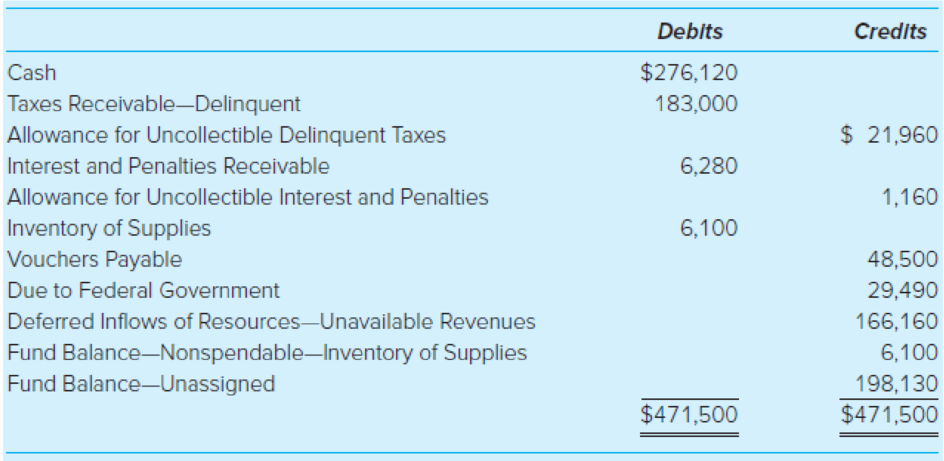

The City of Castleton’s General Fund had the following post-closing

During the year ended June 30, 2020, the following transactions, in summary form, with subsidiary ledger detail omitted, occurred:

- 1. The budget for FY 2020 provided for General Fund estimated revenues totaling $3,140,000 and appropriations totaling $3,100,000.

- 2. The city council authorized temporary borrowing of $500,000 in the form of a 120-day tax anticipation note. The loan was obtained from a local bank at a discount of 6 percent per annum (debit Expenditures for the discount in the General Fund journal and Expenses—General Government in the governmental activities journal).

- 3. The property tax levy for FY 2020 was recorded. Net assessed valuation of taxable property for the year was $43,000,000, and the tax rate was $5 per $100. It was estimated that 3 percent of the levy would be uncollectible.

- 4. Purchase orders and contracts were issued to vendors and others in the amount of $2,060,000.

- 5. $1,961,000 of current taxes, $103,270 of delinquent taxes, and $3,570 of interest and penalties were collected. The delinquent taxes and associated interest and penalties were collected more than 60 days after the prior year-end.

- 6. Additional interest and penalties on delinquent taxes were accrued in the amount of $3,430, of which 30 percent was estimated to be uncollectible.

- 7. Because of a change in state law, the city was notified that it will receive $80,000 less in intergovernmental revenues than was budgeted.

- 8. Delinquent taxes of $12,792 were deemed uncollectible and written off. The associated interest and penalties of $952 also were written off.

- 9. Total payroll during the year was $819,490. Of that amount, $62,690 was withheld for employees’ FICA tax liability, $103,710 for employees’ federal income tax liability, and $34,400 for state taxes; the balance was paid to employees in cash.

- 10. The employer’s FICA tax liability was recorded for $62,690.

- 11. Revenues from sources other than taxes were collected in the amount of $947,000.

- 12. Amounts due the federal government as of June 30, 2020, and amounts due for FICA taxes and state and federal withholding taxes during the year were vouchered.

- 13. Purchase orders and contracts encumbered in the amount of $1,988,040 were filled at a net cost of $1,987,570, which was vouchered.

- 14. Vouchers payable totaling $2,201,660 were paid after deducting a credit for purchases discount of $8,030 (credit Expenditures).

- 15. The tax anticipation note of $500,000 was repaid.

- 16. All unpaid current year’s property taxes became delinquent. The balances of the current taxes receivables and related uncollectibles were transferred to delinquent accounts. The City uses the 60-day rule for all revenues and does not expect to collect any delinquent property taxes or interest and penalties in the first 60 days of the next fiscal year.

