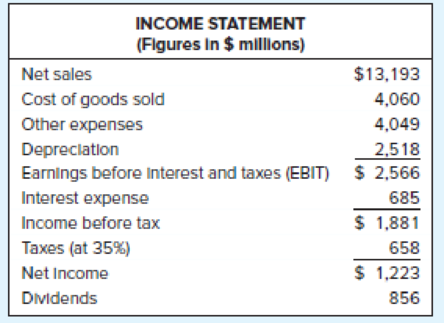

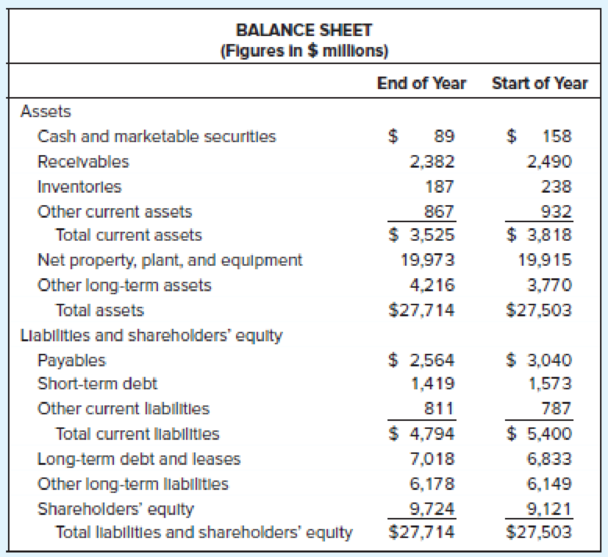

Financial Ratios. Here are simplified financial statements for Phone Corporation in a recent year:

Calculate the following financial ratios for Phone Corporation using the methodologies listed for each part:

- a.

Return on equity (use average balance sheet figures) - b.

Return on assets (use average balance sheet figures) - c. Return on capital (use average balance sheet figures)

- d. Days in inventory (use start-of-year balance sheet figures)

- e. Inventory turnover (use start-of-year balance sheet figures)

- f. Average collection period (use start-of-year balance sheet figures)

- g. Operating profit margin

- h. Long-term debt ratio (use end-of-year balance sheet figures)

- i. Total debt ratio (use end-of-year balance sheet figures)

- j. Times interest earned

- k. Cash coverage ratio

- l. Current ratio (use end-of-year balance sheet figures)

- m. Quick ratio (use end-of-year balance sheet figures)

a.

To compute: Return on equity (ROE)

Explanation of Solution

The formula to calculate return on equity is as follows:

The calculation of return on equity is as follows:

Hence, the ROE is 13%

b.

To compute: Return on assets (ROA)

Explanation of Solution

The formula to calculate return on asset is as follows:

The calculation of return on capital is as follows:

Hence, the ROA is 6.04%

c.

To compute: Return on capital (ROC)

Explanation of Solution

The formula to calculate return on capital is as follows:

The calculation of return on equity is as follows:

Hence, the ROC is 10.20%

d.

To compute: Days in inventory.

Explanation of Solution

The formula to calculate days in inventory is as follows:

.

The calculation of days in inventory is as follows:

Hence, the days in inventory is 21.40 days

e.

To compute: Inventory turn over

Explanation of Solution

The formula to calculate inventory turnover is as follows:

The calculation of inventory turnover is as follows:

Hence, the inventory turnover is 19.11

f.

To compute: Average collection period(ACP)

Explanation of Solution

The formula to calculate average collection period is as follows:

The calculation of average collection period is as follows:

Hence, the ACP is 68.89 days.

g.

To compute: Operating profit margin (OPM)

Explanation of Solution

The formula to calculate operating profit margin is as follows:

The calculation of operating profit margin is as follows:

Hence, the OPM is 12.64%

h.

To compute: Long term debt ratio

Explanation of Solution

The formula to calculate operating profit margin is as follows:

The calculation of long term debt ratio is as follows:

Hence the long term debt ratio is 0.42

i.

To compute: Total debt ratio

Explanation of Solution

The formula to calculate total debt ratio is as follows:

The calculation of total debt ratio is as follows:

Hence the total debt ratio is 0.65

j.

To compute: Times interest earned

Explanation of Solution

The formula to calculate times interest earned is as follows:

The calculation of times interest earned is as follows:

Hence the time interest earned is 3.75

k.

To compute: Cash coverage ratio

Explanation of Solution

The formula to calculate cash coverage ratio is as follows:

The calculation of cash coverage ratio is as follows:

Hence the cash coverage ratio is 7.42

l.

To compute: Current ratio

Explanation of Solution

The formula to calculate current ratio is as follows:

The calculation of current ratio is as follows:

Hence the current ratio is 0.74

m.

To compute: Quick ratio

Explanation of Solution

The formula to calculate quick ratio is as follows:

The calculation of quick ratio is as follows:

Hence the quick ratio is 0.52

Want to see more full solutions like this?

Chapter 4 Solutions

FUND.OF CORPORATE FINANCE ACCESS

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: 1. Calculate the return on sales. (Note: Round the percent to two decimal places.) 2. CONCEPTUAL CONNECTION Briefly explain the meaning of the return on sales ratio, and comment on whether Juroes return on sales ratio appears appropriate.arrow_forwardGrammatico Company has just completed its third year of operations. The income statement is as follows: Selected information from the balance sheet is as follows: Required: Note: Round answers to two decimal places. 1. Compute the times-interest-earned ratio. 2. Compute the debt ratio. 3. CONCEPTUAL CONNECTION Assume that the lower quartile, median, and upper quartile values for debt and times-interest-earned ratios in Grammaticos industry are as follows: How does Grammatico compare with the industrial norms? Does it have too much debt?arrow_forwardFinancial Statement Analysis The financial statements for Nike, Inc., are presented in Appendix C at the end of the text. The following additional information (in thousands) is available: Instructions 1. Determine the following measures for the fiscal years ended May 31, 2013 (fiscal 2012), and May 31, 2012 (fiscal 2011), rounding to one decimal place. a. Working capital b. Current ratio c. Quick ratio d. Accounts receivable turnover e. Number of days sales in receivables f. Inventory turnover g. Number of days sales in inventory h. Ratio of liabilities to stockholders equity i. Ratio of sales to assets j. Rate earned on total assets, assuming interest expense is 23 million for the year ending May 31, 2013, and 31 million for the year ending May 31, 2012 k. Rate earned on common stockholders equity l. Price-earnings ratio, assuming that the market price was 61.66 per share on May 31, 2013, and 53.10 per share on May 31, 2012 m. Percentage relationship of net income to sales 2. What conclusions can be drawn from these analyses?arrow_forward

- Jasmine Company provided the following income statements for its first 3 years of operation: Refer to the information for Jasmine Company above. Required: Prepare common-size income statements by using net sales as the base. (Note: Round answers to the nearest whole percentage.)arrow_forwardFinancial statement analysis The financial statements for Nike, Inc., are presented in Appendix D at the end of the text. Use the following additional information (in thousands): Instructions 1. Determine the following measures for the fiscal years ended May 31, 2016, and May 31, 2015. Round ratios and percentages to one decimal place. a. Working capital b. Current ratio c. Quick ratio d. Accounts receivable turnover e. Number of days sales in receivables f. Inventory turnover g. Number of days sales in inventory h. Ratio of liabilities to stockholders equity i. Asset turnover j. Return on total assets. k. Return on common stockholders equity l. Price-earnings ratio, assuming that the market price was 54.90 per share on May 29, 2016, and 52.81 per share on May 30, 2015 m. Percentage relationship of net income to sales 2. What conclusions can be drawn from these analyses?arrow_forwardScherer Company provided the following income statements for its first 3 years of operation: Refer to the information for Scherer Company on the previous page. Required: Prepare common-size income statements by using net sales as the base. (Note: Round answers to the nearest whole percentage.)arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning