Concept explainers

1.

Introduction:

Inventory is a record of finished goods of a company which they can sell to the customer, work in progress which can be transformed into finish goods and raw material which is a means of production. Inventory is also classified as a current asset in the balance sheet and it is valued by FIFO LIFO and weighted average method.

To calculate: The total cost of goods available for sale and the number of units available for sales.

1.

Answer to Problem 2PSB

The total cost of goods available for sale is 235,500 and the total number of goods available for sale is 65 units

Explanation of Solution

Cost of goods available for sales and the number of goods available for sales:

| Date | Particular | Unit | Rate ($) | Total Cost ($) |

| 1st April | Opening inventory | 20 | 3000 | 60000 |

| 6th April | Purchases | 30 | 3500 | 105,000 |

| 17th April | Purchases | 5 | 4500 | 22,500 |

| 25st April | Purchases | 10 | 4800 | 48,000 |

| Total | 65 | 235,500 | ||

So, the total cost of goods available for sale is $23,500 and the total number of goods available for sale is 65 units

2.

Introduction:

Inventory is a record of finished goods of a company which they can sell to the customer, work in progress which can be transformed into finish goods and raw material which is a means of production. Inventory is also classified as a current asset in the balance sheet and it is valued by FIFO LIFO and weighted average method.

To compute: The number of unit in ending inventory for the company M.

2.

Answer to Problem 2PSB

The number of units in ending inventory is 5 units.

Explanation of Solution

The number of units in closing inventory is as follows:

The number of units in ending inventory is 5 units

3.

Introduction:

Inventory is a record of finished goods of a company which they can sell to the customer, work in progress which can be transformed into finish goods and raw material which is a means of production. Inventory is also classified as a current asset in the balance sheet and it is valued by FIFO LIFO and weighted average method.

To compute: The cost assigned to ending inventory for the company M using FIFO, LIFO and weighted average and specific identification.

3.

Answer to Problem 2PSB

Cost assigned to ending inventory using FIFO is $24,000, using LIFO is $15,000, using weighted average is $ 20000 and specific Identification is $22,500.

Explanation of Solution

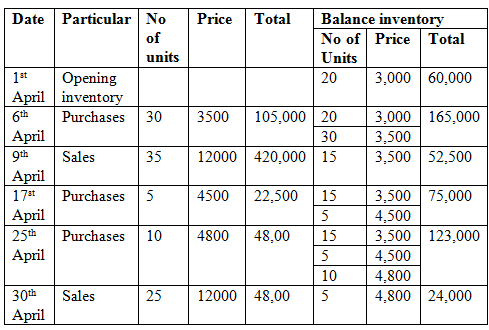

- Cost assigned to ending inventory for the company A using FIFO :

- Calculating the assigned amount of ending inventory according to LIFO method:

Using FIFO method closing inventory of 5 units will consist:

Thus, cost assigned to ending inventory using FIFO is $24,000.

Using the LIFO method closing inventory of 5 units will consist

Thus, the cost of assigned to ending inventory using LIFO is $15,000

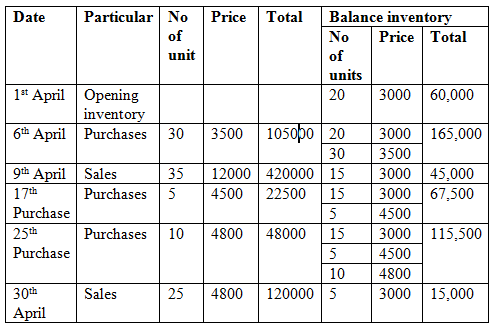

Calculating the assigned amount of ending inventory according to the weighted-average method:

The weighted average cost is calculated as:

| Date | Particular | No of unit | Price | Total | Balance inventory | ||

| No of units | Price | Total | |||||

| 1st April | Opening inventory | 20 | 3,000 | 60,000 | 20 | 3,000 | 60,000 |

| 6th April | Purchase | 30 | 3,500 | 105,000 | 50 | 3,300 | 165,000 |

| 9th April | Sales | (35) | 3,300 | (115,500) | 15 | 3,300 | 49,500 |

| 17th April | Purchase | 5 | 4,500 | 22,500 | 20 | 3,600 | 72,000 |

| 25th April | Purchase | 10 | 4,800 | 48,000 | 30 | 4,000 | 120,000 |

| 30th April | Sales | (25) | 4,000 | (100,000) | 5 | 4,000 | 20,000 |

Thus, cost assigned to ending inventory of $ 20,000

Cost assigned to total inventory using the specific identification method:

Using specific identification method closing inventory of 5 units will consist

Thus, the cost assigned to ending inventory is $22,500.

4.

Introduction:

Inventory is a record of finished goods of a company which they can sell to the customer, work in progress which can be transformed into finish goods and raw material which is a means of production. Inventory is also classified as a current asset in the balance sheet and it is valued by FIFO LIFO and weighted average method.

To compute: The gross profit earn by the company is cost assigned to ending inventory for the company A using FIFO,LIFO and weighted average and specific identification.

4.

Answer to Problem 2PSB

Gross using FIFO methods is $558,500, using LIFO method is $549,500, using weighted average method is $55,4500, and specific identification method is $557,000.

Explanation of Solution

| Particular | FIFO | LIFO | weighted average | Specific identification |

| Cost of goods available for sale | 235500 | 235500 | 235500 | 235500 |

| Less: closing stock 5 units | 24000 | 15000 | 200,000 | 22500 |

| Cost of goods sold | 211,500 | 220,500 | 215,500 | 213,000 |

Gross profit earned by the company:

| Particular | FIFO method | LIFO method | Weighted average method | Specific identification method |

| Total Sales | $770,000 | $770,000 | $770,000 | $770,000 |

| Less: Cost of goods sold | 211,500 | 220,500 | 215,500 | 213,000 |

| Total | $558,500 | $549,500 | $554,500 | 557,000 |

Thus, gross using FIFO methods is $558,500, using the LIFO method is $549,500, using the weighted average method is $554500, and the specific identification method is $557,000.

Want to see more full solutions like this?

Chapter 5 Solutions

Financial Accounting: Information for Decisions

- Use the last-in, first-out (LIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forwardUse the first-in, first-out (FIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forwardCalculate a) cost of goods sold, b) ending inventory, and c) gross margin for B76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for weighted average (AVG).arrow_forward

- Use the weighted-average (AVG) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for B75 Company, considering the following transactions.arrow_forwardUse the first-in, first-out method (FIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for B75 Company, considering the following transactions.arrow_forwardInventory Costing: Average Cost Refer to the information for Filimonov Inc. and assume that the company uses a perpetual inventory system. Required: Calculate the cost of goods sold and the cost of ending inventory using the average cost method. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.)arrow_forward

- Assume that the business in Exercise 7-3 maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4.arrow_forwardAssume that the business in Exercise 7-5 maintains a perpetual inventory system, costing by the first-in, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3.arrow_forwardAssume that the business in Exercise 6-9 maintains a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale, assuming the first-in, first-out method. Present the data in the form illustrated in Exhibit 3.arrow_forward

- ( Appendix 6B) Inventory Costing Methods: Periodic Inventory System The inventory accounting records for Lee Enterprises contained the following data: Required: 1. Calculate the cost of ending inventory and the cost of goods sold using the FIFO, LIFO, and average cost methods. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.) 2. CONCEPTUAL CONNECTION Compare the ending inventory and cost of goods sold computed under all three methods. What can you conclude about the effects of the inventory costing methods on the balance sheet and the income statement?arrow_forwardPerpetual and Periodic Inventory Systems Below is a list of inventory systems options. a. Perpetual inventory system b. Periodic inventory system c. Both perpetual and periodic inventory systems Required: Match each option with one of the following: 1. Only revenue is recorded as sales are made during the period; the cost of goods sold is recorded at the end of the period. 2. Cost of goods sold is determined as each sale is made. 3. Inventory purchases are recorded in an inventory account. 4. Inventory purchases are recorded in a purchases account. 5. Cost of goods sold is determined only at the end of the period by subtracting the cost of ending inventory from the cost of goods available for sale. 6. Both revenue and cost of goods sold are recorded during the period as sales are made. 7. The inventory is verified by a physical count.arrow_forwardAssume that the business in Exercise 7-9 maintains a perpetual inventory system. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, assuming the first-in, first-out method. Present the data in the form illustrated in Exhibit 3.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning