Contemporary Engineering Economics Plus MyLab Engineering with eText -- Access Card Package (6th Edition)

6th Edition

ISBN: 9780134162690

Author: Chan S. Park

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 10P

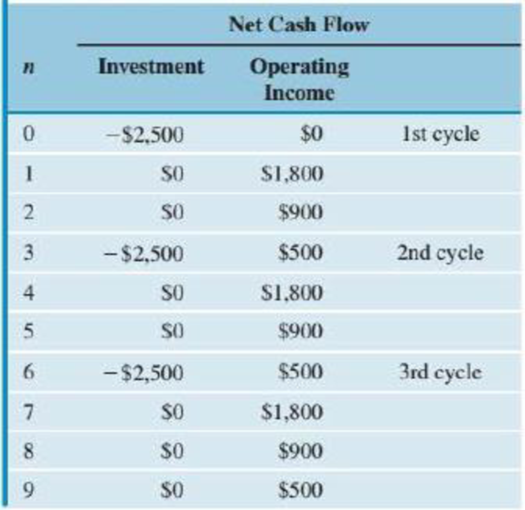

The repeating cash flows for a certain project are as given in Table P6.10. Find the equivalent annual worth for this project at i = 10%, and determine the acceptability of the project.

TABLE P6.10

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A UK manufacturer of particle board furniture is considering investing in a new stamping machine. The machine is expected to have a useful life of five years, after which the machine can be sold as scrap for an estimated £5000. The firm plans to issue bonds to pay for the machine and intends to treat the interest rate on the bonds as the relevant discount rate for evaluating the project. The machine will cost the firm £175,000, all of which must be paid at the beginning of the project. The new stamping machine will reduce costs £50,000 per year, for each year of the machineʹs life. The firm treats all the cost savings as if they occur at year end. Should the firm plan to undertake the investment project, bonds will be issued in approximately three months. The firm has estimated the supply and demand for loanable funds given by these equations:LD = 25,000,000 - 125,000,000r LS = 2,500,000 + 62,500,000r(1) Given the information above, should the firm undertake the investment in the…

Advanced Electrical Insulator Company is considering replacing a brokeninspection machine, which has been used to test the mechanical strength of electrical insulators with a newer and more efficient one. If repaired, the old machine can be used for another five years although the firm does not expect to realize any salvage value from scrapping it in five years. Alternatively, the firm can sell the machine to another firm in the industry now for $5,000. If the machine is kept, it will require an immediate $1,200 overhaul to restore it to operable condition. The overhaul will neither extend the service life originally estimated nor increase the value of the inspection machine. The operating costs are estimated at $2,000 during the first year and are expected to increase by $1,500 per year thereafter. Future market values are expected to decline by $1,000 per year. The new machine costs $10,000 and will have operating costs of $2,000 in the first year, increasing by $800 per year…

Consider the following cash flow data for two competing investment projects:

(a) At i = 12%, which of the two projects would be a better choice?{b)At i = 22%, which project is chosen by the NPW rule?

Chapter 6 Solutions

Contemporary Engineering Economics Plus MyLab Engineering with eText -- Access Card Package (6th Edition)

Ch. 6 - Prob. 1PCh. 6 - Prob. 2PCh. 6 - Prob. 3PCh. 6 - Prob. 4PCh. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Consider the cash flows in Table P6.7 for the...Ch. 6 - Prob. 8PCh. 6 - Prob. 9PCh. 6 - The repeating cash flows for a certain project are...

Ch. 6 - Beginning next year, a foundation will support an...Ch. 6 - Prob. 12PCh. 6 - Prob. 13PCh. 6 - Prob. 14PCh. 6 - Prob. 15PCh. 6 - Prob. 16PCh. 6 - Prob. 17PCh. 6 - Prob. 18PCh. 6 - The Geo-Star Manufacturing Company is considering...Ch. 6 - Prob. 20PCh. 6 - Prob. 21PCh. 6 - Prob. 22PCh. 6 - Prob. 23PCh. 6 - Prob. 24PCh. 6 - Prob. 25PCh. 6 - Prob. 26PCh. 6 - Prob. 27PCh. 6 - Prob. 28PCh. 6 - Prob. 29PCh. 6 - Prob. 30PCh. 6 - Prob. 31PCh. 6 - Prob. 32PCh. 6 - Prob. 33PCh. 6 - Prob. 34PCh. 6 - Prob. 35PCh. 6 - Prob. 36PCh. 6 - Prob. 37PCh. 6 - Prob. 38PCh. 6 - Prob. 39PCh. 6 - Prob. 40PCh. 6 - Prob. 41PCh. 6 - Prob. 42PCh. 6 - Prob. 43PCh. 6 - Prob. 44PCh. 6 - Prob. 45PCh. 6 - Prob. 46PCh. 6 - Prob. 47PCh. 6 - Prob. 48PCh. 6 - Prob. 49PCh. 6 - Prob. 50PCh. 6 - Prob. 51PCh. 6 - Prob. 52PCh. 6 - Prob. 53PCh. 6 - Prob. 1STCh. 6 - Prob. 2STCh. 6 - Prob. 3STCh. 6 - Prob. 4ST

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider the following two mutually exclusive service projects with projectlives of three years and two years, respectively. (The mutually exclusive service projects will have identical revenues for each year of service.) The interest rate is known to be 12%. Net Cash Flow End of Year Project A Project B 0 -$1,000 -$800 1 -400 -200 2 -400 -200+0 3 -400+200 If the required service period is six years and both projects can be repeated with the given costs and better service projects are unavailable in the future, which project is better and why? Choose from the following options:(a) Select Project B because it will save you $344 in present worth over the required service period.(b) Select Project A because it will cost $1,818…arrow_forwardYour company is considering a new computer system with an initial cost of $1 million. When implemented, the system will save $300,000 per year in inventory and administration costs. The system has a service life of five years and is classified in the three-year MACRS category. At the end of the fifth year, its residual value was estimated at $50,000. The system has no impact on net working capital. The marginal tax rate is 40 per cent. The required rate of return is 8 per cent.arrow_forwardA small manufacturing firm is considering the purchase of a new machine to modernize one of its current production lines. Two types of machines are available on the market. The lives of Machine A and Machine B are four years and six years, respectively, but the firm does not expect to need the service of either machine for more than five years. The machines have the following expected receipts and disbursements: After four years of use, the salvage value for Machine B will be $1,000. The firm always has another option: to lease a machine at $3,000 per year, fully maintained by the leasing company. The lease payment will be made at the beginning of each year.(a) How many decision alternatives are there?(b) Which decision appears to be the best at i = 10%?arrow_forward

- Smith and Co. has to choose between two mutually exclusive projects. If it chooses project A, Smith and Co. will have the opportunity to make a similar investment in three years. However, if it chooses project B, it will not have the opportunity to make a second investment. The following table lists the cash flows for these projects. If the firm uses the replacement chain (common life) approach, what will be the difference between the net present value (NPV) of project A and project B, assuming that both projects have a weighted average cost of capital of 10%? Cash Flow Project A Project B Year 0: –$17,500 Year 0: –$40,000 Year 1: 10,000 Year 1: 8,000 Year 2: 16,000 Year 2: 16,000 Year 3: 15,000 Year 3: 15,000 Year 4: 12,000 Year 5: 11,000 Year 6: 10,000 $15,731 $11,012 $12,585 $9,439 $14,158 Smith and Co. is considering a three-year project that has a weighted average cost of capital…arrow_forwardYou have been asked to evaluate the profitability of building a new distribution center under the following conditions:I. The proposal is for a distribution center costing $1,500,000. The facility has an expected useful life of 35 years and a net salvage value (net proceeds from its sale after tax adjustments) of $225,000.II. Annual savings (due to a better strategic location) of $227,000 are expected, annual maintenance and administrative costs will be $114,000, and annual income taxes are $43,000. Suppose that the firm's MARR is 12%. Determine the net present worth of the investment.arrow_forwardCT Corp. is considering two mutually exclusive projects. Both require an initial investment of P120,000 at t = 0. Project X has an expected life of 2 years with after-tax cash inflows of P67,000 and P75,000 at the end of Years 1 and 2, respectively. In addition, Project X can be repeated at the end of Year 2 with no changes in its cash flows. Project Y has an expected life of 4 years with after-tax cash inflows of P38,500 at the end of each of the next 4 years. Each project has a WACC of 8%. Listed below are the requirements for this data set: Using the replacement chain approach, how much is the NPV of Project X? (Round the final answer to the nearest peso. Use the "NPV formula" in excel for exact computation. Otherwise, answer based on rounded pv factors will also be accepted.) Which of the two projects will be more profitable considering the replacement chain approach on the NPV of Project X? Using the equivalent annuity approach, what is the equivalent annuity of Project Y?…arrow_forward

- A machine tool company is considering a new investment in a punch pressmachine that will cost $100,000 and has an annual maintenance cost of $10,000. There is also an additional overhauling cost of $20,000 for the equipment once every four years. Assuming that this equipment will last 12 years under these conditions, what is the cost of owning and maintaining the punch press at an interest rate of 10%?arrow_forwardConsider the following two mutually exclusive investment projects that have unequal service lives: (a) What assumption(s) do you need in order to compare a set of mutually exclusive investments with unequal service lives?(b) With the assumption(s) defined in (a) and using i = 10%, determine which project should be selected.(c) If your analysis period (study period) is just three years, what should bethe salvage value of Project B at the end of year 3 in order to make the twoalternatives economically indifferent?arrow_forwardA radiology clinic is considering buying a new $700,000 x-ray machine, which will have no salvage value after installation because the cost of removal will be approximately equal to its sales value. Maintenance is estimated at $24,000 per year as long as the machine is owned. After 10 years the x-ray source will be depleted and the machine must be scrapped. Which of the following represents the most economic life of this x-ray machine? Solve a.One year, because it will have no salvage after installation b. Five years, because the maintenance costs are constant c. Ten years, because maintenance costs don't increase d. Cannot be determined from the information given.arrow_forward

- A machine is under consideration for investment. The cost of the machine is 28,000. Each year it operates the machine generate a savings of P16,000. Given an effective annual interest rate of 16%. What is the discounted payback period in years, on the investment in the machine? Show complete solution.arrow_forwardYou are considering purchasing a new punch press machine. This machine will have an estimated service life of 10 years. The expected after-tax salvage value at the end of service life will be 10% of the purchase cost. Its annual after-tax operating cash flows are estimated to be $60,000. If you can purchase the machine at $308,758, what is the expected rate of return on this investment?(a) 12%(b) 13.6%(c) 15%(d) 17.2%arrow_forwardConsider the following two mutually exclusive projects: (a) At an interest rate of 25%, which project would you recommend choosing?(b) Compute the area of negative project balance, discounted payback period, and area of positive project balance for each project. Which project isexposed to a higher risk of loss if either project terminates at the end ofyear 2?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Break Even Analysis (BEP); Author: Tutorials Point (India) Ltd.;https://www.youtube.com/watch?v=wOEkc3O_Q_Y;License: Standard YouTube License, CC-BY

Cost Volume Profit Analysis (CVP): calculating the Break Even Point; Author: Edspira;https://www.youtube.com/watch?v=Nw2IioaF6Lc;License: Standard Youtube License