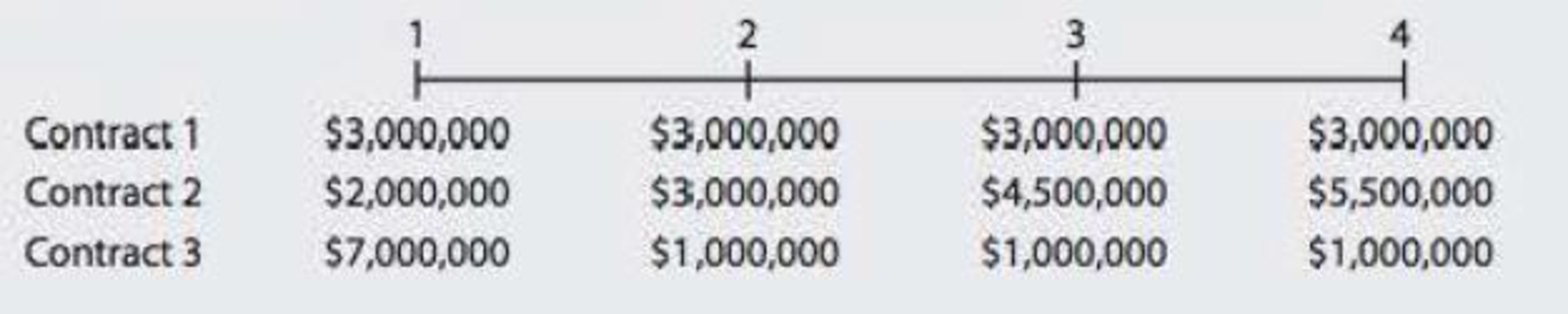

PV OF A CASH FLOW STREAM A rookie quarterback is negotiating his first NFL contract. His

As his adviser, which contract would you recommend that he accept?

To calculate: The best stream for present value of cash flow

Introduction:

Future Value of Cash Flow:

If single cash flow put in an investment today which pays us compound interest how much does it grow over the period of time is known as future value of cash flow.

Explanation of Solution

Calculation of present value of cash flow stream at 7% compounding rate

| Contract 1 | Contract 2 | Contract 3 | ||||

| Year | Cash in flow | Present Value | Cash in flow | Present Value | Cash in flow | Present Value |

| 1 | 3,000,000 | 2,803,738 | 2,000,000 | 1,869,159 | 7,000,000 | 6,542,056 |

| 2 | 3,000,000 | 2,620,316 | 3,000,000 | 2,620,316 | 1,000,000 | 873,439 |

| 3 | 3,000,000 | 2,448,894 | 4,500,000 | 3,673,340 | 1,000,000 | 816,298 |

| 4 | 3,000,000 | 2,288,686 | 5,500,000 | 4,195,924 | 1,000,000 | 762,895 |

| Total PV | 10,161,634 | 12,358,739 | 8,994,688 | |||

Table (1)

Working Note for present value:

Present value for year 1 and contract 1

Present value for year 2 and contract 1

Present value for year 3 and contract 1

Present value for year 4 and contract 1

Present value for year 1 and contract 2

Present value for year 2 and contract 2

Formula to calculate present value for year 3 and contract 2

Formula to calculate present value for year 4 and contract 2

Formula to calculate present value for year 1 and contract 3

Formula to calculate present value for year 2 and contract 3

Formula to calculate present value for year 3 and contract 3

Formula to calculate present value for year 4 and contract 3

So, the contract 2 is the best option as total present value is highest for contract 2.

Want to see more full solutions like this?

Chapter 5 Solutions

Fundamentals of Financial Management, Concise Edition

- Week 4 Giant Equipment Ltd. is considering two projects to invest next year. Both projects have the same start-up costs. Project A will produce annual cash flows of $42,000 at the beginning of each year for eight years. Project B will produce cash flows of $48,000 at the end of each year for seven years. The company requires a 12% return. Required: Which project should the company select if the interest rate is 14% at the cash flows in Project B is also at the beginning of each year?arrow_forward(Question #5) Bud Jett (get it…like budget) has two options for an investment.a. OPTION 1 – Invest $2,000 per month for 20 years at the beginning of each year and earn 8% annually.b. OPTION 2 – Invest $2,000 per month for 20 years at the end of each year and earn 8% annually. Calculate both options and select which investment is better for our financial cartoon friend: Bud Jett.arrow_forward5. To invest capital, a person has the following options:a) Fixed-term investment with interest of 21.5% compounded by semestersb) Certificates that pay 20.5% compounded each week.c) Bonuses that give you 20.68% earnings compounded by months. Assuming that they all offer the same liquidity, that is, they have equal chances of recovering the investment, which one should you decide?arrow_forward

