EBK CONTEMPORARY ENGINEERING ECONOMICS

6th Edition

ISBN: 9780134123950

Author: Park

Publisher: PEARSON CUSTOM PUB.(CONSIGNMENT)

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 9P

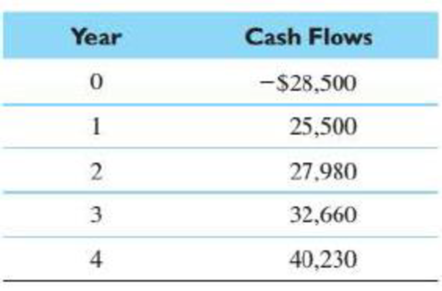

Consider the cash flows from an investment project.

- (a) Compute the net present worth of the project at i = 10%.

- (b) Plot the present worth as a function of the interest rate (from 0% to 30%).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The interest rate earned on an investment in an asset is called

Group of answer choices

a. The capital output ratio.

b. The rate of return.

c. The risk quotient.

d. Capitalization.

e. Depreciation.

Are the investment decisions based solely on an estimate of a project's profitability?

NextGen Wealth Ltd is a large manufacturing firm Ghana, that was created 20 years ago by Opanin Nsiah’s family. It was initially financed with an equity investment by the Opanin Nsiah family and ten other individuals. Over time, NextGen Wealth Ltd has obtained substantial loans from finance companies and commercial banks. The loans that NextGen Wealth Ltd has obtained from commercial banks stipulate that NextGen Wealth Ltd must receive the banks’ approval before pursuing any large projects. The interest rate on the loans is tied to market interest rates, and is adjusted every six months. Thus, NextGen Wealth Ltd.’s cost of obtaining funds is sensitive to interest rate movements. It has a credit line with a bank in case it suddenly needs to obtain funds for a temporary period. It has purchased Treasury securities that it could sell if it experiences any liquidity problems. NextGen Wealth Ltd has assets valued at about Gh₵50 million and generates sales of about Gh₵100 million per year.…

Chapter 5 Solutions

EBK CONTEMPORARY ENGINEERING ECONOMICS

Ch. 5 - Prob. 1PCh. 5 - Prob. 2PCh. 5 - If a project costs 100,000 and is expected to...Ch. 5 - Refer to Problem 5.2, and answer the following...Ch. 5 - Prob. 5PCh. 5 - Prob. 6PCh. 5 - Prob. 7PCh. 5 - Prob. 8PCh. 5 - Consider the cash flows from an investment...Ch. 5 - Prob. 10P

Ch. 5 - Prob. 11PCh. 5 - Prob. 12PCh. 5 - Prob. 13PCh. 5 - Prob. 14PCh. 5 - Prob. 15PCh. 5 - Prob. 16PCh. 5 - Prob. 17PCh. 5 - Prob. 18PCh. 5 - Consider the project balances in Table P5.19 for a...Ch. 5 - Your RD group has developed and tested a computer...Ch. 5 - Prob. 21PCh. 5 - Prob. 22PCh. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 - Prob. 25PCh. 5 - Prob. 26PCh. 5 - Prob. 27PCh. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Prob. 30PCh. 5 - Prob. 31PCh. 5 - Prob. 32PCh. 5 - Geo-Star Manufacturing Company is considering a...Ch. 5 - Prob. 34PCh. 5 - Prob. 35PCh. 5 - Prob. 36PCh. 5 - Prob. 37PCh. 5 - Prob. 38PCh. 5 - Prob. 39PCh. 5 - Prob. 40PCh. 5 - Prob. 41PCh. 5 - Prob. 42PCh. 5 - Two methods of carrying away surface runoff water...Ch. 5 - Prob. 44PCh. 5 - Prob. 45PCh. 5 - Prob. 46PCh. 5 - Prob. 47PCh. 5 - Prob. 48PCh. 5 - Prob. 49PCh. 5 - Prob. 50PCh. 5 - Prob. 51PCh. 5 - Prob. 52PCh. 5 - Prob. 53PCh. 5 - Prob. 54PCh. 5 - Prob. 55PCh. 5 - Prob. 56PCh. 5 - Prob. 57PCh. 5 - Prob. 58PCh. 5 - Prob. 59PCh. 5 - Prob. 1STCh. 5 - Prob. 2ST

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

Determine the price elasticity of demand if, in response to an increase in price of 10 percent, quantity demand...

Microeconomics

• Illustrate and interpret shifts in the short-run and long-run aggregate supply curves.

Economics of Money, Banking and Financial Markets, The, Business School Edition (4th Edition) (The Pearson Series in Economics)

Suppose the own price elasticity of demand for good X is -3, its income elasticity is 1, its advertising elasti...

Managerial Economics & Business Strategy (Mcgraw-hill Series Economics)

Using the midpoint formula, calculate elasticity for each of the following changes in demand.

Principles of Economics (12th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- To finance a new project costing $45 million, a company borrowed $31 million at 16% per year interest and used retained earnings valued at 12% per year for the remainder of the investment. What is the company’s weighted average cost of capital for the project?arrow_forwardIdentify the special cash flow category for each of the following. While developing a new product line, Cook Company spent $3 million two years ago to build a plant for a new product. Ultimately that project was not pursued. You are now evaluating a new project and would locate production inside of this building. What type of cash flow is the cost of the building? You hope to increase membership at your yoga studio by opening a smoothie bar inside of the yoga studio. When considering the feasibility of the smoothie bar, what type of cash flow is the increased studio membership? Suppose Walker Publishing Company is considering bringing out a new finance text whose projected revenues include some revenues that will be taken away from another of Walker's books. What type of cash flow are the lost sales on the older book? You currently operate a taco truck but are considering converting the food truck into a bubble tea truck. What type of cash flow are the profits currently earned…arrow_forwardWhat process does the net present value method use to help management determine whether a project is acceptable to a company? Options : A. It discounts net cash flows to their present value and then compares that value to the capital outlay required by the project.B. It determines the interest rate that will cause the present value of the capital expenditure to equal the present value of the expected net cash flows.C. It divides the present value of net cash flows by the initial investment to determine the profitability index of the project.D. It identifies the time period required to recover the cost of the capital investment from the net annual cash flow produced by the project.arrow_forward

- Describe the net future worth of the project?arrow_forwardConduct a feasibility study for a project that your company is considering. Your report should focus on a financial or economic evaluation of the projectarrow_forwardThe investor-developer would not be comfortable with a 7.8 percent return on cost because the margin for error is too risky. If construction costs are higher or rents are lower than anticipated, the project may not be feasible. The asking price of the project is $4,600,000 and the construction cost per unit is $80,400. The current rent to justify the land acqusition is $1.3 per square foot. The weighted average is 900 square feet per unit. Average vacancy and Operating expenses are 5% and 35% of Gross Revenue respectively. Use the following data to rework the calculations in Concept Box 16.2 in order to assess the feasibility of the project: Required: a. Based on the fact that the project appears to have 9,360 square feet of surface area in excess of zoning requirements, the developer could make an argument to the planning department for an additional 10 units, 250 units in total, or 25 units per acre. What is the percentage return on total cost under the revised proposal? Is the…arrow_forward

- Engineering Economics Bawal gumamit ng excel( Don't use Excel) A firm is considering the development of several new products. The products under consideration are listed here; the products in each project group are mutually exclusive. (Insert Table) At most one product from each group will be selected. The firm has MARR of 10% per year and a capital investment budget limitation on development costs of P2,100,000. the life of all products is assumed to be ten (10) years. Assume no market values at the end of 10 years.arrow_forwardFor mutually exclusive projects, the internal rate of return and the net present value give consistent accept/reject decisions if: A.the investment projects have identical cash flows in the final year. B.the required rate of return is less than the discount rate, which causes the net present value profiles of the two projects to intersect. C.the net present value profiles for both projects do not intersect. D.the investment projects have equal lives.arrow_forwardIt is the sum of all costs that are incurred periodically and continuously in order that the project in which an investment has been made may be operated, produce a commodity or service and distribute and sell that commodity or service. Salvage cost Profit Operating cost Fixed costarrow_forward

- A water supply cooperative plans to increase its water supply by 8.5 million gallons per day to meet increasing demand. One alternative is to spend $10 million to increase the size of an existing reservoir in an environmentally acceptable way. Added annual upkeep will be $25,000 for this option. A second option is to drill new wells and provide added pipelines for transportation to treatment facilities at an initial cost of $1.5 million and annual cost of $120,000. The reservoir is expected to last indefinitely, but the productive well life is only 10 years. Compare the alternatives at 5% per year.arrow_forwardA financial investor has an investment portfolio. A bond in her investment portfolio will mature next month and provide her $25,000 to reinvest. The choices for reinvestment have been narrowed to the following two options:Option 1: Reinvest in a foreign bond that will mature in one year. Thistransaction will entail a brokerage fee of $150. For simplicity, assume thatthe bond will provide interest over the one-year period of $2,450, $2,000, or $1,675 and that the probabilities of these occurrences are assessed to be 0.25, 0.45, and 0.30, respectively.Option 2: Reinvest in a $25,000 certificate with a savings and loan association.Assume that this certificate has an effective annual rate of 7.5%.Which form of reinvestment should the investor choose in order to maximize her expected financial gain?arrow_forwardCalculate the LCOE of the following power plants. Assume a useful life of 25 years and a discount rate of 5% for all plants, for simplicity. Report the LCOE for each plant.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Break Even Analysis (BEP); Author: Tutorials Point (India) Ltd.;https://www.youtube.com/watch?v=wOEkc3O_Q_Y;License: Standard YouTube License, CC-BY

Cost Volume Profit Analysis (CVP): calculating the Break Even Point; Author: Edspira;https://www.youtube.com/watch?v=Nw2IioaF6Lc;License: Standard Youtube License