Bundle: College Accounting: A Career Approach (with QuickBooks Online), Loose-leaf Version, 13th + LMS Integrated CengageNOWV2, 1 term (6 months) Printed Access

13th Edition

ISBN: 9781337587358

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 2PB

The

Data for the adjustments are as follows:

- a. Expired or used-up insurance, $425.

- b.

Depreciation expense on equipment, $2,750. - c. Wages accrued or earned since the last payday, $475 (owed and to be paid on the next payday).

- d. Supplies remaining at end of month, $215.

Required

- 1. Complete a work sheet. (Skip this step if using GL.)

- 2. Journalize the

adjusting entries .

*If you are using CLGL, use the year 2020 when recording transactions.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

A partial work sheet for Marge's Place is shown below.

Prepare the following adjustments on this work sheet for the month ended June 30, 20--.

Expired or used-up insurance, $450.

Depreciation expense on equipment, $750 (Remember to credit the Accumulated Depreciation account for equipment, not Equipment).

Wages accrued or earned since the last payday, $380 (owed and to be paid on the next payday).

Supplies used, $110.

If no amount is required, enter 0.

Marge's Place

Work Sheet

For Month Ended June 30, 20--

TRIAL BALANCE

ADJUSTMENTS

ACCOUNT NAME

DEBIT

CREDIT

DEBIT

CREDIT

1

Cash

4,370

fill in the blank 1

fill in the blank 2

1

2

Supplies

250

fill in the blank 3

fill in the blank 4

2

3

Prepaid Insurance

1,800

fill in the blank 5

fill in the blank 6

3

4

Equipment

4,880

fill in the blank 7

fill in the blank 8

4

5

Accumulated Depreciation, Equipment

1,350

fill in the blank 9

fill in the blank 10

5

6

Accounts Payable…

Record journal entries for the following transactions.

a. On December 1, $14,000 was received for a service contract to be performed from December 1 through April 30. If an amount box does not require an entry, leave it blank.

Dec. 1 Accounts Receivable

14,000

Fees Earned

14,000

b. Assuming the work is performed evenly throughout the contract period, prepare the adjusting journal entry on December 31. If an amount box does not reguire an entry, leave it blank.

Dec. 31

dropdown

Next

Required 1. Prepare and complete a 10-column work sheet for fiscal year 2019, starting with the unadjusted trial balance and including adjustments based on these additional facts. a. The supplies available at the end of fiscal year 2019 had a cost of $7,900. b. The cost of expired insurance for the fiscal year is $10,600. c. Annual depreciation on equipment is $7,000. d. The April utilities expense of $800 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $800 amount owed needs to be recorded. e. The company’s employees have earned $2,000 of accrued and unpaid wages at fiscal year-end. f. The rent expense incurred and not yet paid or recorded at fiscal year-end is $3,000. g. Additional property taxes of $550 have been assessed for this fiscal year but have not been paid or recorded in the accounts. h. The $300 accrued interest for April on the long-term notes payable has not yet been paid or recorded. 2. Using information…

Chapter 4 Solutions

Bundle: College Accounting: A Career Approach (with QuickBooks Online), Loose-leaf Version, 13th + LMS Integrated CengageNOWV2, 1 term (6 months) Printed Access

Ch. 4 - The __________ represents the sequence of steps in...Ch. 4 - The __________ is a working paper used by...Ch. 4 - On the work sheet, assets are recorded in which of...Ch. 4 - Rainy Day Services had 430 of supplies reported on...Ch. 4 - On the work sheet, Accumulated Depreciation,...Ch. 4 - The __________ requires that expenses be matched...Ch. 4 - Accumulated Depreciation, Equipment is reported a....Ch. 4 - What is the purpose of a work sheet?Ch. 4 - What is the purpose of adjusting entries?Ch. 4 - Prob. 3DQ

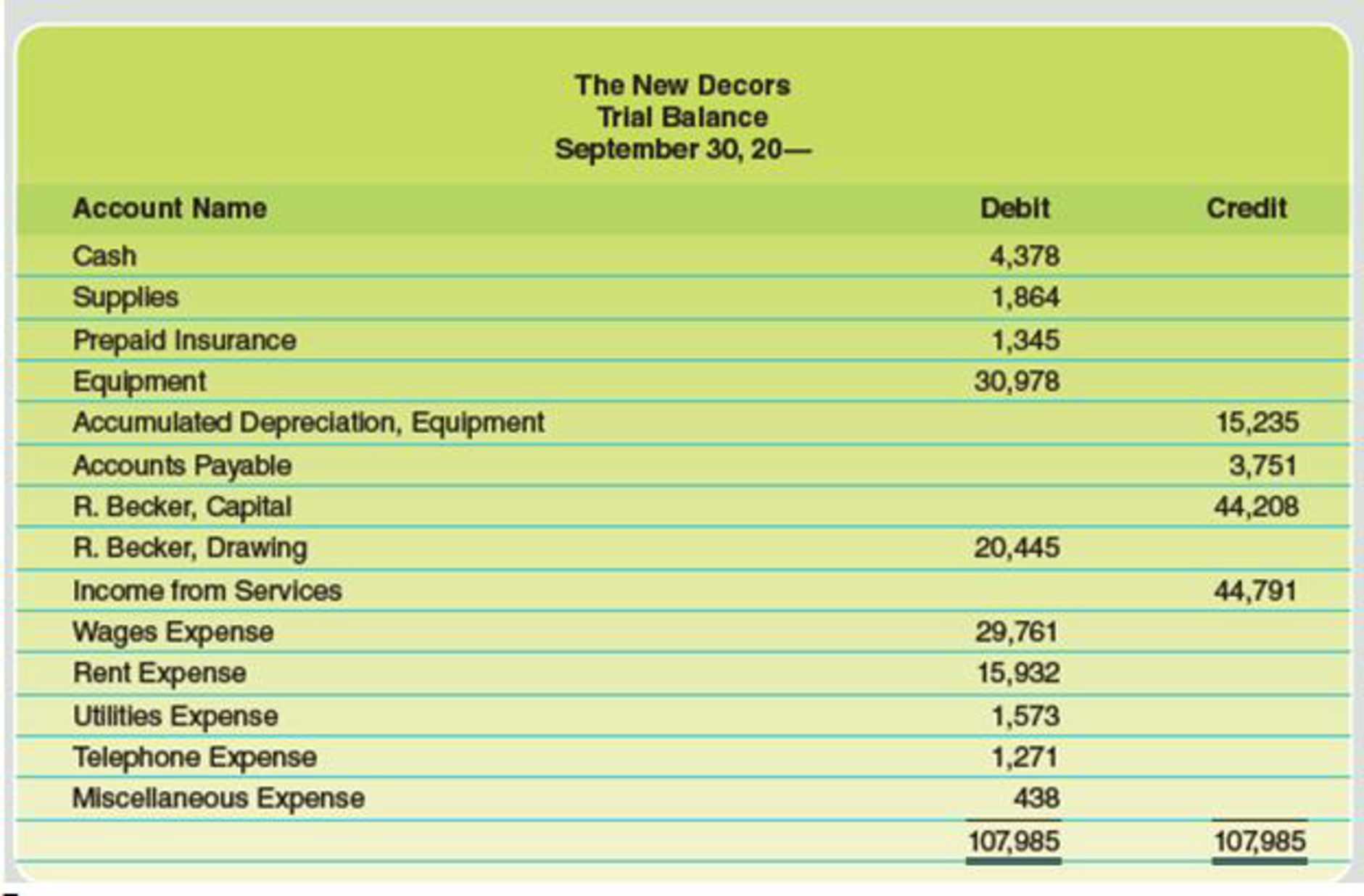

Ch. 4 - Prob. 4DQCh. 4 - Prob. 5DQCh. 4 - Define depreciation as it relates to a van you...Ch. 4 - Prob. 7DQCh. 4 - Why is it necessary to journalize and post...Ch. 4 - 1. List the following classifications of accounts...Ch. 4 - Classify each of the accounts listed below as...Ch. 4 - Place a check mark next to any account(s)...Ch. 4 - A partial work sheet for Marges Place is shown...Ch. 4 - Complete the work sheet for Ramey Company, dated...Ch. 4 - Journalize the adjusting entries from the partial...Ch. 4 - Journalize the adjusting entries from the partial...Ch. 4 - Journalize the following adjusting entries that...Ch. 4 - Determine on which financial statement each...Ch. 4 - Prob. 1PACh. 4 - The trial balance of Clayton Cleaners for the...Ch. 4 - The trial balance for Game Time on July 31 is as...Ch. 4 - The trial balance for Benner Hair Salon on March...Ch. 4 - The trial balance for Masons Insurance Agency as...Ch. 4 - The trial balance of The New Decors for the month...Ch. 4 - The trial balance for Harris Pitch and Putt on...Ch. 4 - The trial balance for Wilson Financial Services on...Ch. 4 - Prob. 1ACh. 4 - You are the bookkeeper for a small but thriving...Ch. 4 - Prob. 3ACh. 4 - Your client is preparing financial statements to...Ch. 4 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

Preparing Financial Statements from a Trial Balance The following accounts are taken from Equilibrium Riding, I...

Fundamentals of Financial Accounting

18. What is the calculation for return on assets (ROA)? Explain what ROA measures.

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

What are assets limited as to use and how do they differ from restricted assets?

Accounting For Governmental & Nonprofit Entities

The managers of an organization are responsible for performing several broad functions. They are ______________...

Principles of Accounting Volume 2

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (11th Edition)

Ravenna Candles recently purchased candleholders for resale in its shops. Which of the following costs would be...

Financial Accounting (12th Edition) (What's New in Accounting)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume the following data for Casper Company before its year-end adjustments: Journalize the adjusting entries for the following:a. Estimated customer allowancesb. Estimated customer returnsarrow_forwardPrepare adjustment entries of followingmCompany A at January 31st. 1. Office supplies having original cost $4,320 were unused till the end of the period. Office supplies having original cost of $22,800 are shown on unadjusted trial balance. 2. Prepaid rent of $36,000 was paid for the months January, February and March. 3. The equipment costing $80,000 has useful life of 5 years and its estimated salvage value is $14,000. Depreciation is provided using the straight line depreciation method. 4. The interest rate on $20,000 note payable is 9%. Accrue the interest for one month. 5. $3,000 worth of service has been provided to the customer who paid advance amount of $4,000.arrow_forwardSuppose a customer rents a vehicle for three months from Franklin Rental on November 1, paying $3,750 ($1,250/month). Required: 1.&2. Record the necessary entries in the Journal Entry Worksheet below. 3. Calculate the year-end adjusted balances of Deferred Revenue and Service Revenue (assuming the balance of Deferred Revenue at the beginning of the year is $0).arrow_forward

- The Unadjusted Trial Balance for Hawkeye Ranges as of December 31 is presented in requirement 1. The following additional Information relates to the required year-end adjustments. a. As of December 31, employees had earned $717 of unpaid and unrecorded salaries. The next payday is January 4, at which time $1,276 of salaries will be paid. b. Cost of supplies still available at December 31 total is $2,160. c. An interest payment is made every three months. The amount of unrecorded accrued interest at December 31 is $1,275. The next Interest payment, at an amount of $1,530, is due on January 15. d. Analysis of Unearned Revenue shows $4,480 remaining unearned at December 31. e. Accrues $7,213 of revenue for services provided. Payment will be collected on January 31. f. Depreciation expense is $10,184. Required: 1. Complete the six-column table by entering adjustments that reflect the above information. 2. Prepare journal entries for adjustments entered in the six-column table for…arrow_forwardWyco's fiscal Year ends September 30. On September 10, it's collects $30.000 for a painting job and credits unearned painting revenue. As of September 30, 60% of the work has been done. What adjusting entry must WyCo record on September 30?arrow_forwardSchrand Services offers janitorial services on both a contract basis and an hourly basis. On January I, Schrand collected $26, I00 cash in advance on a six-month contract for work to be performed evenly during the next six months. Prepare the entry on January I to reflect the receipt of $26,100 cash for contract work; use the financial statement effects template. Adjust the appropriate accounts on January 31 for the contract work done during January; use the financial statement effects template . At January 31, a total of 30 hours of hourly rate janitor work was performed but unb illed. The billing rate is $ 19 per hour. Prepare the accounting adjustment needed on January 31, using the financial statement effects template. (The firm uses the account Fees Receivable to reflect the revenue earned but not yet billed.) Refer to above information to prepare Journal entry for each part 1, 2 and 3.arrow_forward

- On October 1, Goodwell Company rented warehouse space to a tenant for $1,600 per month and received $8,000 for five months' rent in advance on that date, with the lease beginning immediately. The cash receipt was credited to the Unearned Revenue account. The company's annual accounting period ends on December 31. The Unearned Revenue account balance at the end of December, after adjustment, should be: Multiple Choice $3,200. $1,600. $8,000. $6,400. $4,800.arrow_forwardTransaction Entries and Adjusting Entries: Deluxe Building Services offers janitorial services on both a contract basis and an hourly basis. On January 1, Deluxe collected $42,000 in advance on a six-month contract for work to be performed evenly during the next six months. a. Provide the general journal entry on January 1 to record the receipt of $42,000 for contract work. b. Provide the adjusting entry to be made on January 31, for the contract work done during January. c. At January 31, a total of 40 hours of hourly rate janitor work was unbilled. The billing rate is $25 per hour. Provide the adjusting entry needed on January 31. ( Note: The firm uses the account Fees Receivable to reflect amounts due but not yet billed.)arrow_forwardThe worksheet at the end of October has P4,000 in the Trial Balance credit column for Accumulated Depreciation and has P4,750 in the Balance Sheet credit column for Accumulated Depreciation. What was the amount of the Depreciation expense adjustment for the month of October? *arrow_forward

- Depreciation for equipment this month is $300. The necessary adjusting entry will include a:arrow_forwardOn October 1, Vista View Company rented warehouse space to a tenant for $2,100 per month and received $10,500 for five months' rent in advance on that date, with the lease beginning immediately. The cash receipt was credited to the Unearned Rent account. The company's annual accounting period ends on December 31. The Unearned Rent account balance at the end of December, after adjustment, should be: Multiple Choice $10,500. $6,300. $2,100. $8,400. $4,200. < Prev 20 of 30 Next MacBook Airarrow_forwardOlney Cleaning Company had the following items that require adjustment at year end. For one cleaning contract, $11,100 cash was received in advance. The cash was credited to Unearned Service Revenue upon receipt. At year end, $260 of the service revenue was still unearned. For another cleaning contract, $8,700 cash was received in advance and credited to Unearned Service Revenue upon receipt. At year end, $3,000 of the services had been provided. Required: 1. Prepare the adjusting journal entries needed at December 31. If an amount box does not require an entry, leave it blank. Dec. 31 Unearned Service Revenue fill in the blank 02e1a8f7d03afe9_2 fill in the blank 02e1a8f7d03afe9_3 Service Revenue fill in the blank 02e1a8f7d03afe9_5 fill in the blank 02e1a8f7d03afe9_6 Dec. 31 Unearned Service Revenue fill in the blank 02e1a8f7d03afe9_8 fill in the blank 02e1a8f7d03afe9_9 Service Revenue fill in the blank 02e1a8f7d03afe9_11 fill in the blank 02e1a8f7d03afe9_12…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY