FUNDAMENTAL ACCT PRIN TEXT+CONNECT CODE

15th Edition

ISBN: 9781265564483

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 3GLP

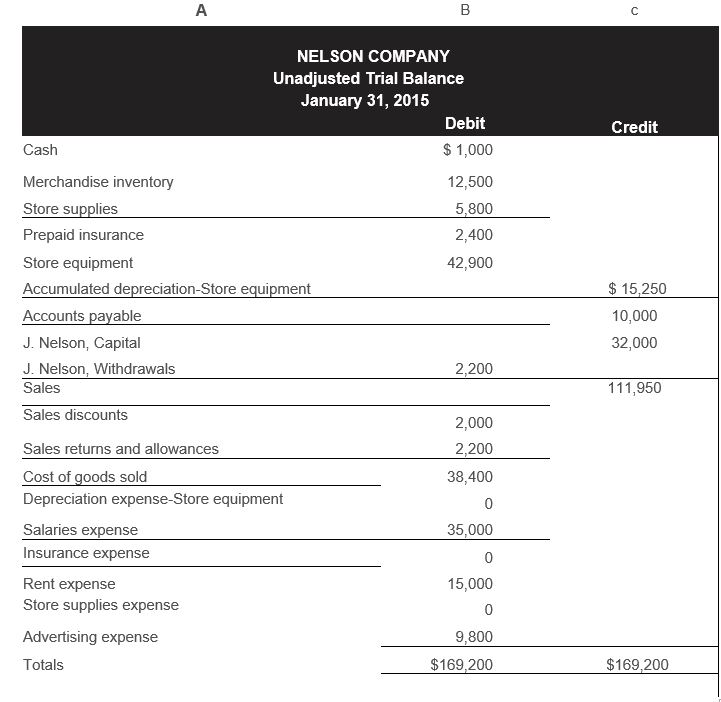

Based on Problem 5-5A

Problem 5-5A

Preparing

Rent expense and salaries expense are equally divided between selling activities and the general and administrative activities. Nelson Company uses a perpetual inventory system.

Required

- Prepare adjusting

journal entries to reflect each of the following: - Store supplies still available at fiscal year-end amount to $1,750.

- Expired insurance, an administrative expense, for the fiscal year is $1,400.

Depreciation expense on store equipment, a selling expense, is $1.525 for the fiscal year.- To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows S10.900 of inventory is still available at fiscal year-end.

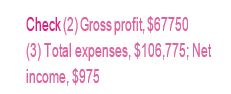

- Prepare a multiple-step income statement for fiscal year 2015.

- Prepare a single-step income statement for fiscal year 2015.

- Compute the

current ratio , acid-test ratio, and gross margin ratio as of January 31, 2015. (Round ratios to two decimals.)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Required information Skip to question [The following information applies to the questions displayed below.] Valley Company’s adjusted account balances from its general ledger on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense—selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Adjusted Account Balances Debit Credit Merchandise inventory (ending) $ 41,000 Other (non-inventory) assets 130,400 Total liabilities $ 25,000 K. Valley, Capital 104,550 K. Valley, Withdrawals 8,000 Sales 225,600 Sales discounts 2,250 Sales returns and allowances 12,000 Cost of goods sold 74,500 Sales salaries expense 32,000 Rent expense—Selling space 8,000 Store supplies expense 1,500 Advertising expense 13,000 Office salaries expense 28,500 Rent expense—Office space 3,600 Office…

Required information

Skip to question

[The following information applies to the questions displayed below.] The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. Nelson Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: Depreciation Expense—Store Equipment, Sales Salaries Expense, Rent Expense—Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative.

NELSON COMPANY

Unadjusted Trial Balance

January 31

Debit

Credit

Cash

$ 20,050

Merchandise inventory

12,000

Store supplies

5,400

Prepaid insurance

2,600

Store equipment

42,800

Accumulated depreciation—Store equipment

$ 19,750

Accounts payable

15,000

Common stock

3,000

Retained earnings

29,000

Dividends

2,300

Sales

115,550

Sales discounts

2,000

Sales returns and allowances

2,050

Cost of goods sold

38,000…

Instructions:

a. Prepare the cost flow assumption table for Hasellhouf Company's merchandise inventory using FIFO method (2 decimals rounding).

b. Journalize the transactions above using perpetual method and make the

necessary adjustments and make the necessary adjustments for depreciation

(using the straight-line method), insurance, supplies, and interests

c. Post all the entries to the general ledgers.

d. Prepare multiple-step income statement, owner's equity statement, and balance sheet.

e. Journalize the closing entries.

Chapter 5 Solutions

FUNDAMENTAL ACCT PRIN TEXT+CONNECT CODE

Ch. 5 - Prob. 1DQCh. 5 - 2. In comparing the accounts of a merchandising...Ch. 5 - Prob. 3DQCh. 5 - Prob. 4DQCh. 5 - Prob. 5DQCh. 5 - Prob. 6DQCh. 5 - Prob. 7DQCh. 5 - Prob. 8DQCh. 5 - Prob. 9DQCh. 5 - Prob. 10DQ

Ch. 5 - Prob. 11DQCh. 5 - Prob. 12DQCh. 5 - Prob. 13DQCh. 5 - Prob. 14DQCh. 5 - Prob. 15DQCh. 5 - Prob. 1QSCh. 5 - Prob. 2QSCh. 5 - Prob. 3QSCh. 5 - Prob. 4QSCh. 5 - Prob. 5QSCh. 5 - Prob. 6QSCh. 5 - Prob. 7QSCh. 5 - Prob. 8QSCh. 5 - Prob. 9QSCh. 5 - Prob. 10QSCh. 5 - Prob. 11QSCh. 5 - Prob. 12QSCh. 5 - Prob. 13QSCh. 5 - Prob. 14QSCh. 5 - Prob. 15QSCh. 5 - Prob. 16QSCh. 5 - Prob. 17QSCh. 5 - Prob. 18QSCh. 5 - Prob. 1ECh. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - Prob. 5ECh. 5 - Exercise 5-6 Recording purchase returns and...Ch. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - Prob. 10ECh. 5 - Prob. 11ECh. 5 - Prob. 12ECh. 5 - Prob. 13ECh. 5 - Prob. 14ECh. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Exercise 5-17A Recording purchases and...Ch. 5 - Prob. 18ECh. 5 - Prob. 19ECh. 5 - Prob. 20ECh. 5 - Prepare journal entries to record the following...Ch. 5 - (

Problem 5-2A

Preparing journal entries for...Ch. 5 - Prob. 3APSACh. 5 - Prob. 4APSACh. 5 - Prob. 5APSACh. 5 - Prob. 6APSACh. 5 - Prob. 1BPSBCh. 5 - Prepare journal entries to record the following...Ch. 5 - Prob. 3BPSBCh. 5 - Prob. 4BPSBCh. 5 - Prob. 5BPSBCh. 5 - Problem 5-6BE Refer to the data and information in...Ch. 5 - Prob. 5SPCh. 5 - Prob. 1GLPCh. 5 - Prepare journal entries to record the following...Ch. 5 - Based on Problem 5-5A Problem 5-5A Preparing...Ch. 5 - Prob. 1BTNCh. 5 - Prob. 2BTNCh. 5 - Prob. 3BTNCh. 5 - Prob. 4BTNCh. 5 - Prob. 5BTNCh. 5 - Prob. 6BTNCh. 5 - Prob. 7BTNCh. 5 - Prob. 8BTNCh. 5 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- JOURNALIZE ADJUSTING ENTRY FOR A MERCHANDISING BUSINESS: PERPETUAL INVENTORY SYSTEM On December 31, Anup Enterprises completed a physical count of its inventory. Although the merchandise inventory account shows a balance of 200,000, the physical count comes to 210,000. Prepare the appropriate adjusting entry under the perpetual inventory systemarrow_forwardAssume that the business in Exercise 6-9 maintains a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale, assuming the last-in, first-out method. Present the data in the form illustrated in Exhibit 4.arrow_forwardPerpetual and Periodic Inventory Systems Following is a partial list of account balances for two different merchandising companies. The amounts in the accounts represent the balances at the end of the year before any adjustments are made or the books are closed. Required Identify which inventory system, perpetual or periodic, each of the two companies uses. Explain how you know which systemeach company uses by looking at the types of accounts on its books. How much inventory should Company A have on hand at the end of the year? What is its cost of goods sold for the year? Explain why you cannot determine Company Bs cost of goods sold for the year from the information available.arrow_forward

- Assume that the business in Exercise 7-9 maintains a perpetual inventory system. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, assuming the last-in, first-out method. Present the data in the form illustrated in Exhibit 4.arrow_forwardAssume that the business in Exercise 6-9 maintains a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale, assuming the first-in, first-out method. Present the data in the form illustrated in Exhibit 3.arrow_forwardADJUSTMENT FOR MERCHANDISE INVENTORY USING T ACCOUNTS: PERIODIC INVENTORY SYSTEM Sandra Owens owns a business called Sandras Sporting Goods. Her beginning inventory as of January 1, 20--, was 33,000, and her ending inventory as of December 31, 20--, was S36,000. Set up T accounts for Merchandise Inventory and Income Summary and perform the year-end adjustment for Merchandise Inventory.arrow_forward

- Assume that the business in Exercise 7-3 maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 5.arrow_forwardWORK SHEET EXTENSIONS FOR MERCHANDISE INVENTORY ADJUSTMENTS: PERIODIC INVENTORY SYSTEM The following partial work sheet is taken from Nicoles Gift Shop for the year ended December 31, 20--. The ending merchandise inventory is 37,000. 1. Complete the Adjustments columns for the merchandise inventory. 2. Extend the merchandise inventory to the Adjusted Trial Balance and Balance Sheet columns. 3. Extend the remaining accounts to the Adjusted Trial Balance and Income Statement columns. 4. Prepare a cost of goods sold section from the partial work sheet.arrow_forwardAssume that the business in Exercise 7-5 maintains a perpetual inventory system, costing by the first-in, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3.arrow_forward

- ADJUSTMENT FOR MERCHANDISE INVENTORY USING T ACCOUNTS: PERIODIC INVENTORY SYSTEM Matt Henry owns a business called Henrys Sporting Goods. His beginning inventory as of January 1, 20--, was 45,000, and his ending inventory as of December 31, 20--, was 57,000. Set up T accounts for Merchandise Inventory and Income Summary and perform the year-end adjustment for Merchandise Inventory.arrow_forwardSALES RETURNS AND ALLOWANCES ADJUSTMENT At the end of year 1, MCs estimates that 2,400 of the current years sales will be returned in year 2. Prepare the adjusting entry at the end of year 1 to record the estimated sales returns and allowances and customer refunds payable for this 2,400. Use accounts as illustrated in the chapter.arrow_forwardPeriodic Inventory System Raynolde Company uses a periodic inventory system. At the end of the year, the following information is available: Required: Prepare a schedule to compute Raynoldes cost of goods sold.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License