Long-term contract; revenue recognition over time

• LO5–8, LO5–9

In 2018, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2020. Information related to the contract is as follows: Westgate recognizes revenue over time according to percentage of completion.

Required:

1. Calculate the amount of revenue and gross profit to be recognized in each of the three years.

2. Prepare all necessary

3. Prepare a partial balance sheet for 2018 and 2019 showing any items related to the contract. Indicate whether any of the amounts shown are contract assets or contract liabilities.

4. Calculate the amount of revenue and gross profit to be recognized in each of the three years assuming the following costs incurred and costs to complete information:

5. Calculate the amount of revenue and gross profit to be recognized in each of the three years assuming the following costs incurred and costs to complete information:

Requirement – 1

Contract

Contract is a written document that creates legal enforcement for buying and selling the property. It is committed by the parties to perform their obligations and enforcing their rights.

Revenue recognized point of long term contract

A long-term contract qualifies for revenue recognition over time. The seller can recognize the revenue as per percentage of the completion of the project, which is recognized by revenue minus cost of completion until date.

If a contract does not meet the performance obligation norm, the seller cannot recognize the revenue till the project complete.

The revenue recognition principle

The revenue recognition principle refers to the revenue that should be recognized in the time period, when the performance obligation (sales or services) of the company is completed.

To determine: The amount of revenue and gross profit or loss to be recognized in 2018, 2019, and 2020.

Explanation of Solution

Recognized revenue

In the year 2018:

Given,

The contract price is $10,000,000

Actual cost to date is $2,400,000

Calculated total estimated cost is $8,000,000(1)

Now, calculate the revenue recognition:

Hence, the calculated revenue recognition is $3,000,000.

In the year 2019:

Given,

The contract price is $10,000,000

Actual cost to date is $6,000,000

Calculated total estimated cost is $8,000,000

Now, calculate the revenue recognition:

Hence, the calculated revenue recognition is $4,500,000.

In the year 2020:

Given,

Contract price is $10,000,000

Calculated revenue recognition in 2018 is $3,000,000

Calculated revenue recognition in 2019 is $4,500,000

Now, calculate the revenue recognition:

Hence, the calculated revenue recognition is$2,500,000.

Recognized gross profit

In the year 2018

Here,

Estimated gross profit in 2018 is $2,000,000 (1)

Total estimated cost is $8,000,000,

Actual cost to date is $2,400,000.

Now, calculate the gross profitrecognition:

Hence, the calculated gross profit recognition is $6,000,000.

In the year 2019

Here,

Estimated gross profit in 2019 is $2,000,000(1)

Total estimated cost is $8,000,000,

Gross profit recognition in 2018 is $6,000,000

Actual cost to date is $6,000,000.

Now, calculate the gross profitrecognition:

Hence, the calculated gross profit recognition is $9,000,000.

In the year 2020

Here,

Estimated gross profit in 2020 is $1,800,000(1)

Gross profit recognition in 2018 is $6,000,000,

Gross profit recognition in 2019 is $9,000,000.

Now, calculate the gross profitrecognition:

Hence, the calculated gross profit recognition is $3,000,000.

Working note:

Calculate the value of gross profit (in millions)

| Particulars | 2018 | 2019 | 2020 | |||

| Contract price | $1,000 | $1,000 | $1,000 | |||

| Actual costs to date | $240 | $600 | $820 | |||

| Estimated costs to complete | $560 | $200 | $0 | |||

| Less: Total estimated cost | $800 | $800 | $820 | |||

| Estimated gross profit | $200 | $200 | $180 | |||

Table (1)

(1)

Requirement – 2

To prepare: The journal entries for the year 2018, 2019 and 2020.

Explanation of Solution

In the year 2018:

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Construction in progress | $2,400,000 | |||

| Various accounts | $2,400,000 | |||

| (To record construction cost) |

Table (2)

- Construction in progress is an asset. There is an increase in asset value. Therefore, it is debited.

- Various accounts are revenue. There is an increase in liability value. Therefore, it is credited.

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Account receivable | $2,000,000 | |||

| Billings on construction contract | $2,000,000 | |||

| (To record progress billings) |

Table (3)

- Account receivable is an asset. There is an increase in asset value. Therefore, it is debited.

- Billings on construction contract is revenue. There is a decrease in liability value. Therefore, it is debited.

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Cash | $1,800,000 | |||

| Account receivable | $1,800,000 | |||

| (To record cash collection) |

Table (4)

- Cash is an asset. There is an increase in asset value. Therefore, it is debited.

- Account receivable is an asset. There is a decrease in asset value. Therefore, it is credited.

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Cost of construction | $600,000 | |||

| Construction in progress | $2,400,000 | |||

| Revenue from long-term contracts | $3,000,000 | |||

| (To record gross profit) |

Table (5)

- Cost of constructionis anexpense. There is a decrease in liability value. Therefore, it is debited.

- Construction in progress is an asset. There is an increase in asset value. Therefore, it is debited.

- Revenue from long-term contracts is revenue. There is an increase in liability value. Therefore, it is credited.

In the year 2019:

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Construction in progress | $3,600,000 | |||

| Various accounts | $3,600,000 | |||

| (To record construction cost) |

Table (6)

- Construction in progress is an asset. There is an increase in asset value. Therefore, it is debited.

- Various accounts are revenue. There is an increase in liability value. Therefore, it is credited.

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Account receivable | $4,000,000 | |||

| Billings on construction contract | $4,000,000 | |||

| (To record progress billings) |

Table (7)

- Account receivable is an asset. There is an increase in asset value. Therefore, it is debited.

- Billings on construction contract is revenue. There is a decrease in liability value. Therefore, it is debited.

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Cash | $3,600,000 | |||

| Account receivable | $3,600,000 | |||

| (To record cash collection) |

Table (8)

- Cash is an asset. There is an increase in asset value. Therefore, it is debited.

- Account receivable is an asset. There is a decrease in asset value. Therefore, it is credited.

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Cost of construction | $900,000 | |||

| Construction in progress | $3,600,000 | |||

| Revenue from long-term contracts | $4,500,000 | |||

| (To record gross profit) |

Table (9)

- Cost of constructionis anexpense. There is a decrease in liability value. Therefore, it is debited.

- Construction in progress is an asset. There is an increase in asset value. Therefore, it is debited.

- Revenue from long-term contracts is revenue. There is an increase in liability value. Therefore, it is credited.

In the year 2020:

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Construction in progress | $2,200,000 | |||

| Various accounts | $2,200,000 | |||

| (To record construction cost) |

Table (10)

- Construction in progress is an asset. There is an increase in asset value. Therefore, it is debited.

- Various accounts are revenue. There is an increase in liability value. Therefore, it is credited.

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Account receivable | $4,000,000 | |||

| Billings on construction contract | $4,000,000 | |||

| (To record progress billings) |

Table (11)

- Account receivable is an asset. There is an increase in asset value. Therefore, it is debited.

- Billings on construction contract is revenue. There is a decrease in liability value. Therefore, it is debited.

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Cash | $4,600,000 | |||

| Account receivable | $4,600,000 | |||

| (To record cash collection) |

Table (12)

- Cash is an asset. There is an increase in asset value. Therefore, it is debited.

- Account receivable is an asset. There is a decrease in asset value. Therefore, it is credited.

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Construction in progress | $300,000 | |||

| Cost of construction | $2,200,000 | |||

| Revenue from long-term contracts | $2,500,000 | |||

| (To record gross profit) |

Table (13)

- Construction in progress is an asset. There is an increase in asset value. Therefore, it is debited.

- Cost of constructionis anexpense. There is a decrease in liability value. Therefore, it is debited.

- Revenue from long-term contracts is revenue. There is an increase in liability value. Therefore, it is credited.

Requirement – 3

To prepare: The partial balance sheet for 2018 and 2019.

Explanation of Solution

Partial balance sheet of W Construction Company is as follows:

In the year 2018:

| Assets | 2018 | |

| Account receivables | $200,000 | |

| Construction in progress | $3,000,000 | |

| Less: Billings | ($2,000,000) | |

| Costs in excess of billings | $1,000,000 | |

Table (14)

In the year 2019:

| Assets | 2019 | |

| Account receivables | $600,000 | |

| Construction in progress | $7,500,000 | |

| Less: Billings | ($6,000,000) | |

| Costs in excess of billings | $1,500,000 | |

Table (15)

Requirement – 4

Explanation of Solution

Recognized revenue

In the year 2018:

Given,

The contract price is $10,000,000

Actual cost to date is $2,400,000

Calculated total estimated cost is $8,000,000(1)

Now, calculate the revenue recognition:

Hence, the calculated revenue recognition is $3,000,000.

In the year 2019:

Given,

The contract price is $10,000,000

Actual cost to date is $6,200,000

Calculated total estimated cost is $9,300,000

Now, calculate the revenue recognition:

Hence, the calculated revenue recognition is $3,666,667.

In the year 2020:

Given,

Contract price is $10,000,000

Calculated revenue recognition in 2018 is $3,000,000

Calculated revenue recognition in 2019 is $3,666,667

Now, calculate the revenue recognition:

Hence, the calculated revenue recognition is$3,333,333.

Recognized gross profit

In the year 2018

Here,

Estimated gross profit in 2018 is $2,000,000, (2)

Total estimated cost is $8,000,000,

Actual cost to date is $2,400,000.

Now, calculate the gross profitrecognition:

Hence, the calculated gross profit recognition is $6,000,000.

In the year 2019

Here,

Estimated gross profit in 2019 is $700,000 (2)

Total estimated cost is $9,300,000,

Gross profit recognition in 2018 is $6,000,000

Actual cost to date is $6,200,000.

Now, calculate the gross profitrecognition:

Hence, the calculated gross loss recognition is $133,333.

In the year 2020

Here,

Estimated gross profit in 2020 is $600,000(2)

Gross profit recognition in 2018 is $600,000,

Gross profit recognition in 2019 is -$133,333.

Now, calculate the gross profitrecognition:

Hence, the calculated gross profit recognition is $133,333.

Working note

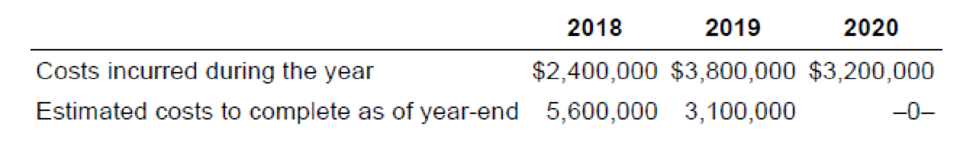

| Particulars | 2018 | 2019 | 2020 |

| Costs incurred during the year | $2,400,000 | $3,800,000 | $3,200,000 |

| Estimated costs to complete as of year-end | $5,600,000 | $3,100,000 |

Calculate the estimated gross profit ($ in millions):

| Particulars | 2018 | 2019 | 2020 | |||

| Contract price | $1,000 | $1,000 | $1,000 | |||

| Actual costs to date | $240 | $620 | $940 | |||

| Estimated costs to complete | $560 | $310 | $0 | |||

| Total estimated cost | $800 | $930 | $940 | |||

| Estimated gross profit | $200 | $70 | $60 | |||

Table (15)

(2)

Requirement – 5

Explanation of Solution

Recognized revenue

In the year 2018:

Given,

The contract price is $10,000,000

Actual cost to date is $2,400,000

Calculated total estimated cost is $8,000,000(1)

Now, calculate the revenue recognition:

Hence, the calculated revenue recognition is $3,000,000.

In the year 2019:

Given,

The contract price is $10,000,000

Actual cost to date is $6,200,000

Calculated total estimated cost is $10,300,000

Now, calculate the revenue recognition:

Hence, the calculated revenue recognition is $3,019,417.

In the year 2020:

Given,

Contract price is $10,000,000

Calculated revenue recognition in 2018 is $3,000,000

Calculated revenue recognition in 2019 is $3,019,417

Now, calculate the revenue recognition:

Hence, the calculated revenue recognition is$3,980,583.

Recognized gross profit

In the year 2018

Here,

Estimated gross profit in 2018 is $2,000,000(3)

Total estimated cost is 8,000,000

Actual cost to date is $2,400,000

Now, calculate the gross profitrecognition:

Hence, the calculated gross profit recognition is $6,000,000.

In the year 2019

Here,

Estimated gross profit in 2019 is -$300,000(3)

Gross profit recognition in 2018 is $6,000,000.

Now, calculate the gross profitrecognition:

Hence, the calculated gross profit recognition is ($900,000).

In the year 2020

Here,

Estimated gross profit in 2020 is -$100,000 (3)

Gross profit recognition in 2018 is $600,000,

Gross profit recognition in 2019 is -$900,000.

Now, calculate the gross profitrecognition:

Hence, the calculated gross profit recognition is $200,000.

Working note

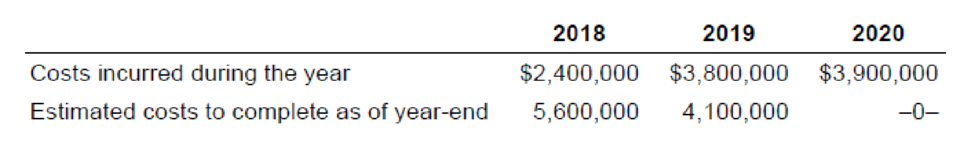

| Particulars | 2018 | 2019 | 2020 |

| Costs incurred during the year | $2,400,000 | $3,800,000 | $3,900,000 |

| Estimated costs to complete as of year-end | $5,600,000 | $4,100,000 |

Calculate the value of estimated gross profit ($ in millions):

| Particulars | 2018 | 2019 | 2020 | |||

| Contract price | $1,000 | $1,000 | $1,000 | |||

| Actual costs to date | $240 | $620 | $1,100 | |||

| Estimated costs to complete | $560 | $410 | $0 | |||

| Less: Total estimated cost | $800 | $1,030 | $1,010 | |||

| Estimated gross profit | $200 | -$30 | -$10 | |||

(3)

Want to see more full solutions like this?

Chapter 5 Solutions

INTERMEDIATE ACCOUNTING ACCESS

- Q 9 – A company constructs a building for its own use. Construction began on January 1, 2020 and ended on December 31,2020. In 2020, the company made the following expenditures related to this building: January 1, $480,000; March 31, $900,000; June 30, $1,600,000; and October 30, $1,800,000. To help finance construction, the company arranged a 15% construction loan on January 1 for $1,000,000. The company’s other borrowings, outstanding for the whole year, consisted of a $2 million loan and a $4 million note with interest rates of 8% and 6%, respectively. Determine the amount of interest to be capitalized in 2020 in relation to the construction of the building. Q 10 –Eshaq Company’s record of transactions concerning part X for the month of February was as follows.arrow_forwardProblem 13NOREEN INC, a truck dealer, sells a truck on January 1, 2019, to MENDOZA INC for P3,000,000. NOREEN agrees to repurchase the truck on December 31, 2020 for P3,630,000. How much should NOREEN INC record interest and retirement of its liability to MENDOZAINC on December 31, 2020?None C. 330,000; 3,630,000 300,000; 3,600,000 D. 630,000; 3,630,000arrow_forwardHmm.211. blossom home inc, a real estate developing company was accounting for its long-term contracts using the completed contract method prior to 2024. in 2024 it changed to the percentage of completion method. The company decided to use the same for income tax purposes, rate enacted is 20%. Income before taxes under both the methods for the past three years appears below 2022 2023 2024 Completed Contract 440000 294000 148000 Percentage of completion 740000 367000 260000 Which of the following will be included in the journal entry made by Blossom Home to record the inco.me effect after taxes?arrow_forward

- 56 On February 20, 2022, ABC Construction Company entered into a fixed-price contract to construct a commercial building for P9,000,000. ABC determined that the performance obligation is satisfied over time. Information relating to the contract is as follows: 2022 2023 Percentage of completion 25% 75% Estimated costs at completion P6,750,000 P7,200,000 How much is the contract costs charged to profit or loss in 2022? On February 20, 2022, ABC Construction Company entered into a fixed-price contract to construct a commercial building for P9,000,000. ABC determined that the performance obligation is satisfied over time. Information relating to the contract is as follows: 2022 2023 Percentage of completion 25% 75% Estimated costs at completion P6,750,000 P7,200,000 How much is the contract costs charged to profit or loss in 2022?arrow_forwardProblem 4: On April 1, 2020, DEF Corporation entered into a franchise agreement. This will allow DEF to collect P200,000 cash as down payment and a 5-year, 8%, P1,000,000 note. The effective rate equals nominal rate for this note. The franchise allows the franchisee to use DEF Corporation's intellectual property and any updates to those over a period of 10 years. Required: 10. Contract liability as of Dec. 31, 2020 11. Total carrying value of the receivables from the customer as of Dec. 31, 2020arrow_forwardQuestion 3What is the proper solution for this problem? B. On August 1, 2021, the board of directors of LL Co. voted to approve the disposal of one of its B division.The sale is expected to occur in June of next year. The B division's revenue and expenses for the period from January 1 to July 31 amounted to P14,000,000 and P10,000,000, respectively. For the period from August 1 to December 31, B Division's revenue amounted to P5,000,000 while expenses totaled P4,500,000. The carrying amount of B Division's net assets on December 31, 2021 was P21,000,000 and the fair value less cost of disposal was P25,000,000. The sale contract requires the company to pay termination cost of affected employees in the amount of P1,200,000 to be paid on September 30, 2022. The income tax rate is 30%. Required:25 – 27. Determine the income (loss) net of tax from discontinued operation.arrow_forward

- 43. On February 20, 2022, ABC Construction Company entered into a fixed-price contract to construct a commercial building for P9,000,000. ABC determined that the performance obligation is satisfied over time. Information relating to the contract is as follows: 2022 2023 Percentage of completion 25% 75% Estimated costs at completion P6,750,000 P7,200,000 How much is the contract costs charged to profit or loss in 2022?arrow_forward7..new.continue..c-d Sage Industries and Pronghorn Inc. enter into an agreement that requires Pronghorn Inc. to build three diesel-electric engines to Sage’s specifications. Upon completion of the engines, Sage has agreed to lease them for a period of 10 years and to assume all costs and risks of ownership. The lease is non-cancelable, becomes effective on January 1, 2020, and requires annual rental payments of $405,443 each January 1, starting January 1, 2020.Sage’s incremental borrowing rate is 8%. The implicit interest rate used by Pronghorn and known to Sage is 7%. The total cost of building the three engines is $2,685,000. The economic life of the engines is estimated to be 10 years, with residual value set at zero. Sage depreciates similar equipment on a straight-line basis. At the end of the lease, Sage assumes title to the engines. Collectibility of the lease payments is probable. (c) Prepare the journal entry to record the transaction on January 1, 2020, on the books of…arrow_forward41. On February 20, 2022, ABC Construction Company entered into a fixed-price contract to construct a commercial building for P9,000,000. ABC determined that the performance obligation is satisfied over time. Information relating to the contract is as follows: 2022 2023 Percentage of completion 25% 75% Estimated costs at completion P6,750,000 P7,200,000 How much is the gross profit to be recognized in 2023?arrow_forward

- Kk.23. MN’s compensation package for its PEO consisted of a $600,000 salary plus $200,000 unfunded deferred compensation. The PEO will receive the $200,000 when he retires in 2026. He is also a participant in MN’s qualified pension plan. MN contributed $21,000 to fund a $90,000 annual pension that the PEO will begin to receive in 2026. Required: Compute MN's current year financial statement expense for the PEO’s compensation. Compute MN's current year tax deduction for the PEO’s compensation. Compute the PEO’s current year taxable compensation income. How much taxable income will the PEO recognize in 2026?arrow_forwardExercise 8-19 (LO. 2) Euclid acquires a 7-year class asset on May 9, 2020, for $80,000 (the only asset acquired during the year). Euclid does not elect immediate expensing under § 179. He does not claim any available additional first-year depreciation. Click here to access the depreciation table to use for this problem. If required, round your answers to the nearest dollar. Calculate Euclid's cost recovery deduction for 2020 and 2021.2020: $2021: $ 8-7cCost Recovery Tables Summary of Tables Exhibit 8.3 Regular MACRS table for personalty. Depreciation methods: 200 or 150 percent declining-balance switching to straight-line. Recovery periods: 3, 5, 7, 10, 15, 20 years. Convention: half-year. Exhibit 8.4 Regular MACRS table for personalty. Depreciation method: 200 percent declining-balance switching to straight-line. Recovery periods: 3, 5, 7 years. Convention: mid-quarter. Exhibit 8.5 MACRS optional straight-line table for personalty.…arrow_forward#80 Dream Home Inc., a real estate developing company, was accounting for its long-term contracts using the completed contract method prior to 2021. In 2021, it changed to the percentage-of-completion method.The company decided to use the same for income tax purposes. The tax rate enacted is 20%.Income before taxes under both the methods for the past three years appears below. 2019 2020 2021 Completed contract $450,000 $300,000 $150,000 Percentage-of-completion 750,000 375,000 270,000 Which of the following will be included in the journal entry made by Dream Home to record the income effect? Question 80 options: a A debit to Retained Earnings for $300,000 b A credit to Retained Earnings for $200,000 c A credit to Retained Earnings for $300,000 d A debit to Retained Earnings for $200,000arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT