CORPORATE FINANCE--CONNECT ACCESS CARD

12th Edition

ISBN: 9781264331062

Author: Ross

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 11QAP

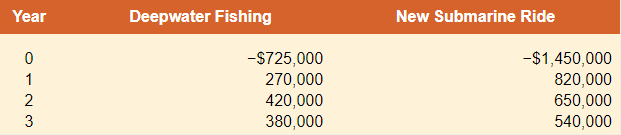

As a financial analyst for BRC, you are asked the following questions:

a. If your decision rule is to accept the project with the greater IRR, which project should you choose?

b. Because you are fully aware of the IRR rule’s scale problem, you calculate the incremental IRR for the cash flows. Based on your computation, which project should you choose?

c. To be prudent, you compute the NPV for both projects. Which project should you choose? Is it consistent with the incremental IRR rule?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider the following two mutually exclusive projects:

Year

Cash Flow (A)

Cash Flow (B)

0

-$ 54,000

-$ 23,000

1

12,700

11,600

2

23,200

11,200

3

27,600

4

46,500

12,500

6,000

Whichever project you choose, if any, you require a rate of return of 14 percent on your Investment. If you apply the payback criterion, you will choose Project

NPV criterion, you will choose Project

If you apply the IRR criterion, you will choose Project

If you choose the profitability Index criterion, you will choose Project

Based on your first four answers, which project will you finally choose?

If you apply the

Consider the following two mutually exclusive projects:

Year Cash Flow (A) Cash Flow (B)

0 −$29,000 −$29000

1 14,400 4,300

2 12,300 9,800

3 9,200 15,200

4 5,100 16,800

a) What is the Internal Rate of Return (IRR) for each of these projects?

b) Using the IRR decision rule, which project should the company accept?

c) If the required return is 11 percent, what is the Net Present Value (NV) for each of these projects?

d) Using the NPV decision rule, which project should the company accept?

e) Why do you think the NPV and IRR rules do not agree on same project approval/rejection direction?

Calculate the payback period, net present value, and internal rate of return for Project A. Assume a discount rate of 10%. Should the firm accept or reject Project A? Explain. If Project A and Project B are mutually exclusive, which is the better choice? Explain. What are “non-conventional” cash flows? What issues arise when evaluating projects with “non-conventional” cash flows?

Project A

Project B

Year

Cash Flow

Year

Cash Flow

0

-$100,000

0

-$1

1

$70,000

1

$0

2

$0

2

$0

3

$50,000

3

$10

Chapter 5 Solutions

CORPORATE FINANCE--CONNECT ACCESS CARD

Ch. 5 - Payback Period and Net Present Value If a project...Ch. 5 - Net Present Value Suppose a project has...Ch. 5 - Comparing Investment Criteria Define each of the...Ch. 5 - Payback and Internal Rate of Return A project has...Ch. 5 - Prob. 5CQCh. 5 - Capital Budgeting Problems What are some of the...Ch. 5 - Prob. 7CQCh. 5 - Prob. 8CQCh. 5 - Net Present Value versus Profitability Index...Ch. 5 - Internal Rate of Return Projects A and B have the...

Ch. 5 - Net Present Value You are evaluating Project A and...Ch. 5 - Modified Internal Rate of Return One of the less...Ch. 5 - Net Present Value It is sometimes stated that the...Ch. 5 - Prob. 14CQCh. 5 - Prob. 1QAPCh. 5 - Prob. 2QAPCh. 5 - Prob. 3QAPCh. 5 - Prob. 4QAPCh. 5 - Prob. 5QAPCh. 5 - Prob. 6QAPCh. 5 - Prob. 7QAPCh. 5 - Prob. 8QAPCh. 5 - Prob. 9QAPCh. 5 - Prob. 10QAPCh. 5 - NPV versus IRR Consider the following cash flows...Ch. 5 - Prob. 12QAPCh. 5 - Prob. 13QAPCh. 5 - Prob. 14QAPCh. 5 - Prob. 15QAPCh. 5 - Comparing Investment Criteria Consider the...Ch. 5 - Prob. 17QAPCh. 5 - Comparing Investment Criteria Consider the...Ch. 5 - Prob. 19QAPCh. 5 - Prob. 20QAPCh. 5 - MIRR Suppose the company in the previous problem...Ch. 5 - Prob. 22QAPCh. 5 - Prob. 23QAPCh. 5 - Prob. 24QAPCh. 5 - Prob. 25QAPCh. 5 - Prob. 26QAPCh. 5 - Prob. 27QAPCh. 5 - Prob. 28QAPCh. 5 - Prob. 29QAPCh. 5 - Prob. 30QAPCh. 5 - Construct a spreadsheet to calculate the payback...Ch. 5 - Based on your analysis, should the company open...Ch. 5 - Prob. 3MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- ABC Telecom has to choose between two mutually exclusive projects. If it chooses project A, ABC Telecom will have the opportunity to make a similar investment in three years. However, if it chooses project B, it will not have the opportunity to make a second investment. The following table lists the cash flows for these projects. If the firm uses the replacement chain (common life) approach, what will be the difference between the net present value (NPV) of project A and project B, assuming that both projects have a weighted average cost of capital of 11%? Project A Year 0: Year 1: Year 2: Year 3: $9,351 O $15,585 $14,027 $13,247 O $11,689 $21,804 $23,881 Cash Flow O $24,919 O $20,766 O $17,651 -$17,500 10,000 16,000 15,000 ABC Telecom is considering a three-year project that has a weighted average cost of capital of 12% and a NPV of $49,876. ABC Telecom can replicate this project indefinitely. What is the equivalent annual annuity (EAA) for this project? Project B Year 0: Year 1: Year…arrow_forwardA company is considering three alternative Investment projects with different net cash flows. The present value of net cash flows is calculated using Excel and the results follow. Potential Projects Present value of net cash flows (excluding initial investment) Initial investment Complete this question by entering your answers in the tabs below. a. Compute the net present value of each project. b. If the company accepts all positive net present value projects, which of these will It accept? c. If the company can choose only one project, which will it choose on the basis of net present value? Required A Required B Compute the net present value of each project. Potential Projects Project A Present value of net cash flows Initial investment Net present value Required C Project E Project C $10,685 (10,000)arrow_forwardABC Telecom has to choose between two mutually exclusive projects. If it chooses project A, ABC Telecom will have the opportunity to make a similar investment in three years. However, if it chooses project B, it will not have the opportunity to make a second investment. The following table lists the cash flows for these projects. If the firm uses the replacement chain (common life) approach, what will be the difference between the net present value (NPV) of project A and project B, assuming that both projects have a weighted average cost of capital of 11%? Project A Year 0: Year 1: Year 2: Year 3: $11,217 $14,422 $13,620 $17,626 $16,024 $35,090 $28,987 $30,513 $36,616 Cash Flow $38,141 -$12,500 8,000 14,000 13,000 ABC Telecom is considering a four-year project that has a weighted average cost of capital of 13% and a NPV of $90,760. ABC Telecom can replicate this project indefinitely. What is the equivalent annual annuity (EAA) for this project? Project B Year 0: Year 1: Year 2: Year 3:…arrow_forward

- Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown below. The required rate of return on projects of both of their risk class is 8 percent, and that the maximum allowable payback and discounted payback statistic for the projects are 2 and 3 years, respectively. Time Project A Cash Flow Project B Cash Flow Use the payback decision rule to evaluate these projects, which one(s) should it be accepted or rejected? Multiple Choice 0 -35,000 -45,000 1 25,000 25,000 2 45,000 5,000 3 16,000 65,000arrow_forwardConsider the cash flows for the investment projects given in Table. Assume that the MARR = 10%. (a) Suppose A, B, and C are mutually exclusive projects. Which project would be selected on the basis of the IRR criterion? (b) Assume that projects C and E are mutually exclusive. Using the IRR criterion, which Project would you select?. Net Cash Flow B D. E -4,850 2,100 2,100 2,500 4,250 3,200 2,850 800 300 4,250 4,250 2,850 2,900 1,050 500 -835 -835 -835 -835 1,500 3.250 1,600 1,200 2,100 2,100arrow_forwardConsider the two mutually exclusive projects described in the table below. the question requires a step by step excel solutionFor any positive value of the MARR, divide the possible MARR values into ranges with different decisions;describe and discuss what decision would be made in each range and why. You will need to calculate the crossover rate to determine the precise MARR where the decision changes. Include an NPV profile table and chart to illustrate your answer.Year Cash Flow Project A Cash Flow Project B0 -450,000 -700,0001 200,000 200,0002 150,000 200,0003 100,000 200,0004 100,000 200,0005 75,000 200,000arrow_forward

- Consider the cash flows for the following investment projects: (a) For Project A. find the value of X that makes the equivalent annual receiptsequal the equivalent annual disbursement at i = 13%.(b) Would you accept Project Bat i = 15% based on the AE criterion?arrow_forwardconsider the following two investments with the cashfow as shown. given the project are mutually exclusive, use Incremental-Investement Analysis to determine which of the two projects you should select. Given that the MARR required by management is 12%.arrow_forwardA firm evaluates all of its projects by applying the NPV decision rule. A project under consideration has the following cash flows: Year Cash Flow 0 –$ 28,900 1 12,900 2 15,900 3 11,900 What is the NPV for the project if the required return is 11 percent? At a required return of 11 percent, should the firm accept this project? What is the NPV for the project if the required return is 25 percent?arrow_forward

- Consider the cash flows for the investment projects given in Table. Assume that the MARR = 10%. (a) Suppose A, B, and C are mutually exclusive projects. Which project would be selected on the basis of the IRR criterion (b) Assume that projects C and È are mutually exclusive. Using the IRR criterion, which Project would you select? Net Cash Flow A В C D E -4,250 3,200 2,850 -4,250 1,500 3,250 1,600 1,200 -4,250 2,850 -4,850 2,100 2,100 2,100 2,100 2,500 1 -835 2,900 1,050 500 2 -835 3 800 -835 4 300 -835arrow_forwardPraxis Corp. has to choose between two mutually exclusive projects. If it chooses project A, Praxis Corp. will have the opportunity to make a similar investment in three years. However, if it chooses project B, it will not have the opportunity to make a second investment. The following table lists the cash flows for these projects. If the firm uses the replacement chain (common life) approach, what will be the difference between the net present value (NPV) of project A and project B, assuming that both projects have a weighted average cost of capital of 13%? Cash Flow Project A Project B Year 0: –$17,500 Year 0: –$45,000 Year 1: 10,000 Year 1: 10,000 Year 2: 16,000 Year 2: 17,000 Year 3: 15,000 Year 3: 16,000 Year 4: 15,000 Year 5: 14,000 Year 6: 13,000 $9,656 $14,163 $10,944 $12,875 $10,300arrow_forwardPraxis Corp. has to choose between two mutually exclusive projects. If it chooses project A, Praxis Corp. will have the opportunity to make a similar investment in three years. However, if it chooses project B, it will not have the opportunity to make a second investment. The following table lists the cash flows for these projects. If the firm uses the replacement chain (common life) approach, what will be the difference between the net present value (NPV) of project A and project B, assuming that both projects have a weighted average cost of capital of 10%? Cash Flow Project A Project B Year 0: –$12,500 Year 0: –$45,000 Year 1: 8,000 Year 1: 10,000 Year 2: 14,000 Year 2: 17,000 Year 3: 13,000 Year 3: 16,000 Year 4: 15,000 Year 5: 14,000 Year 6: 13,000 $11,776 $9,421 $7,066 $10,598 $7,654 Praxis Corp. is considering a three-year project that has a weighted average cost of capital of 11%…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Financial Risks - Part 1; Author: KnowledgEquity - Support for CPA;https://www.youtube.com/watch?v=mFjSYlBS-VE;License: Standard youtube license