Concept explainers

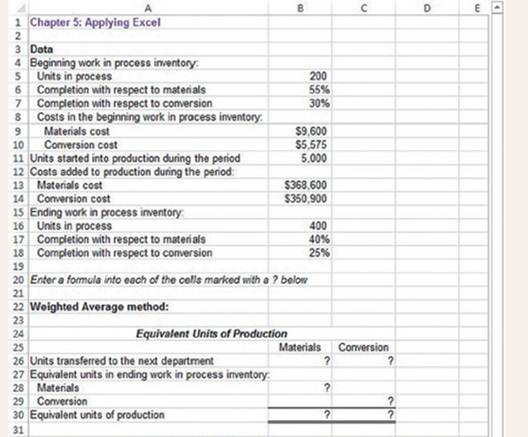

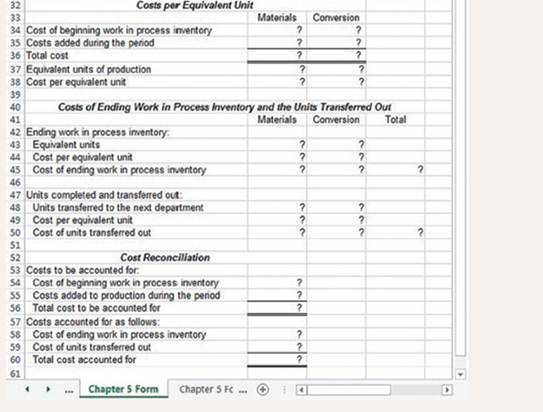

This exercise relates to the Double Diamond Skis’ Shaping and Milling Department that was discussed earlier in the chapter. The Excel worksheet form that appears below consolidates data from Exhibits 5-5 and 5-8. Download the workbook containing this form from Connect, where you will also receive instructions about how to use this worksheet form.

You should proceed to the requirements below only after completing your worksheet.

Required:

- Check your worksheet by changing the beginning work in process inventory to 100 units, the units started into production during the period to 2,500 units, and the units in ending work in process inventory to 200 units, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the cost per equivalent unit for materials should now be $152.50 and the cost per equivalent unit for conversion should be $145.50. If you do not get these answers, find the errors in your worksheet and correct them. How much is the total cost of the units transferred out? Did it change? Why or why not?

Total cost of units transferred out.

Unit of goods completed in the production process and transferred to other department during in the period, cost incurred to this completed goods which includes material and conversions jointly is known as total cost of units transferred out.

Total cost of the units transferred out and its cost is changed or not.

Answer to Problem 1AE

Solution:

| Costs per equivalent unit | Materials | Conversion |

| Cost of beginning work in process inventory | 9600 |

5575 |

| Cost added during the period | 368600 | 350900 |

| Total Cost | 378200 | 356475 |

| Equivalent unit of production | 2480 | 2450 |

| Cost per equivalent unit | 152.50 | 145.50 |

Total cost of the units transferred out is $715,200.

Yes, total cost of the units transferred out was changed because current equivalent unit of production was decreased at the same time cost per equivalent unit has increased.

Explanation of Solution

Explanations:

Formulas used:

Calculations:

- Total cost for material= $9600 + $368600=$378,200

Total cost for conversion= $5575+$350900=$356475

Equivalent unit of production for materials = 2400 units +80 units (200 units *40/100=80) =2480units

Equivalent unit of production for conversion = 2400 units +50 units (200 units * 25/100=50) =2450 units.

Cost per equivalent unit for material = $378,200 / 2480units = $152.50

Cost per equivalent unit for conversion=$356475 / 2450 units = $145.50

Units complete and transferred during in the period = 2500 units -100 units=2400

Total cost of the units transferred out = 2400 * $298 ($152.50+$145.50=$298) =$715,200.

Above calculation derived given cost per equivalent unit for materials as well as conversion also derived total cost of the units transferred and above explanation stated total cost of the units transferred out was changed.

Want to see more full solutions like this?

Chapter 5 Solutions

Introduction To Managerial Accounting

- The instructions for this practice worksheet are in the first picture (2 word document) - the second picture has the excel worksheet to input answers. I’m having a difficult time understanding how to do this - thank you!arrow_forwardConvert the accompanying database to an excel table to find: a. The total cost of all orders b. The total quantity of airframe fasteners purchased. c. The total cost of all orders placed with Manley Valve.arrow_forwardto create a model for a production cost report using the weighted average method for the month of May. Following good Excel design techniques, you should have an input area in which you put the department information for the month, and an output area that calculates the production cost report. As always, you should have only formulas or references in your output area. You should also include directions (in a text box) for users. After completion of the production cost report using the weighted average method, create a new worksheet and label the tab “FIFO”. Create a production cost report using the same information using the FIFO method. Spartans Bakery has two department: mixing and baking. All products start in the Mixing Department, where materials are added and conversion costs (labor, overhead) are incurred. Once the product is “finished” with regards to the Mixing, it moves to the Baking Department where additional conversion costs are incurred before moving to Finished…arrow_forward

- Jay Corporation has provided data from a two-year period to aid in planning. The Controller has asked you to prepare a contribution format income statement. Use the information included in the Excel Simulation and the Excel functions described below to complete the task.arrow_forwardThe Excel worksheet form that appears below is to be used to recreate the Review Problem pertaining to the Magnetic Imaging Division of Medical Diagnostics, Inc. Download the workbook containing this form from Connect, where you will also receive instructions about how to use this worksheet form. You should proceed to the requirements below only after completing your worksheet. Required: 1. Check your worksheet by changing the average operating assets in cell B6 to $8,000,000. The ROI should now be 38% arid the residual income should now be $1,000,000. If you do not get these answers, find the errors in your worksheet and correct them. Explain why the ROI and the residual income both increase when the average operating assets decrease. 2. Revise the data in your worksheet as follows: a. What is the ROI? b. What is the residual income? c. Explain the relationship between the ROI and the residual income?arrow_forwardGenX is a career training company that offers both online and on-campus weekend training courses on web development, data science, coding, and digital marketing. The accompanying data file shows the courses that will be offered next month by GenX. The data set contains course name (Course), whether the course is offered online or on-campus (Mode), current enrollment (Enrollment), tuition per student (Tuition), cost of instructors (Instructor costs), facility costs (Facility costs), technical service costs (Technical services), and historical cancellation rate for the course (Cancellation rate). Only on-campus courses incur facility costs. Online courses carry much higher costs for technical services than on-campus courses. The historical cancellation rate is used to project the actual enrollments of the courses. GenX would like to develop a spreadsheet model that calculates the projected revenue and profit for the month. Course Mode Enrollment Tuition Instructor costs Facility…arrow_forward

- Kruger Designs hired a consulting firm 3 months ago to redesign the information system that the architects use.The architects will be able to use state-of-the-art computer-aided design (CAD) programs to help in designing the products. Further, they will be able to store these designs on a network server where they and other architects may be able to call them back up for future designs with similar components. The consulting firm has been instructed to develop the system without disrupting the architects. In fact, top management believes that the best route is to develop the system and then to introduce it to the architects during a training session.Management does not want the architects to spend precious billable hours guessing about the new system or putting work off until the new system is working. Thus, the consultants are operating in a back room under a shroud of secrecy.Requireda. Do you think that management is taking the best course of action for the announcement of the new…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) Becker Tabletops has two support departments (Janitorial and Cafeteria) and two production departments (Cutting and Assembly). Relevant details for these departments are as follows: Support Department Cost Driver Janitorial Department Square footage to be serviced Cafeteria Department Number of employees Line Item Description JanitorialDepartment CafeteriaDepartment CuttingDepartment AssemblyDepartment Department costs $280,000 $170,000 $1,520,000 $690,000 Square feet 50 4,900 500 4,500 Number of employees 8 2 36 24 Allocate the support department costs to the production departments using the direct method. Line Item Description CuttingDepartment AssemblyDepartment Janitorial Department cost allocation $fill in the blank 1 $fill in the…arrow_forwardHow difficult is it to expand the original RedBrandmodel? Answer this by adding a new plant, two newwarehouses, and three new customers, and modify thespreadsheet model appropriately. You can make up therequired input data.arrow_forward

- Penny is compiling a list of costs incurred so far on a project. She must categorize these costs so that she can present the amount of direct cost incurred. Which of the following should Penny include in this list?This type of question contains radio buttons and checkboxes for selection of options. Use Tab for navigation and Enter or space to select the option. option A Expense incurred in meeting the regulatory standards for the company option B Benefits for employees in the organization option C Travel expenses to the customer’s office option D Costs incurred for maintaining coffee stations around the office.arrow_forwardAnswer the following questions using the Answer Report and the Sensitivity Report on thefollowing page. Support your answers with explanations and the work showed.Your run a company that produces three electrical products – clocks, radios, and toasters. You are asked to figure out how many of each of these things should be produced, and the computer solution (answer report and sensitivity report generated in Microsoft Excel) is given on the next page. 1.) How many of each of the electronic appliances should you make? (Make sure your answer makes sense.)2.) How much will you end up profiting?3.) Which of the constraints are binding? What does the slack for each non-binding constraint represent?arrow_forwardConvert the accompanying database to an Excel table to find: a.The total cost of all orders. b.Thetotal quantity of airframe fasteners purchased. c. The total cost of all orders placed with Manley Valve. Question content area bottom Part 1 a. The total cost of all orders is $?????? enter your response here.arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning