To determine: The amount of quarterly check.

The annuity refers to the payments of equal amount to be made after certain periods. These payments are made monthly, semi-annually or annually.

Effective Annual Rate:

The effective annual rate is the rate which is incurred or received on the various investment or loans. The effective annual rate is affected by the increase in compounding years.

Explanation of Solution

Given,

The salary structure is offered for 6 years.

The expected increase in the contract amount is $2,700,000.

The amount of signup bonus is $10 million.

The salary is needed in every 3 months.

The annual interest rate is 5.7% that is compounded on daily basis.

Calculation of the value of the quarterly check:

The formula to calculate the quarterly check amount is,

Substitute $28,069,200 for the present value and 20.19 for the

The monthly savings are $1,390,252.60.

Working note:

Calculation of the effective annual rate:

The effective annual rate is 5.87%.

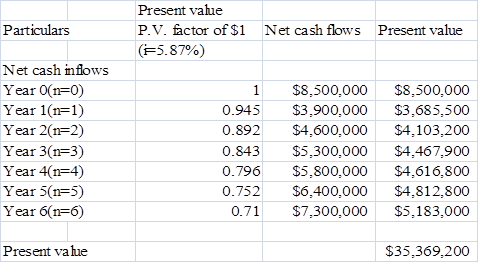

Calculation of the present value of the contract offer:

The present value of the contract offer is $35,369,200.

Computation of the present value of the new contract,

The present value of new contract is $38,069,200.

Calculation of the effective quarterly rate,

The effective quarterly rate is 1.43%.

Calculation of the present value of the quarterly salary,

The present value of quarterly salary is $28,069,200.

Calculation of the

Thus, the amount of quarterly check will be $1,390,252.60.

Want to see more full solutions like this?

Chapter 4 Solutions

Loose Leaf for Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- You are negotiating a sports contract for your client. The client’s opportunity cost (interest rate) is 9%. He has been offered two possible 4 year contracts. Payments are guaranteed and will be made at the end of each year. The terms of each contract are as follows: Which contract will you choose? (Ch. 5) Year 1 Year 2 Year 3 Year 4 Contract 1 4,500,000 4,500,000 4,500,000 4,500,000 Contract 2 22,000,000 Group of answer choices Contract 1 Contract 2arrow_forwardYou are negotiating a sports contract for your client. The client’s opportunity cost (interest rate) is 9.00%. She has been offered two possible 4 year contracts. Payments are guaranteed and will be made at the end of each year. The terms of each contract are shown below. Which contract should you advise your client to choose? Contract # Year 1 Year 2 Year 3 Year 4 Contract 1 5,000,000 5,000,000 5,000,000 5,000,000 Contract 2 0 0 0 22,000,000 Group of answer choices Contract 2 Both contracts have the exact same value Contract 1arrow_forwardWhen deciding which contract to choose based on highest present value and a 10% discount rate, if billy and his agent think that tax rates are liekly to be higher in the future how might that sway his decision? Contract 1 $900,000 signing bonus $850,000 at the end of each year for the next 5 years Contract 2 $200,000 immediate signing bonus $100,000 at the end of each year for the next five years $150,000 a year at the end of years 5 through 10 $1,000,000 a year at the end of years 11 through 40 Contract 3 $1,000,000 immediate signing bonus $500,000 at the end of year 1 $1,000,000 at the end of year 2 $1,500,000 at the end of year 3 $2,500,000 at the end of year 4 As part of the third offer hhe was also promised a $200,000 bonus for any year in which he was selected to play in the Pro Bowl All Star game. his agent figured there was a 25% probability of that occuring in each of the next 4 years.arrow_forward

- Head & Shoulders shampoo insured spokesman Troy Polamalu’s (of the Pittsburgh Steelers) head of hair for $1 million with Lloyd’s of London. The insurance payout would be triggered if he lost at least 60% of his hair during an on-field event. Assume the insurance company placed the odds of a payout at 1% in year 5. If Lloyd’s of London wanted a rate of return of 20% per year compounded semiannually, how much did Head and Shoulders have to pay in a lump sum amount for the insurance policy?arrow_forwardYou have been hired as a financial advisor to Michael Jordan. He has received two offers forplaying professional basketball and wants to select the best offer, based on considerations ofmoney only. Offer A is a $10m offer for $2m a year for 5 years. Offer B is a $11m offer of $1ma year for four years and $7m in year 5. What is your advice? (Hint: compare the present value ofeach contract by assuming a range of interest rate, say 8% - 14%)arrow_forwardCompany XYZ has hired you as a consultant. It has suggested two options to pay for your services: Option A: An initial payment of 100,000AED on signing the contract, 200,000AED end of the second year and 100,000 at end of the third year. Option B: An initial payment of 100,000AED on signing the contract, 150,000AED end of the first year, and 140, 000AED end of the second year. Which payment plan should you accept if the market interest rate is 10%? Briefly explain your choice.arrow_forward

- A famous quarterback just signed a $19.5 contract providing $3.9 million a year for 5 years. A less famous receiver signed a $18.5 million 5-year contract providing $4 million now and $2.9 million a year for 5 years. The interest rate is 10%.arrow_forwardAs a result of a slowdown in operations, Tradewind Stores is offering employees who have been terminated a severance package of $95,000 cash paid today; $95,000 to be paid in one year; and an annuity of $30,000 to be paid each year for 8 years. Required: What is the present value of the package assuming an interest rate of 11 percent? (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.)arrow_forwardPV OF A CASH FLOW STREAM A rookie quarterback is negotiating his first NFL contract. His opportunity cost is 7%. He has been offered three possible 4-year contracts. Payments are guaranteed, and they would be made at the end of each year. Terms of each contract are as follows:arrow_forward

- Ma1. MontyHardy recently rejected a $16,800,000, five-year contract with the Vancouver Seals hockey team. The contract offer called for an immediate signing bonus of $6,300,000 and annual payments of $2,100,000. To sweeten the deal, the president of player personnel for the Seals has now offered a $18,460,000, five-year contract. This contract calls for annual increases and a balloon payment at the end of five years. Year 1 $2,100,000 Year 2 2,180,000 Year 3 2,260,000 Year 4 2,340,000 Year 5 2,440,000 Year 5 balloon payment 7,140,000 Total $18,460,000 Suppose you are Hardy's agent and you wish to evaluate the two contracts using a required rate of return of 15 percent. In present value terms, how much better is the second contract?arrow_forwardSam is negotiating to purchase an annuity of $50 000 p.a. for 10 years. Funds currently earn 6% p.a. To sweeten the deal, the supplier offers (a) to make it an annuity due (with 10 payments in total) or (b) to add an extra payment of $10 000 to be paid immediately. Which is the better deal for Sam, if the price remains the same? Please do fast ASAP fastarrow_forwardIn 2018 a football player signed a comtract reported to be worth $98.5 million. The contract was to be paid as $14.7 million in 2018, $14.9 million in 2019, $17.1 million in 2020, $17.2 million in 2021, $17.2 million in 2022, and $17.4 million in 2023. If the appropriate interest rate is 9 percent, what kind of deal did the player snag? Assume all payments are paid at the end of the year.arrow_forward

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning