Concept explainers

Equity Entries with Differential

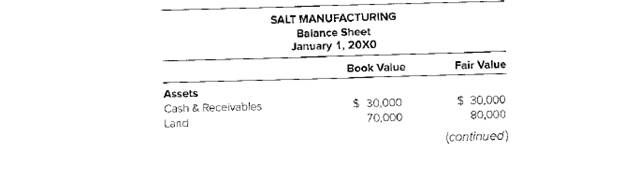

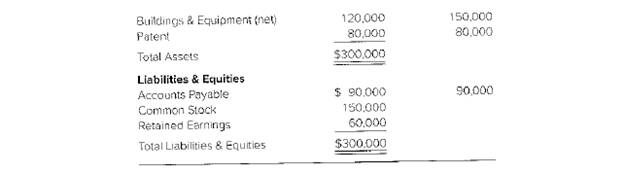

On January 1, 20X0, Pepper Corporation issued 6,000 of its $10 par value shares to acquire45 percent of the shares of Salt Manufacturing. Salt Manufacturing’s balance sheet immediatelybefore the acquisition contained the following items:

On the date of the stockacquisition, Pepper’s shares were selling a $35, and Salt Manufacturing’sbuildings and equipment had a remaining economic life of 10 year. The amount of the differential assigned to

In the two years following the stock acquisition. Salt Manufacturing reported net income of$80,000 and $50,000 and paid dividends of $20,000 and $40,000, respectively. Pepper used theequity method in accounting for its ownership of Salt Manufacturing.

Required

a. Give the entry recorded by Pepper Corporation at the time of acquisition.

b. Give the

c. What balance will be reported in Peppers investment account on December 31, 20X1?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

ADVANCED FINANCIAL ACCOUNTING IA

- On January 2, 20Y4, Destiny Company acquired 42% of the outstanding stock of Emerald Company for $350,000. For the year ended December 31, 20Y4 Destiny Company earned income of $200,000 and paid dividends of $25,000. On January 31, 20Y5, Destiny Company sold all of its investment in Emerald Company stock for $400,000. Journalize the entries for Destiny Company for the purchase of the stock, the share of Emerald income, the dividends received from Emerald Company, and the sale of the Emerald Company stock.arrow_forwardPrepare entries to record both the acquisition and the sale of these shares. 1. On May 20, Montero Company paid $198,000 to acquire 70 shares (5%) of ORD Corporation as a long-term investment. 2. On August 5, Montero sold one-tenth of the ORD shares for $22,000.arrow_forwardOn January 1, 20x1, Pinup Corp. acquired 34,560 outstanding ordinary shares of Slug Corp. for a cash consideration of P5,158,400. The shareholders' equity of Slug Corp. on the date of business combination is presented below: Ordinary shares P100 par value 5,760,000 Share premium 1,600,000 Retained Earnings 960,000 Pinup Corp agreed to issue additional 1,000 shares to former owners of Slug Corp if the market price per share of Pinup Corp shares increase to P120 per share. On the acquisition date, the contingent consideration was estimated at P80,000. What is the amount of non-controlling interest if it is measured at its proportionate share in the identifiable net assets of Slug Corp.? O 3,328,000 O 4,992,000 O 3,200,000 O 3,492,267arrow_forward

- On May 20, Montero Co. paid $150,000 to acquire 30 shares (4%) of ORD Corp. as a long-term investment. On August 5, Montero sold one-tenth of the ORD shares for $18,000. 1. Prepare entries to record both (a) the acquisition and (b) the sale of these shares. 2. Should this stock investment be reported at fair value or at cost on the balance sheet?arrow_forwardOn January 1, 20X2, Parent Inc. issued 32,000 shares of its P10 par value common stock for all the outstanding shares of Son Company. The fair value of Parent Inc.'s stock is P25 per share. Parent Inc. pays P50,000 in registering the stocks. Given below are the statements of financial position (SFP) of the companies before the acquisition: Parent Inc. Statement of Financial Position January 1, 20X2 Assets Liabilities and Equity P210,000 420,000 400,000 500,000 505,000 P2,035,000 Cash P200,000 Accounts Payable 185,000 Bonds Payable 190,000 Common Stock, P10 par value 300,000 Additional Paid-In Capital (APIC) 740,000 Retained Earnings 420,000 Total Liabilities and Equity P2,035,000 Accounts Receivable Inventory Land Building, net of depreciation Equipment, net of depreciation Total Assets Son Company Statement of Financial Position January 1, 20X2 Book Value Fair Value P55,000 150,000 130,000 500,000 300,000 P1,135,000 Accounts Receivable Inventory Land P55,000 130,000 85,000 320,000…arrow_forwardOn January 1, 20X2, Parent Inc. issued 32,000 shares of its P10 par value common stock for all the outstanding shares of Son Company. The fair value of Parent Inc.'s stock is P25 per share. Parent Inc. pays P50,000 in registering the stocks. Given below are the statements of financial position (SFP) of the companies before the acquisition: Parent Inc. Statement of Financial Position January 1, 20X2 Assets Liabilities and Equity P200,000 Accounts Payable 185,000 Bonds Payable 190,000 Common Stock, P10 par value 300,000 Additional Paid-In Capital (APIC) 740,000 Retained Earnings 420,000 Total Liabilities and Equity Cash P210,000 420,000 400,000 500,000 505,000 P2,035,000 Accounts Receivable Inventory Land Building, net of depreciation Equipment, net of depreciation Total Assets P2,035,000 Son Company Statement of Financial Position January 1, 20X2 Book Value Fair Value Accounts Receivable P55,000 130,000 85,000 320,000 140,000 P730,000 P55,000 150,000 130,000 500,000 300,000 P1,135,000…arrow_forward

- On January 1, 20x1 Pinup Corp acquired 34,560 outstanding ordinary shares of Slug corp. for a cash consideration pf P5,158,400. The shareholder’s equity of Slug Corp. on the date of business combination is presented below: Ordinary shares P100 par value 5,760,000 Share premium 1,600,000 Retained Earnings 960,000 Pinup Corp agreed to issue additional 1,000 shares to former owners of Slug Corp if the market price per share of Pinup Corp shares increase to P120 pe share. On the acquisition date, the contingent consideration was estimated at P80,000. What is the amount of non-controlling interest if it is measured at its proportionate share in the identifiable net assets of Slug Corp? 3,328,000 3,492,267 4,992,000 3,200,000arrow_forwardRecording Entries for Equity Investment: FV-NI and Equity Method On January 1, 2020, Allen Corporation purchased 30% of the 66,000 outstanding common shares of Towne Corporation at $17 per share as a long-term investment. On the date of purchase, the book value and the fair value of the net assets of Towne Corporation were equal. During the year, Towne Corporation reported net income of $52,800 and declared and paid dividends of $17,600. As of December 31, 2020, common shares of Towne Corporation were trading at $20 per share. Journal Entries with Significant Influence Journal Entries without Significant Influence Financial Statement Presentation c. Indicate the amount of income that would be reported on the 2020 income statement and the investment balance on the 2020 year-end balance sheet under requirement (a) and requirement (b). Income Investment Net Balance 2020 Dec. 31, 2020 a. Investment accounted for under the equity method Answer Answer b. Investment…arrow_forwardGant Company purchased 30 percent of the outstanding shares of Temp Company for $87,000 on January 1, 20X6. The following results are reported for Temp Company: Net income Dividends paid Fair value of shares held by Gant: January 1 December 31 a. Carries the investment at fair value. b. Uses the equity method. 20X6 $ 43,000 14,000 Income from investment Balance in investment S $ 87,000 106,000 Required: Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in Temp at the end of each year assuming that Gant uses the following options in accounting for its investment in Temp: Complete this question by entering your answers in the tabs below. 20X7 $ 38,000 28,000 20X6 106,000 103,000 20X7 (800) $ 39,400 95,700 $ 109,000 Answer is complete but not entirely correct. Required A Required B Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning