![MindTap for Garman/Forgue's Personal Finance Tax Update, 13th Edition [Instant Access], 2 terms](https://s3.amazonaws.com/compass-isbn-assets/textbook_empty_images/large_textbook_empty.svg)

MindTap for Garman/Forgue's Personal Finance Tax Update, 13th Edition [Instant Access], 2 terms

13th Edition

ISBN: 9780357438909

Author: Garman; E. Thomas; Forgue; Raymond

Publisher: Cengage Learning US

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 3DTM

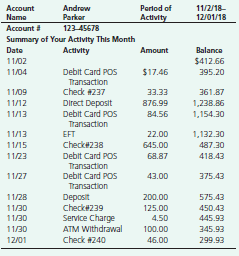

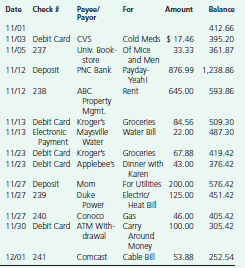

Reconciling a Checking Account. Andrew Parker, of San Marcos, Texas, has a checking account at the credit union affiliated with his university. Illustrated below are his monthly statement and check register for the account. Reconcile the checking

Account and answer the following questions.

- What is the total of the outstanding checks?

- What is the total of the outstanding deposits?

- Why is there a difference between the uncorrected balance in the check register and the balance on the statement?

- What is the updated and correct balance in the check register on the next page?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

For the following question, reconcile the bank statement and check register. Would they need to make an adjustment or does everything reconcile?

Sylvia’s checkbook balance on July 31 is $389.32. The information on her bank statement is given below. The outstanding checks, unrecorded deposits, and unrecorded ATM transactions are listed here also. From this information will her account reconcile?

Bank statement: $434.30; Interest: $0.79; Service charge: $2.75

Outstanding checks: #911: $53.29; #912: $31.16; #913: $20.04; #920: $11.42; #923: $24.50; #925: $16.90; #930: $33.30; #932: $8.70; #933: $10.55. Unrecorded deposits ATM: 7/30: $183.52; 7/31: $69.40. Unrecorded ATM withdrawals: 7/30: $40.00; 7/31: $50.00

Bank Statement Reconcile Amount:

Check Register Reconcile Amount:

In the normal operation of business, you receive a check from a customer and deposit it into your checking account. With your bank statement, you are advised that this

check for $775 is "NSF." The bank also informs you that due to the amount of activity on your business account the monthly service charge is $75. During a bank

reconciliation, you will

Oa. add both values to balance according to bank

Ob. add both values to balance according to books

Oc. subtract both values from balance according to books

Od. subtract both values from balance according to bank

You are the training director for tellers at a large local bank. As part of a new training program you are developing, you have given your trainees this "sample" check register. It is filled out but some of the balances

are incorrect.

Check

Number

Date

4/7

4/14

4/16

1208 4/17

4/21

PLEASE BE SURE TO DEDUCT ANY BANK CHARGES THAT APPLY TO YOUR ACCOUNT.

Description of Transaction

To: Deposit

For:

To: Mario's Market Debit Card

For:

To: ATM Withdrawal

For:

To: Bargain Properties

For:

To: Electronic Payroll Deposit

For:

Amount of

payment or

withdrawal (-)

48 65

135 00

870

00

✓

Amount of

Deposit or

interest (+)

755 80

1,350 00

Balance Forward

Bal.

Bal.

Bal.

Bal.

469 30

1,225 10

1,176 45

996 45

181 45

Bal. 1,531 45

You instruct your trainees to find and correct the errors in the balances. If your trainees do so, what should the corrected final balance be (in $)?

$

Chapter 5 Solutions

MindTap for Garman/Forgue's Personal Finance Tax Update, 13th Edition [Instant Access], 2 terms

Ch. 5.1 - Prob. 1CCCh. 5.1 - Explain the circumstances when it would be...Ch. 5.1 - Prob. 3CCCh. 5.1 - Summarize your insurance protections when you have...Ch. 5.2 - Explain why opening a checking account and a money...Ch. 5.2 - Prob. 2CCCh. 5.2 - Prob. 3CCCh. 5.2 - Prob. 4CCCh. 5.3 - Prob. 1CCCh. 5.3 - Prob. 2CC

Ch. 5.4 - Prob. 1CCCh. 5.4 - Prob. 2CCCh. 5.4 - Prob. 3CCCh. 5.4 - Prob. 4CCCh. 5.5 - Prob. 1CCCh. 5.5 - Prob. 2CCCh. 5 - Invest Now or Later? Twins Natalie and Kaitlyn are...Ch. 5 - Prob. 2DTMCh. 5 - Reconciling a Checking Account. Andrew Parker, of...Ch. 5 - Saving for College. You want to create a college...Ch. 5 - Prob. 5DTMCh. 5 - Prob. 1FPCCh. 5 - Prob. 2FPCCh. 5 - Prob. 3FPCCh. 5 - Prob. 4FPCCh. 5 - Prob. 5FPCCh. 5 - Prob. 6FPCCh. 5 - Prob. 7FPCCh. 5 - Prob. 8FPCCh. 5 - Keep Your Accounts Current. Go online every few...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose that Lena, who has an account at SunTrust Bank, writes a check for $140 to Jose, who has an account at National City Bank. Use following the T-account for SunTrust Bank to show how it is affected after the check clears. Assets Liabilitiesarrow_forwardThe current month's bank statement for your account arrives in the mail. In reviewing the statement, you notice a deposit listed for $400 that you did not make. It has been credited in error to your account. Discuss with your fellow classmates whether you have an ethical or legal obligation to inform the bank of the error. What action should you take?arrow_forwardThe current month's bank statement for your account arrives in the mail. In reviewing the statement you notice a deposit listed for $400 that you did not make. It has credited in error to your account. Discuss whether you have an ethical or legal obligation to the error. What action should you take?arrow_forward

- "The current month's bank statement for your account arrives in the mail. In reviewing the statement, you notice a deposit listed for $400 that you did not make. It has been credited in error to your account. Discuss whether you have an ethical or legal obligation to inform the bank of the error. What action should you take?" Thoroughly discuss the pros and cons of what the results would be if you reported it versus not reporting it. Be sure to tell what option you would choose and explain why."arrow_forwardHow do you record a debit card purchase in Quickbooks? A. Use the Enter Bills window to enter the information, then immediately go to the Pay Bills window and prepare th check. B. Prepare a journal entry to debit the expense account of the purchase and credit cash. C. Wait until you do the bank reconciliation and enter one journal entry for all of your debit card purchases. D. Using the Write Checks window, in the No. field,type “Debit.” Enter the vendor name and amount in the check area.arrow_forwardis the answer to this question correct If you received a check from Mr. Jones for $500 for work you performed last week, which journal would you use to record receipt of the amount they owed you? What would be recorded? This transaction will be recorded in the Cash Receipts Journal. The receipt of cash from the sale of goods, as payment on accounts receivable or from other transactions, is recorded in a cash receipts journal with a debit to cash and a credit to the source of the cash, whether that is from sales revenue, payment on an account receivable, or some other account. Chapter 7 Accounting Information Systems out of Principles of Accounting, Volume 1. CASH RECEIPTS JOURNAL Date Account Cash DR Accounts Receivable CR 2022 Mar.13 Mr. Jones $ 500 $ 500arrow_forward

- Roger Richman owns Richman Blankets.He asks you to explain how he should treat the following reconciling items when reconciling the company’s bank account. Choose the answer on the right. 1. Outstanding checks. Add to balance per bank/Deduct from balance per books/Add to balance per books/Deduct from balance per bank 2. A deposit in transit. Add to balance per books/Deduct from balance per books/Deduct from balance per bank/Add to balance per bank 3. The bank charged to the company account a check written by another company. Add to balance per bank/Deduct from balance per books/Add to balance per books/Deduct from balance per bank 4. A debit memorandum for a bank service charge. Add to balance per books/Deduct from balance per bank/Add to balance per bank/Deduct from balance per booksarrow_forwardDirection: Match the following bank accounts to its usage or description listed below. Write your answer on the blank before the number. Choose from the following Savings Account Current Account Time Deposit UITF _________________1. The simplest form of bank account. _________________2. A bank account which cannot be withdrawn until the contract period has ended. _________________3. It is a type of bank account that pooled funds managed by experts to ensure high yield and quality returns. _________________4. It allows a limited number of withdrawals only. _________________5. It makes saving very rewarding. _________________6. It allows numerous withdrawals with a large sum of money. _________________7. The investors earn through the increase in fair value of the pooled fund. _________________8. The investors earn through interest while saving. _________________9. This bank account comes with atm or passbook. ________________10. This is evidence by a…arrow_forwardOn November 3, Micah Asuncion received from the bank her bank statement for the month of October. She compared her checkbook to the bank statement and discovered the following: Prepare a bank reconciliation. CHECKBOOK Balance P333,203.50 Balance P369,725.56 Deposits: Deposits: 10/3 P59,600.00 10/3 P59,600.00 10/10 P53,740.00 10/10 P53,700.00 10/26 P27,610.00 10/16 P46,030.00 10/31 P30,260.00 10/26 P27,610.00 Check Issued and Recorded: Checks Cancelled: No.3 P14,435.00 No.5 P38,206.00 No.5 P38,026.00 No.16 P17,300.00 No.16…arrow_forward

- Use the example attached to help fill out Zoe's checking account register. Use the information below to log Zoe’s payments and deposits in her checking account register. Wednesday, 9/26 Zoe received her car insurance bill in the mail today. She writes a check for $115 to pay the bill. Record the amount for check #101 in her check register.arrow_forwardFor each of the items in the following list, identify where it is included on a bank reconciliation: 1. EFT payment made by a customer. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Bank debit memorandum for service charges. Outstanding cheques from the current month. Bank error in recording a $1,779 deposit as $1,977. Outstanding cheques from the previous month that are still outstanding. Outstanding cheques from the previous month that are no longer outstanding. Bank error in recording a company cheque made out for $160 as $610. Bank credit memorandum for interest revenue. Company error in recording a deposit of $160 as $1,600. Bank debit memorandum for a customer's NSF cheque. Deposit in transit from the current month. Company error in recording a cheque made out for $630 as $360.arrow_forwardThe bank mistakenly withdraws a check amounting $75,000 on thecompany’s account. What is the journal entry to correct the bank record?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

What Is A Checking Account?; Author: The Smart Investor;https://www.youtube.com/watch?v=vGymt1Rauak;License: Standard Youtube License