- 17. A physical inventory of materials and supplies at June 30, 2020, showed a total of $9,100. Inventory is recorded using the purchases method in the General Fund; the consumption method is used at the government-wide level. (Note: A periodic inventory system is used both in the General Fund and at the government-wide level. When inventory was purchased during the year, Expenditures were debited in the General Fund journal and Inventory of Supplies was debited in the governmental activities journal.)

Required

- a. Record in general journal form the effect of the above transactions on the General Fund and governmental activities for the year ended June 30, 2020. Do not record subsidiary ledger debits and credits.

- b. Record in general

journal form entries to close the budgetary and operating statement accounts in the General Fund only. Do not close the governmental activities accounts. - c. Prepare a General Fund

balance sheet as of June 30, 2020. - d. Prepare a statement of revenues, expenditures, and changes in fund balance for the year ended June 30, 2020. Do not prepare the government-wide financial statements.

a.

Journalize the given transactions in General Fund and governmental activities in the general journals for the year ended June 30, 2020.

Explanation of Solution

General Fund: The chief operating fund of state and local government used to record the departmental operating activities and government support services is referred to as General Fund, or General Operating Fund, or General Revenue Fund. The activities recorded in General Funds are police, fire, public works, recreation, education, culture, social services, city office, finance, personnel, and data processing.

Journalize the given transactions in General Fund and governmental activities in the general journals for the year ended June 30, 2020.

1.

Entry to record estimated revenues and appropriations:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Estimated Revenues | $3,140,000 | ||

| Appropriations | $3,100,000 | ||

| Budgetary Fund Balance | 40,000 | ||

Table (1)

2.

Entry to record the receipt of temporary borrowing as loan:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Cash | $490,000 | ||

| Expenditures–2020 | $10,000 | ||

| Tax Anticipation Notes Payable | $500,000 | ||

| Governmental Activities: | |||

| Cash | $490,000 | ||

| Expenses–General Government | $10,000 | ||

| Tax Anticipation Notes Payable | $500,000 | ||

Table (2)

Note: The local bank charged 6% discount per year on the temporary borrowing of $500,000 which amounts to $10,000

3.

Entries to record property tax levy:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Taxes Receivable–Current | $2,150,000 | ||

| Allowance for Uncollectible Current Taxes | $64,500 | ||

| Revenues | $2,085,500 | ||

| Governmental Activities: | |||

| Taxes Receivable–Current | $2,150,000 | ||

| Allowance for Uncollectible Current Taxes | $64,500 | ||

| Revenues | $2,085,500 | ||

Table (3)

Working Notes:

Compute gross tax levied.

Compute uncollectible taxes.

4.

Entry to record supplies ordered at an estimated cost:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Encumbrances–2020 | $2,060,000 | ||

| Encumbrances Outstanding–2020 | $2,060,000 | ||

Table (4)

5.

Entry to record collection of delinquent taxes, interest, and penalties:

| General Ledger | |||

| Debits | Credits | ||

| General Fund and Governmental Activities: | |||

| Cash | $2,067,840 | ||

| Taxes Receivable–Current | $1,961,000 | ||

| Taxes Receivable–Delinquent | $103,270 | ||

| Interest and Penalties Receivable on Taxes | $3,570 | ||

| General Fund: | |||

| Deferred Inflows of Resources–Unavailable Revenues | $106,840 | ||

| Revenues | $106,840 | ||

Note: The delinquent taxes and interest and penalties are recorded as Deferred Inflows of Resources–Unavailable Revenues because those taxes are collected after 60-day after the end of prior period.

Table (5)

6.

Entry to record accrued interest and penalties:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Interest and Penalties Receivable on Taxes | $3,430 | ||

| Allowance for Uncollectible Interest and Penalties | $1,029 | ||

| Revenues | $2,401 | ||

| Governmental Activities: | |||

| Interest and Penalties Receivable on Taxes | $3,430 | ||

| Allowance for Uncollectible Interest and Penalties | $1,029 | ||

| General Revenues–Interest and Penalties on Delinquent Taxes | $2,401 | ||

Table (6)

7.

Entry to record decrease in the revenues than was budgeted:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Budgetary Fund Balance | $80,000 | ||

| Estimated Revenues | $80,000 | ||

Table (7)

8.

Entry to record delinquent taxes, interest and penalties as uncollectible and written off:

| General Ledger | |||

| Debits | Credits | ||

| General Fund and Governmental Activities: | |||

| Allowance for Uncollectible Delinquent Taxes | $12,792 | ||

| Allowance for Uncollectible Interest and Penalties | $952 | ||

| Taxes Receivable–Delinquent | $12,792 | ||

| Interest and Penalties Receivable on Taxes | $952 | ||

Table (8)

9.

Entry to record payment of payroll taxes:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Expenditures–2020 | $819,490 | ||

| Due to Federal Government | $166,400 | ||

| Due to State Government | $34,400 | ||

| Cash | $618,690 | ||

| Governmental Activities: | |||

| Expenses | $819,490 | ||

| Due to Federal Government | $166,400 | ||

| Due to State Government | $34,400 | ||

| Cash | $618,690 | ||

Table (9)

10.

Entry to record employer’s FICA tax liability:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Expenditures–2020 | $62,690 | ||

| Due to Federal Government | $62,690 | ||

| Governmental Activities: | |||

| Expenses | $62,690 | ||

| Due to Federal Government | $62,690 | ||

Table (10)

11.

Entry to record revenues other than taxes:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Cash | $947,000 | ||

| Revenues | $947,000 | ||

| Governmental Activities: | |||

| Cash | $947,000 | ||

| Revenues (program or general) | $947,000 | ||

Table (11)

12.

Entry to record FICA and state and federal withholding taxes:

| General Ledger | |||

| Debits | Credits | ||

| General Fund and Governmental Activities: | |||

| Due to Federal Government | $258,580 | ||

| Due to State Government | $34,400 | ||

| Vouchers Payable | $292,980 | ||

Table (12)

13.

Entry to record purchase orders encumbered:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Encumbrances Outstanding–2020 | $1,988,040 | ||

| Encumbrances–2020 | $1,988,040 | ||

| Expenditures–2020 | $1,987,570 | ||

| Vouchers Payable | $1,987,570 | ||

| Governmental Activities: | |||

| Expenses | $1,987,570 | ||

| Vouchers Payable | $1,987,570 | ||

Table (13)

14.

Entry to record payment of vouchers payable:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Vouchers Payable | $2,201,660 | ||

| Cash | $2,193,630 | ||

| Expenditures–2020 | $8,030 | ||

| Governmental Activities: | |||

| Vouchers Payable | $2,201,660 | ||

| Cash | $2,193,630 | ||

| Expenses | $8,030 | ||

Table (14)

15.

Entry to record the repayment of the tax anticipation notes:

| General Ledger | |||

| Debits | Credits | ||

| General Fund and Governmental Activities: | |||

| Tax Anticipation Notes Payable | $500,000 | ||

| Cash | $500,000 | ||

Table (15)

16.

Entries to record reclassification of uncollected taxes as delinquent taxes:

| General Ledger | |||

| Debits | Credits | ||

| General Fund and Governmental Activities: | |||

| Taxes Receivable–Delinquent | $189,000 | ||

| Allowance for Uncollectible Current Taxes | $64,500 | ||

| Taxes Receivable–Current | $189,000 | ||

| Allowance for Uncollectible Delinquent Taxes | $64,500 | ||

| General Fund: | |||

| Revenues | $126,901 | ||

| Deferred Inflows of Resources–Unavailable Revenues | $126,901 | ||

Table (16)

Note: The uncollected taxes amount to $189,000

17.

Entry to record the repayment of the tax anticipation notes:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Inventory Supplies | $3,000 | ||

| Fund Balance–Nonspendable–Inventory of Supplies | $3,000 | ||

Table (17)

b.

Prepare journal entries to close budgetary and operating statement accounts in the General Fund.

Explanation of Solution

Prepare journal entries to close budgetary and operating statement accounts in the General Fund.

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Appropriations | $3,100,000 | ||

| Estimated Revenues | $3,060,000 | ||

| Budgetary Fund Balance | $40,000 | ||

| Revenues | $3,014,840 | ||

| Expenditures–2020 | $2,871,720 | ||

| Fund Balance–Unassigned | $143,120 | ||

Table (18)

c.

Prepare General Fund balance sheet of City C as of June 30, 2020.

Explanation of Solution

General Fund balance sheet: This is the financial statement that reports the financial position of the General Fund, and includes the sections assets, liabilities, deferred inflows of resources, and fund balances.

Prepare General Fund balance sheet of City C as of June 30, 2020.

| City C | ||

| General Fund Balance Sheet | ||

| As of June 30, 2020 | ||

| Assets | ||

| Cash | $468,640 | |

| Taxes receivable–Delinquent | $255,938 | |

| Less: Allowance for uncollectible taxes–Delinquent | $73,668 | $182,270 |

| Interest and penalties receivable | $5,188 | |

| Less: Allowance for uncollectible interest and penalties | $1,237 | $3,951 |

| Inventory of supplies | $9,100 | |

| Total Assets | $663,961 | |

| Liabilities, Deferred Inflows of Resources and Fund Balances | ||

| Liabilities and deferred inflows of resources: | ||

| Vouchers payable | $127,390 | |

| Deferred inflows of resources–Unavailable revenues | $186,221 | |

| Total liabilities and deferred inflows of resources | $313,611 | |

| Fund balances: | ||

| Nonspendable–inventory of supplies | $9,100 | |

| Unassigned | $341,250 | |

| Total fund balances | $350,350 | |

| Total liabilities, deferred inflows of resources, and fund balances | $663,961 | |

Table (19)

d.

Prepare a statement of revenues, expenditures, and changes in fund balance of General Fund for City C for the year ended June 30, 2020.

Explanation of Solution

Statement of revenues, expenditures, and changes in fund balance: This is the operating statement that accounts for the revenues and expenditures, and changes in the fund balances of the governmental funds.

Prepare a statement of revenues, expenditures, and changes in fund balance of General Fund for City C for the year ended June 30, 2020.

| City C | |

| Statement of Revenues, Expenditures, and Changes in Fund Balance | |

| For the Year Ended June 30, 2020 | |

| Revenues | |

| Taxes | $2,064,270 |

| Interest and penalties on taxes | 3,570 |

| Other sources | 947,000 |

| Total Revenues | $3,014,840 |

| Expenditures | |

| Salaries and wages | $882,180 |

| Interest on note payable | 10,000 |

| Other | 1,979,540 |

| Total Expenditures | $2,871,720 |

| Excess (deficiency) of revenues over expenditures | 143,120 |

| Increase in inventory of supplies | 3,000 |

| Fund balances–January 1, 2020 | 204,230 |

| Fund Balances–December 31, 2020 | $350,350 |

Table (20)

Want to see more full solutions like this?

Chapter 4 Solutions

Accounting For Governmental & Nonprofit Entities

- Rose City formally integrates budgetary accounts into its general fund. During the year ended December 31, 2019, Rose received a state grant to buy a bus and an additional grant for bus operation in 2019. In 2019, only 90% of the capital grant was used for the bus purchase, but 100% of the operating grant was disbursed. Rose has incurred the following long-term obligations:a. General obligation bonds issued for the water and sewer fund which will service the debt.b. Revenue bonds to be repaid from admission fees collected from users of the municipal recreation center.These bonds are expected to be paid from enterprise funds and are secured by Rose’s full faith, credit, and taxing power as further assurance that the obligations will be paid. Rose’s 2019 expenditures from the general fund include payments for structural alterations to a firehouse and furniture for the mayor’s office.In Rose’s general fund balance sheet presentation at December 31, 2019, which of the following…arrow_forwardOn October 1, 2019, the City of Mizner issued $6,000,000 in 4%, general obligation bonds at 101 for the purpose of constructing an addition to City Hall. The premium was transferred to a debt service fund. A total of $5,968,750 was used to construct the addition, which was completed prior to June 30, 2020. The remaining funds were transferred to the debt service fund. The bonds were dated October 1, 2019, and paid interest on April 1 and October 1. The first of 20 annual principal payments of $300,000 is due October 1, 2020. The fiscal year for Mizner is July 1- June 30.In addition to a $6,000,000 liability in the government-wide Statement of Net Position, how would the bond sale be reported? Multiple Choice As a $6,000,000 other financing source in the capital projects fund, a $60,000 other financing source in the debt service fund, and as a $6,000,000 liability in the debt service fund. As a $6,060,000 other financing source in the capital projects fund, a $60,000…arrow_forwardThe following information relates to Redwood City during its fiscal year ended December 31, 2019:a. On October 31, 2019, to finance the construction of a city hall annex, Redwood issued 8%, 10-year general obligation bonds at their face value of $600,000. Construction expenditures during the period equaled $364,000.b. Redwood reported $109,000 from hotel room taxes, restricted for tourist promotion, in a special revenue fund. The fund paid $81,000 for general promotions and $22,000 for a motor vehicle.c. 2019 general fund revenues of $104,500 were transferred to a debt service fund and used to repay $100,000 of 9%, 15-year term bonds and $4,500 of interest. The bonds were used to acquire a citizens’ center.d. At December 31, 2019, as a consequence of past services, city firefighters had accumulated entitlements to compensated absences valued at $140,000. General fund resources available at December 31, 2019, are expected to be used to settle $30,000 of this amount, and $110,000 is…arrow_forward

- The following transactions relate to the General Fund of the City of Buffalo Falls for the year ended December 31, 2020: Beginning balances were: Cash, $99,000; Taxes Receivable, $198,500; Accounts Payable, $56,750; and Fund Balance, $240,750. The budget was passed. Estimated revenues amounted to $1,290,000 and appropriations totaled $1,286,200. All expenditures are classified as General Government. Property taxes were levied in the amount of $945,000. All of the taxes are expected to be collected before February 2021. Cash receipts totaled $915,000 for property taxes and $312,500 from other revenue. Contracts were issued for contracted services in the amount of $105,750. Contracted services were performed relating to $94,500 of the contracts with invoices amounting to $91,700. Other expenditures amounted to $990,500. Accounts payable were paid in the amount of $1,132,500. The books were closed. Required:a. Prepare journal entries for the above transactions.b. Prepare a Statement of…arrow_forwardThe City of Mayville had total fund balance in its General Fund of $200,000 on December 31, 2019. The City of Maysville’s General Fund balance sheet for its December 31, 2019 year end shows inventory of $8,000 and prepaid rent of $10,000. The City also had $60,000 of outstanding encumbrances in its General Fund at year-end. In December 2019, a grantor provided the City with $42,000 that must be used to buy musical instruments for the City’s youth orchestra. No instruments had been purchased at year-end. How much should the City report as unassigned fund balance in its General Fund on December 31, 2019? $38,000 $60,000 $80,000 $102,000 $120,000arrow_forwardOn October 1, 2019, the City of Thomasville issued $5,000,000 in 4%, general obligation bonds at 101 for the purpose of constructing an addition to City Hall. The premium was transferred to a debt service fund. A total of $4,968,750 was used to construct the addition, which was completed prior to June 30, 2020. The remaining funds were transferred to the debt service fund. The bonds were dated October 1, 2019, and paid interest on April 1 and October 1. The first of 20 annual principal payments of $250,000 is due October 1, 2020. The fiscal year for Thomasville is July 1 - June 30.How would the construction costs be reported at year-end? As an expenditure of the capital projects fund and an expense in the government-wide Statement of Activities. As an expenditure of the capital projects fund only. As an expenditure of the capital projects fund and a capital asset in the government-wide Statement of Net Position. As a capital asset in the Statement of Net Position only.arrow_forward

- The following transactions occurred during the 2020 fiscal year for the City of Evergreen. For budgetary purposes, the city reports encumbrances in the Expenditures section of its budgetary comparison schedule for the General Fund but excludes expenditures chargeable to a prior year’s appropriation. The budget prepared for the fiscal year 2020 was as follows: Estimated Revenues: Taxes $ 1,957,000 Licenses and permits 374,000 Intergovernmental revenue 399,000 Miscellaneous revenues 64,000 Total estimated revenues 2,794,000 Appropriations: General government 475,200 Public safety 890,200 Public works 654,200 Health and welfare 604,200 Miscellaneous 88,000 Total appropriations 2,711,800 Budgeted increase in fund balance $ 82,200 Encumbrances issued against the appropriations during the year were as follows: General government $ 60,000 Public safety 252,000 Public works 394,000 Health and…arrow_forwardAssume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $646,000. Parks reports net expenses of $180,000. Art museum reports net revenues of $61,000. General government revenues for the year were $941,000 with an overall increase in the city's net position of $176,000. The fund financial statements provide the following for the entire year: The general fund reports a $51,500 increase in its fund balance. The capital projects fund reports a $52,250 increase in its fund balance. The enterprise fund reports a $69,500 increase in its net position. The city asks the…arrow_forwardAssume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $766,000. Parks reports net expenses of $163,000. Art museum reports net revenues of $58,250. General government revenues for the year were $1,069,750 with an overall increase in the city's net position of $199,000. The fund financial statements provide the following for the entire year: The general fund reports a $35,750 increase in its fund balance. The capital projects fund reports a $45,750 increase in its fund balance. The enterprise fund reports a $72,750 increase in its net position. The city asks…arrow_forward

- Assume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $702,000. Parks reports net expenses of $144,000. Art museum reports net revenues of $50,250. General government revenues for the year were $966,750 with an overall increase in the city's net position of $171,000. The fund financial statements provide the following for the entire year: The general fund reports a $45,250 increase in its fund balance. The capital projects fund reports a $53,750 increase in its fund balance. The enterprise fund reports a $69,000 increase in its net position. The city asks the…arrow_forwardAssume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $615,000. Parks reports net expenses of $102,000. Art museum reports net revenues of $51,000. General government revenues for the year were $894,000 with an overall increase in the city's net position of $228,000. The fund financial statements provide the following for the entire year: The general fund reports a $44,000 increase in its fund balance. The capital projects fund reports a $64,500 increase in its fund balance. The enterprise fund reports a $62,250 increase in its net position. The city asks the…arrow_forwardThe following information pertains to the City of Williamson for 2020, its first year of legal existence. For convenience, assume that all transactions are for the general fund, which has three separate functions: general government, public safety, and health and sanitation. Receipts: Property taxes $320,000 Franchise taxes 42,000 Charges for general government services 5,000 Charges for public safety services 3,000 Charges for health and sanitation services 42,000 Issued long-term note payable 200,000 Receivables at end of year: Property taxes (90% estimated to be collectible) 90,000 Payments: Salary: General government 66,000 Public safety 39,000 Health and sanitation 22,000 Rent: General government 11,000 Public safety 18,000 Health and sanitation 3,000 Maintenance: General government 21,000 Public safety 5,000 Health and sanitation 9,000 Insurance: General government 8,000 Public safety ($2,000 still prepaid…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education