Intermediate Financial Management (MindTap Course List)

12th Edition

ISBN: 9781285850030

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 3MC

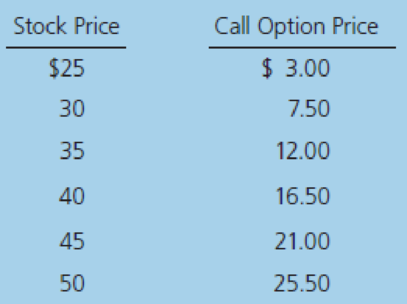

Consider Triple Play’s call option with a $25 strike price. The following table contains historical values for this option at different stock prices:

- (1) Create a table that shows (a) stock price, (b) strike price, (c) exercise value, (d) option price, and (e) the time value, which is the option’s price less its exercise value.

- (2) What happens to the time value as the stock price rises? Why?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider Triple Play’s call option with a $25 strike price. The following table contains historical values for this option at different stock prices:

Stock Price Call Option Price

$25 $ 3.00

30 7.50

35 12.00

40 16.50

45 21.00

50 25.50

Create a table which shows (1) stock price, (2) strike price, (3) exercise value, (4) option price, and (5) the time value.

Consider two put options on different stocks. The table below reports the relevant information for both options:

Put optionTime to maturityCurrent price of underlying stockStrike priceVolatility ( )X1 year$27$1830%Y1 year$25$2030%All else equal, which put option has a lower premium?

A.Put option Y B.Put option X

Suppose that put options on a stock with strike prices $66 and $75 cost $3 and $5, respectively.

How can the options be used to create (a) a bull spread and (b) a bear spread?

For what range of future stock prices will the bear spread strategy be profitable.

Is the profit for the bear spread strategy limited? If so, how much and at what price range?

At what price range will you exercise the long position from the bear spread strategy?

At what range of future stock prices will the bear spread strategy lead to a loss?

What is the maximum loss that you can incur from bear spread strategy and at what price range?

Chapter 5 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 5 - Define each of the following terms:

Option; call...Ch. 5 - Prob. 2QCh. 5 - Prob. 3QCh. 5 - Prob. 1PCh. 5 - The exercise price on one of Flanagan Companys...Ch. 5 - Black-Scholes Model

Assume that you have been...Ch. 5 - Put–Call Parity

The current price of a stock is...Ch. 5 - Prob. 5PCh. 5 - Binomial Model The current price of a stock is 20....Ch. 5 - Prob. 7P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- In 1973, Fischer Black and Myron Scholes developed the Black-Scholes option pricing model (OPM). (1) What assumptions underlie the OPM? (2) Write out the three equations that constitute the model. (3) According to the OPM, what is the value of a call option with the following characteristics? Stock price = 27.00 Strike price = 25.00 Time to expiration = 6 months = 0.5 years Risk-free rate = 6.0% Stock return standard deviation = 0.49arrow_forwardA butterfly spread is a position in three options on the same underlying stock with different strikes. An investor buys one call with a strike K1 = 22, sells two calls with a strike K2 = 24 and buys one call with a strike K3 = 26. What is the payoff of the butterfly spread, if the stock price equals $26 at maturity?arrow_forwardMichael Weber, CFA, is analyzing several aspects of option valuation, including the determinants of the value of an option, the characteristics of various models used to value options, and the potential for divergence of calculated option values from observed market prices.a. What is the expected effect on the value of a call option on common stock if the volatility of the underlying stock price decreases? If the time to expiration of the option increases?b. Using the Black-Scholes option-pricing model and an estimate of stock return volatility, Weber calculates the price of a 3-month call option and notices the option’s calculated value is different from its market price. With respect to Weber’s use of the Black-Scholes option-pricing model,i. Discuss why the calculated value of an out-of-the-money European option may differ from its market price.ii. Discuss why the calculated value of an American option may differ from its market price.arrow_forward

- Both call and put options are affected by the following five factors: the exercise price, the underlying stock price, the time to expiration, the stock’s standard deviation, and the risk-free rate. However, the direction of the effects on call and put options could be different. Use the following table to identify whether each statement describes put options or call options. Statement Put Option Call Option 1. When the exercise price increases, option prices increase. 2. An option is more valuable the longer the maturity. 3. The effect of the time to maturity on the option prices is indeterminate. 4. As the risk-free rate increases, the value of the option increases.arrow_forwardConsider a call option whose maturity date is T and strike price is K. At any time t < T, is it always the case that the call option's price must be greater than or equal to max(St – K,0), where St is the stock price at t? (Your answer cannot be more than 30 words. Answers with more than 30 words will not be graded.)arrow_forwardAssume that you have been given the following information on Purcell Industries' call options: Current stock price = $14 Strike price of option = $13 Time to maturity of option = 9 months Risk-free rate = 6% Variance of stock return = 0.16 d1 = 0.51704 N(d1) = 0.69744 d2 = 0.17063 N(d2) = 0.56774 According to the Black-Scholes option pricing model, what is the option's value?arrow_forward

- Suppose that you purchased a call option on the S&P 100 Index. The option has an exercise price of 1,680, and the index is now at 1,720. What will happen when you exercise the option?arrow_forwardA call option on the stock of Bedrock Boulders has a market price of $7.The stock sells for $30 a share, and the option has a strike price of $25 ashare. What is the exercise value of the call option? What is the option’stime value?arrow_forwardWhich of the following is not a determinant of the value of a call option in the Black-Scholes model? A. The interest rate. B. The exercise price of the stock. C. The price of the underlying stock. D. The beta of the underlying stock. Need typed answer only.Please give answer within 45 minutesarrow_forward

- Which is the most risky transaction to undertake in the stock index option markets if the stock market is expected to increase substantially after the transaction is completed? Choose the correct.a. Write a call option.b. Write a put option.c. Buy a call option.d. Buy a put option.arrow_forward1. What is the fair value for a two-year American put option with a strike price of $85 over a stock which is trading at $86.15 which has a volatility of 37% when the risk free rate is 1.75% using the two step binomial tree? a) What is the delta of this option? b) What is the probability of a down movement in this stock? c) What is the probability of an up movement in this stock? d) What is the proportional move up for this stock e) What is the proportional move down for this stock f) What would be the value of the call option with the same strike price?arrow_forwardBased on Torelli’s scenarios, what is the mean return of GMS stock? What is the standard deviation of the return of GMS stock? 2. After a cursory examination of the put option prices, Torelli suspects that a good strategy is to buy one put option A for each share of GMS stock purchased. What are the mean and standard deviation of return for this strategy?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Accounting for Derivatives Comprehensive Guide; Author: WallStreetMojo;https://www.youtube.com/watch?v=9D-0LoM4dy4;License: Standard YouTube License, CC-BY

Option Trading Basics-Simplest Explanation; Author: Sky View Trading;https://www.youtube.com/watch?v=joJ8mbwuYW8;License: Standard YouTube License, CC-BY