost of Goods Sold account is debited.

- Merchandise Inventory is an asset account. Since merchandise is sold, asset value decreased, and a decrease in asset is credited.

Transaction 5a:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Sales Revenue | 1,680 | |||||

| Accounts Receivable | 1,680 | |||||

| (Record merchandise sold on account returned) | ||||||

Table (9)

Description:

- Sales Revenue is a revenue account. Since goods sold were returned, revenues decreased, and a decrease in revenues (equity) is debited.

- Accounts Receivable is an asset account. The goods sold were returned, and amount to be received decreased, and a decrease in asset is credited.

Transaction 5b:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Merchandise Inventory | 900 | |||||

| Cost of Goods Sold | 900 | |||||

| (Record cost incurred on merchandise sold being reduced for the goods returned) | ||||||

Table (10)

Description:

- Merchandise Inventory is an asset account. Since merchandise sold is returned, asset value increased, and an increase in asset is debited.

- Cost of Goods Sold is an expense account. Since goods sold were returned, expenses decreased, and a decrease in expenses (equity) is credited.

Transaction 6:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Transportation-out | 140 | |||||

| Cash | 140 | |||||

| (Record freight charges on goods sold) | ||||||

Table (11)

Description:

- Transportation-out is an expense account. Since losses and expenses decrease equity and a decrease in equity is debited, Transportation-out account is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction 7a:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Sales Revenue | 242 | |||||

| Accounts Receivable | 242 | |||||

| (Record allowance granted on damaged merchandise sold on account) | ||||||

Table (12)

Description:

- Sales Revenue is a revenue account. Since sale allowance is granted on goods sold, revenues decreased, and a decrease in revenues (equity) is debited.

- Accounts Receivable is an asset account. The sale allowance is granted on goods sold, and amount to be received decreased, and a decrease in asset is credited.

Working Notes:

Compute sales discount.

Transaction 7b:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Cash | 11,858 | |||||

| Accounts Receivable | 11,858 | |||||

| (Record cash collected in part, on merchandise sold on account) | ||||||

Table (13)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable is an asset account. The sale allowance is granted on goods sold, and amount to be received decreased, and a decrease in asset is credited.

Working Notes:

Compute cash received.

Note: Refer to Equation (2) for computation of sales discount.

Transaction 8:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Cash | 8,500 | |||||

| Land | 7,000 | |||||

| Gain from Sale of Land | 1,500 | |||||

| (Record sale of land) | ||||||

Table (14)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Land is an asset account. Since land is sold, asset account decreased, and a decrease in asset is credited.

- Gain from Sale of Land is a revenue account. Since gains and revenues increase equity, and an increase in equity is credited, Gain on Sale of Land account is credited.

Transaction 9:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Interest Receivable | 600 | |||||

| Interest Revenue | 600 | |||||

| (Record accrued interest income) | ||||||

Table (15)

Description:

- Interest Receivable is an asset account. Since interest to be received has increased, asset value increased, and an increase in asset is debited.

- Interest Revenue is a revenue account. Since gains and revenues increase equity, and an increase in equity is credited, Interest Revenue account is credited.

Transaction 10:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Cost of Goods Sold | 642 | |||||

| Merchandise Inventory | 642 | |||||

| (Record inventory loss or shrinkage) | ||||||

Table (16)

Description:

- Cost of Goods Sold is an expense account. Loss of inventory is identified after evaluating the physical count and the recorded inventory. Since losses and expenses decrease equity and a decrease in equity is debited, Cost of Goods Sold account is debited.

- Merchandise Inventory is an asset account. Since merchandise is lost, asset value decreased, and a decrease in asset is credited.

Working Notes:

Calculate loss of inventory.

Step 1: Compute value of inventory as per records.

| Merchandise Inventory | |||

| Beginning balance | $15,000 | Accounts payable | $400 |

| Accounts payable | 5,200 | Accounts payable | 48 |

| Cash | 190 | Cost of goods sold | 6,800 |

| Cost of goods sold | 900 | ||

| Total | 21,290 | Total | 7,248 |

| Balance | $14,042 | ||

Table (17)

Step 2: Compute inventory loss or shrinkage.

Note: Refer to Table (17) for computation of balance of Merchandise Inventory account.

b.

Post the beginning balances into T-accounts, and post the journal entries prepared in Part (b) into T-accounts.

b.

Explanation of Solution

Post the beginning balances and journal entries prepared in Part (b) into T-accounts.

| Cash | |||

| Beginning balance | $6,900 | Merchandise inventory | $190 |

| Accounts receivable | 11,858 | Accounts payable | 4,752 |

| Land | 7,000 | Sales revenue | 1,680 |

| Gain on sale of land | 1,500 | Transportation-out | 140 |

| Total | 27,258 | Total | 6,762 |

| Balance | $20,496 | ||

Table (18)

| Accounts Receivable | |||

| Sales revenue | $12,100 | Sales revenue | $242 |

| Cash | 11,858 | ||

| Total | 12,100 | Total | 12,100 |

| Balance | $0 | ||

Table (19)

| Interest Receivable | |||

| Interest revenue | $600 | ||

| Total | 600 | Total | $0 |

| Balance | $600 | ||

Table (20)

| Merchandise Inventory | |||

| Beginning balance | $15,000 | Accounts payable | $400 |

| Accounts payable | 5,200 | Accounts payable | 48 |

| Cash | 190 | Cost of goods sold | 6,800 |

| Cost of goods sold | 900 | ||

| Total | 21,290 | Total | 7,248 |

| Balance | $14,042 | ||

| Cost of goods sold | 642 | ||

| Total | 14,042 | Total | 642 |

| Balance | $13,400 | ||

Table (21)

| Land | |||

| Beginning balance | $7,000 | Cash | $7,000 |

| Total | 7,000 | Total | $7,000 |

| Balance | $0 | ||

Table (22)

| Accounts Payable | |||

| Merchandise inventory | $400 | Merchandise inventory | $5,200 |

| Merchandise inventory | 48 | ||

| Cash | 4,752 | ||

| Total | 5,200 | Total | 5,200 |

| Balance | $0 | ||

Table (23)

| Common Stock | |||

| Beginning balance | $15,000 | ||

| Total | $0 | Total | 15,000 |

| Balance | $15,000 | ||

Table (24)

| Beginning balance | $13,900 | ||

| Total | $0 | Total | 13,900 |

| Balance | $13,900 | ||

Table (25)

| Sales Revenue | |||

| Cash | $1,680 | Accounts receivable | $12,100 |

| Accounts receivable | 242 | ||

| Total | $1,922 | Total | 12,100 |

| Balance | $10,178 | ||

Table (26)

| Cost of Goods Sold | |||

| Merchandise inventory | $6,800 | Merchandise inventory | $900 |

| Merchandise inventory | 642 | ||

| Total | 7,442 | Total | 900 |

| Balance | $6,542 | ||

Table (27)

| Transportation-out | |||

| Cash | $140 | ||

| Total | 140 | Total | $0 |

| Balance | $140 | ||

Table (28)

| Interest Revenue | |||

| Interest receivable | $600 | ||

| Total | $0 | Total | 600 |

| Balance | $600 | ||

Table (29)

| Gain from Sale of Land | |||

| Cash | $1,500 | ||

| Total | $0 | Total | 1,500 |

| Balance | $1,500 | ||

Table (30)

d.

Prepare a multistep income statement, statement of stockholders’ equity, balance sheet, and statement of cash flows for Company R, based on the account balances derived in Part (c).

d.

Explanation of Solution

Multi-step income statement: The income statement represented in multi-steps with several subtotals, to report the income from principal operations, and separate the other expenses and revenues which affect net income, is referred to as multi-step income statement.

Prepare a multistep income statement for Company R for the year ended December 31, 2016.

| Company R | ||

| Income Statement | ||

| For the Year Ended December 31, 2016 | ||

| Sales | $12,100 | |

| Sales returns | (1,680) | |

| Sales discounts | (242) | |

| Net sales | $10,178 | |

| Cost of goods sold | (6,542) | |

| Gross margin | 3,636 | |

| Operating expenses: | ||

| Transportation-out | (140) | |

| Operating income | 3,496 | |

| Non-operating items: | ||

| Interest revenue | 600 | |

| Gain on sale of land | 1,500 | 2,100 |

| Net income | $5,596 | |

Table (31)

Statement of stockholders’ equity: The statement which reports the changes in stock, paid-in capital, retained earnings, and

Prepare a statement of stockholders’ equity for Company R for the year ended December 31, 2016.

| Company R | ||

| Statement of Stockholders’ Equity | ||

| For the Year Ended December 31, 2016 | ||

| Beginning common stock | $15,000 | |

| Stock issued | 0 | |

| Ending common stock | $15,000 | |

| Beginning retained earnings | $13,900 | |

| Net income | 5,596 | |

| Ending retained earnings | 19,496 | |

| Total stockholders’ equity | $34,496 | |

Table (32)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare the balance sheet for Company R as at December 31, 2016.

| Company R | ||

| Balance Sheet | ||

| December 31, 2016 | ||

| Assets | ||

| Cash | $20,496 | |

| Accounts receivable | 13,400 | |

| Merchandise inventory | 600 | |

| Total assets | $34,496 | |

| Liabilities | $0 | |

| Stockholders’ equity | ||

| Common stock | 15,000 | |

| Retained earnings | 19,494 | |

| Total stockholders’ equity | 34,496 | |

| Total liabilities and stockholders’ equity | $34,496 | |

Table (33)

Statement of cash flows: Statement of cash flows reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities. Ending cash balance computed in balance sheet is required in statement of cash flows. Operating activities include cash inflows and outflows from business operations. Investing activities includes cash inflows and cash outflows from purchase and sale of land or equipment, or investments. Financing activities includes cash inflows and outflows from issuance of common stock and debt, payment of debt and dividends.

Prepare the statement of cash flows for Company R for the year ended December 31, 2016.

| Company R | ||

| Statement of Cash Flows | ||

| For the Year Ended December 31, 2016 | ||

| Cash flows from operating activities: | ||

| | $10,178 | |

| | (4,942) | |

| Cash outflow for expenses | (140) | |

| Net cash flow from operating activities | $5,096 | |

| Cash flows from investing activities: | ||

| Cash inflow from sale of land | 8,500 | |

| Cash flows from financing activities | 0 | |

| Net change in cash | 13,596 | |

| Add: Beginning cash balance | 6,900 | |

| Ending cash balance | $20,496 | |

Table (34)

e.

Prepare closing entries at the end of 2016, post the closing entries into T-accounts, and prepare post-closing

e.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare closing entries at the end of 2016 for Company R.

Closing revenues:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Sales Revenue | 10,178 | |||||

| Interest Revenue | 600 | |||||

| Gain from Sale of Land | 1,500 | |||||

| Retained Earnings | 12,278 | |||||

| (Record revenues being closed to Retained Earnings account) | ||||||

Table (35)

Description:

- Sales Revenue, Interest Revenue, and Gain from Sale of Land are revenue accounts. Since revenues are closed to Retained Earnings account, the accounts are cancelled by debiting to reverse its effect.

- Retained Earnings is a stockholders’ equity account. Since revenues are transferred to the account, the value increased, and an increase in equity is credited.

Closing expenses:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 2016 | ||||||

| Retained Earnings | 6,682 | |||||

| Cost of Goods Sold | 6,542 | |||||

| Transportation-out | 140 | |||||

| (Record expenses being closed to Retained Earnings account) | ||||||

Table (36)

Description:

- Retained Earnings is a stockholders’ equity account. Since expenses are transferred to the account, the value decreased, and a decrease in equity is debited.

- Cost of Goods Sold and Transportation-out are expenses accounts. Since expenses are closed to Retained Earnings account, the accounts are cancelled by crediting to reverse the effect.

Post the entries into T-accounts.

| Cash | |||

| Balance | $20,496 | ||

Table (37)

| Interest Receivable | |||

| Balance | $600 | ||

Table (38)

| Merchandise Inventory | |||

| Balance | $13,400 | ||

Table (39)

| Common Stock | |||

| Balance | $15,000 | ||

Table (40)

| Retained Earnings | |||

| Beginning balance | $13,900 | ||

| Total | $0 | Total | 13,900 |

| Balance | $13,900 | ||

| Cost of goods sold | 6,542 | Sales revenue | 10,178 |

| Transportation-out | 140 | Interest revenue | 600 |

| Gain from sale of land | 1,500 | ||

| Total | 6,682 | Total | 26,178 |

| Balance | $19,496 | ||

Table (41)

| Sales Revenue | |||

| Cash | $1,680 | Accounts receivable | $12,100 |

| Accounts receivable | 242 | ||

| Total | $1,922 | Total | 12,100 |

| Balance | $10,178 | ||

| Retained earnings | 10,178 | ||

| Total | 10,178 | Total | 10,178 |

| Balance | $0 | ||

Table (41)

| Cost of Goods Sold | |||

| Merchandise inventory | $6,800 | Merchandise inventory | $900 |

| Merchandise inventory | 642 | ||

| Total | 7,442 | Total | 900 |

| Balance | $6,542 | ||

| Retained earnings | 6,542 | ||

| Total | 6,542 | Total | 6,542 |

| Balance | $0 | ||

Table (42)

| Transportation-out | |||

| Cash | $140 | ||

| Total | 140 | Total | $0 |

| Balance | $140 | ||

| Retained earnings | 140 | ||

| Total | 140 | Total | 140 |

| Balance | $0 | ||

Table (43)

| Interest Revenue | |||

| Interest receivable | $600 | ||

| Total | $0 | Total | 600 |

| Balance | $600 | ||

| Retained earnings | 600 | ||

| Total | 600 | Total | 600 |

| Balance | $0 | ||

Table (44)

| Gain from Sale of Land | |||

| Cash | $1,500 | ||

| Total | $0 | Total | 1,500 |

| Balance | $1,500 | ||

| Retained earnings | 1,500 | ||

| Total | 1,500 | Total | 1,500 |

| Balance | $0 | ||

Table (45)

Post-closing trial balance: Post-closing trial balance is a summary of all the asset, liability, and equity accounts and their balances, after the closing entries are prepared. So, post-closing trial balance reports the balances of permanent accounts only.

Prepare post-closing trial balance for Company R as of December 31, 2016.

| Company R | ||

| Post-Closing Trial Balance | ||

| December 31, 2016 | ||

| Account Titles | Debit ($) | Credit ($) |

| Cash | $20,496 | |

| Merchandise Inventory | 13,400 | |

| Interest receivable | 600 | |

| Common Stock | $15,000 | |

| Retained earnings | 19,496 | |

| Total | $34,496 | $34,496 |

Table (46)

Want to see more full solutions like this?

Chapter 4 Solutions

FUND.FINAN.ACCT.CONC.-WKPPRS.>CUSTOM<

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education