Concept explainers

Continuing problem

Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account Balances for Palisade Creek Co. as of May 1, 2016 (unless otherwise indicated), are as follows:

| 110 | Cash | $ 83,600 |

| 112 | 233,900 | |

| 115 | Merchandise Inventory | 624,400 |

| 116 | Estimated Returns Inventory | 28,000 |

| 117 | Prepaid Insurance | 16,800 |

| 118 | Store Supplies | 11,400 |

| 123 | Store Equipment | 569,500 |

| 124 | Accumulated |

56,700 |

| 210 | Accounts Payable | 96,600 |

| 211 | Salaries Payable | — |

| 212 | Customers Refunds Payable | 50,000 |

| 310 | Common Stock | 100,000 |

| 311 | 585,300 | |

| 312 | Dividends | 135,000 |

| 313 | Income Summary | — |

| 410 | Sales | 5,069,000 |

| 510 | Cost of Merchandise Sold | 2,823,000 |

| 520 | Sales Salaries Expense | 664,800 |

| 521 | Advertising Expense | 281,000 |

| 522 | Depreciation Expense | — |

| 523 | Store Supplies Expense | — |

| 529 | Miscellaneous Selling Expense | 12,600 |

| 530 | Office Salaries Expense | 382,100 |

| 531 | Rent Expense | 83,700 |

| 532 | Insurance Expense | — |

| 539 | Miscellaneous Administrative Expense | 7,800 |

During May, the last month of the fiscal year, the following transactions were completed:

| May 1. | Paid rent for May, $5,000. |

| 3. | Purchased merchandise on account from Martin Co. terms 2/10t n/30, FOB shipping point, $36,000. |

| 4. | Paid freight on purchase of May 3, $600. |

| 6. | Sold merchandise on account to Korman Co., terms 2/10, n/30, FOB shipping point, $68,500. The cost of the merchandise sold was $41,000. |

| 7. | Received $22,300 cash from Halstad Co. on account. |

| 10. | Sold merchandise for cash, $54,000. The cost of the merchandise sold was $32,000. |

| 13. | Paid for merchandise purchased on May 3- |

| 15. | Paid advertising expense for last half of May, $11,000. |

| 16. | Received cash from sale of May 6. |

| 19. | Purchased merchandise for cash, $18,700. |

| 19. | Paid $33,450 to Buttons Co. on account |

| 20. | Paid Korman Co. a cash refund of $13,230 for returned merchandise from sale of May 6. The invoice amount of the returned merchandise was $13,500 and the cost of the returned merchandise was $8,000. Record the following transactions on Page 21 of the journal: |

| 20. | Sold merchandise on account to Crescent Co., terms 1/10, n/30, FOB shipping point, $110,000. The cost of the merchandise sold was $70,000. |

| 21. | For the convenience of Crescent Co., paid freight on sale of May 20. $2,300. |

| 21. | Received $42,900 cash from Gee Co. on account. |

| May 21. | Purchased merchandise on account from Osterman Co., terms 1/10, n/30, FOB destination. $88,000. |

| 24. | Returned of damaged merchandise purchased on May 21, receiving a credit memo from the seller for $5,000. |

| 26. | Refunded cash on sales made for cash. $7,500. The cost of the merchandise returned was $4,800. |

| 28. | Paid sales salaries of $56,000 and office salaries of $29,000. |

| 29. | Purchased store supplies for cash, $2,400. |

| 30. | Sold merchandise on account to Turner Co., terms 2/10, n/30, FOB shipping point, $78,750. The cost of the merchandise sold was $47,000. |

| 30. | Received cash from sale of May 20 plus freight paid on May 21. |

| 31. | Paid for purchase of May 21. less return of May 24. |

Instructions

- 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark (✓) in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal.

- 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers.

- 3. Prepare an unadjusted

trial balance . - 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6).

| a. | Merchandise inventory on May 31 | $570,000 | |

| b. | Insurance expired during the year | 12,000 | |

| c. | Store supplies on hand on May 31 | 4,000 | |

| d. | Depreciation for the current year | 14,000 | |

| e. | Accrued salaries on May 31: | ||

| Sales salaries | $7,000 | ||

| Office salaries | 6,600 | 13,600 | |

| f. | The adjustment for customer returns and allowances is $60,000 for sales and $35,000 for cost of merchandise sold. | ||

- 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet.

- 6. Journalize and post the

adjusting entries . Record the adjusting entries on Page 22 of the journal. - 7. Prepare an adjusted trial balance.

- 8. Prepare an income statement, a retained earnings statement, and a balance sheet.

- 9. Prepare and

post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the retained earnings account.

10. Prepare a post-closing trial balance.

Comprehensive Problem

1, 2, 6, and 9.

To Post: The balance of each of the accounts.

Explanation of Solution

Enter the balances of each of the accounts.

Cash Account:

| Cash Account | Account No. 110 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 83,600 | |||

| 1 | 20 | 5,000 | |||||

| 4 | 20 | 600 | |||||

| 7 | 20 | 22,300 | |||||

| 10 | 20 | 54,000 | |||||

| 13 | 20 | 35,280 | |||||

| 15 | 20 | 11,000 | |||||

| 16 | 20 | 67,130 | |||||

| 19 | 20 | 18,700 | |||||

| 19 | 20 | 33,450 | |||||

| 20 | 20 | 13,230 | |||||

| 21 | 21 | 2,300 | |||||

| 21 | 21 | 42,900 | |||||

| 26 | 21 | 7,500 | |||||

| 28 | 21 | 85,000 | |||||

| 29 | 21 | 2,400 | |||||

| 30 | 21 | 111,200 | |||||

| 31 | 21 | 82,170 | 84,500 | ||||

Table (1)

Accounts Receivable Account:

| Accounts Receivable | Account No. 112 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 233,900 | |||

| 6 | 20 | 67,130 | |||||

| 7 | 20 | 22,300 | |||||

| 16 | 20 | 67,130 | |||||

| 20 | 21 | 108,900 | |||||

| 21 | 21 | 2,300 | |||||

| 21 | 21 | 42,900 | |||||

| 30 | 21 | 77,175 | |||||

| 30 | 21 | 111,200 | 245,875 | ||||

Table (2)

Inventory Account:

| Inventory | Account No. 115 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 624,400 | |||

| 3 | 20 | 35,280 | |||||

| 4 | 20 | 600 | |||||

| 6 | 20 | 41,000 | |||||

| 10 | 20 | 32,000 | |||||

| 19 | 20 | 18,700 | |||||

| 20 | 20 | 8,000 | |||||

| 20 | 21 | 70,000 | |||||

| 21 | 21 | 87,120 | |||||

| 24 | 21 | 4,950 | |||||

| 26 | 21 | 4,800 | |||||

| 30 | 21 | 47,000 | 583,950 | ||||

| 31 | Adjusting | 22 | 13,950 | 570,000 | |||

Table (3)

Estimated Returns Inventory Account:

| Estimated Returns Inventory | Account No. 116 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 28,000 | |||

| 20 | 20 | 8,000 | |||||

| 26 | 21 | 4,800 | 15,200 | ||||

| 31 | Adjusting | 22 | 35,000 | 50,200 | |||

Table (4)

Prepaid Insurance Account:

| Prepaid Insurance | Account No. 117 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 16,800 | |||

| 31 | Adjusting | 22 | 12,000 | 4,800 | |||

Table (5)

Store Supplies Account:

| Store Supplies | Account No. 118 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 11,400 | |||

| 29 | 21 | 2,400 | 13,800 | ||||

| 31 | Adjusting | 22 | 9,800 | 4,000 | |||

Table (6)

Store Equipment Account:

| Store Equipment | Account No. 123 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 569,500 | |||

Table (7)

Accumulated Depreciation – Store Equipment Account:

| Accumulated Depreciation – Store Equipment | Account No. 124 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 56,700 | |||

| 31 | Adjusting | 22 | 14,000 | 70,700 | |||

Table (8)

Accounts Payable Account:

| Accounts Payable | Account No. 210 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 96,600 | |||

| 3 | 20 | 35,280 | |||||

| 13 | 20 | 35,280 | |||||

| 19 | 20 | 33,450 | |||||

| 21 | 21 | 87,120 | |||||

| 24 | 21 | 4,950 | |||||

| 31 | 21 | 82,170 | 63,150 | ||||

Table (9)

Salaries Payable Account:

| Salaries Payable | Account No. 211 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 31 | Adjusting | 22 | 13,600 | 13,600 | ||

Table (10)

Customers Refunds Payable Account:

| Customers Refunds Payable | Account No. 212 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 50,000 | |||

| 20 | 20 | 13,230 | |||||

| 26 | 21 | 7,500 | 29,270 | ||||

| 31 | Adjusting | 22 | 60,000 | 89,270 | |||

Table (11)

Common Stock Account:

| Common Stock | Account No. 310 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 100,000 | |||

Table (12)

Retained Earnings Account:

| Retained Earnings | Account No. 311 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2017 | |||||||

| June | 1 |

|

✓ | 585,300 | |||

| 2016 | |||||||

| May | 31 | Closing | 23 | 741,855 | |||

| 31 | Closing | 23 | 135,000 | 1,192,155 | |||

Table (13)

Dividends Account:

| Dividends | Account No. 312 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 135,000 | |||

| 31 | Closing | 23 | 135,000 | ||||

Table (14)

Income Summary Account:

| Income Summary | Account No. 313 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 31 | Closing | 23 | 5,316,205 | |||

| 31 | Closing | 23 | 4,574,350 | 741,855 | |||

| 31 | Closing | 23 | 741,855 | ||||

Table (15)

Sales Account:

| Sales | Account No. 410 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 5,069,000 | |||

| 6 | 20 | 67,130 | |||||

| 10 | 20 | 54,000 | |||||

| 20 | 21 | 108,900 | |||||

| 30 | 21 | 77,175 | 5,376,205 | ||||

| 31 | Adjusting | 22 | 60,000 | 5,316,205 | |||

| 31 | Closing | 23 | 5,316,205 | ||||

Table (16)

Cost of Goods Sold Account:

| Cost of Goods Sold | Account No. 510 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 2,823,000 | |||

| 6 | 20 | 41,000 | |||||

| 10 | 20 | 32,000 | |||||

| 20 | 21 | 70,000 | |||||

| 30 | 21 | 47,000 | 3,013,000 | ||||

| 31 | Adjusting | 22 | 13,950 | ||||

| 31 | Adjusting | 22 | 35,000 | 2,991,950 | |||

| 31 | Closing | 23 | 2,991,950 | ||||

Table (17)

Sales Salaries Expense Account:

| Sales Salaries Expense | Account No. 520 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 664,800 | |||

| 28 | 21 | 56,000 | 720,800 | ||||

| 31 | Adjusting | 22 | 7,000 | 727,800 | |||

| 31 | Closing | 23 | 727,800 | ||||

Table (18)

Advertising Expense Account:

| Advertising Expense | Account No. 521 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 281,000 | |||

| 15 | 20 | 11,000 | 292,000 | ||||

| 31 | Closing | 23 | 292,000 | ||||

Table (19)

Depreciation Expense Account:

| Depreciation Expense | Account No. 522 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 31 | Adjusting | 22 | 14,000 | 14,000 | ||

| 31 | Closing | 23 | 14,000 | ||||

Table (20)

Stores Supplies Expense Account:

| Stores Supplies Expense | Account No. 523 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 31 | Adjusting | 22 | 9,800 | 9,800 | ||

| 31 | Closing | 23 | 9,800 | ||||

Table (21)

Miscellaneous Selling Expense Account:

| Miscellaneous Selling Expense | Account No. 529 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 12,600 | |||

| 31 | Closing | 23 | 12,600 | ||||

Table (22)

Office Salaries Expense Account:

| Office Salaries Expense | Account No. 530 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 382,100 | |||

| 28 | 21 | 29,000 | 411,100 | ||||

| 31 | Adjusting | 22 | 6,600 | 417,700 | |||

| 31 | Closing | 23 | 417,700 | ||||

Table (23)

Rent Expense Account:

| Rent Expense | Account No. 531 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 83,700 | |||

| 1 | 20 | 5,000 | 88,700 | ||||

| 31 | Closing | 23 | 88,700 | ||||

Table (24)

Insurance Expense Account:

| Insurance Expense | Account No. 532 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 31 | Adjusting | 22 | 12,000 | 12,000 | ||

| 31 | Closing | 23 | 12,000 | ||||

Table (25)

Miscellaneous Administrative Expense Account:

| Miscellaneous Administrative Expense | Account No. 539 | ||||||

| Date | Item |

Post. Ref. |

Debit | Credit | Balance ($) | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| May | 1 |

|

✓ | 7,800 | |||

| 31 | Closing | 23 | 7,800 | ||||

Table (26)

1. And 2.

To Record: The journal entries.

Explanation of Solution

| Date | Particulars | Post. Ref. | Page 20 | ||

| Debit ($) | Credit ($) | ||||

| 2016 | |||||

| May | 1 | Rent Expense | 531 | 5,000 | |

| Cash | 110 | 5,000 | |||

| 3 | Inventory | 115 | 35,280 | ||

| Accounts Payable | 210 | 35,280 | |||

| 4 | Inventory | 115 | 600 | ||

| Cash | 110 | 600 | |||

| 6 | Accounts Receivable | 112 | 67,130 | ||

| Sales | 410 | 67,130 | |||

| 6 | Cost of Goods Sold | 510 | 41,000 | ||

| Inventory | 115 | 41,000 | |||

| 7 | Cash | 110 | 22,300 | ||

| Accounts Receivable | 112 | 22,300 | |||

| 10 | Cash | 110 | 54,000 | ||

| Sales | 410 | 54,000 | |||

| 10 | Cost of Goods Sold | 510 | 32,000 | ||

| Inventory | 115 | 32,000 | |||

| 13 | Accounts Payable | 210 | 35,280 | ||

| Cash | 110 | 35,280 | |||

| 15 | Advertising Expense | 521 | 11,000 | ||

| Cash | 110 | 11,000 | |||

| 16 | Cash | 110 | 67,130 | ||

| Accounts Receivable | 112 | 67,130 | |||

| 19 | Inventory | 115 | 18,700 | ||

| Cash | 110 | 18,700 | |||

| 19 | Accounts Payable | 210 | 33,450 | ||

| Cash | 110 | 33,450 | |||

| 20 | Customers Refunds Payable | 212 | 13,230 | ||

| Cash | 110 | 13,230 | |||

| 20 | Inventory | 115 | 8,000 | ||

| Estimated Returns Inventory | 116 | 8,000 | |||

| Date | Particulars | Post. Ref. | Page 21 | ||

| Debit ($) | Credit ($) | ||||

| 20 | Accounts Receivable | 112 | 108,900 | ||

| Sales | 410 | 108,900 | |||

| 20 | Cost of Goods Sold | 510 | 70,000 | ||

| Inventory | 115 | 70,000 | |||

| 21 | Accounts Receivable | 112 | 2,300 | ||

| Cash | 110 | 2,300 | |||

| 21 | Cash | 110 | 42,900 | ||

| Accounts Receivable | 112 | 42,900 | |||

| 21 | Inventory | 115 | 87,120 | ||

| Accounts Payable | 210 | 87,120 | |||

| 24 | Accounts Payable | 210 | 4,950 | ||

| Inventory | 115 | 4,950 | |||

| 26 | Customers Refunds Payable | 212 | 7,500 | ||

| Cash | 110 | 7,500 | |||

| 26 | Inventory | 115 | 4,800 | ||

| Estimated Returns Inventory | 116 | 4,800 | |||

| 28 | Sales Salaries Expense | 520 | 56,000 | ||

| Office Salaries Expense | 530 | 29,000 | |||

| Cash | 110 | 85,000 | |||

| 29 | Store Supplies | 118 | 2,400 | ||

| Cash | 110 | 2,400 | |||

| 30 | Accounts Receivable | 112 | 77,175 | ||

| Sales | 410 | 77,175 | |||

| 30 | Cost of Goods Sold | 510 | 47,000 | ||

| Inventory | 115 | 47,000 | |||

| 30 | Cash | 110 | 111,200 | ||

| Accounts Receivable | 112 | 111,200 | |||

| 31 | Accounts Payable | 210 | 82,170 | ||

| Cash | 110 | 82,170 | |||

Table (27)

3.

To Prepare: The unadjusted trial balance of Company P.

Explanation of Solution

Prepare an unadjusted trial balance.

P Company Unadjusted Trial Balance As on May 31, 2016 |

|||

| Accounts | Account No. |

Debit Balances ($) |

Credit Balances ($) |

| Cash | 110 | 84,500 | |

| Accounts Receivable | 112 | 245,875 | |

| Inventory | 115 | 583,950 | |

| Estimated Returns Inventory | 116 | 15,200 | |

| Prepaid Insurance | 117 | 16,800 | |

| Store Supplies | 118 | 13,800 | |

| Store Equipment | 123 | 569,500 | |

| Accumulated Depreciation—Store Equipment | 124 | 56,700 | |

| Accounts Payable | 210 | 63,150 | |

| Salaries Payable | 211 | — | |

| Customers Refunds Payable | 212 | 29,270 | |

| Common Stock | 310 | 100,000 | |

| Retained Earnings | 311 | 585,300 | |

| Dividends | 312 | 135,000 | |

| Sales | 410 | 5,376,205 | |

| Cost of Goods Sold | 510 | 3,013,000 | |

| Sales Salaries Expense | 520 | 720,800 | |

| Advertising Expense | 521 | 292,000 | |

| Depreciation Expense | 522 | — | |

| Store Supplies Expense | 523 | — | |

| Miscellaneous Selling Expense | 529 | 12,600 | |

| Office Salaries Expense | 530 | 411,100 | |

| Rent Expense | 531 | 88,700 | |

| Insurance Expense | 532 | — | |

| Miscellaneous Administrative Expense | 539 | 7,800 | |

| Total | 6,210,625 | 6,210,625 | |

Table (28)

4. and 6.

To Record: The adjusting entry.

Explanation of Solution

| Date | Particulars |

Post. Ref. |

Page 22 | ||

| Debit ($) | Credit ($) | ||||

| 2016 | Adjusting Entries | ||||

| May | 31 | Cost of Goods Sold | 510 | 13,950 | |

| Inventory | 115 | 13,950 | |||

| 31 | Insurance Expense | 532 | 12,000 | ||

| Prepaid Insurance | 117 | 12,000 | |||

| 31 | Store Supplies Expense | 523 | 9,800 | ||

| Store Supplies | 118 | 9,800 | |||

| 31 | Depreciation Expense | 522 | 14,000 | ||

Accumulated. Depreciation —Store Equipment |

124 | 14,000 | |||

| 31 | Sales Salaries Expense | 520 | 7,000 | ||

| Office Salaries Expense | 530 | 6,600 | |||

| Salaries Payable | 211 | 13,600 | |||

| 31 | Sales | 410 | 60,000 | ||

| Customer Refunds Payable | 212 | 60,000 | |||

| 31 | Estimated Returns Inventory | 116 | 35,000 | ||

| Cost of Goods Sold | 510 | 35,000 | |||

Table (29)

7.

To Prepare: The adjusted trial balance of Company P.

Explanation of Solution

Prepare the adjusted trial balance.

P Company Adjusted Trial Balance As on May 31, 2016 |

|||

| Particulars | Account No. |

Debit Balances ($) |

Credit Balances ($) |

| Cash | 110 | 84,500 | |

| Accounts Receivable | 112 | 245,875 | |

| Inventory | 115 | 570,000 | |

| Estimated Returns Inventory | 116 | 50,200 | |

| Prepaid Insurance | 117 | 4,800 | |

| Store Supplies | 118 | 4,000 | |

| Store Equipment | 123 | 569,500 | |

| Accumulated Depreciation—Store Equipment | 124 | 70,700 | |

| Accounts Payable | 210 | 63,150 | |

| Salaries Payable | 211 | 13,600 | |

| Customers Refunds Payable | 212 | 89,270 | |

| Common Stock | 310 | 100,000 | |

| Retained Earnings | 311 | 585,300 | |

| Dividends | 312 | 135,000 | |

| Sales | 410 | 5,316,205 | |

| Cost of Goods Sold | 510 | 2,991,950 | |

| Sales Salaries Expense | 520 | 727,800 | |

| Advertising Expense | 521 | 292,000 | |

| Depreciation Expense | 522 | 14,000 | |

| Store Supplies Expense | 523 | 9,800 | |

| Miscellaneous Selling Expense | 529 | 12,600 | |

| Office Salaries Expense | 530 | 417,700 | |

| Rent Expense | 531 | 88,700 | |

| Insurance Expense | 532 | 12,000 | |

| Miscellaneous Administrative Expense | 539 | 7,800 | |

| Total | 6,238,225 | 6,238,225 | |

Table (30)

8.

To Prepare: The income statement, retained earnings, and balance sheet of P Company.

Explanation of Solution

Prepare the income statement.

P Company Income Statement For the Year Ended May 31, 2016 |

|||

| Particulars | Amount ($) | Amount ($) | Amount ($) |

| Sales | 5,316,205 | ||

| Cost of goods sold | (2,991,950) | ||

| Gross profit | 2,324,255 | ||

| Expenses: | |||

| Selling expenses: | |||

| Sales salaries expense | 727,800 | ||

| Advertising expense | 292,000 | ||

| Depreciation expense | 14,000 | ||

| Store supplies expense | 9,800 | ||

| Miscellaneous selling expense | 12,600 | ||

| Total selling expenses | 1,056,200 | ||

| Administrative expenses: | |||

| Office salaries expense | 417,700 | ||

| Rent expense | 88,700 | ||

| Insurance expense | 12,000 | ||

| Miscellaneous administrative expense | 7,800 | ||

| Total administrative expenses | 526,200 | ||

| Total expenses | (1,582,400) | ||

| Net income | 741,855 | ||

Table (31)

Prepare the retained earnings statement.

P Company Retained Earnings Statement For the Year Ended May 31, 2016 |

||

| Retained earnings, June 1, 2015 | 585,300 | |

| Net income | 741,855 | |

| Dividends | (135,000) | |

| Change in retained earnings | 606,855 | |

| Retained earnings, May 31, 2016 | 1,192,155 | |

Table (32)

Prepare the balance sheet of P Company.

P Company Balance Sheet As on May 31, 2016 |

||

| Assets | Amount ($) | Amount ($) |

| Current assets: | ||

| Cash | $84,500 | |

| Accounts receivable | 245,875 | |

| Inventory | 570,000 | |

| Estimated returns inventory | 50,200 | |

| Prepaid insurance | 4,800 | |

| Store supplies | 4,000 | |

| Total current assets | $ 959,375 | |

| Property, plant, and equipment: | ||

| Store equipment | $ 569,500 | |

| Accumulated depreciation—store equipment | (70,700) | |

| Total property, plant, and equipment | 498,800 | |

| Total assets | $1,458,175 | |

| Liabilities | ||

| Current liabilities: | ||

| Accounts payable | $63,150 | |

| Salaries payable | 13,600 | |

| Customers refunds payable | 89,270 | |

| Total liabilities | $ 166,020 | |

| Stockholders’ Equity | ||

| Common stock | $ 100,000 | |

| Retained earnings | 1,192,155 | |

| Total stockholders’ equity | 1,292,155 | |

| Total liabilities and stockholders’ equity | $1,458,175 | |

Table (33)

9.

To Post: The closing entries.

Explanation of Solution

Prepare the closing entries.

| Date | Particulars |

Post. Ref. |

Page 23 | ||

| Debit ($) | Credit ($) | ||||

| 2016 | Closing Entries | ||||

| May | 31 | Sales | 410 | 5,316,205 | |

| Income Summary | 313 | 5,316,205 | |||

| 31 | Income Summary | 313 | 4,574,350 | ||

| Cost of Goods Sold | 510 | 2,991,950 | |||

| Sales Salaries Expense | 520 | 727,800 | |||

| Advertising Expense | 521 | 292,000 | |||

| Depreciation Expense | 522 | 14,000 | |||

| Store Supplies Expense | 523 | 9,800 | |||

| Miscellaneous Selling Expense | 529 | 12,600 | |||

| Office Salaries Expense | 530 | 417,700 | |||

| Rent Expense | 531 | 88,700 | |||

| Insurance Expense | 532 | 12,000 | |||

| Miscellaneous Administrative Expenses | 539 | 7,800 | |||

| 31 | Income Summary | 313 | 741,855 | ||

| Retained Earnings | 311 | 741,855 | |||

| 31 | Retained Earnings | 311 | 135,000 | ||

| Dividends | 312 | 135,000 | |||

Table (34)

10.

To Prepare: The post-closing trial balance.

Explanation of Solution

Prepare the post-closing trial balance.

P Company Post-Closing Trial Balance May 31, 2016 |

|||

| Accounts | Account No. |

Debit Balances ($) |

Credit Balances ($) |

| Cash | 110 | 84,500 | |

| Accounts Receivable | 112 | 245,875 | |

| Inventory | 115 | 570,000 | |

| Estimated Returns Inventory | 116 | 50,200 | |

| Prepaid Insurance | 117 | 4,800 | |

| Store Supplies | 118 | 4,000 | |

| Store Equipment | 123 | 569,500 | |

| Accumulated Depreciation—Store Equipment | 124 | 70,700 | |

| Accounts Payable | 210 | 63,150 | |

| Salaries Payable | 211 | 13,600 | |

| Customers Refunds Payable | 212 | 89,270 | |

| Common Stock | 310 | 100,000 | |

| Retained Earnings | 311 | 1,192,155 | |

| Total | 1,528,875 | 1,528,875 | |

Table (35)

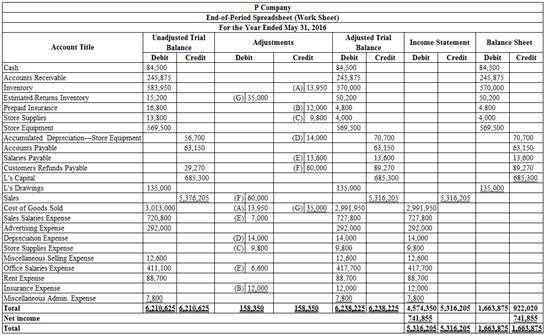

5.

To Prepare: The worksheet for Company P.

Explanation of Solution

Prepare the worksheet.

Figure (1)

Want to see more full solutions like this?

Chapter 5 Solutions

Financial & Managerial Accounting

- Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2016 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: May 1. Paid rent for May, 5,000. 3. Purchased merchandise on account from Martin Co., terms 2/10, n/30, FOB shipping point, 36,000. 4. Paid freight on purchase of May 3, 600. 6. Sold merchandise on account to Korman Co., terms 2/10, n/30, FOB shipping point, 68,500. The cost of the merchandise sold was 41,000. 7. Received 22,300 cash from Halstad Co. on account. 10. Sold merchandise for cash, 54,000. The cost of the merchandise sold was 32,000. 13. Paid for merchandise purchased on May 3. 15. Paid advertising expense for last half of May, 11,000. 16. Received cash from sale of May 6. 19. Purchased merchandise for cash, 18,700. 19. Paid 33,450 to Buttons Co. on account. 20. Paid Korman Co. a cash refund of 13,230 for returned merchandise from sale of May 6. The invoice amount of the returned merchandise was 13,500 and the cost of the returned merchandise was 8,000. Record the following transactions on Page 21 of the journal: 20. Sold merchandise on account to Crescent Co., terms 1/10, n/30, FOB shipping point, 110,000. The cost of the merchandise sold was 70,000. 21. For the convenience of Crescent Co., paid freight on sale of May 20, 2,300. 21. Received 42,900 cash from Gee Co. on account. May 21. Purchased merchandise on account from Osterman Co., terms 1/10, n/30, FOB destination, 88,000. 24. Returned of damaged merchandise purchased on May 21, receiving a credit memo from the seller for 5,000. 26. Refunded cash on sales made for cash, 7,500. The cost of the merchandise returned was 4,800. 28. Paid sales salaries of 56,000 and office salaries of 29, 000. 29. Purchased store supplies for cash, 2,400. 30. Sold merchandise on account to Turner Co., terms 2/10, n/30, FOB shipping point, 78,750. The cost of the merchandise sold was 47,000. 30. Received cash from sale of May 20 plus freight paid on May 21. 31. Paid for purchase of May 21, less return of May 24. Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). f. The adjustment for customer returns and allowances is 60,000 for sales and 35,000 for cost of merchandise sold. 5. (Optional) Enter the unadjusted trial balance on a IO-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the owners capital account. 10. Prepare a post-closing trial balance.arrow_forwardInventory Analysis The following account balances are taken from the records of Lewis Inc., a wholesaler of fresh fruits and vegetables: Required Compute Lewiss inventory turnover ratio for 2016 and 2015. Compute the number of days sales in inventory for 2016 and 2015. Assume 360 days in a year. Comment on your answers in parts (1) and (2) relative to the companys management of inventory over the two years. What problems do you see in its inventory management?arrow_forwardAnalyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following transactions: a. Made credit sales of $825,000. The cost of the merchandise sold was $560,000. b. Collected accounts receivable in the amount of $752,600. c. Purchased goods on credit in the amount of $574,300. d. Paid accounts payable in the amount of $536,200. Required: Prepare the journal entries necessary to record the transactions. Indicate whether each transaction increased cash, decreased cash, or had no effect on cash.arrow_forward

- Effects of an Inventory Error The income statements for Graul Corporation for the 3 years ending in 2019 appear below. During 2019, Graul discovered that the 2017 ending inventory had been misstated due to the following two transactions being recorded incorrectly. a. A purchase return of inventory costing $42,000 was recorded twice. b. A credit purchase of inventory' made on December 20 for $28,500 was not recorded. The goods were shipped F.O.B. shipping point and were shipped on December 22, 2017. Required: 1. Was ending inventory for 2017 overstated or understated? By how much? 2. Prepare correct income statements for all 3 years. 3. CONCEPTUAL CONNECTION Did the error in 2017 affect cumulative net income for the 3-year period? Explain your response. 4. CONCEPTUAL CONNECTION Why was the 2019 net income unaffected?arrow_forwardJOURNAL ENTRIESPERPETUAL INVENTORY Joan Ziemba owns a small variety store. The following transactions took place during March of the current year. Journalize the transactions in a general journal using the perpetual inventory method. Mar.3 Purchased merchandise on account from City Galleria, 2,900. 7 Paid freight charge on merchandise purchased, 225. 13 Sold merchandise on account to Amber Specialties, 3,400. The cost of the merchandise was 2,200. 18 Received a credit memo from City Galleria for merchandise returned, 650. 22 Issued a credit memo to Amber Specialties for merchandise returned, 600. The cost of the merchandise was 320.arrow_forwardAnalyzing Inventory The recent financial statements of McLelland Clothing Inc. include the following data: Required: 1. Calculate McLellands gross profit ratio (rounded to two decimal places), inventory turnover ratio (rounded to three decimal places), and the average days to sell inventory (assume a 365-day year and round to two decimal places) using the FIFO inventory costing method. Be sure to explain what each ratio means. 2. Calculate McLellands gross profit ratio (rounded to two decimal places), inventory turnover ratio (rounded to three decimal places), and the average days to sell inventory (assume a 365-day year and round to two decimal places) using the LIFO inventory costing method. Be sure to explain what each ratio means. 3. CONCEPTUAL CONNECTION Which ratios-the ones computed using FIFO or LIFO inventory values-provide the better indicator of how successful McLelland was at managing and controlling its inventory?arrow_forward

- JOURNAL ENTRIESPERIODIC INVENTORY Amy Douglas owns a business called Douglas Distributors. The following transactions took place during January of the current year. Journalize the transactions in a general journal using the periodic inventory method. Jan. 5 Purchased merchandise on account from Elite Warehouse, 4,100. 8 Paid freight charge on merchandise purchased, 300. 12 Sold merchandise on account to Memories Unlimited, 5,200. 15 Received a credit memo from Elite Warehouse for merchandise returned, 700. 22 Issued a credit memo to Memories Unlimited for merchandise returned, 400.arrow_forwardJOURNAL ENTRIESPERIODIC INVENTORY Paul Nasipak owns a business called Diamond Distributors. The following transactions took place during January of the current year. Journalize the transactions in a general journal using the periodic inventory method. Jan.5 Purchased merchandise on account from Prestigious Jewelers, 3,300. 8 Paid freight charge on merchandise purchased, 300. 12 Sold merchandise on account to Diamonds Unlimited, 4,500. 15 Received a credit memo from Prestigious Jewelers for merchandise returned, 700. 22 Issued a credit memo to Diamonds Unlimited for merchandise returned, 900.arrow_forwardLongmire Sons nude sales un credit to Alderman Sports totaling 500,000 on April 18. The cost of the goods sold is 400,000. Longmire estimates 3% of its sales to Alderman may be returned. On May 22, 9,000 worth of goods (with a cost of 7,200) are returned by Alderman. Longmire uses a periodic inventory system. Prepare the related journal entries for Longmire Sons.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning