To calculate: The annual percentage rate and the effective annual rate of the two loans

Introduction:

Explanation of Solution

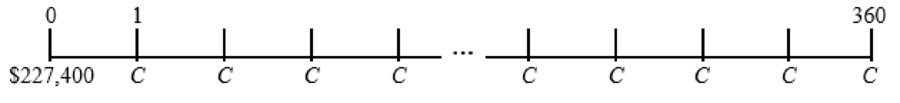

Time line of the payments:

Formula to calculate the present value

Note: C denotes the payments, r denotes the rate of exchange, and t denotes the period. The payment is found using the formula of the present value of annuity.

Compute the present value annuity:

Hence, the payment C is $1,276.92

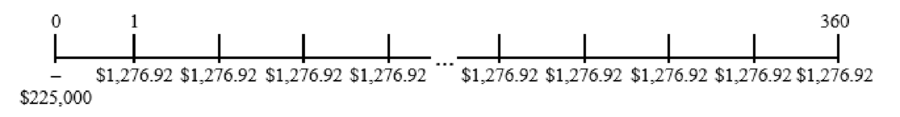

Note: Using the calculated C amount in the equation of the present value of annuity and with the original amount that has to be borrowed $225,000, the r values is found.

Time line of the payments:

Formula to calculate the present value annuity:

Note: C denotes the payments, r denotes the rate of exchange, and t denotes the period.

Compute the present value annuity:

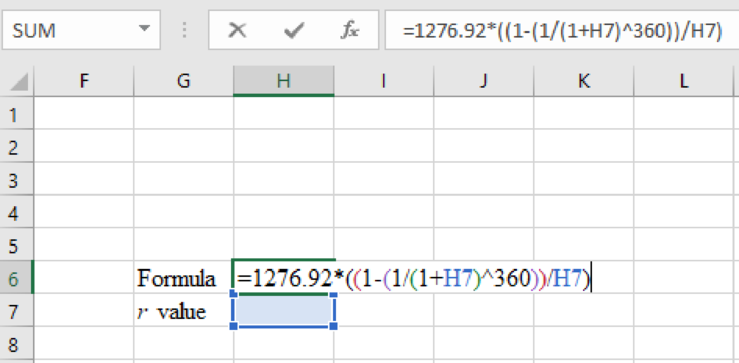

Note: To find the interest rate, it is necessary to solve the equation using a spreadsheet.

Compute the interest rate using the spreadsheet:

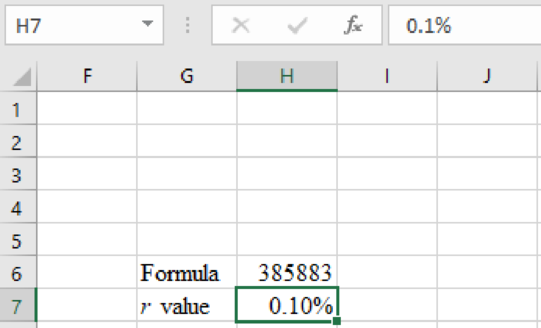

Step 1:

- Type the formula of the present value annuity in H6 in the spreadsheet and consider the r value as H7

Step 2:

- Assume the r value as 0.10%

Step 3:

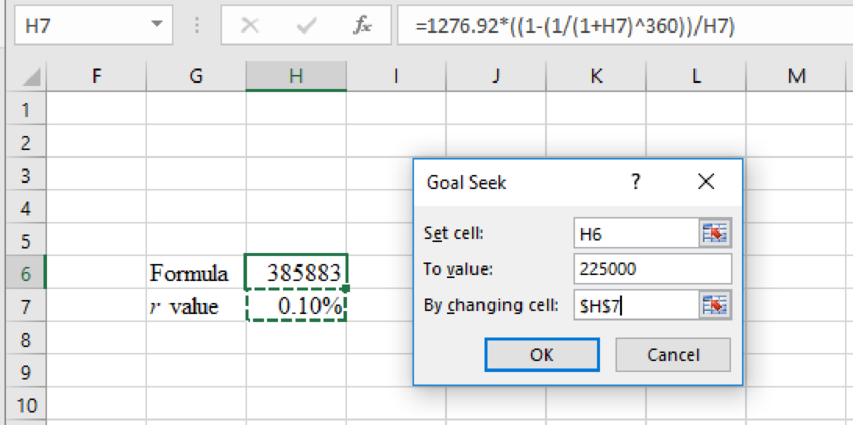

- In the spreadsheet, go to Data and select What-If-Analysis.

- Under What-If-Analysis tab, select Goal Seek

- In set cell, select H6 (the formula)

- The ‘To value’ is considered as 225,000 (the value of the present value of annuity)

- The H7 cell is selected for the 'by changing cell'.

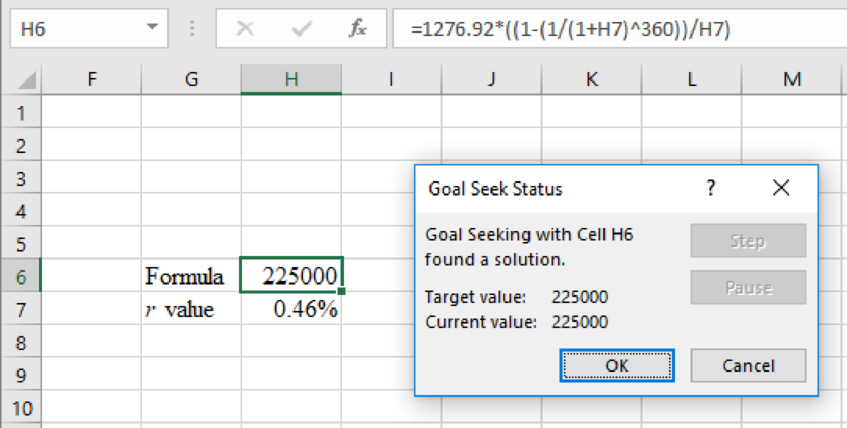

Step 4:

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears with the r value

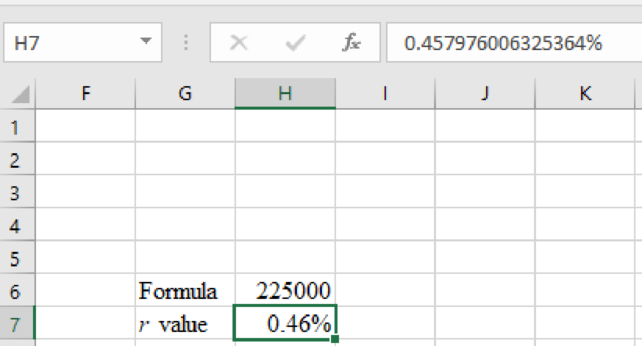

Step 5:

- The r value appears to be 0.4579%

Hence, the r value is 0.4580%

Compute the annual percentage rate:

Note: The annual percentage rate is computed by multiplying the interest rate with the number of periods in a year.

Hence, the annual percentage rate is 5.50%

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Hence, the effective annual rate is 0.0564% or 5.64%

Calculations for the nonrefundable fee:

Annual percentage rate is 5.50%

Note: The annual percentage rate for the nonrefundable fee is the quoted rate, as the fee is not considered as a part of the loan. The effective annual rate is computed with the help of the annual percentage rate.

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Hence, the effective annual rate for the non-refundable fee is 0.0554% or 5.54%.

Want to see more full solutions like this?

Chapter 4 Solutions

Loose Leaf Corporate Finance: Core Principles and Applications

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education