Concept explainers

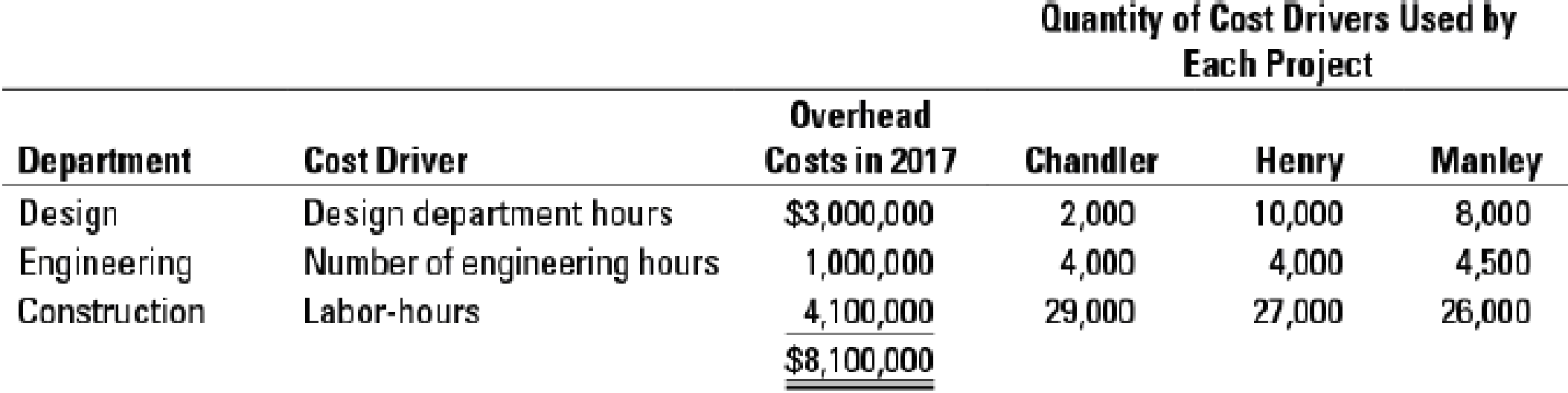

Department costing, service company. DLN is an architectural firm that designs and builds buildings. It prices each job on a cost plus 20% basis. Overhead costs in 2017 are $8,100,000. DLN’s simple costing system allocates overhead costs to its jobs based on number of jobs. There were three jobs in 2017. One customer, Chandler, has complained that the cost and price of its building in Chicago was not competitive. As a result, the controller has initiated a detailed review of the overhead allocation to determine if overhead costs should be charged to jobs in proportion to consumption of overhead resources by jobs. She gathers the following information:

- 1. Compute the overhead allocated to each project in 2017 using the simple costing system that allocates overhead costs to jobs based on the number of jobs

Required

- 2. Compute the overhead allocated to each project in 2017 using department overhead cost rates.

- 3. Do you think Chandler had a valid reason for dissatisfaction with the cost and price of its building? How does the allocation based on department rates change costs for each project?

- 4. What value, if any, would DLN get by allocating costs of each department based on the activities done in that department?

Learn your wayIncludes step-by-step video

Chapter 5 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Financial Accounting (12th Edition) (What's New in Accounting)

Financial Accounting, Student Value Edition (5th Edition)

Intermediate Accounting

Cost Accounting (15th Edition)

Horngren's Accounting (11th Edition)

- Automotive Products (AP) designs and produces automotive parts. In 2017, actual manufacturing overhead is $317,250. AP's simple costing system allocates manufacturing overhead to its three customers based on machine-hours and prices its contracts based on full costs. One of its customers has regularly complained of being charged noncompetitive prices, so AP's controller DrewBailey realizes that it is time to examine the consumption of overhead resources more closely. He knows that there are three main departments that consume overhead resources: design, production, and engineering. Interviews with the department personnel and examination of time records yield the following detailed information: Read the requirements2. Requirement 1. Compute the manufacturing overhead allocated to each customer in 2017 using the simple costing system that uses machine-hours as the allocation base. Determine the formula needed to calculate overhead using the simple costing method and…arrow_forwardAutomotive Products (AP) designs and produces automotive parts. In 2014, actual variable manufacturing overhead is $308,600. AP’s simple costing system allocates variable manufacturing overhead to its three customers based on machine-hours and prices its contracts based on full costs. One of its customers has regularly complained of being charged noncompetitive prices, so AP’s controller Devon Smith realizes that it is time to examine the consumption of overhead resources more closely. He knows that there are three main departments that consume overhead resources: design, production, and engineering. Interviews with the department personnel and examination of time records yield the following detailed information. Compute the manufacturing overhead allocated to each customer in 2014 using the simple costing system that uses machine-hours as the allocation base.2. Compute the manufacturing overhead allocated to each customer in 2014 using department-based manufacturing overhead…arrow_forwardPlant-wide, department, and ABC indirect cost rates. Roadster Company (RC) designs and produces automotive parts. In 2017, actual variable manufacturing overhead is $280,000. RC’s simple costing system allocates variable manufacturing overhead to its three customers based on machine-hours and prices its contracts based on full costs. One of its customershas regularly complained of being charged noncompetitive prices, so RC’s controller Matthew Draper realizes that it is time to examine the consumption of overhead resources more closely. He knows that there are three main departments that consume overhead resources: design, production, and engineering. Interviews with the department personnel and examination of time records yield the following detailed information:arrow_forward

- Q.Do you think Chandler had a valid reason for dissatisfaction with the cost and price of its building? How does the allocation based on department rates change costs for each project?arrow_forwardPlease answer me quickely!arrow_forwardIsaacson's Fine Furnishings manufactures upscale custom furniture. Isaacson's currently uses a plantwide overhead rate based on direct labor hours to allocate its $1,170,000 of manufacturing overhead to individual jobs. However, Delores Johnson, owner and CEO, is considering refining the company's costing system by using departmental overhead rates. Currently, the Machining Department incurs $735,000 of manufacturing overhead while the Finishing Department incurs $435,000 of manufacturing overhead. Johnson has identified machine hours (MH) as the primary manufacturing overhead cost driver in the Machining Department and direct labor (DL) hours as the primary cost driver in the Finishing Department The Isaacson's plant completed Jobs 450 and 455 on May 15. Both jobs incurred a total of 7 DL hours throughout the entire production process. Job 450 incurred 1 MH in the Machining Department and 6 DL hours in the Finishing Department (the other DL hour occurred in the Machining…arrow_forward

- Isaacson's Fine Furnishings manufactures upscale custom furniture. Isaacson's currently uses a plantwide overhead rate based on direct labor hours to allocate its $1,170,000 of manufacturing overhead to individual jobs. However, Delores Johnson, owner and CEO, is considering refining the company's costing system by using departmental overhead rates. Currently, the Machining Department incurs $735,000 of manufacturing overhead while the Finishing Department incurs $435,000 of manufacturing overhead. Johnson has identified machine hours (MH) as the primary manufacturing overhead cost driver in the Machining Department and direct labor (DL) hours as the primary cost driver in the Finishing Department. 3. If Isaacson's continues to use the plantwide overhead rate, how much manufacturing overhead would be allocated to Job 450 and Job 455? 4. If Isaacson's uses departmental overhead rates, how much manufacturing overhead would be allocated to Job 450 and Job455?…arrow_forwardIsaacson's Fine Furnishings manufactures upscale custom furniture. Isaacson's currently uses a plantwide overhead rate based on direct labor hours to allocate its $1,170,000 of manufacturing overhead to individual jobs. However, Delores Johnson, owner and CEO, is considering refining the company's costing system by using departmental overhead rates. Currently, the Machining Department incurs $735,000 of manufacturing overhead while the Finishing Department incurs $435,000 of manufacturing overhead. Johnson has identified machine hours (MH) as the primary manufacturing overhead cost driver in the Machining Department and direct labor (DL) hours as the primary cost driver in the Finishing Department. 1. Compute the plantwide overhead rate assuming that Isaacson's expects to incur 26,000 total DL hours during the year 2. Compute departmental overhead rates assuming that Isaacson's expects to incur 15,000 MH in the Machining Department and 17,400 DL hours in the…arrow_forwardJean Sharpe decides to gather additional data to identify the cause of overhead costs and figure out which products are most profitable. She notices that $30,000 of the overhead originated from the equipment used. She decides to incorporate machine-hours into the overhead allocation base to determine the effect on product profitability. Almond Dream requires 2 machine-hours per case, Krispy Krackle requires 7 hours per case, and Creamy Crunch requires 6 hours per case. Additionally, Jean notices that the $15,000 per month spent to rent 10,000 square feet of factory space accounts for almost 22 percent of the overhead. The assignment of square feet is 1,000 to Almond Dream, 4,000 to Krispy Krackle, and 5,000 to Creamy Crunch. Jean decides to incorporate this into the allocation base for the rental costs. Because labor-hours are still an important cost driver for overhead, Jean decides that she should use labor-hours to allocate the remaining $24,500. CBI still plans to produce 1,000…arrow_forward

- Jean Sharpe decides to gather additional data to identify the cause of overhead costs and figure out which products are most profitable. She notices that $30,000 of the overhead originated from the equipment used. She decides to incorporate machine-hours into the overhead allocation base to determine the effect on product profitability. Almond Dream requires 2 machine-hours per case, Krispy Krackle requires 7 hours per case, and Creamy Crunch requires 6 hours per case. Additionally, Jean notices that the $15,000 per month spent to rent 10,000 square feet of factory space accounts for almost 22 percent of the overhead. The assignment of square feet is 1,000 to Almond Dream, 4,000 to Krispy Krackle, and 5,000 to Creamy Crunch. Jean decides to incorporate this into the allocation base for the rental costs. Because labor-hours are still an important cost driver for overhead, Jean decides that she should use labor-hours to allocate the remaining $24,500. CBI still plans to produce 1,000…arrow_forwardJean Sharpe decides to gather additional data to identify the cause of overhead costs and figure out which products are most profitable. She notices that $30,000 of the overhead originated from the equipment used. She decides to incorporate machine-hours into the overhead allocation base to determine the effect on product profitability. Almond Dream requires 2 machine-hours per case, Krispy Krackle requires 7 hours per case, and Creamy Crunch requires 6 hours per case. Additionally, Jean notices that the $15,000 per month spent to rent 10,000 square feet of factory space accounts for almost 22 percent of the overhead. The assignment of square feet is 1,000 to Almond Dream, 4,000 to Krispy Krackle, and 5,000 to Creamy Crunch. Jean decides to incorporate this into the allocation base for the rental costs. Because labor-hours are still an important cost driver for overhead, Jean decides that she should use labor-hours to allocate the remaining $24,500. CBI still plans to produce 1,000…arrow_forwardPlease help. I'm getting this wrong every time I try to calculate it. Wilmington Company has two manufacturing departments--Assembly and Fabrication. It considers all of its manufacturing overhead costs to be fixed costs. The first set of data that is shown below is based on estimates from the beginning of the year. The second set of data relates to one particular job completed during the year--Job Bravo. Estimated Data Assembly Fabrication Total Manufacturing overhead costs $ 1,920,000 $ 2,240,000 $ 4,160,000 Direct labor-hours 80,000 48,000 128,000 Machine-hours 32,000 160,000 192,000 Job Bravo Assembly Fabrication Total Direct labor-hours 17 9 26 Machine-hours 9 12 21 Required: 1. If Wilmington used a plantwide predetermined overhead rate based on direct labor-hours, how much manufacturing overhead would be applied to Job Bravo? 2. If Wilmington uses departmental predetermined overhead rates with direct labor-hours as the allocation…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College