Plessor Industries acquired 80% of the outstanding common stock of Slammer Company on January 1, 2015. for S320,000. On that date, Slammer’s book values approximated fair values. and the balance of its

On January 1, 2016. Slammer signed a 5-year lease with Plessor for the rental of a small factory building with a 10-year life. Payments of $25000 are due at the beginning of each year on January 1, and Slammer is expected to exercise the $5,000 bargain purchase option at the end of the fifth year. The fair value of the factory was $103,770 at the start of the lease term. Plessor’s implicit rate on the lease is 12%. A second lease agreement. for the rental of production equipment with an 8-year life, was signed by Slammer on January 1, 2017. The terms of this 4-year lease require a payment of $15,000 at the beginning of each year on January 1. The present value of the lease payments at Plessor’s 12% implicit rate was equal to the fair value of the equipment, $52,298, when the lease was signed. The cost of the equipment to Plessor was $45,000, and there is a $2,000 bargain purchase option. Eight-year, straight-line

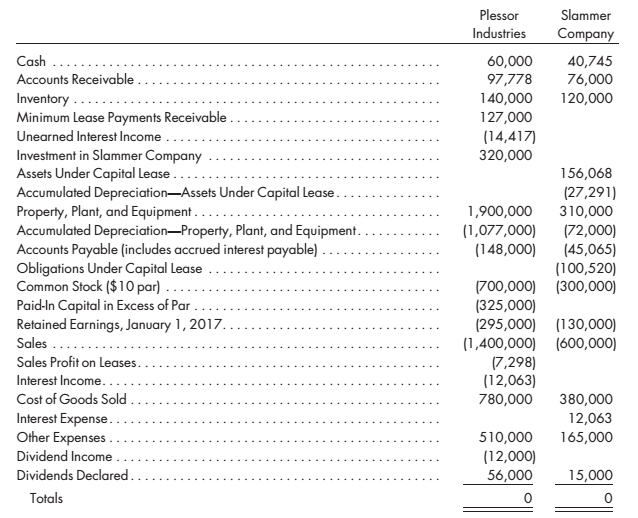

The following

Required

Prepare the worksheet necessary to produce the consolidated financial statements of Plessor Industries and its subsidiary for the year ended December 31. 2017. Include the determination and distribution of excess and income distribution schedules.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Advanced Accounting

- On May 1, 2015, Zoe Inc. purchased Branta Corp. for $15,000,000 in cash. They only received $12,000,000 in net assets. In 2016, the market value of the goodwill obtained from Branta Corp. was valued at $4,000,000, but in 2017 it dropped to $2,000,000. Prepare the journal entry for the creation of goodwill and the entry to record any impairments to it in subsequent years.arrow_forwardParilo Company acquired 170,000 of Makofske Co., 5% bonds on May 1, 2016, at their face amount. Interest is paid semiannually on May 1 and November 1. On November 1, 2016, Parilo Company sold 50,000 of the bonds for 96. Journalize entries to record the following: a. The initial acquisition of the bonds on May 1. b. The semiannual interest received on November 1. c. The sale of the bonds on November 1. d. The accrual of 1,000 interest on December 31, 2016.arrow_forwardOn January 1, 2017, Stream Company acquired 30 percent of the outstanding voting shares of Q-Video, Inc., for $770,000. Q-Video manufactures specialty cables for computer monitors. On that date, Q-Video reported assets and liabilities with book values of $1.9 million and $700,000, respectively. A customer list compiled by Q-Video had an appraised value of $300,000, although it was not recorded on its books. The expected remaining life of the customer list was five years with straight-line amortization deemed appropriate. Any remaining excess cost was not identifiable with any particular asset and thus was considered goodwill. Q-Video generated net income of $250,000 in 2017 and a net loss of $100,000 in 2018. In each of these two years, Q-Video declared and paid a cash dividend of $15,000 to its stockholders. During 2017, Q-Video sold inventory that had an original cost of $100,000 to Stream for $160,000. Of this balance, $80,000 was resold to outsiders during 2017, and the remainder…arrow_forward

- On January 1, 2017, Stream Company acquired 30 percent of the outstanding voting shares of Q-Video, Inc., for $770,000. Q-Video manufactures specialty cables for computer monitors. On that date, Q-Video reported assets and liabilities with book values of $1.9 million and $700,000, respectively. A customer list compiled by Q-Video had an appraised value of $300,000, although it was not recorded on its books. The expected remaining life of the customer list was five years with straight-line amortization deemed appropriate. Any remaining excess cost was not identifiable with any particular asset and thus was considered goodwill.Q-Video generated net income of $250,000 in 2017 and a net loss of $100,000 in 2018. In each of these two years, Q-Video declared and paid a cash dividend of $15,000 to its stockholders.During 2017, Q-Video sold inventory that had an original cost of $100,000 to Stream for $160,000. Of this balance, $80,000 was resold to outsiders during 2017, and the remainder was…arrow_forwardOn January 1, 2018, Sledge had common stock of $270,000 and retained earnings of $410,000. During that year, Sledge reported sales of $280,000, cost of goods sold of $145,000, and operating expenses of $55,000. On January 1, 2016, Percy, Inc., acquired 80 percent of Sledge's outstanding voting stock. At that date, $75,000 of the acquisition-date fair value was assigned to unrecorded contracts (with a 20-year life) and $35,000 to an undervalued building (with a 10-year remaining life). In 2017, Sledge sold inventory costing $15,000 to Percy for $30,000. Of this merchandise, Percy continued to hold $9,000 at year-end. During 2018, Sledge transferred inventory costing $15,750 to Percy for $35,000. Percy still held half of these items at year-end. On January 1, 2017, Percy sold equipment to Sledge for $19,500. This asset originally cost $31,000 but had a January 1, 2017, book value of $12,000. At the time of transfer, the equipment's remaining life was estimated to be five years.…arrow_forwardOn January 1, 2018, Sledge had common stock of $120,000 and retained earnings of $260,000. During that year, Sledge reported sales of $130,000, cost of goods sold of $70,000, and operating expenses of $40,000.On January 1, 2016, Percy, Inc., acquired 80 percent of Sledge’s outstanding voting stock. At that date, $60,000 of the acquisition-date fair value was assigned to unrecorded contracts (with a 20-year life) and $20,000 to an undervalued building (with a 10-year remaining life).In 2017, Sledge sold inventory costing $9,000 to Percy for $15,000. Of this merchandise, Percy continued to hold $5,000 at year-end. During 2018, Sledge transferred inventory costing $11,000 to Percy for $20,000. Percy still held half of these items at year-end.On January 1, 2017, Percy sold equipment to Sledge for $12,000. This asset originally cost $16,000 but had a January 1, 2017, book value of $9,000. At the time of transfer, the equipment’s remaining life was estimated to be five years.Percy has…arrow_forward

- Foxx Corporation acquired all of Greenburg Company’s outstanding stock on January 1, 2016, for $600,000 cash. Greenburg’s accounting records showed net assets on that date of $470,000, although equipment with a 10-year remaining life was undervalued on the records by $90,000. Any recognized goodwill is considered to have an indefinite life. Greenburg reports net income in 2016 of $90,000 and $100,000 in 2017. The subsidiary declared dividends of $20,000 in each of these two years. Account balances for the year ending December 31, 2018, follow. Credit balances are indicated by parentheses. a. Determine the December 31, 2018, consolidated balance for each of the following accounts: Depreciation Expense Dividends Declared Revenues Equipment Buildings Goodwill Common Stock b. How does the parent’s choice of an accounting method for its investment affect the balances computed in requirement (a)? c. Which method of accounting for this subsidiary is the parent actually using for internal…arrow_forwardOn July 1, 2016, Gupta Corporation bought 25% of the outstanding common stock of VB Company for $100 million cash. At the date of acquisition of the stock, VB’s net assets had a total fair value of $350 million and a book value of $220 million. Of the $130 million difference, $20 million was attributable to the appreciated value of inventory that was sold during the last half of 2016, $80 million was attributable to buildings that had a remaining depreciable life of 10 years, and $30 million related to equipment that had a remaining depreciable life of 5 years. Between July 1, 2016, and December 31, 2016, VB earned net income of $32 million and declared and paid cash dividends of $24 million. Required: 1. Prepare all appropriate journal entries related to the investment during 2016, assuming Gupta accounts for this investment by the equity method. 2. Determine the amounts to be reported by Gupta: a. As an investment in Gupta’s December 31, 2016, balance sheet. b. As investment revenue…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning