Concept explainers

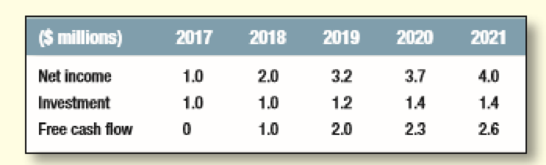

Valuing Tree cash flow Phoenix Corp. faltered in the recent recession but is recovering.

Phoenix’s recovery will be complete by 2021, and there will be no further growth in free cash flow.

- a. Calculate the PV of free cash flow, assuming a

cost of equity of 9%. - b. Assume that Phoenix has 12 million shares outstanding. What is the price per share?

- c. If the 2016 net income is $1 million, what is Phoenix’s P/R ratio? How do you expect that P/E ratio to change from 2017 to 2021?

- d. Confirm that the expected

rate of return on Phoenix stock is exactly 9% in each of the years from 2017 to 2021.

a)

To determine: Present value of free cash flow

Explanation of Solution

Compute the present value of free cash flow:

Hence, the present value is $26.68 million.

b)

To determine: Price per share

Explanation of Solution

Note:

Assume no debt, the share price are as follows,

Hence, the price per share is $2.04.

c)

To determine: PE ratio and change in PE ratio from 2017 to 2021.

Explanation of Solution

Compute PE ratio:

Compute PV of the cash flows at various points in time:

Changes in PE ratio:

d)

To confirm: The expected rate of return is 9%.

Explanation of Solution

Compute rate of return using the formula

Thus, the above calculation shows that the rate of return on Company P is exactly 9%.

Want to see more full solutions like this?

Chapter 4 Solutions

PRIN.OF CORPORATE FINANCE >BI<

- Dividend Payout The Wei Corporation expects next year’s net income to be $15 million. The firm is currently financed with 40% debt. Wei has $12 million of profitable investment opportunities, and it wishes to maintain its existing debt ratio. According to the residual distribution model (assuming all payments are in the form of dividends), how large should Wei’s dividend payout ratio be next year?arrow_forwardWACC Estimation On January 1, the total market value of the Tysseland Company was $60 million. During the year, the company plans to raise and invest $30 million in new projects. The firm’s present market value capital structure, shown here, is considered to be optimal. There is no short-term debt. New bonds will have an 8% coupon rate, and they will be sold at par. Common stock is currently selling at $30 a share. The stockholders’ required rate of return is estimated to be 12%, consisting of a dividend yield of 4% and an expected constant growth rate of 8%. (The next expected dividend is $1.20, so the dividend yield is $1.20/$30 = 4%.) The marginal tax rate is 40%. In order to maintain the present capital structure, how much of the new investment must be financed by common equity? Assuming there is sufficient cash flow for Tysseland to maintain its target capital structure without issuing additional shares of equity, what is its WACC? Suppose now that there is not enough internal cash flow and the firm must issue new shares of stock. Qualitatively speaking, what will happen to the WACC? No numbers are required to answer this question.arrow_forwardCALCULATING THE WACC Here is the condensed 2019 balance sheet for Skye Computer Company (in thousands of dollars): Skyes earnings per share last year were 3.20. The common stock sells for 55.00. last years dividend (D0) was 2.10, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skyes preferred stock pays a dividend of 3.30 per share, and its preferred stock sells for 30.00 per share. The firms before-lax cost of debt is 10%, and its marginal tax rate is 25%. The firms currently outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5%, the risk-free rate is 6%, and Skyes beta is 1.516. The firms total debt, which is the sum of the companys short-term debt and long-term debt, equals 1.2 million. a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the cost of equity from retained earnings, and the cost of newly issued common stock. Use the DCF method to find the cost of common equity. b. Now calculate the cost of common equity from retained earnings, using the CAPM method. c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between r1 and rs as determined by the DCF method, and add that differential to the CAPM value for rs.) d. If Skye continues to use the same market-value capital structure, what is the firms WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock?arrow_forward

- (Measuring growth) Solarpower Systems earned $20 per share at the beginning of the year and paid out $9 in dividends to shareholders (so, D0=$9) and retained $11 to invest in new projects with an expected return on equity of 19 percent. In the future, Solarpower expects to retain the same dividend payout ratio, expects to earn a return of 19 percent on its equity invested in new projects, and will not be changing the number of shares of common stock outstanding. a. Calculate the future growth rate for Solarpower's earnings. b. If the investor's required rate of return for Solarpower's stock is 15 percent, what would be the price of Solarpower's common stock? c. What would happen to the price of Solarpower's common stock if it raised its dividends to $13 and then continued with that same dividend payout ratio permanently? Should Solarpower make this change? (Assume that the investor's required rate of return remains at 15 percent.) d. What would happened to…arrow_forwardCost of Equity The earnings, dividends, and stock price of Shelby Inc. are expected to grow at 8% per year in the future. Shelby's common stock sells for $22 per share, its last dividend was $1.50, and the company will pay a dividend of $1.62 at the end of the current year. Using the discounted cash flow approach, what is its cost of equity? Round your answer to two decimal places. % If the firm's beta is 1.8, the risk-free rate is 10%, and the expected return on the market is 12%, then what would be the firm's cost of equity based on the CAPM approach? Round your answer to two decimal places.arrow_forwardQuantitative Problem 2: Hadley Inc. forecasts the year-end free cash flows (in millions) shown below. Year 1 2 3 4 5 FCF -$22.39 $38.8 $44 $52.8 $56.5 The weighted average cost of capital is 9%, and the FCFs are expected to continue growing at a 3% rate after Year 5. The firm has $24 million of market-value debt, but it has no preferred stock or any other outstanding claims. There are 20 million shares outstanding. What is the value of the stock price today (Year 0)? Round your answer to the nearest cent. Do not round intermediate calculations.$ per sharearrow_forward

- (Liquidity analysis) Airspot Motors, Inc. has $2,172,500 in current assets and $869,000 in current liabilities. The company's managers want to increase the firm's inventory, which will be financed using short-term debt. How much can the firm increase its inventory without its current ratio falling below 2.1 (assuming all other current assets and current liabilities remain constant)?arrow_forwardA company’s common stock is currently selling at $40 per share. Its most recent dividend was $1.60, and the financial community expects that its dividend will grow at 10% per year in the foreseeable future. What is the company’s equity cost of retained earnings? If the company sells new common stock to finance new projects and most pay $2 per share in flotation costs, what is the cost of equity? Be sure to include your work for all calculations.arrow_forwardSubject: accounting Estimating the Market’s Expected Growth Rate in Dividends Mattel, Inc. was trading at a price of $31.24 per common share at December 31, 2015. Using the Gordon growth model, estimate the market’s expected growth in dividends that is required to yield the $31.24 price per common share. Assume that the current dividend per share is $1.52 and is expected to grow thereafter, and that the cost of equity capital is 8.0%. (Hint: Use the equation for the dividend discount model with increasing perpetuity, at the top of page 12-20.) Round answer to one decimal place (ex: 0.0235 = 2.4%). Note: Assume current dividend per share is the dividend amount when the constant growth period begins. Answer%arrow_forward

- (Measuring growth) Solarpower Systems earned $20 per share at the beginning of the year and paid out $8 in dividends to shareholders (so, D0=$8) and retained $12 to invest in new projects with an expected return on equity of 21 percent. In the future, Solarpower expects to retain the same dividend payout ratio, expects to earn a return of 21 percent on its equity invested in new projects, and will not be changing the number of shares of common stock outstanding. a. Calculate the future growth rate for Solarpower's earnings. b. If the investor's required rate of return for Solarpower's stock is 13 percent, what would be the price of Solarpower's common stock? c. What would happen to the price of Solarpower's common stock if it raised its dividends to $12 and then continued with that same dividend payout ratio permanently? Should Solarpower make this change? (Assume that the investor's required rate of return remains at 13 percent.) d. What would happened…arrow_forwardFor 2020 the free cash flow to the firm (FCFF) of ABC Co. was ₱30,000. The firm has total debt of ₱20,000, and there were 12,000 shares outstanding. The required rate of return is 9% and the estimated growth rate in FCFF is 6.5%. How much is the intrinsic value per share of ABC Co.? ₱80.45 ₱94.92 ₱104.83 ₱112.50 answer not givenarrow_forwardQuantitative Problem 2: Hadley Inc. forecasts the year-end free cash flows (in millions) shown below. Year 1 2 3 4 5 FCF -$22.99 $38.8 $43.3 $52.5 $56 The weighted average cost of capital is 10%, and the FCFs are expected to continue growing at a 5% rate after Year 5. The firm has $24 million of market-value debt, but it has no preferred stock or any other outstanding claims. There are 18 million shares outstanding. Also, the firm has zero non-operating assets. What is the value of the stock price today (Year 0)? Round your answer to the nearest cent. Do not round intermediate calculations.$ per share According to the valuation models developed in this chapter, the value that an investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock. The statement above is .arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning