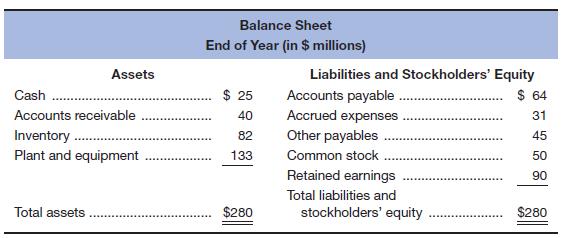

Conn Man’s Shops, a national clothing chain, had sales of $350 million last year. The business has a steady net profit margin of 9 percent and a dividend payout ratio of 25 percent. The balance sheet for the end of last year is shown next.

The firm’s marketing staff has told the president that in the coming year there will be a large increase in the demand for overcoat and wool slacks. A sales increase of 20 percent is

All balance sheet items are expected to maintain the same percent-of-sales relationships as last year,* except for common stock and

a. Will external financing be required for the company during the coming year?

b. What would be the need for external financing if the net profit margin went up to 10.5 percent and the dividend payout ratio was increased to 60 percent? Explain.

a.

To determine: Whether the company requires external finance or not during the coming years.

Introduction:

External Finance:

It is an external/outside source through which a company raises money to accomplish its operations. It can be from the issuance of equity, debt, and loan from banks.

Answer to Problem 29P

The company does not need external finance as the requirement of new funds is negative. It indicates that the company has sufficient fund for its operations.

Explanation of Solution

The calculation of the requirement of the new funds (RNF) is as follows.

Working notes:

The calculation of the total liabilities is as follows.

The calculation of the new sales is as follows.

The calculation of the change in sales is as follows.

The calculation of the retention ratio is as follows.

b.

To determine: Whether the company requires external finance or not during the coming years when the profit margin increases to 10.5% and dividend payout ratio to 60%.

Introduction:

External Finance:

It is an external/outside source through which a company raises money to accomplish its operations. It can be from the issuance of equity, debt, and loan from banks.

Answer to Problem 29P

Due to an increase in profit margin ratio and dividend payout ratio, the company requires external finance of $10,360,000. An increase in profit margin ratio means that the funds of the company increase when there is an increase in the dividend payout ratio. The funds of the company decrease because the company needs to pay more dividends to its shareholders. The payment of a dividend company requires external finance.

Explanation of Solution

The calculation of the requirement of the new funds (RNF) is as follows.

Working notes:

The calculation of the total liabilities is as follows.

The calculation of the new sales is as follows.

The calculation of the change in sales is as follows.

The calculation of the retention ratio is as follows.

Want to see more full solutions like this?

Chapter 4 Solutions

Foundations Of Financial Management

- Macom Manufacturing has total contribution margin of $61,250 and net income of $24,500 for the month of June. Marcus expects sales volume to increase by 10% in July. What are the degree of operating leverage and the expected percent change in income for Macom Manufacturing? 0.4 and 10% 2.5 and 10% 2.5 and 25% 5.0 and 50%arrow_forwardPoleski Manufacturing, which maintains the same level of inventory at the end of each year, provided the following information about expenses anticipated for next year: The selling price of Poleskis single product is 16. In recent years, profits have fallen and Poleskis management is now considering a number of alternatives. Poleski wants to have a net income next year of 250,000, but expects to sell only 120,000 units unless some changes are made. The president of Poleski has asked you to calculate the companys projected net income (assuming 120,000 units are sold) and the sales needed to achieve the companys net income objective for next year. Also, compute Poleskis contribution margin per unit, contribution margin ratio, and break-even point for next year. The worksheet CVP has been provided to assist you. Note that the data from the problem have already been entered into the Data Section of the worksheet.arrow_forwardOwen’s Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity. Balance Sheet(in $ millions) Assets Liabilities and Stockholders' Equity Cash $ 14 Accounts payable $ 25 Accounts receivable 30 Accrued wages 12 Inventory 31 Accrued taxes 16 Current assets $ 75 Current liabilities $ 53 Fixed assets 48 Notes payable 20 Common stock 23 Retained earnings 27 Total assets $ 123 Total liabilities and stockholders' equity $ 123 Owen’s Electronics has an aftertax profit margin of 7 percent and a dividend payout ratio of 40 percent. If sales grow by 30 percent next year, determine how many dollars of new funds are needed to finance…arrow_forward

- Lux Co. recently reported sales of P100 million, and net income equal to P5 million. The company has P70 million in total assets. Over the next year, the company is forecasting a 25 percent increase in sales. Since the company is at full capacity, its assets must increase in proportion to sales. The company also estimates that if sales increase 20 percent, spontaneous liabilities will increase by P2.1 million. If the company’s sales increase, its profit margin will remain at its current level. The company’s dividend payout ratio is 45 percent. Based on the AFN formula, how much additional capital must the company raise in order to support the 20 percent increase in sales?arrow_forwardOwen’s Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity. Balance Sheet(in $ millions) Assets Liabilities and Stockholders' Equity Cash $ 7 Accounts payable $ 20 Accounts receivable 25 Accrued wages 7 Inventory 28 Accrued taxes 13 Current assets $ 60 Current liabilities $ 40 Fixed assets 45 Notes payable 15 Common stock 20 Retained earnings 30 Total assets $ 105 Total liabilities and stockholders' equity $ 105 Owen’s Electronics has an aftertax profit margin of 10 percent and a dividend payout ratio of 45 percent. If sales grow by 20 percent next year, determine how many dollars of new funds are needed to…arrow_forwardOwen’s Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity. Balance Sheet (in $ millions) Assets Liabilities and Stockholders' Equity Cash $ 15 Accounts payable $ 17 Accounts receivable 31 Accrued wages 3 Inventory 32 Accrued taxes 12 Current assets $ 78 Current liabilities $ 32 Fixed assets 46 Notes payable 15 Common stock 18 Retained earnings 59 Total assets $ 124 Total liabilities and stockholders' equity $ 124 Owen’s Electronics has an aftertax profit margin of 8 percent and a dividend payout ratio of 45 percent. If sales grow by 20 percent next year, determine how many dollars of new funds are needed to finance the growth. (Do not round intermediate calculations. Enter…arrow_forward

- Inc. recently reported net income of P5,000,0000. The firm has P40,000,000 total assets. Next year, Inc. is forecasting a 20% increase in sales. The firm also estimates that if sales increase by 20%, spontaneous liabilities will increase by P950,000. The retention ratio is maintained at 75%. If the sales increase, the profit margin will remain at its current level. The company is operating at full capacity. How much is the increase in retained earnings that will contribute to cover the increase in asset? 36,000,000 750,000 3,750,000 4,500,000arrow_forwardCyber Security Systems had sales of 4,600 units at $65 per unit last year. The marketing manager projects a 30 percent increase in unit volume sales this year with a 40 percent price increase. Returned merchandise will represent 5 percent of total sales. What is your net dollar sales projection for this year?arrow_forwardDodge Ball Bearings had sales of 12,000 units at $80 per unit last year. The marketing manager projects a 30 percent increase in unit volume sales this year with a 15 percent price decrease (due to a price reduction by a competitor). Returned merchandise will represent 7 percent of total sales. What is your net dollar sales projection for this year?arrow_forward

- Karen Lamont is in the process of starting a new business and wants to forecast the first year's income statement and balance sheet. She has made several assumptions, which are shown below: Lamont has projected the firm's sales will be $1 million in the first year. She believes that the operating and gross profit margins will be 20 percent and 50 percent, respectively. For working capital, Lamont has estimated the following: Accounts receivable as a percentage of sales: 12% Inventory as a percentage of sales: 15% Accounts payable as a percentage of sales: 7% Accruals as a percentage of sales: 5% A bank has agreed to loan her $300,000, consisting of $100,000 in short-term debt and $200,000 in long-term debt. Both loans will have an 8 percent interest rate. The firm's tax rate will be 30 percent. Lamont will need to purchase $350,000 in plant and equipment. Lamont will provide any other financing needed.Based on Lamont's assumptions in Situation 3, prepare a pro forma income…arrow_forwardAntivirus Inc. expects its sales next year to be $3,100,000. Inventory and accounts receivable will increase by $540,000 to accommodate this sales level. The company has a steady profit margin of 15 percent with a 35 percent dividend payout. How much external financing will the firm have to seek? Assume there is no increase in liabilities other than that which will occur with the external financing.arrow_forwardCheryl Colby, CFO of Charming Florist Ltd., has created the firm’s pro forma balance sheet for the next fiscal year. Sales are projected to grow by 15 percent to $179.4 million. Current assets, fixed assets, and short-term debt are 20 percent, 90 percent, and 15 percent of sales, respectively. The company pays out 40 percent of its net income in dividends. The company currently has $27.2 million of long-term debt, and $13 million in common stock par value. The profit margin is 10 percent. Prepare the current balance sheet for the firm using the projected sales figure. Based on the sales growth forecast, how much does the company need in external funds for the upcoming fiscal yeararrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College