Horngren's Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (12th Edition)

12th Edition

ISBN: 9780134642932

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem E4.19E

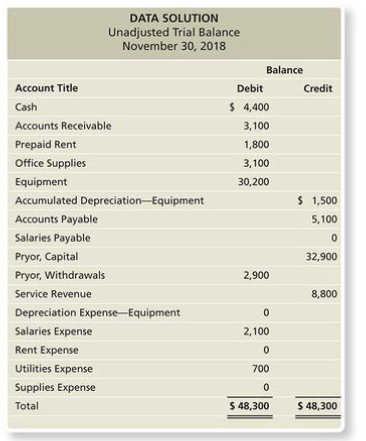

Preparing a worksheet

Learning Objective 2:

Title unadjusted

Additional Information at November 30, 2018:

- Accrued Service Revenue, 5S0Q.

Depreciation. 5350.- Accrued Salaries Expenses, 5650.

- Prepaid Rent expired, 5700.

- Office Supplied used, 5550.

Requirement

- Compute Data Solution’s worksheet for the month ended November 30, 201£.

- How much was net income for November.

Expert Solution & Answer

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

schedule07:24

Students have asked these similar questions

E3-33B. (Learning Objectives 3, 4: Adjust the accounts for prepaid expenses; construct thefinancial statements) Fairmount Co. prepaid three years’ rent ($31,500) on January 1, 2018. AtDecember 31, 2018, Fairmount prepared a trial balance and then made the necessary adjustingentry at the end of the year. Fairmount adjusts its accounts once each year—on December 31.What amount appears for Prepaid Rent ona. Fairmount’s unadjusted trial balance at December 31, 2018?b. Fairmount’s adjusted trial balance at December 31, 2018?What amount appears for Rent Expense onc. Fairmount’s unadjusted trial balance at December 31, 2018?d. Fairmount’s adjusted trial balance at December 31, 2018?

(Learning Objective 5: Construct and use a trial balance) The accounts of Specialty Deck Service, Inc., follow with their normal balances at April 30, 2018. The accounts arelisted in no particular order.Account BalanceDividends..........................Utilities expense ................Accounts receivable...........Delivery expense ...............$ 3,1002,3005,300700Retained earnings.............. 7,800Salary expense................... 8,400AccountCommon stock..................Accounts payable ..............Service revenue..................Equipment.........................Note payable.....................Cash..................................Balance$ 16,2004,30020,50030,80021,00019,200Requirements1. Prepare the company’s trial balance at April 30, 2018, listing accounts in proper sequence,as illustrated in the chapter. For example, Accounts Receivable comes before Equipment.List the expense with the largest balance first, the expense with the next largest balancesecond, and so on.2.…

(Learning Objective 5: Construct a trial balance) Assume that Harbor Marine Company reported the following summarized data at December 31, 2018. Accounts appear in noparticular order; dollar amounts are in millions.Other liabilities ..................... $ 220 Cash......................................Expenses ............................... 26Stockholders’ equity.............. 5Revenues............................... $37Other assets........................... 4Accounts payable .................. 6Prepare the trial balance of Harbor Marine Company at December 31, 2018. List the accountsin their proper order. How much was the company’s net income or net loss?

Chapter 4 Solutions

Horngren's Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (12th Edition)

Ch. 4 - Assets are listed on the balance sheet in the...Ch. 4 - Which of the following accounts would be included...Ch. 4 - Which situation indicates a net loss within the...Ch. 4 - Which of the following accounts is not closed?...Ch. 4 - What do closing entries accomplish? Learning...Ch. 4 - Which of the following is not a closing entry?...Ch. 4 - Which of the following accounts may appear on a...Ch. 4 - 8. Which of the following steps of the accounting...Ch. 4 - Clean Water Softener Systems has Cash of $600,...Ch. 4 - Which of the following statements concerning...

Ch. 4 - What document are financial statements prepared...Ch. 4 - What does the income statement report?Ch. 4 - Prob. 3RQCh. 4 - Prob. 4RQCh. 4 - Why are financial statements prepared in a...Ch. 4 - Prob. 6RQCh. 4 - Prob. 7RQCh. 4 - Prob. 8RQCh. 4 - Prob. 9RQCh. 4 - How could a worksheet help in preparing financial...Ch. 4 - If a business had a net loss for the year, where...Ch. 4 - Prob. 12RQCh. 4 - What are temporary accounts? Are temporary...Ch. 4 - What are permanent accounts? Are permanent...Ch. 4 - How is the Income Summary account used? Is it a...Ch. 4 - Prob. 16RQCh. 4 - If a business had a net loss for the year, what...Ch. 4 - What types of accounts are listed on the...Ch. 4 - Prob. 19RQCh. 4 - What is the current ratio, and how is it...Ch. 4 - Prob. 21ARQCh. 4 - Preparing an income statement Learning Objective 1Ch. 4 - Preparing a statement of owner’s equity. Learning...Ch. 4 - Preparing a balance sheet (unclassified, account...Ch. 4 - Preparing a balance sheet (classified, report...Ch. 4 - Classifying balance sheet accounts Learning...Ch. 4 - Prob. S4.6SECh. 4 - Prob. S4.7SECh. 4 - Determine net loss using a worksheet Learning...Ch. 4 - Identifying temporary and permanent accounts...Ch. 4 - Prob. S4.10SECh. 4 - Posting closing entries directly to Taccounts...Ch. 4 - S412 Identifying accounts included on a...Ch. 4 - Identifying steps in the accounting cycle Learning...Ch. 4 - Calculating the current ratio Learning Objective 6...Ch. 4 - Journalizing reversing entries Learning Objective...Ch. 4 - E416 Preparing the financial statements The...Ch. 4 - Classifying balance sheet accounts Learning...Ch. 4 - Preparing a classified balance sheet and...Ch. 4 - Preparing a worksheet Learning Objective 2: Title...Ch. 4 - Preparing financial statements from the completed...Ch. 4 - Preparing closing entries from an adjusted trial...Ch. 4 - Preparing closing entries from T-accounts Learning...Ch. 4 - Determining the effects of closing entries on the...Ch. 4 - Preparing a worksheet and closing entries Learning...Ch. 4 - Preparing closing entries from an adjusted trial...Ch. 4 - Preparing a worksheet, closing entries, and a...Ch. 4 - Journalizing reversing entries. Learning Objective...Ch. 4 - Journalizing reversing entries Leaning Objectives...Ch. 4 - Preparing financial statements including a...Ch. 4 - Preparing financial statements including a...Ch. 4 - Preparing a worksheet, financial statements, and...Ch. 4 - Completing the accounting cycle from adjusting...Ch. 4 - Completing the accounting cycle from journal...Ch. 4 - Preparing adjusting entries and reversing entries...Ch. 4 - Preparing financial statements including a...Ch. 4 - Preparing financial statements including a...Ch. 4 - Preparing a worksheet financial statements, and...Ch. 4 - Completing the accounting cycle from adjusting...Ch. 4 - Completing the accounting cycle from journal...Ch. 4 - Preparing adjusting entries and reversing entries...Ch. 4 - Using Excel to prepare financial statements,...Ch. 4 - Completing the accounting cycle from adjusted...Ch. 4 - Completing the accounting cycle from adjusted...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - Comprehensive Problem 2 for Chapters 1 —4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 —4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Prob. 4.1TIATCCh. 4 - Prob. 4.1EICh. 4 - Prob. 4.1FSC

Additional Business Textbook Solutions

Find more solutions based on key concepts

Decision Case 3-1

One year ago, Tyler Stasney founded Swift Classified Ads. Stasney remembers that you took a...

Horngren's Accounting (11th Edition)

5. Which inventory costing method results in the lowest net income during a period of rising inventory costs?

W...

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Communication Activity 9-1

In 150 words or fewer, explain the different methods that can be used to calculate d...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Smatter Corporation purchased land for a new building. Which of the following costs would not be included in th...

Financial Accounting (12th Edition) (What's New in Accounting)

Pierce Company had the following costs: Calculate the unit product cost using absorption costing and variable c...

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Given the following information, prepare a production report with materials added at the beginning and ending w...

Principles of Accounting Volume 2

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- E3-21 Journalizing adjusting entries Learning Objective 3 Consider the following situations: Business receives $3,200 on January 1 for 10-month service contract for the period January 1 through October 31. Total salaries for all employees is $3,600 per month. Employees are paid on the 1st and 15th of the month. Work performed but not yet billed to customers for the month is $1,600. The company pays interest on its $16,000, 4% note payable of $53 on the first day of each month. Assume the company records adjusting entries monthly. Journalize the adjusting entries needed as of January 31.arrow_forwardE3-22A. (Learning Objectives 3, 4: Adjust the accounts for prepaid expenses; construct thefinancial statements) Dizzy Toys prepaid three years’ rent ($36,000) on January 1, 2018. AtDecember 31, 2018, Dizzy prepared a trial balance and then made the necessary adjusting entryat the end of the year. Dizzy adjusts its accounts once each year—on December 31.What amount appears for Prepaid Rent ona. Dizzy’s unadjusted trial balance at December 31, 2018?b. Dizzy’s adjusted trial balance at December 31, 2018?What amount appears for Rent Expense onc. Dizzy’s unadjusted trial balance at December 31, 2018?d. Dizzy’s adjusted trial balance at December 31, 2018?arrow_forwardE3-24A. (Learning Objectives 3, 4: Adjust the accounts; construct the financial statements)The adjusted trial balances of Patterson Corporation at August 31, 2018, and August 31, 2017,include these amounts (in millions):2018 2017Accounts receivable............................................................... $430 $210Prepaid insurance .................................................................. 330 400Accrued liabilities payable (for other operating expenses) ..... 710 640Patterson Corporation completed these transactions (in millions) during the year endedAugust 31, 2018.Collections from customers......................................... $20,400Payment of prepaid insurance ..................................... 470Cash payments for other operating expenses............... 4,000Calculate the amount of sales revenue, insurance expense, and other operating expenses toreport on the income statement for the year ended August 31, 2018. Assume all sales are onaccount.arrow_forward

- S3-12. (Learning Objective 3: Adjust the accounts for prepaid rent) Due to the terms ofits lease, Hawke Services, Inc., pays the rent for its new office space in one annual payment of$26,800 on August 1, 2018. The lease covers the period of August 1, 2018, through July 31,2019. Hawke Services has a year-end of December 31. Assume that Hawke Services had noother prepaid rent transactions, nor did it have a Prepaid Rent beginning balance in 2018. Givethe journal entries that Hawke Services would make for (a) the annual rent payment of $26,800on August 1 and (b) the adjusting entry for rent expense on December 31, 2018. What is thebalance of Prepaid Rent at December 31, 2018?arrow_forward(Learning Objective 4: Journalize and post transactions) Orman Consulting performed services for a client who could not pay immediately. Orman expected to collect the$4,600 the following month. A month later, Orman received $2,100 cash from the client.1. Record the two transactions on the books of Orman Consulting. Include an explanation foreach transaction.2. Post to these T-accounts: Cash, Accounts Receivable, and Service Revenue. Compute eachaccount balance and denote it as Bal.arrow_forwardP3-59A. (Learning Objective 3: Adjust the accounts) Journalize the adjusting entry neededon December 31, the end of the current accounting period, for each of the following independent cases affecting Castaway Corporation. Include an explanation for each entry.a. The details of Prepaid Insurance are as follows:Prepaid Insurance2,9004,000JanMar 311 BalCastaway prepays insurance on March 31 each year. At December 31, $1,700 is still prepaid.b. Castaway pays employees each Friday. The amount of the weekly payroll is $6,100 fora five-day work week. The current accounting period ends on a Wednesday.c. Castaway has a note receivable. During the current year, Castaway has earned accruedinterest revenue of $700 that it will collect next year.d. The beginning balance of supplies was $3,000. During the year, Castaway purchasedsupplies costing $6,200, and at December 31 supplies on hand total $2,200.e. Castaway is providing services for Blue Whale Investments, and the owner of BlueWhale paid…arrow_forward

- (Learning Objective 4: Record and report current liabilities) Travis Publishingcompleted the following transactions for one subscriber during 2018:Oct 1 Sold a one-year subscription, collecting cash of $1,800, plus sales tax of 10%.The subscription will begin on October 1.Nov 15 Remitted (paid) the sales tax to the state of South Carolina.Dec 31 Made the necessary adjustment at year-end.Requirement1. Journalize these transactions (explanations not required). Then report any liability on thecompany’s balance sheet at December 31, 2018.arrow_forwardUsing the unadjusted trial balance, calculate the total assets, liabilities, common stock, dividends, revenues, and expenses. Enter those amounts in the expanded accounting equation. TOUCH LEARNING Unadjusted Trial Balance December 31, 2016 Balance Account Title Debit Credit Cash 32,500 Accounts Receivable 30,000 Office Supplies 15,000 Prepaid Rent 20,000 Prepaid Insurance 47,500 Furniture 52,600 Accumulated Depreciation - Furniture 22,500 Accounts Payable…arrow_forwardLearning Objectives 4, 5: Journalize and post transactions; construct and use atrial balance) Olivia Matthews, Certified Public Accountant, operates as a professional corporation (P.C.). The business completed these transactions during the first part of May 2018:May Received $12,000 cash from Matthews, and issued common stock to her.Paid monthly oce rent, $500.Paid cash for a desktop computer, $1,800, with the computer expected toremain in service for five years.Purchased oce furniture on account, $6,000, with the furniture projectedto last for five years.Purchased supplies on account, $900.Performed tax services for a client and received cash for the full amountof $600.Received bill and paid utility expenses, $750.Performed consulting services for a client on account, $3,100.2234591218Requirements1. Journalize the transactions for Olivia Matthews, Certified Public Accountant. Explanationsare not required.2. Post to the T-accounts. Key all items by date and determine the ending balance…arrow_forward

- (Learning Objective 3: Adjust the accounts) Answer the following questions aboutprepaid expenses:a. On March 1, Meadow Tree Service prepaid $7,200 for six months’ rent. Give theadjusting entry to record rent expense at March 31. Include the date of the entry and anexplanation. Then post all amounts to the two accounts involved, and show their balancesat March 31. Meadow adjusts the accounts only at March 31, the end of its fiscal year.b. On March 1, Meadow Tree Service paid $1,050 for supplies. At March 31, Meadow has$400 of supplies on hand. Make the required journal entry at March 31. Then post allamounts to the accounts and show their balances at March 31. Assume no beginningbalance in suppliesarrow_forwardSERVICE COMPANY WORKSHEET P1WORK LEARNING OBJECTIVES * Prepare a worksheet for a proprietorship service firm. * Prepare financial statements from a worksheet. * Compare expense levels to national averages. * Alter the worksheet to include an additional adjusting entry. * Create a chart showing the amount of all expenses. PROBLEM DATA The trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is below: Wikki Cleaners Trial Balance December 31, 2012 Cash $13,200 Cleaning Supplies 22,000 Prepaid Insurance 5,400 Equipment 206,000 Accumulated Depreciation $…arrow_forward(Learning Objective 4: Journalize transactions) Journalize the following transactions. Include dates and a brief explanation for each journal entry.July 1: Issued common stock for $13,000July 5: Performed services on account for $8,000July 9: Purchased office supplies on account for $600July 10: Performed services for cash of $3,100July 12: Received payment in full for services performed on account from July 5July 24: Paid in full for office supplies purchased on July 9July 25: Received and paid monthly electric bill of $450July 30: Signed a note payable to purchase office furniture for $2,500July 31: Paid monthly payroll of $3,100arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License