a)

To calculate: The present value of the payments at an ordinary

Introduction:

The present value of the cash flows in the future with a particular discount rate is the present value of annuity. The repeating payment that is made at the starting of every period is the annuity due.

a)

Answer to Problem 46QP

- The present value of

annuity is $54,619.45. - The present value annuity due is $58,715.90.

Explanation of Solution

Given information:

Person X is going to receive $13,500 per year for 5 years. The correct interest rate is 7.5%

Suppose the payments are in the form of an ordinary

Formula to calculate the present value annuity for sixty months:

Note: C denotes the annual cash flow, r denotes the rate of exchange, and t denotes the time period.

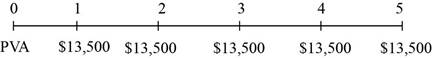

Timeline of the present value of annuity:

Compute the present value annuity:

Hence, the present value of annuity is $54,619.45.

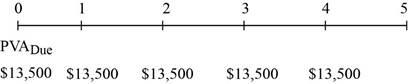

Timeline of the present value of annuity due:

Formula to compute the present value of annuity due:

Note: The PVA is the present value of annuity and r is the rate of interest.

Compute the present value of annuity due:

Hence, the present value of annuity due is $58,715.90.

b)

To calculate: The

Introduction:

The value of a group of recurring payments at a particular date in the future is the future vale of annuity.

b)

Answer to Problem 46QP

- The future value of

annuity is $78,413.28. - The future value of annuity due is $84,294.27.

Explanation of Solution

Given information:

Person X is going to receive $13,500 per year for 5 years. The correct interest rate is 7.5%

The future value of the

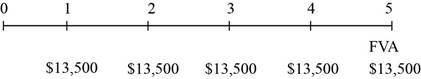

Timeline of the future value of annuity:

Formula to calculate the future value annuity:

Note: C denotes the annual cash flow or annuity payment, r denotes the rate of interest, and t denotes the number of payments.

Compute the future value annuity:

Hence, the future value of annuity is $78,413.28.

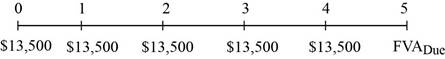

Timeline of the future value of annuity due:

Formula to compute the future value of annuity due:

Note: The FVA is the future value of annuity and r is the rate of interest.

Compute the present value of annuity due:

Hence, the future value of annuity due is $84,294.27.

c)

To find: The highest present value, the ordinary

Introduction:

The present value of the cash flows in the future with a particular discount rate is the present value of annuity. The repeating payment that is made at the starting of every period is the annuity due.

c)

Answer to Problem 46QP

The present value of

Explanation of Solution

If the rate of interest is positive, then the present value of the

If the rate of interest is positive, then the future value of the annuity due will be the highest when compared to the future value of annuity. Every cash flow is made a year before; therefore, every cash flow gets an extra period of compounding.

Hence, the present value of annuity due has the highest present value and the future value of annuity due has the highest future value.

Want to see more full solutions like this?

Chapter 5 Solutions

ESSENTIALS OF CORPORATE FINANCE (LL)

- You want to invest $8,000 at an annual Interest rate of 8% that compounds annually for 12 years. Which table will help you determine the value of your account at the end of 12 years? A. future value of one dollar ($1) B. present value of one dollar ($1) C. future value of an ordinary annuity D. present value of an ordinary annuityarrow_forwardCalculating interest earned and future value of savings account. If you put 6,000 in a savings account that pays interest at the rate of 3 percent, compounded annually, how much will you have in five years? (Hint: Use the future value formula.) How much interest will you earn during the five years? If you put 6,000 each year into a savings account that pays interest at the rate of 4 percent a year, how much would you have after five years?arrow_forwardUse the tables in Appendix B to answer the following questions. A. If you would like to accumulate $4,200 over the next 6 years when the interest rate is 8%, how much do you need to deposit in the account? B. If you place $8,700 in a savings account, how much will you have at the end of 12 years with an interest rate of 8%? C. You invest $2,000 per year, at the end of the year, for 20 years at 10% interest. How much will you have at the end of 20 years? D. You win the lottery and can either receive $500,000 as a lump sum or $60,000 per year for 20 years. Assuming you can earn 3% interest, which do you recommend and why?arrow_forward

- If you are saving the same amount each month in order to buy a new sports car when the new models are released, which of the following will help you determine the savings needed? A. future value of one dollar ($1) B. present value of one dollar ($1) C. future value of an ordinary annuity D. present value of an ordinary annuityarrow_forwardUse the tables in Appendix B to answer the following questions. A. If you would like to accumulate $2,500 over the next 4 years when the interest rate is 15%, how much do you need to deposit in the account? B. If you place $6,200 in a savings account, how much will you have at the end of 7 years with a 12% interest rate? C. You invest $8,000 per year for 10 years at 12% interest, how much will you have at the end of 10 years? D. You win the lottery and can either receive $750,000 as a lump sum or $50,000 per year for 20 years. Assuming you can earn 8% interest, which do you recommend and why?arrow_forwardDefine the stated (quoted) or nominal rate INOM as well as the periodic rate IPER. Will the future value be larger or smaller if we compound an initial amount more often than annually—for example, every 6 months, or semiannually—holding the stated interest rate constant? Why? What is the future value of $100 after 5 years under 12% annual compounding? Semiannual compounding? Quarterly compounding? Monthly compounding? Daily compounding? What is the effective annual rate (EAR or EFF%)? What is the EFF% for a nominal rate of 12%, compounded semiannually? Compounded quarterly? Compounded monthly? Compounded daily?arrow_forward

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT