a.

Calculate FICA tax (OASDI and HI) to be withheld for each person.

a.

Explanation of Solution

Federal Insurance Contributions Act (FICA) tax: Federal government imposes taxes on the employees’ pay to provide benefits to retired, old age, orphans, and disabled. This tax is also referred to as Social Security tax because the program is devised to benefit the society. FICA tax includes two components, OASDI (Old age, survivors, and disability insurance), and HI (health insurance).

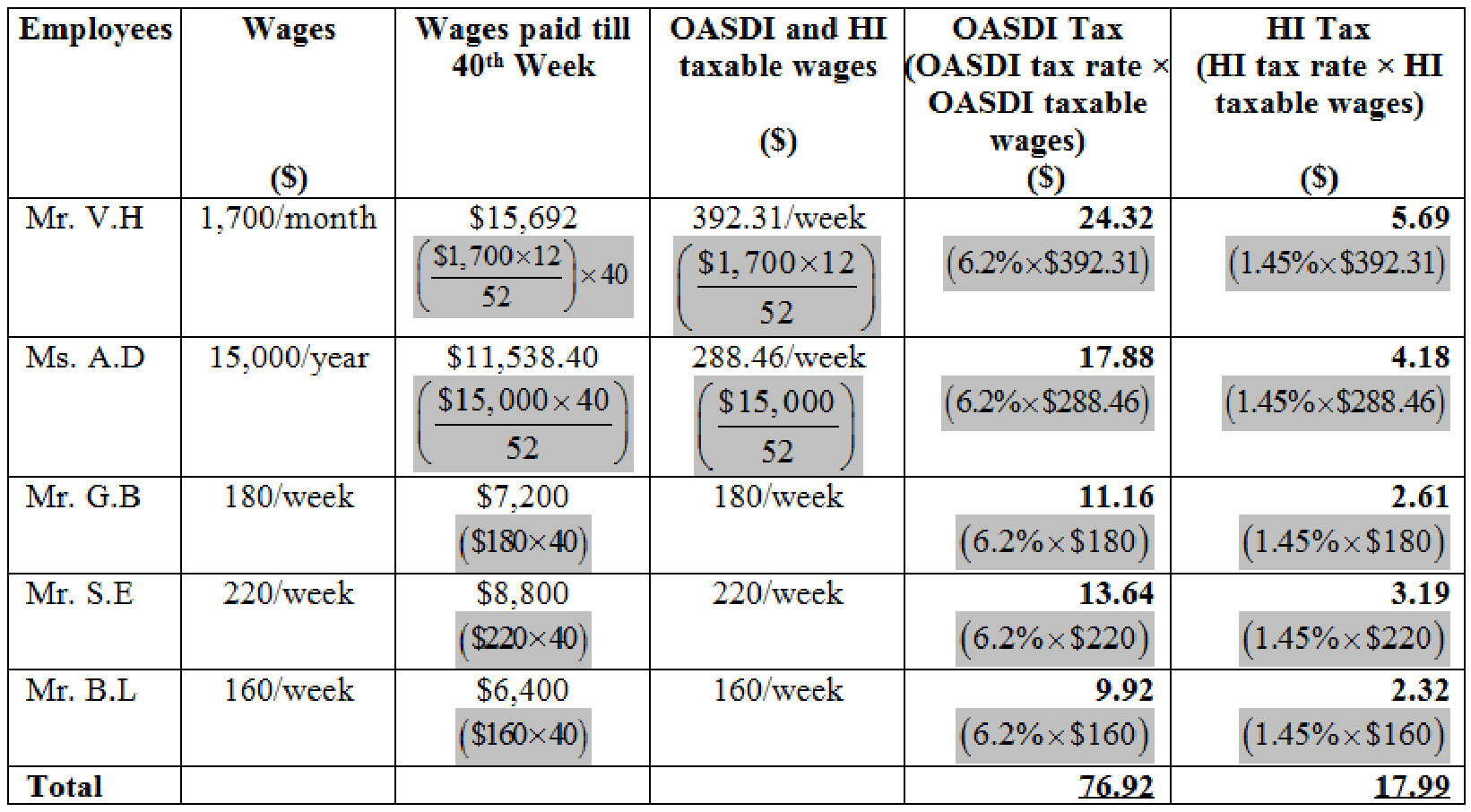

Calculate FICA tax (OASDI and HI) to be withheld for each person.

Table (1)

Note 1: For all the employees, the wages paid till 40th Week is less than the taxable wage limit of $128,400. Hence, full weekly wages of each employee will be taxable for OASDI and HI.

Note 2: The amount received by both the partners is considered as the drawings and not a salary. Thus, FICA taxes are not imposed.

b.

Calculate the amount of the employer’s FICA taxes for the weekly payroll.

b.

Explanation of Solution

Calculate the amount of the employer’s FICA taxes for the weekly payroll.

c.

Calculate the amount of state

c.

Explanation of Solution

State unemployment compensation tax (SUTA): This is the compensation provided to the unemployed people by the state government from the taxes collected from the employers, as a percentage of 5.4% of employees’ payrolls.

Calculate the amount of state unemployment contributions for the weekly payroll.

Step 1: Compute 41st week taxable wages of employee’s for SUTA.

| Employee | Designation | Wages ($) | Wages up to 40th week ($) | Taxable wages on 41st week ($) |

| Mr. V.H | General office worker | 1,700/month |

15,692.40 |

- |

| Ms. A.D | Saleswoman | 15,000/year |

11,538.46 |

- |

| Mr. G.B | Stock clerk | 180/week |

7,200 |

180 |

| Mr. S.E | Deliveryman | 220/week |

8,800 |

- |

| Mr. B.L | Cleaning and maintenance, part-time | 160/week |

6,400 |

160 |

| Total | 340 |

Table (2)

Note 1: For Mr. V.H, Ms. A.D, and Mr. S.E, up to 40th week, the wages is crossing the limit of $8,100. So, none of the wages is taxable in 41st week.

Note 2: For Mr. G.B, up to 40th week, the wages of $7,200 is not crossing the limit of $8,100. So, the full wages of $180 is taxable in 41st week.

Note 3: For Mr. B.L, up to 40th week, the wages of $6,400 is not crossing the limit of $8,100. So, the full wages of $160 is taxable in 41st week.

Step 2: Compute the amount of state unemployment contributions for the weekly payroll.

Hence, the amount of state unemployment contributions for the weekly payroll is $10.54.

d.

Calculate net FUTA tax on the payroll.

d.

Explanation of Solution

Federal unemployment compensation tax (FUTA): This is the compensation provided to the unemployed people by the federal government from the taxes collected from the employers, as a percentage of 6.0% on the first $7,000 of employees’ earnings. Federal government refunds the employers with 5.4% on FUTA, if the employers have paid SUTA. So, FUTA would be reduced to 0.6% for those employers.

Calculate net FUTA tax on the payroll.

Step 1: Compute 41st week taxable wages of employee’s for FUTA.

| Employee | Designation | Wages ($) | Wages up to 40th week ($) | Taxable wages on 41st week ($) |

| Mr. V.H | General office worker | 1,700/month |

15,692.40 |

- |

| Ms. A.D | Saleswoman | 15,000/year |

11,538.46 |

- |

| Mr. G.B | Stock clerk | 180/week |

7,200 |

- |

| Mr. S.E | Deliveryman | 220/week |

8,800 |

- |

| Mr. B.L | Cleaning and maintenance, part-time | 160/week |

6,400 |

160 |

| Total | 160 |

Table (3)

Note 1: For Mr. V.H, Ms. A.D, Mr. GB, and Mr. S.E, up to 40th week, the wages is crossing the limit of $7,000. So, none of the wages is taxable in 41st week.

Note 3: For Mr. B.L, up to 40th week, the wages of $6,400 is not crossing the limit of $7,000. So, the full wages of $160 is taxable in 41st week.

Step 2: Calculate net FUTA tax.

Hence, the net FUTA tax on the payroll is $0.96.

e.

Calculate the total amount of employer’s payroll taxes for the weekly payroll.

e.

Explanation of Solution

| Calculation of employer’s payroll taxes | |

| Type of Tax | Tax Amount |

| OASDI | $76.92 |

| HI | $17.99 |

| FUTA | $0.96 |

| SUTA | $10.54 |

| Total employer’s payroll taxes | $106.41 |

Table (4)

Hence, the total amount of employer’s payroll taxes for the weekly payroll is $106.41.

Want to see more full solutions like this?

Chapter 5 Solutions

PAYROLL ACCOUNTING 2019

- Payrex Co. has six employees. All are paid on a weekly basis. For the payroll period ending January 7, total employee earnings were 12,500, all of which were subject to SUTA, FUTA, Social Security, and Medicare taxes. The SUTA tax rate in Payrexs state is 5.4%, but Payrex qualifies for a rate of 2.0% because of its good record of providing regular employment to its employees. Other employer payroll taxes are at the rates described in the chapter. REQUIRED 1. Calculate Payrexs FUTA, SUTA, Social Security, and Medicare taxes for the week ended January 7. 2. Prepare the journal entry for Payrexs payroll taxes for the week ended January 7. 3. What amount of payroll taxes did Payrex save because of its good employment record?arrow_forwardAudrey Martin and Beth James are partners in the Country Gift Shop, which employs the individuals listed below. Paychecks are distributed every Friday to all employees. Based on the information given, compute the amounts listed below for a weekly payroll period. Employers OASDI Tax ________ Employers HI Tax ________arrow_forwardDuring the third calendar quarter of 20--, the Beechtree Inn, owned by Dawn Smedley, employed the persons listed below. Also given are the employees salaries or wages and the amount of tips reported to the owner. The tips were reported by the 10th of each month. The federal income tax and FICA tax to be withheld from the tips were estimated by the owner and withheld equally over the 13 weekly pay periods. The employers portion of FICA tax on the tips was estimated as the same amount. Employees are paid weekly on Friday. The following paydays occurred during this quarter: Taxes withheld for the 13 paydays in the third quarter follow: Based on the information given, complete Form 941 on the following pages for Dawn Smedley. Phone number: (901) 555-7959 Date filed: October 31, 20--arrow_forward

- During the third calendar quarter of 20--, Bayview Inn, owned by Diane R. Peters, employed the persons listed below. Also given are the employees salaries or wages and the amount of tips reported to the owner. The tips were reported by the 10th of each month. The federal income tax and FICA tax to be withheld from the tips were estimated by the owner and withheld equally over the 13 weekly pay periods. The employers portion of FICA tax on the tips was estimated as the same amount. Employees are paid weekly on Friday. The following paydays occurred during this quarter: Taxes withheld for the 13 paydays in the third quarter follow: Based on the information given, complete Form 941 on the following pages for Diane R. Peters. Phone number: (901) 555-7959 Date filed: October 31, 20--arrow_forwardDuring the year, employee Sean Matthews earned wages in the amount of 250,000. Discuss how the employees HI tax will differ from the employers HI tax for this employee.arrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,