Concept explainers

All journals and general ledger;

The transactions completed by AM Express Company during March 2016, the first month of the fiscal year, were as follows:

Mar. 1. Issued Check No. 205 for March rent, $2,450.

2. Purchased a vehicle on account from McIntyre Sales Co., $26,900.

3. Purchased office equipment on account from Office Mate Inc., $1,570.

5. Issued Invoice No. 91 to Ellis Co., $7,000.

6. Received check for $7,950 from Chavez Co. in payment of invoice.

7. Issued Invoice No. 92 to Trent Co., $9,840.

9. Issued Check No. 206 for fuel expense, $820.

10. Received check for $10,000 from Sajeev Co. in payment of invoice.

10. Issued Check No. 207 to Office City in payment of $450 invoice.

Mar. 10. Issued Check No. 208 to Bastille Co. in payment of $1,890 invoice.

11. Issued Invoice No. 93 to Jarvis Co., $7,200.

11. Issued Check No. 209 to Porter Co. in payment of $415 invoice.

12. Received check for $7,000 from Ellis Co. in payment of March 5 invoice.

13. Issued Check No. 210 to McIntyre Sales Co. in payment of $26,900 invoice of

March 2.

16. Cash fees earned for March 1-16, $26,800.

16. Issued Check No. 211 for purchase of a vehicle, $28,500.

17. Issued Check No. 212 for miscellaneous administrative expense, $4,680.

18. Purchased maintenance supplies on account from Bastille Co., $2,430.

18. Received check for rent revenue on office space, $900.

19. Purchased the following on account from Master Supply Co. Maintenance supplies, $2,640, and office supplies, $1,500.

20. Issued Check No. 213 in payment of advertising expense, $8,590.

20. Used maintenance supplies with a cost of $4,400 to repair vehicles.

21. Purchased office supplies on account from Office City, $990.

24. Issued Invoice No. 94 to Sajeev Co., $9,200.

25. Received check for $14,000 from Chavez Co. in payment of invoice.

25. Issued Invoice No. 95 to Trent Co., $6,300.

26. Issued Check No. 214 to Office Mate Inc. in payment of $1,570 invoice of March 3.

27. Issued Check No. 215 to J. Wu as a personal withdrawal, $4,000.

30. Issued Check No. 216 in payment of driver salaries, $33,300.

31. Issued Check No. 217 in payment of office salaries, $21,200.

31. Issued Check No. 218 for office supplies, $600.

31. Cash fees earned for March 17-31, $29,400.

Instructions

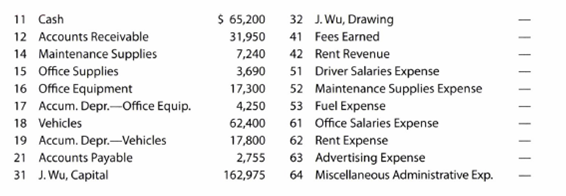

1. Enter the following account balances in the general ledger as of March 1:

2. Journalize the transactions for March 2016, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made.

3. Post the appropriate individual entries to the general ledger.

4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances.

5. Prepare a trial balance.

Trending nowThis is a popular solution!

Chapter 5 Solutions

Bundle: Accounting, Chapters 1-13, 26th + Working Papers, Chapters 1-17 For Warren/reeve/duchac's Accounting, 26th And Financial Accounting, 14th + ... For Warren/reeve/duchac's Accounting, 26th

- The transactions completed by AM Express Company during March 2016, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March 2016, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardThe following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?arrow_forwardThe following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?arrow_forward

- Prepare journal entries to record the following transactions that occurred in March: A. on first day of the month, purchased building for cash, $75,000 B. on fourth day of month, purchased inventory, on account, $6,875 C. on eleventh day of month, billed customer for services provided, $8,390 D. on nineteenth day of month, paid current month utility bill, $2,000 E. on last day of month, paid suppliers for previous purchases, $2,850arrow_forwardRefer to RE6-8. On April 23, 2020, McKinncy Co. receives a check, from Mangold Corporation for 8,500. Prepare the journal entry for McKinncy to record the collection of the account previously written off.arrow_forwardThe following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. 1 Purchased merchandise on account from Kirkwood Co., $396,000, terms n/30. 31 Issued a 30-day, 4% note for $396,000 to Kirkwood Co., on account. Apr. 30 Paid Kirkwood Co. the amount owed on the note of March 31. Jun. 1 Borrowed $174,000 from Triple Creek Bank, issuing a 45-day, 4% note. Jul. 1 Purchased tools by issuing a $258,000, 60-day note to Poulin Co., which discounted the note at the rate of 7%. 16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 6.5% note for $174,000. (Journalize both the debit and credit to the notes payable account.) Aug. 15 Paid Triple Creek Bank the amount due on the note of July 16. 30 Paid Poulin Co. the amount due on the note of July 1. Dec. 1 Purchased equipment from Greenwood Co. for $400,000, paying $114,000 cash and issuing a series of ten 4% notes…arrow_forward

- Journal Entries for Accounts and Notes ReceivableLancaster, Inc., began business on January 1. Certain transactions for the year follow: Jun.8 Received a $18,000, 60 day, eight percent note on account from R. Elliot. Aug.7 Received payment from R. Elliot on her note (principal plus interest). Sep.1 Received a $21,000, 120 day, nine percent note from B. Shore Company on account. Dec.16 Received a $17,000, 45 day, ten percent note from C. Judd on account. Dec.30 B. Shore Company failed to pay its note. Dec.31 Wrote off B. Shore's account as uncollectible. Lancaster, Inc., uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $25,600. An analysis of aged receivables indicates that the desired balance of the allowance account should be $22,500. Dec.31 Made the…arrow_forwardJournal Entries for Accounts and Notes ReceivableLancaster, Inc., began business on January 1. Certain transactions for the year follow: Jun.8 Received a $18,000, 60 day, eight percent note on account from R. Elliot. Aug.7 Received payment from R. Elliot on her note (principal plus interest). Sep.1 Received a $21,000, 120 day, nine percent note from B. Shore Company on account. Dec.16 Received a $17,000, 45 day, ten percent note from C. Judd on account. Dec.30 B. Shore Company failed to pay its note. Dec.31 Wrote off B. Shore's account as uncollectible. Lancaster, Inc., uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $25,600. An analysis of aged receivables indicates that the desired balance of the allowance account should be $22,500. Dec.31 Made the…arrow_forwardJournal Entries for Accounts and Notes ReceivableLancaster, Inc., began business on January 1. Certain transactions for the year follow: Jun.8 Received a $18,000, 60 day, eight percent note on account from R. Elliot. Aug.7 Received payment from R. Elliot on her note (principal plus interest). Sep.1 Received a $21,000, 120 day, nine percent note from B. Shore Company on account. Dec.16 Received a $17,000, 45 day, ten percent note from C. Judd on account. Dec.30 B. Shore Company failed to pay its note. Dec.31 Wrote off B. Shore's account as uncollectible. Lancaster, Inc., uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $25,600. An analysis of aged receivables indicates that the desired balance of the allowance account should be $22,500. Dec.31 Made the…arrow_forward

- Journal Entries for Accounts and Notes ReceivableLancaster, Inc., began business on January 1. Certain transactions for the year follow: Jun.8 Received a $15,000, 60 day, eight percent note on account from R. Elliot. Aug.7 Received payment from R. Elliot on her note (principal plus interest). Sep.1 Received a $18,000, 120 day, nine percent note from B. Shore Company on account. Dec.16 Received a $14,400, 45 day, ten percent note from C. Judd on account. Dec.30 B. Shore Company failed to pay its note. Dec.31 Wrote off B. Shore’s account as uncollectible. Lancaster, Inc., uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $22,600. An analysis of aged receivables indicates that the desired balance of the allowance account should be $19,500. Dec.31 Made the…arrow_forwardOn December 31 of last year, the balance sheet of Union Company had accounts receivable of $74,5000 and a credit balance in Allowance for Uncollectible Accounts of $5,075. During the current year, Union's financial records included the following selected activities: Sales on accounts $298,750 Sales returns and allowances, $18,250 Collections from customers, $287,500 Accounts written off as worthless, $4,000 1) Prepare T accounts for Accounts receivable and Allowance for uncollectible accounts. Enter the beginning balances and show the effects on these accounts of the items listed above. Determine the ending balance of each account.arrow_forwardThe following items were selected from among the transactions completed by Shin Co. during the current year: Jan. 10. Purchased merchandise on account from Beckham Co., $420,000, terms n/30. Feb. 9. Issued a 30-day, 6% note for $420,000 to Beckham Co., on account. Mar. 11. Paid Beckham Co. the amount owed on the note of February 9. May 1. Borrowed $240,000 from Verity Bank, issuing a 45-day, 5% note. June 1. Purchased tools by issuing a $312,000, 60-day note to Rassmuessen Co., which discounted the note at the rate of 5%. 15. Paid Verity Bank the interest due on the note of May 1 and renewed the loan by issuing a new 45-day, 7% note for $240,000. (Journalize both the debit and credit to the notes payable account.) July 30. Paid Verity Bank the amount due on the note of June 15. 30. Paid Rassmuessen Co. the amount due on the note of June 1. Dec. 1. Purchased office equipment from Lambert Co. for $700,500 paying $160,500 and issuing a series of ten 5% notes for $54,000 each, coming due…arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning