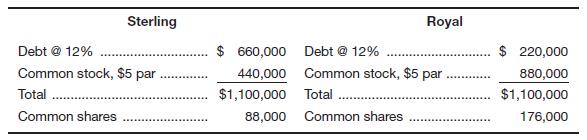

Sterling Optical and Royal Optical both make glass frames and each is able to generate earnings before interest and taxes of

a. Compute earnings per share for both firms. Assume a 25 percent tax rate.

b. In part a, you should have gotten the same answer for both companies’ earnings per share. Assuming a P/E ratio of 22 for each company, what would its stock price be?

c. Now as part of your analysis, assume the P/E ratio would be 16 for the riskier company in terms of heavy debt utilization in the capital structure and 24 for the less risky company. What would the stock prices for the two firms be under these assumptions? (Note: Although interest rates also would likely be different based on risk, we will hold them constant for ease of analysis.)

d. Based on the evidence in part c, should management be concerned only about the impact of financing plans on earnings per share, or should stockholders’ wealth maximization (stock price) be considered as well?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

FOUND.OF FINANCIAL MANAGEMENT-ACCESS

- Calculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 30% long-term debt, 15% preferred stock, and 55% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 22%. Debt The firm can sell for $1015 a 10-year, $1,000-par-value bond paying annual interest at a 8.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 8.50% (annual dividend) preferred stock having a par value of $100 can be sold for $96. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $60 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.70 ten years ago to the $5.07 dividend payment,…arrow_forwardCalculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 30% long-term debt, 15% preferred stock, and 55% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 22%. Debt The firm can sell for $1025 a 18-year, $1,000-par-value bond paying annual interest at a 8.00% coupon rate. A flotation cost of 4% of the par value is required. Preferred stock 10.00% (annual dividend) preferred stock having a par value of $100 can be sold for $92. An additional fee of $2 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $59.43 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.00 ten years ago to the $3.26 dividend payment, Do, that the company just recently…arrow_forwardAs an Analyst you were tasked to compute for the Weighted Average Cost of Capital of variouscompanies given the following information. Income tax rate is 25% a. What is the cost of equity of each companies?b. What is the after tax cost of debt of each companies?c. What is the WACC of each companies? W Corp A Corp Co. Corp Ca Corp Risk Free rate 4.00% 3.00% 2.00% 3.50% Beta 1.25 % 1.50% 1.30% 1.40% Market Return 12.00% 11.00 % 10:00% 8:00% Debt to Equity Ratio 2.5 3 4 3.5 Credit Spread om BPS 200 300 250 150arrow_forward

- Calculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 40% long-term debt, 15% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 23%. Debt The firm can sell for $1010 a 14-year, $1,000-par-value bond paying annual interest at a 8.00% coupon rate. A flotation cost of 3.5% of the par value is required. Preferred stock 7.00% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $80 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.50 ten years ago to the $4.92 dividend payment, D, that the company just recently…arrow_forwardDillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 35% long-term debt, 20% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 21%. Debt The firm can sell for $1030 a 13-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 8.5% (annual dividend) preferred stock having a par value of $100 can be sold for $90. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $60 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.75 ten years ago to the $5.41 dividend payment, D0, that the company just recently made. If the…arrow_forwardSun Pharma Company earns Rs 10 per share, is capitalized at a rate of 12 per cent and has a rate of return on investment of 20 per cent. What should be the price per share at 70 per cent dividend pay-out ratio according to Walter and Gordon model respectively ? Is this the optimum pay-out ratio according to Walter Model ? Justify your answer showing relevant calculations. What are the similarities and dissimilarities between Walter and Gordon Modelarrow_forward

- Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 35% long-term debt, 20% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 21%. Debt The firm can sell for $1030 a 13-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 8.5% (annual dividend) preferred stock having a par value of $100 can be sold for $90. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $60 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.75 ten years ago to the $5.41 dividend payment, D0, that the company just recently made. If the…arrow_forwardDillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 40% long-term debt, 15% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 26%. Debt The firm can sell for $1005 a 13-year, $1,000-par-value bond paying annual interest at a 6.00% coupon rate. A flotation cost of 2.5% of the par value is required. Preferred stock 7.00% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $5 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $80 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.50 ten years ago to the $4.92 dividend payment, D0, that the company just recently made. If…arrow_forwardDillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 40% long-term debt, 15% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 26%. Debt The firm can sell for $1005 a 13-year, $1,000-par-value bond paying annual interest at a 6.00% coupon rate. A flotation cost of 2.5% of the par value is required. Preferred stock 7.00% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $5 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $80 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.50 ten years ago to the $4.92 dividend payment, D0, that the company just recently made. If…arrow_forward

- 1 Suppose you have a firm with investor-supplied capital of $30 million. Further suppose that the WACC of the firm is 9%, and you are given the following income statement of the firm. Show work for all parts requiring computation. sales 26 M operating cost 16 m interest expense 3m Taxes (44%) What is the net income of the firm? What is the EVA of the firm? What is the difference between EVA and MVA?arrow_forwardThere are two firms in the same business: Air Wolf and Red Wolf. Both are in the same risk class, and each has an EBIT (Earnings Before Interest & Taxes) of $10 million. Air Wolf has no debt and Red Wolf has $4 million of debt. The cost of equity is 8% and the cost of debt is 10%. Assume a tax rate of 30%. Calculate the: (a) total value of each firm and (b) the breakdown of value or capital structure in terms of its components (debt & equity).arrow_forwardCalculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 50% long-term debt, 15% preferred stock, and 35% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 29%. Debt The firm can sell for $1015 a 20-year, $1,000-par-value bond paying annual interest at a 6.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 9.50% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $2 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $90 per share. The stock has paid a dividend that has gradually increased for many years, rising from $3.00 ten years ago to the $5.63 dividend payment,…arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education