a

Calculate the predetermined overhead rate used by the company.

a

Explanation of Solution

Calculation of total labor hours:

Hence, the total labor hours is $48,000.

Calculation of allocation rate:

Hence, the allocation rate per labor hour is $21.

b

Calculate the total overhead cost allocated by the company to each product.

b

Explanation of Solution

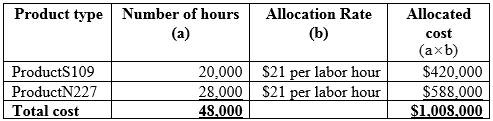

Calculation of overhead cost allocated to each type of product:

Table (1)

Hence, the total allocated cost is $1,008,000.

c

Explain the reason why the combined total cost is the same in both the requirements and is the ABC system more accurate than the traditional system.

c

Explanation of Solution

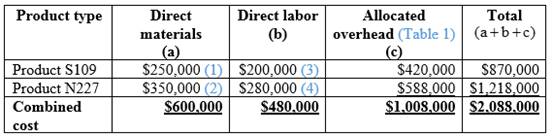

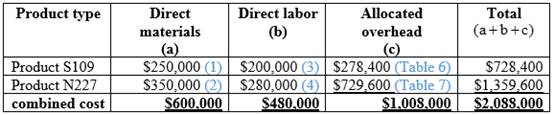

Calculation of total cost of each product line and combined cost of the products:

Table (2)

Hence, the total combined cost is $2,088,000.

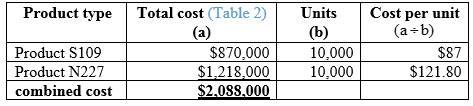

Calculation of cost per unit using traditional cost method:

Table (3)

Hence, the costs per unit of product S109 and product N227 are $87 and $121.80.

Working notes:

Calculation of direct material cost for product S109:

Hence, the direct material cost for product S109 is $250,000.

(1)

Calculation of direct material cost for product N227:

Hence, the direct material cost for product N227 is $350,000.

(2)

Calculation of direct labor cost for product S109:

Hence, the direct labor cost for product S109 is $200,000.

(3)

Calculation of direct labor cost for product N227:

Hence, the direct labor cost for product N227 is $280,000.

(4)

d

Calculate the price of each product using mark-up value.

d

Explanation of Solution

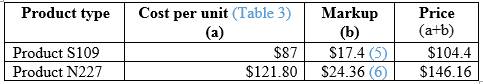

Calculation of price for each product:

Table (4)

Hence, the prices of each product using markup are $104.4 and 146.16.

Working notes:

Calculation of mark-up value for Product S109:

Hence, the mark-up value for Product S109 is 17.4.

(5)

Calculation of mark-up value for Product N227:

Hence, the mark-up value for Product N227 is 24.36.

(6)

e

Calculate the price of each product using mark-up value.

e

Explanation of Solution

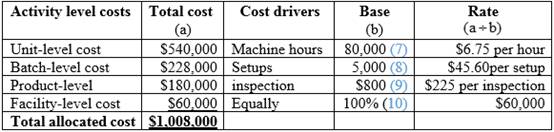

Calculation of overhead cost under ABC system:

Table (5)

Working notes:

Calculation of base rate for unit-level cost:

Hence, the base rate for unit-level cost is 80,000 hours.

(7)

Calculation of base rate for batch-level cost:

Hence, the base rate for batch-level cost is 5,000 setups.

(8)

The calculation of base rate for product-level cost:

Hence, the base rate for product-level cost is 800 inspection.

(9)

Calculation of base rate for facility-level cost:

Hence, the base rate for facility-level cost is 100%.

(10)

f

Calculate the total and per unit cost of each product using ABC system.

f

Explanation of Solution

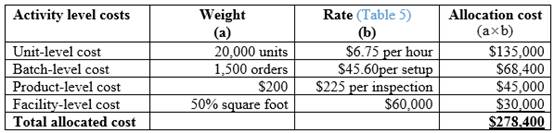

Calculation of total allocated cost for the product S109:

Table (6)

Hence, the total allocated cost for product S109 is 278,000.

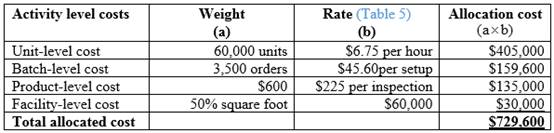

Calculation of total allocated cost for the product N227:

Table (7)

Hence, the total allocated cost for product N227 is 729,600.

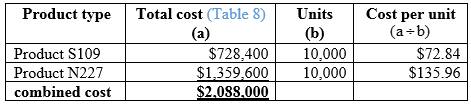

Calculation of total cost of each product line and combined cost of the products using ABC system:

Table (8)

Hence, the total combined cost is $2,088,000.

Calculation of cost per unit using ABC method:

Table (9)

Hence, the costs per unit of product S109 and product N227 are $72.84 and $135.96.

g

Calculate the revised price for each product.

g

Explanation of Solution

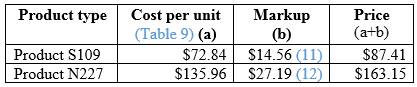

Calculation of revised price for each product:

Table (10)

Hence, the prices of each product using markup are $87.41 and 163.15.

Working notes:

Calculation of mark-up value for Product S109:

Hence, the mark-up value for Product S109 is 14.56.

(11)

Calculation of mark-up value for Product N227:

Hence, the mark-up value for Product N227 is 27.19.

(12)

h

Based on the results from requirements f and g, explain the reason why product N227 costs more and reason for adjusting sales price.

h

Explanation of Solution

Manufacturing the product N227 is more costly because it requires more machine setups, inspection cost, and machine hours than Product S109. However, the ABC system reveals the accurate cost of the product. Laboratory B needs to adjust its prices in order to sustain in the market for a long term.

Want to see more full solutions like this?

Chapter 5 Solutions

FUND.MAN.ACC.CONCEPTS W/CONNECT (LL)

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education