Concept explainers

To determine: How to select the best decision based on Expected Monetary Value (EMV) criterion.

Introduction: Expected Monetary Value (EMV) is a system for calculating expected returns for certain decision made by a company.

Answer to Problem 18P

The low-technology approach can be selected with a cost of $145,000.

Explanation of Solution

Given information:

Strategies used:

| Low-tech | ||

| Fixed cost | Probability | Variable cost |

| $45,000.00 | 0.3 | $0.55 |

| 0.4 | $0.50 | |

| 0.3 | $0.45 | |

| Sub-contract | ||

| Fixed cost | Probability | Variable cost |

| $65,000.00 | 0.7 | $0.45 |

| 0.2 | $0.40 | |

| 0.1 | $0.35 | |

| High-tech | ||

| Fixed cost | Probability | Variable cost |

| $75,000.00 | 0.9 | $0.40 |

| 0.1 | $0.35 | |

| 0 | $0.00 | |

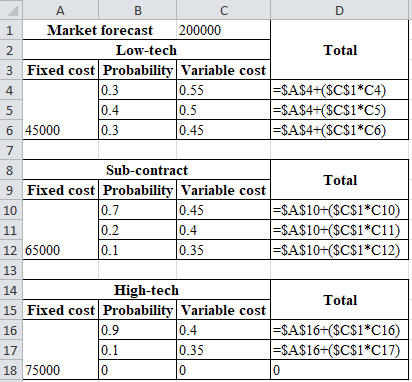

| Market forecast | 200,000 | Total | |

| Low-tech | |||

| Fixed cost | Probability | Variable cost | |

| $45,000.00 | 0.3 | $0.55 | $155,000.00 |

| 0.4 | $0.50 | $145,000.00 | |

| 0.3 | $0.45 | $135,000.00 | |

| Sub-contract | Total | ||

| Fixed cost | Probability | Variable cost | |

| $65,000.00 | 0.7 | $0.45 | $155,000.00 |

| 0.2 | $0.40 | $145,000.00 | |

| 0.1 | $0.35 | $135,000.00 | |

| High-tech | Total | ||

| Fixed cost | Probability | Variable cost | |

| $75,000.00 | 0.9 | $0.40 | $155,000.00 |

| 0.1 | $0.35 | $145,000.00 | |

| 0 | $0.00 | $0.00 | |

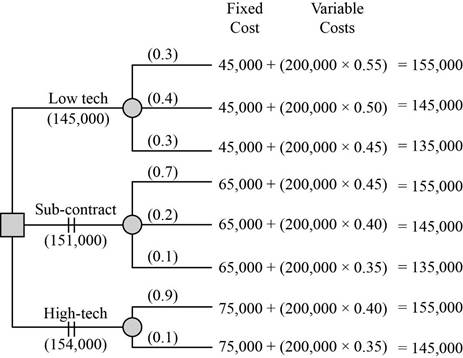

Calculation of total cost:

Low technology:

- Probability 0.3

With a probability of 0.3, the variable cost is calculated by multiplying the total market forecast of 200,000 with the variable cost $0.55. The product is added with the fixed cost, which is $45,000. The resultant total cost is $155,000.

- Probability 0.4

With a probability of 0.4, the variable cost is calculated by multiplying the total market forecast of 200,000 with the variable cost $0.50. The product is added with the fixed cost, which is $45,000. The resultant total cost is $145,000.

- Probability 0.3

With a probability of 0.3, the variable cost is calculated by multiplying the total market forecast of 200,000 with the variable cost $0.45. The product is added with the fixed cost, which is $45,000. The resultant total cost is $135,000.

Sub-contract:

- Probability 0.7

With a probability of 0.7, the variable cost is calculated by multiplying the total market forecast of 200,000 with the variable cost $0.45. The product is added with the fixed cost, which is $65,000. The resultant total cost is $155,000.

- Probability 0.2

With a probability of 0.2, the variable cost is calculated by multiplying the total market forecast of 200,000 with the variable cost $0.40. The product is added with the fixed cost which is $65,000. The resultant total cost is $145,000.

- Probability 0.1

With a probability of 0.1, the variable cost is calculated by multiplying the total market forecast of 200,000 with the variable cost $0.35. The product is added with the fixed cost which is $65,000. The resultant total cost is $135,000.

High-tech:

- Probability 0.9

With a probability of 0.9, the variable cost is calculated by multiplying the total market forecast of 200,000 with the variable cost $0.40. The product is added with the fixed cost which is $75,000. The resultant total cost is $155,000.

- Probability 0.1

With a probability of 0.1, the variable cost is calculated by multiplying the total market forecast of 200,000 with the variable cost $0.35. The product is added with the fixed cost which is $75,000. The resultant total cost is $145,000.

Hence, from the above calculations, it can be inferred that market forecast for low-technology (which consists of hiring several new junior engineers)at the cost of $145,000 can be selected.

Want to see more full solutions like this?

Chapter 5 Solutions

EBK PRINCIPLES OF OPERATIONS MANAGEMENT

- The Ministry of Health has implemented the system and it is now in full use. Evaluation now needs to take place. For each of the following, identify two questions that could be asked in order to evaluate the new system. (a) Versatility (b)Robustnessarrow_forwardAnalyses and design may be compared using the following criteria: The difference between analyses and designs is that the former generates models, whilst the latter focuses on the final product.arrow_forwardTrue or False: Engineering Technologist study the design process because 85% of problem of new products are reported due to a poor design process. The basic elements of product design are Product function, Product form, and Material.arrow_forward

- How the goal of six sigma is realistic for the Vedio stores and dvd kiosks ?arrow_forwardState What is redundancy and how can it improve product design ?arrow_forwardHow does quality planning differ depending on the criteria for functionality, system output, performance, dependability, and maintainability?arrow_forward

- Mont Corp produces and sells 1,000 dining tables per year. Currently its only quality problem with the products is related to varnishing. It currently incurs $400 per year for quality training and $600 per year for reliability engineering. Inspection cost is $6 per unit, and all units produced are inspected. Traditionally, at an internal inspection, 9% of all units fully-produced are found to have problems with the varnishing, and are reworked. Rework cost is $100 per unit. Defective units sold to customers are returned to the company and reworked. External failures are 1% of units sold, and the company incurs the shipping costs at the rate of $20 per unit. In 2020, management are considering an alternative method of inspecting products which will reduce inspection cost by $1.50 per unit. The alternative method will reduce the internal failure to 4% of all units produced, and increase the external failure rate to 6% of all units sold. In addition, with the alternative inspection…arrow_forwardDesign criteria, unlike product requirements, A. Are used to increase the quality of workmanship B. Are the basis of cost benefit analysis C. Are used to evaluate design alternatives D. Are characteristics the product must possessarrow_forwardDetail the design principles as well as the overall concept of the design. What qualities must a product need to have in order to be considered "excellent" in terms of its design?arrow_forward

- Honeywell reported that it increased team productivity by 20 percent and reduced requirements errors by 10 percent. What functionalities of ALM may have enabled Honeywell to accomplish this? Can you please answer this question from the following case study: Honeywell Technology Solutions Lab (HTSL), through its IT Services and Solutions business unit, develops software solutions for other parts of Honeywell Inc. HTSL is based in Bengaluru (Bangalore), India, with centres in Beijing (China), Brno (Czech Republic), Hyderabad (India), Madurai (India), and Shanghai (China). In 2010, the company identified a problem: At HTSL, various groups such as requirement writers and development, quality assurance (QA), and project management teams worked independently in separate “silos.” It was difficult to track project requirements and the status of their implementation. HTSL needed a system to manage the requirements and their relationships to each other. Beyond managing the requirements, HTSL…arrow_forwardDescribe What is redundancy and how can it improve product design ?arrow_forwardResidents of Mill River have fond memories of ice skating at a local park. An artist has captured the experience in a drawing and is hoping to reproduce it and sell framed copies to current and former residents. He thinks that if the market is good he can sell 400 copies of the elegant version at $125 each. If the market is not good, he will sell only 300 at $90 each. He can make a deluxe version of the same drawing instead. He feels that if the market is good he can sell 500 copies of the deluxe version at $100 each. If the market is not good, he will sell only 400 copies at $70 each. In either case, production costs will be approximately $35,000. He can also choose to do nothing, if he believes there is a 50% probability of a good market, what should he do and why?arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.