- i will 5 upvotes urgent You just got a new job and are offered several contracts from which to choose. Which is the best deal assuming a positive rate of interest? Payment of $6 million over six years, paid in installments at the beginning of each year, but growing by 3% per year. Payment of $6 million over six years, paid in installments at the end of each year, but growing by 3% per year. Payment of $6 million over six years, paid in equal installments at the beginning of each year. Payment of $6 million over six years, paid in equal installments at the end of each year.arrow_forward24. A top-ranked quarterback just signed a 5-year contract, providing $3 million per year, payable at the end of each month. A hockey superstar accepts a 5-year contract, with a $4 million signing bonus, payable immediately and $2.1 million per year, payable at the end of each month. The quarterback brags that his contract is better because he is getting $15 million and the hockey player is getting only $14.5 million. Is the quarterback right? The interest rate is 8%, EAR.arrow_forward12. I need help with finance home work question asap please An investment that would require an initial cash outflow of $360,000 at the beginning is expected to produce cash inflows of $70,000 at the end of each of the investment's 7 years. Assume the required return is 13% and you wanted to determine the investment's discounted paypack period. What amount would you subtract from the investment's initial cash outflow of $360,000 when determining how much of the initial cost would be left to recover on a discounted basis at the beginning of the second year?arrow_forward

- Funding a retirement goal. Austin Miller wishes to have 800,000 in a retirement fund 20 years from now. He can create the retirement fund by making a single lump-sum deposit today. a. If upon retirement in 20 years, Austin plans to invest 800,000 in a fund that earns 4 percent, what is the maximum annual withdrawal he can make over the following 15 years? b. How much would Austin need to have on deposit at retirement in order to withdraw 35,000 annually over the 15 years if the retirement fund earns 4 percent? c. To achieve his annual withdrawal goal of 35,000 calculated in part b, how much more than the amount calculated in part a must Austin deposit today in an investment earning 4 percent annual interest?arrow_forwardDetermining Loan Repayments Jerry Rockness needs 40,000 to pay off a loan due on December 31, 2028. His plans included the making of 10 annual deposits beginning on December 31, 2019, in accumulating a fund to pay off the loan. Without making a precise calculation, Jerry made 3 annual deposits of 4,000 each on December 31, 2019, 2020, and 2021, which have been earning interest at 10% compounded annually. Required: What is the equal amount of each of the next 7 deposits for the period December 31, 2022, to December 31, 2028, to reach the fund objective, assuming that the fund will continue to earn interest at 10% compounded annually?arrow_forwardQUESTION TWO You are in a managerial position with $50,000 available cash. You have the option of investing the money for five years at a fixed interest rate of 10 percent per annum. You also have to decide on investing the money either annually, semi-annually or quarterly. Given the options available to you, which investment decision will you take? Explain your choice. Hint: find the future value of your cash for the five years for each kind of investment package and show which will give you the highest yield.arrow_forward

- Week 4Giant Equipment Ltd. is considering two projects to invest next year. Both projects have the same start-up costs. Project A will produce annual cash flows of $42,000 at the beginning of each year for eight years. Project B will produce cash flows of $48,000 at the end of each year for seven years. Thecompany requires a 12% return.Required:a) Which project should the company select and why? b) Which project should the company select if the interest rate is 14% at the cash flows in Project B is also at the beginning of each year?arrow_forward.a. A first-round draft choice goalkeeper has been signed to a three-year, $10 million contract. The details provide for an immediate cash bonus of $1million. The player is $2million in salary at the end of the first year, $3 million the next, and 4 million at the end of the last year. Assuming a 10% discount rate, is this package worth $10 million? How much is it worth? .b Suppose a business takes out a GHC5000, 5-year loan at 9%. If the loan agreement calls for the borrower to pay the interest on the loan balance each year and to reduce the loan balance each year by GHC 1000, what would the loan repayment schedule look like? .c. Example: after carefully going over your budget, you have determined you can afford to pay GHC632 per month toward a new sports car. You call up your local bank and find out that the going rate is 1% per month for 48 months. How much can you borrow?arrow_forwardA professional athlete has signed a contract worth $56 million over 5 years. Assume that value is the value of the contract today. (a) If the contract pays out at the end of each year and the interest rate is 6% nominal annual, compounded monthly, how much is it worth at the end of each year? (b) Draw a cash flow diagram of the payouts of the cash flow in part (a). (c) If the interest rate is 6% nominal annual compounded monthly and the athlete would like to defer the payouts over a span of 25 years, calculate the monthly income over 25 years.arrow_forward

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning