The Effect of Adjustments

Assume you are the accountant for Austin Industries. Ellis Austin, the owner of the company, is in a hurry to receive the financial statements for the year ended December 31, 2019, and asks you how soon they will be ready. You tell him you have just completed the

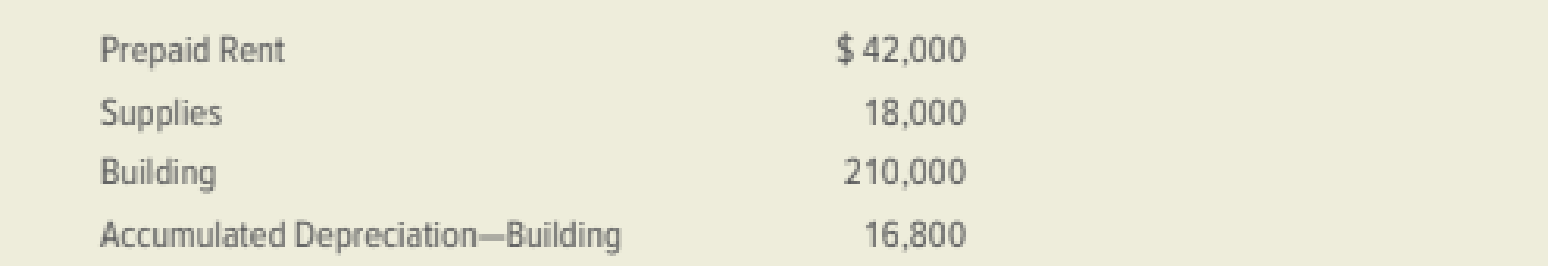

If the income statement were prepared using trial balance amounts, the net income would be $95,560. A review of the company's records reveals the following information:

- 1. Rent of $42,000 was paid on July 1, 2019, for 12 months.

- 2. Purchases of supplies during the year totaled $8,000. An inventory of supplies taken at year-end showed supplies on hand of $2,720.

- 3. The building was purchased three years ago and has an estimated life of 30 years.

- 4. No adjustments have been made to any of the accounts during the year.

Write a memo to Mr. Austin explaining the effect on the financial statements of omitting the adjustments. Indicate the change to net income that results from the adjusting entries.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

COLLEGE ACCOUNTING ETEXT+CONNECT ACCESS

- Required: Prepare the following, December 31, 2019, financial statements: Income Statement Retained Earnings Statement Balance Sheet December 31, 2019, adjusted trial balance is provided below. Prepare the fiscal year-end closing entries. Prepare the January 1, 2020 opening trial balance. Prepare the journal entries for the first six months of 2020. The owners provided a written summary of activities they believe accounting entries need to be prepared (see page 2). The owners would like to know the current (as of 6/30/20) cash and the inventory balance. They would like you to provide a “T” account showing the activity in each account.arrow_forwardYou have just joined Queenie Limited, which is a small merchandising company, as an accountant. Queenie Limited was set up on January 1, 2020. You have recently asked the bookkeeper to prepare the draft of the financial statements for the first year of operations ended December 31, 2020 for your review. The bookkeeper said that she only knew how to prepare a trial balance and below was the trial balance submitted by the bookkeeper. Queenie Limited Trial Balance December 31, 2020 DR CR 2$ $ Truck Office equipment Cash 280,950 102,000 30,750 Share capital Sales revenue received 240,000 577,080 Salaries paid Utilities paid Rent paid Insurance paid 181,500 12,000 195,000 14,880 817,080 817,080 In discussing the trial balance with the bookkeeper, you asked whether adjusting entries have been prepared to get the accounts up to date for the trial balance. The bookkeeper said that there was no need to make adjusting entries as Queenie Limited was a small company. Required: Explain why the…arrow_forwardDevlin Company has prepared following partially completed worksheet for the year ended December 31, 2019: 1. Complete the worksheet. (Round to the nearest dollar.) 2. Prepar company's financial statements. 3. Prepare (a) adjusting and (b ) closing entries in the general journal.arrow_forward

- In quickbooks I need: Record the appropriate adjusting journal entries on 1/31/2021 based on the following: A bill for $675 was received and recorded in the next month from FixIt, Inc. for advertising placed in the current month. Create a new liability account like you did earlier in the chapter.arrow_forwardBenderson, Inc. makes adjusting journal entries (AJEs) at the end of every month when they prepare their financial statements. Their accountant forgot to record the AJE to accrue utility expense for July 2019 on the July 31, 2019 financial statements. As a result of the omission:arrow_forwardAmeena Enterprise is a business management service founded by Madam Ameena in 2019. Mr. Ali is an accountant responsible for preparing the financial statements for Ameena Enterprise. Miss Maria has been appointed as new account clerk at Ameena Enterprise. Mr. Ali has several tasks planned to test Miss Maria's ability to work. Firstly, he asked Miss Maria to prepare the journal entries to record the transactions of Ameena Enterprise for the month of April 2021. The following are the transactions that occurred in April 2021: Transactions Purchased office equipment of RM14,000. 40% of the amount is purchased on credit basis and the remaining balance is paid by cash. Accrued revenues of RM3,500 previously recorded to accounts receivable were collected. Date 1 April I April 1 April 2 April 3 April Paid office rental in advance for RM4,500. Paid all accrued salaries for Mac 2021, RM3,000. Provided services amounting RM2,400 for the customer who made the advance payment March 2021. 10 April…arrow_forward

- Aylmer has some customers that pay for services in advance of work started. At December 31, 2020, the accountant reviewed unearned revenue to see how much revenue had been earned. Calculate the amount and the journal entries too. Please include all steps of calutlations for my reference. Thanks!arrow_forwardPrepare the January 1, 2020 opening trial balance. Prepare the journal entries for the first six months of 2020. The owners would like to know the current (as of 6/30/20) cash and inventory They would like you to provide a “T” account showing the activity in each account.arrow_forwardYou have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance. After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new category. This will change the required allowance for uncollectible accounts…arrow_forward

- You have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance. After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new category. This will change the required allowance for uncollectible accounts…arrow_forwardYou have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance.3.What is the ethical dilemma you face? What are the ethical considerations? Consider your options and responsibilities as assistant controller.4.Identify the key internal and external stakeholders. What are the negative impacts that can happen if you do not follow the instructions of your supervisor?5.What are the…arrow_forwardYou have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance. After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new category. This will change the required allowance for uncollectible accounts…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT