Concept explainers

a.

Show the effect of each transaction on the

a.

Explanation of Solution

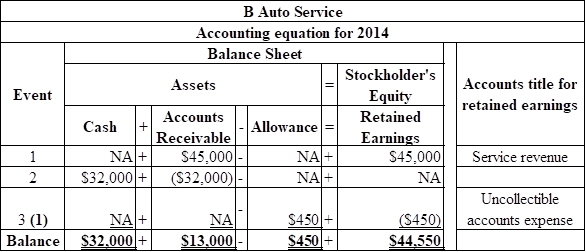

Show the effect of each transaction on the accounting equation for 2014:

Table (1)

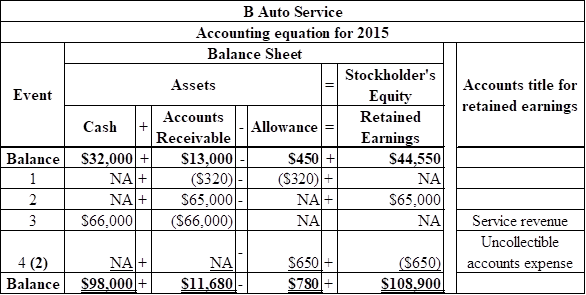

Show the effect of each transaction on the accounting equation for 2015:

Table (2)

Working note 1: Calculate the Uncollectible accounts expenses for 2014:

Estimated Uncollectible accounts are 1% of the revenue on account. Revenue on account is $45,000.

Working note 2: Calculate the Uncollectible accounts expenses for 2015:

Estimated Uncollectible accounts are 1% of the revenue on account. Revenue on account is $65,000.

b. (1)

Ascertain the net income for 2014.

b. (1)

Explanation of Solution

Net income: Net income is the excess amount of revenue which arises after deducting all the expenses of a company. In simple terms, it is the difference between total revenue and total expenses of the company.

Ascertain the net income for 2014:

Hence, the net income for 2014 is $44,550.

b. (2)

Ascertain the net cash flows from operating activities for 2014.

b. (2)

Explanation of Solution

Cash flows from operating activities: These refer to the cash received or cash paid in day-to-day operating activities of a company.

During 2014, cash collected from the customers is $32,000, and there is no cash payments made during the year, therefore the net cash flows from the operating activities are $32,000.

b. (3)

Ascertain the balance of accounts receivables at the end of 2014.

b. (3)

Explanation of Solution

The Accounts receivable balance at the end of 2014 is $13,000 (Refer Table (1)).

b. (4)

Ascertain the net realizable value of accounts receivables at the end of 2014.

b. (4)

Explanation of Solution

Cash realizable value (net realizable value): Cash realizable value is the net amount of receivables which a business expects to collect from its debtors. Accounts receivable less allowance for doubtful accounts is represented as cash realizable value.

Ascertain the net realizable value of accounts receivables at the end of 2014:

Thus, the Net realizable value of accounts receivable at the end of the 2014 is $12,550.

c. (1)

Ascertain the net income for 2015.

c. (1)

Explanation of Solution

Net income: Net income is the excess amount of revenue which arises after deducting all the expenses of a company. In simple terms, it is the difference between total revenue and total expenses of the company.

Ascertain the net income for 2015:

Hence, the net income for 2015 is $64,350.

c. (2)

Ascertain the net cash flows from operating activities for 2015.

c. (2)

Explanation of Solution

Cash flows from operating activities: These refer to the cash received or cash paid in day-to-day operating activities of a company.

During 2015, cash collected from the customers is $66,000, and there is no cash payments made during the year, therefore the net cash flows from the operating activities are $66,000.

c. (3)

Ascertain the balance of accounts receivables at the end of 2015.

c. (3)

Explanation of Solution

Accounts receivable: Accounts receivable refers to the amounts to be received within a short period from customers upon the sale of goods and services on account. In other words, accounts receivable are amounts customers owe to the business. Accounts receivable is an asset of a business.

The Accounts receivable balance at the end of 2015 is $11,680 (Refer Table (2)).

c. (4)

Ascertain the net realizable value of accounts receivables at the end of 2015.

c. (4)

Explanation of Solution

Cash realizable value (net realizable value): Cash realizable value is the net amount of receivables which a business expects to collect from its debtors. Accounts receivable less allowance for doubtful accounts is represented as cash realizable value.

Ascertain the net realizable value of accounts receivables at the end of 2015:

Thus, the Net realizable value of accounts receivable at the end of the 2015 is $10,900.

Want to see more full solutions like this?

Chapter 5 Solutions

SURVEY OF ACCOUNTING-ACCESS >CUSTOM<

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education