FUND.ACCT.PRIN -ONLINE ONLY >I<

22nd Edition

ISBN: 9780077632878

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 6BPSB

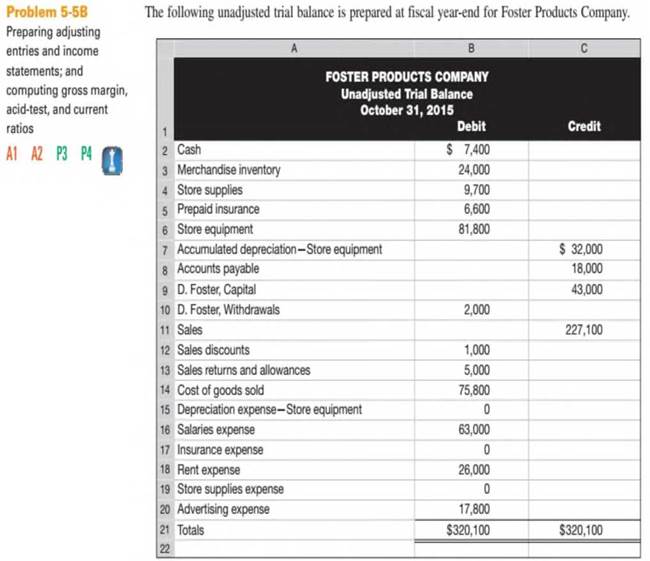

Problem 5-6BE

Refer to the data and information in Problem 5-5B.

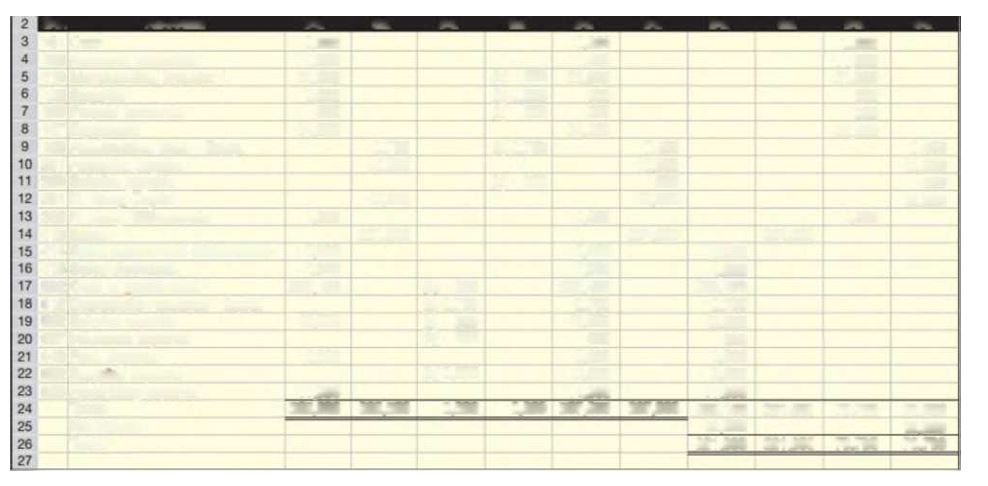

Preparing a work sheet for a merchandiser

Required

Prepare and complete the entire 10-column work sheet for Foster Products Company. Follow the structure of Exhibit 5B.1 in Appendix 5B.

Rent expense and salaries expense are equally divided between selling activities and the general and administrative activities. Foster Products Company uses a perpetual inventory system.

Required

- Prepare

adjusting journal entries to reflect each of the following. - Store supplies still available at fiscal year-end amount to $3,700.

- Expired insurance, an administrative expense, for the fiscal year is $2,800.

Depreciation expense on store equipment, a selling expense, is $3,000 for the fiscal year.- To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $21,300 of inventory is still available at fiscal year-end.

EXHIBIT 5B.1

Work Sheet for Merchandiser (using a perpetual system)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

CASE 2. MODALITY COMPANY

The following describes the expenditure cycle manual procedures for MODALITY Company.

The inventory control clerk examines the inventory records for items that must be replenished and prepares a two-part purchase requisition. Copy 1 of the requisition is sent to the purchasing department, and Copy 2 is filed.

Upon receipt of the requisition, the purchasing clerk selects a supplier from the valid vendor file (reference file) and prepares a three part purchase order. Copy 1 is sent to the supplier, Copy 2 is sent to the accounts payable department where it is filed temporarily, and Copy 3 is filed in the purchases department.

A few days aftr the supplier ships the order, the goods arrive at the receiving department. They are inspected, and the receiving clerk prepares a three-part receiving report describing the number and quality of the items received. Copy 1 of the receiving report accompanies the goods to the stores, where they are secured. Copy 2 is sent to…

Prepare T-accounts for inventories, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entries to these T-accounts (don’t forget to enter the opening balances in your inventory accounts). Compute an ending balance in each account.

A manufacturer's Raw Materials Inventory account appears as follows:

Beginning

Purchases

Debit

2. Direct materials used.

3. Indirect materials used.

View transaction list

Ending

All raw materials purchases are made on credit. Prepare journal entries to record the:

1. Purchase of raw materials.

1

Raw Materials Inventory

25,700

100,700

Journal entry worksheet

2 3

27,900

Credit

82,800 Direct materials used

15,700 Indirect materials used

Record the purchase of raw materials on credit.

Chapter 5 Solutions

FUND.ACCT.PRIN -ONLINE ONLY >I<

Ch. 5 - Prob. 1DQCh. 5 - 2. In comparing the accounts of a merchandising...Ch. 5 - Prob. 3DQCh. 5 - Prob. 4DQCh. 5 - Prob. 5DQCh. 5 - Prob. 6DQCh. 5 - Prob. 7DQCh. 5 - Prob. 8DQCh. 5 - Prob. 9DQCh. 5 - Prob. 10DQ

Ch. 5 - Prob. 11DQCh. 5 - Prob. 12DQCh. 5 - Prob. 13DQCh. 5 - Prob. 14DQCh. 5 - Prob. 15DQCh. 5 - Prob. 1QSCh. 5 - Prob. 2QSCh. 5 - Prob. 3QSCh. 5 - Prob. 4QSCh. 5 - Prob. 5QSCh. 5 - Prob. 6QSCh. 5 - Prob. 7QSCh. 5 - Prob. 8QSCh. 5 - Prob. 9QSCh. 5 - Prob. 10QSCh. 5 - Prob. 11QSCh. 5 - Prob. 12QSCh. 5 - Prob. 13QSCh. 5 - Prob. 14QSCh. 5 - Prob. 15QSCh. 5 - Prob. 16QSCh. 5 - Prob. 17QSCh. 5 - Prob. 18QSCh. 5 - Prob. 1ECh. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - Prob. 5ECh. 5 - Exercise 5-6 Recording purchase returns and...Ch. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - Prob. 10ECh. 5 - Prob. 11ECh. 5 - Prob. 12ECh. 5 - Prob. 13ECh. 5 - Prob. 14ECh. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Exercise 5-17A Recording purchases and...Ch. 5 - Prob. 18ECh. 5 - Prob. 19ECh. 5 - Prob. 20ECh. 5 - Prepare journal entries to record the following...Ch. 5 - (

Problem 5-2A

Preparing journal entries for...Ch. 5 - Prob. 3APSACh. 5 - Prob. 4APSACh. 5 - Prob. 5APSACh. 5 - Prob. 6APSACh. 5 - Prob. 1BPSBCh. 5 - Prepare journal entries to record the following...Ch. 5 - Prob. 3BPSBCh. 5 - Prob. 4BPSBCh. 5 - Prob. 5BPSBCh. 5 - Problem 5-6BE Refer to the data and information in...Ch. 5 - Prob. 5SPCh. 5 - Prob. 1GLPCh. 5 - Prepare journal entries to record the following...Ch. 5 - Based on Problem 5-5A Problem 5-5A Preparing...Ch. 5 - Prob. 1BTNCh. 5 - Prob. 2BTNCh. 5 - Prob. 3BTNCh. 5 - Prob. 4BTNCh. 5 - Prob. 5BTNCh. 5 - Prob. 6BTNCh. 5 - Prob. 7BTNCh. 5 - Prob. 8BTNCh. 5 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume that the business in Exercise 7-3 maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 5.arrow_forwardAssume that the business in Exercise 7-9 maintains a perpetual inventory system. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, assuming the first-in, first-out method. Present the data in the form illustrated in Exhibit 3.arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) Every entry should have narration please Prepare journal entries to record the following merchandising transactions of Cabela’s, which uses the perpetual inventory system and the gross method. Hint: It will help to identify each receivable and payable; for example, record the purchase on July 1 in Accounts Payable—Boden. July 1 Purchased merchandise from Boden Company for $7,000 under credit terms of 2/15, n/30, FOB shipping point, invoice dated July 1. July 2 Sold merchandise to Creek Company for $1,000 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $583. July 3 Paid $130 cash for freight charges on the purchase of July 1. July 8 Sold merchandise that had cost $2,300 for $2,700 cash. July 9 Purchased…arrow_forward

- Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entries to these T-accounts (don’t forget to enter the beginning balances in your inventory accounts). Prepare an income statement. All of the information needed for the income statement is available in the journal entries and T-accounts you have prepared.arrow_forwardInstructions: a. Prepare the cost flow assumption table for Hasellhouf Company's merchandise inventory using FIFO method (2 decimals rounding). b. Journalize the transactions above using perpetual method and make the necessary adjustments and make the necessary adjustments for depreciation (using the straight-line method), insurance, supplies, and interests c. Post all the entries to the general ledgers. d. Prepare multiple-step income statement, owner's equity statement, and balance sheet. e. Journalize the closing entries.arrow_forwardThe cost accountant for Sunset Fashions has compiled the following information for last quarter's operations: Administrative costs Merchandise inventory, April 1 Merchandise inventory, June 30 Merchandise purchases Miscellaneous store costs Sales commissions Sales revenue Store lease Utilities Transportation-in costs Wages and benefits Required: 1. Prepare a cost of goods sold statement. 2. Prepare an income statement. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement. SUNSET FASHIONS Income Statement For the Quarter Ended June 30 Sales revenue Cost of goods sold Gross margin Store rent Operating loss $ $ $ 232,000 55,000 45,500 1,790,000 23,400 134,400 3,126,000 53,000 57,900 124,400 770,000 $ 3,126,000 1,923,900 1,202,100 53,000 68,400arrow_forward

- now how the three inventory accounts are reported on the April 30 balance sheet. Complete this question by entering your answers in the tabs below. Req 5A Req 5B Show how the three inventory accounts are reported on the April 30 balance sheet. Raw materials Work in process Finished goods Inventories Total inventories N 8 huluarrow_forwardUnder a perpetual inventory system, the journal entry needed to record the sale of a job includes a Question 41 options: debit to Cost of Goods Sold account and credit to Sales Revenue account. debit to Sales Revenue account and credit to Accounts Receivable account. debit to Accounts Receivable account and credit to Sales Revenue account. debit to Finished Goods Inventory account and credit to Cost of Goods Sold account.arrow_forwardSYSTEM DOCUMENTATION-EXPENDITURE CYCLE (MANUAL PROCEDURES)The following describes the expenditure cycle manual procedures for a hypothetical company. The inventory control clerk examines the inventory records for items that must be replenished and prepares a two-part purchase requisition. Copy 1 of the requisition is sent to the purchasing department, and Copy 2 is filed. Upon receipt of the requisition, the purchasing clerk selects a supplier from the valid vendor file (reference file) and prepares a three-part purchase order. Copy 1 is sent to the supplier,Copy 2 is sent to the AP department where it is filed temporarily, and Copy 3 is filed in the purchasing department. A few days after the supplier ships the order, the goods arrive at the receiving department. They are inspected, and the receiving clerk prepares a three-part receiving report describing the number and quality of the items received. Copy 1 of the receiving report accompanies the goods to the stores, where they are…arrow_forward

- A manufacturer’s Raw Materials Inventory account appears as follows: Raw Materials Inventory Debit Credit Beginning 25,700 Purchases 100,700 82,800 Direct materials used 15,700 Indirect materials used Ending 27,900 All raw materials purchases are made on credit. Prepare journal entries to record the:1. Purchase of raw materials.2. Direct materials used.3. Indirect materials used.arrow_forwardInstructions In this assignment you will record eight transactions related to the sale and purchase of merchandise. You will record each transaction according to the procedures of a periodic inventory system. You will record each transaction according to the procedures of a perpetual inventory system. Include the date for each transaction. Include a brief explanation for each entry similar to the sample entry example. Please skip a line between each transaction entry. You may use the journals provided or create your own journals. If you create your own journals they must have a date column, description column, a debit column and a credit column. You may hand write the journal entries or type them. Transactions to Record Sample Ace Company issues a $200 Sales Allowance to a customer who received damaged merchandise purchased in Feb from Ace. Mar 1 Ace Company sells merchandise totaling $1,500 on account with terms 2/15, n/30, FOB destination. Cost of goods is…arrow_forwardIn preparing closing entries for a merchandising company, the Income Summary account will be credited for the balance of freight-out. O sales revenue. ● sales discounts. ● inventory.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License