Concept explainers

a.

To determine:

Internal Rate of Return (IRR):

IRR is the rate at which the future cash inflows will be equal to the initial

a.

Answer to Problem 10QP

Solution:

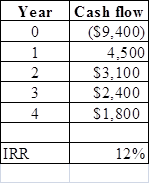

Compute the IRR.

Explanation of Solution

- The excel spreadsheet is used to calculate the internal

rate of return . - The IRR function is used to compute the internal rate of return.

Hence, internal rate of return is 12%.

b.

To explain: Whether Person X should accept this offer or not on 10% discount rate.

b.

Answer to Problem 10QP

Solution:

Person X should accept this offer on 10% discount rate.

Explanation of Solution

One should accept this offer because internal rate of return is 12% which is higher than the discount rate of 10%. It means that the current project will fetch profit for the company.

Hence, Person X should accept this project.

c.

To explain: Whether one should accept this offer or not on 20% discount rate.

c.

Answer to Problem 10QP

Solution:

Person X should not accept this offer on 20% discount rate.

Explanation of Solution

Person X should not accept this offer because internal rate of return is 12% which is lower than the discount rate of 20%. It means that the current project will not be able to earn even what is initially invested in the project.

Hence, Person X should not accept this project.

d.

To determine: NPV at 10% and 20% discount rate.

Net present value refers to the present value of all the future cash flow that is adjusted according to the

d.

Explanation of Solution

Compute the NPV.

For discount rate of 10%:

Given,

C0 is $9,400.

CF1 is $4,500.

CF2 is $3,100.

CF3 is $2,400.

CF4 is $1,800.

r is 10%.

Solution:

Formula to compute NPV,

Where,

- C0 is initial investment.

- CF1 is

cash inflow in first year. - CF2 is cash inflow in second year.

- CF3 is cash inflow in third year.

- CF4 is cash inflow in fourth year.

- r is discount rate.

Substitute, $9,400 for C0, $4,500 for CF1, $3,100 for CF2, $2,400 for CF3,$1,800 for CF4 and 10% for r.

The NPV for discount rate of 10% is $285.47.

For discount rate of 20%:

Given,

C0 is $9,400.

CF1 is $4,500.

CF2 is $3,100.

CF3 is $2,400.

CF4 is $1,800.

r is 20%.

Formula to compute NPV,

Where,

- C0 is initial investment.

- CF1 is cash inflow in first year.

- CF2 is cash inflow in second year.

- CF3 is cash inflow in third year.

- CF4 is cash inflow in fourth year.

- r is discount rate.

Substitute, $9,400 for C0, $4,500 for CF1, $3,100 for CF2, $2,400 for CF3,$1,800 for CF4 and 20% for r.

The NPV for discount rate of 20% is −$1,240.27.

Hence, NPV for discount rate of 10% and 20% is $285.47 and -$1,240.27 respectively.

e.

To explain: Whether NPV rule is consistent with IRR rule or not.

e.

Answer to Problem 10QP

Solution:

Yes, NPV rule is consistent with the internal rate of return method.

Explanation of Solution

NPV rule is consistent with IRR because according to both the methods, project with 10% discount rate is accepted and project with 20% discount rate should be discarded. It is because project is giving positive return only when 10% discount rate is used otherwise it is giving negative returns and it is consistent because, only once the signs of the cash flows changes.

Hence, NPV is consistent with the IRR rule.

Want to see more full solutions like this?

Chapter 5 Solutions

FINANCE 601 ACCESS CODE (CUSTOM)

- The appropriate discount rate for the following cash flows is 6.98 percent per year. Year Cash Flow 1 $ 2,400 2 0 3 3,840 4 2,090 What is the present value of the cash flows? (Do not round intermediate calculations and round your final answer to 2 decimal places, e.g., 32.16.) Present Valuearrow_forwardHow much will you need to invest today to get the following cash flows at a discount rate of 8.25%: Y1: $1,500 Y2: $1,700 Y3: $2,500 b) What is the total value of the cash flows given in (a) at the end of 3 years at a discount rate of 6.2 %? c) Alfred has the option of choosing between two savings accounts one with which pays 7.15% with quarterly compounding and another with 7% with monthly compounding. Which account should he use? Please answer fast I give you upvotearrow_forward[1]- If a person deposits $1000 per quarter into an account at an interest rate of 12% persemiannually.a) Draw cash flow diagram, CFD?b) How much will be in the account at the end of 6 years? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Investment X offers to pay you $6,100 per year for 9 years, whereas Investment Y offers to pay you $8,400 per year for 5 years. If the discount rate is 7 percent, what is the present value of these cash flows? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. If the discount rate is 23 percent, what is the present value of these cash flows? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.arrow_forwardUneven Cash Flow Stream Find the present values of the following cash flow streams. The appropriate interest rate is 6%. Round your answers to the nearest cent. (Note that, when working with the calculator's cash flow register, you must enter CF0 = 0. ) Year Cash Stream A Cash Stream B 1 $100 $300 2 400 400 3 400 400 4 400 400 5 300 100 Stream A $ _______Stream B $ _______arrow_forwardWhat would you be willing to pay (now) for the following yearend cash flows if your required return is 6.25%? Year 1 5,000 Year 2 4,000 Year 3 3,000 Year 4 2,200arrow_forward

- Which of the following annual cashflows has the lowest net present value if the discount rate is 10%? Question 20 options: $100; $100; $100; $100 $0; $0; $0; $400 $350; $0; $0; $0 $50; $50; $50; $375arrow_forwardWhat is the present value of a perpetual stream of cash flows that pays $ 7,500 at the end of year one and the annual cash flows grow at a rate of 2% per year indefinitely, if the appropriate discount rate is 9%? What if the appropriate discount rate is 7%? Question content area bottom Part 1 a. If the appropriate discount rate is 9%, the present value of the growing perpetuity is $ enter your response here . (Round to the nearest cent.)arrow_forwardWhat is the future value of the following cash flows, given an appropriate discount rate of 6.96% (to the nearest penny)? Year 1 Year 2 Year 3 Year 4 Year 5 $4708 $6056 $3724 $8267 $7761arrow_forward

- A 100 dollar cash payment in 20 years and a discount rate of 5 percent gives you a specific present value. Consider instead a cash flow for 10 years and a discount rate of 10 percent. What would the payment need to be for the present values of the two cash flows to be the same? A)100 B)97.76 C)96.80 D)103.21arrow_forwardConsider the following cash flows: Year Cash Flow 2 $ 22,000 3 40,000 5 58,000 Assume an interest rate of 8.8 percent per year. a. If today is Year 0, what is the future value of the cash flows five years from now? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If today is Year 0, what is the future value of the cash flows ten years from now? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning