Concept explainers

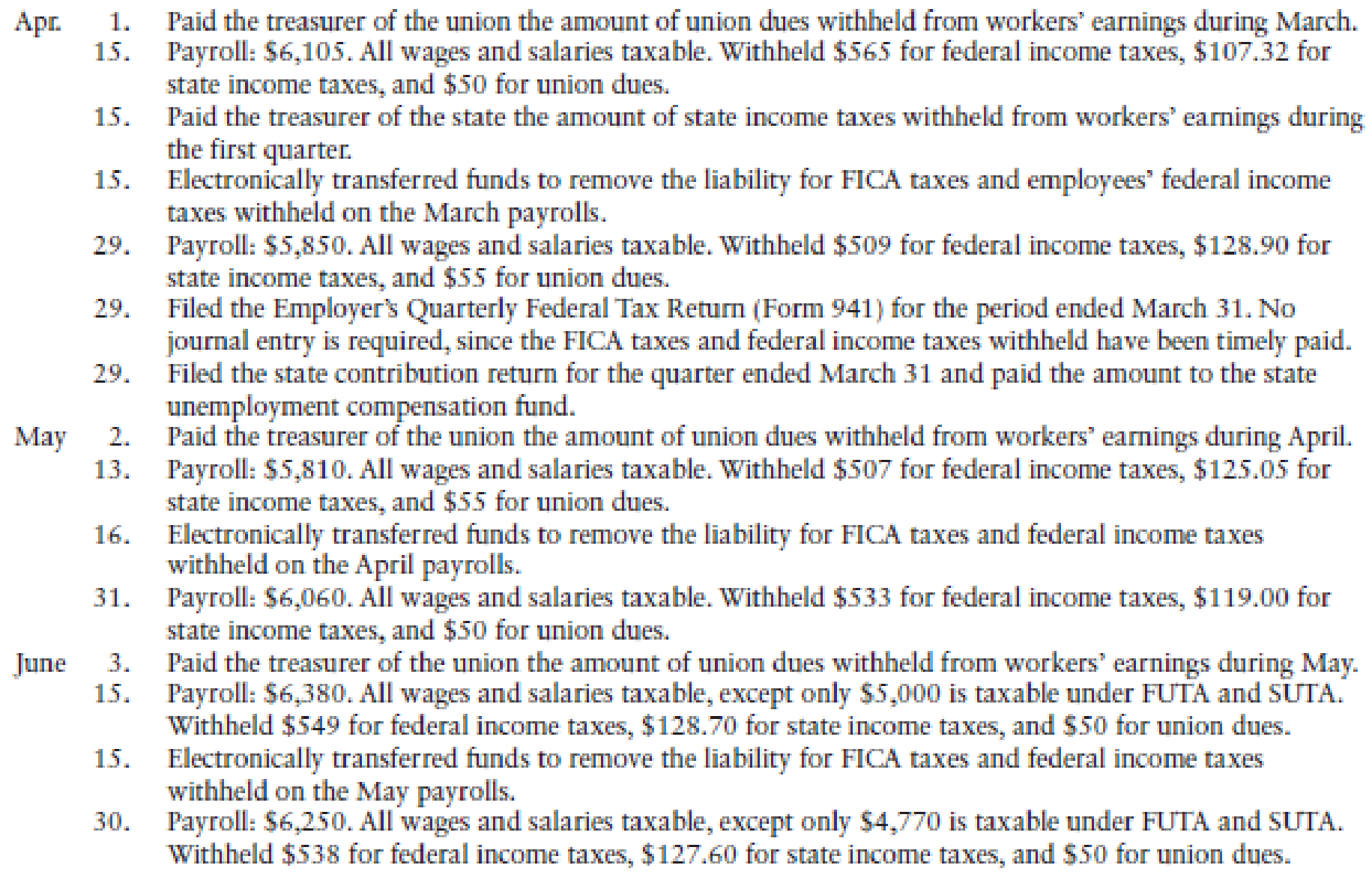

In the Illustrative Case in this chapter, payroll transactions for Brookins Company were analyzed, journalized, and posted for the third quarter of the fiscal year. In this problem, you are to record the payroll transactions for the last quarter of the firm’s fiscal year. The last quarter begins on April 1, 20--.

Refer to the Illustrative Case on pages 6-27 to 6-33 and proceed as follows:

- a. Analyze and journalize the transactions described in the following narrative. Use the two-column journal paper provided on pages 6-49 to 6-53. Omit the writing of explanations in the

journal entries . - b.

Post the journal entries to the general ledger accounts on pages 6-54 to 6-59.

Narrative of Transactions:

- c. Answer the following questions:

- 1. The total amount of the liability for FICA taxes and federal income taxes withheld as of June 30 is................................................................................ $ __________

- 2. The total amount of the liability for state income taxes withheld as of June 30 is....................................................................................................... $ __________

- 3. The amount of FUTA taxes that must be paid to the federal government on or before August 1 (assume July 31 is a Sunday) is........................................ $ __________

- 4. The amount of contributions that must be paid into the state

unemployment compensation fund on or before August 1 is.................................................. $ __________ - 5. The total amount due the treasurer of the union is........................................ $ __________

- 6. The total amount of wages and salaries expense since the beginning of the fiscal year is.................................................................................................... $ __________

- 7. The total amount of payroll taxes expense since the beginning of the fiscal year is............................................................................................................. $ __________

- 8. Using the partial journal below, journalize the entry to record the vacation accrual at the end of the company’s fiscal year. The amount of Brookins Company’s vacation accrual for the fiscal year is $15,000.

a.

Journalize the given transactions in the books of Company B.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Journalize the given transactions in the books of Company B.

| Page: 19 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 1 | Union Dues Payable | 28 | 100 | ||

| Cash | 11 | 100 | ||||

| (Record cash paid for the union dues) | ||||||

| 15 | Wages and Salaries | 51 | 6,105.00 | |||

| FICA Taxes Payable-OASDI | 20 | 378.51 | ||||

| FICA taxes Payable-HI | 21 | 88.52 | ||||

| Employees FIT Payable | 25 | 565.00 | ||||

| Employees SIT Payable | 26 | 107.32 | ||||

| Union Dues Payable | 28 | 50.00 | ||||

| Cash | 11 | 4,915.65 | ||||

| (Record payment of wages and salaries and the employees’ withheld taxes) | ||||||

| 15 | Payroll Taxes | 55 | 645.11 | |||

| FICA Taxes Payable-OASDI | 20 | 378.51 | ||||

| FICA taxes Payable-HI | 21 | 88.52 | ||||

| FUTA Taxes Payable | 22 | 36.63 | ||||

| SUTA Taxes Payable | 23 | 141.45 | ||||

| (Record payroll taxes and the employer’s withheld taxes) | ||||||

| 15 | Employees SIT Payable | 26 | 546.92 | |||

| Cash | 11 | 546.92 | ||||

| (Record payment of state unemployment taxes) | ||||||

| 15 | FICA Taxes Payable-OASDI | 20 | 1,068.88 | |||

| FICA taxes Payable-HI | 21 | 249.98 | ||||

| Employees FIT Payable | 25 | 1,124.00 | ||||

| Cash | 11 | 2,442.86 | ||||

| (Record payment of taxes withheld on March payrolls) | ||||||

| 29 | Wages and Salaries | 51 | 5,850.00 | |||

| FICA Taxes Payable-OASDI | 20 | 362.70 | ||||

| FICA taxes Payable-HI | 21 | 84.83 | ||||

| Employees FIT Payable | 25 | 509.00 | ||||

| Employees SIT Payable | 26 | 128.90 | ||||

| Union Dues Payable | 28 | 55.00 | ||||

| Cash | 11 | 4,709.57 | ||||

| (Record payment of wages and salaries and the employees’ withheld taxes) | ||||||

| 29 | Payroll Taxes | 55 | 617.18 | |||

| FICA Taxes Payable-OASDI | 20 | 362.70 | ||||

| FICA taxes Payable-HI | 21 | 84.83 | ||||

| FUTA Taxes Payable | 22 | 35.10 | ||||

| SUTA Taxes Payable | 23 | 134.55 | ||||

| (Record payroll taxes and the employer’s withheld taxes) | ||||||

| 29 | SUTA Taxes Payable | 23 | 571.78 | |||

| Cash | 11 | 571.78 | ||||

| (Record payment of SUTA taxes for the quarter ended March 31) | ||||||

| May | 2 | Union Dues Payable | 28 | 105 | ||

| Cash | 11 | 105 | ||||

| (Record cash paid for the union dues) | ||||||

| Page: 20 | ||||||

| 13 | Wages and Salaries | 51 | 5,810.00 | |||

| FICA Taxes Payable-OASDI | 20 | 360.22 | ||||

| FICA taxes Payable-HI | 21 | 84.25 | ||||

| Employees FIT Payable | 25 | 507.00 | ||||

| Employees SIT Payable | 26 | 125.05 | ||||

| Union Dues Payable | 28 | 55.00 | ||||

| Cash | 11 | 4,678.48 | ||||

| (Record payment of wages and salaries and the employees’ withheld taxes) | ||||||

| 13 | Payroll Taxes | 55 | 612.96 | |||

| FICA Taxes Payable-OASDI | 20 | 360.22 | ||||

| FICA taxes Payable-HI | 21 | 84.25 | ||||

| FUTA Taxes Payable | 22 | 34.86 | ||||

| SUTA Taxes Payable | 23 | 133.63 | ||||

| (Record payroll taxes and the employer’s withheld taxes) | ||||||

| 16 | FICA Taxes Payable-OASDI | 20 | 1,482.42 | |||

| FICA taxes Payable-HI | 21 | 346.70 | ||||

| Employees FIT Payable | 22 | 1,074.00 | ||||

| Cash | 11 | 2,903.12 | ||||

| (Record payment of taxes withheld on April 15th and 29th payrolls) | ||||||

| 31 | Wages and Salaries | 51 | 6,060.00 | |||

| FICA Taxes Payable-OASDI | 20 | 375.72 | ||||

| FICA taxes Payable-HI | 21 | 87.87 | ||||

| Employees FIT Payable | 25 | 533.00 | ||||

| Employees SIT Payable | 26 | 119.00 | ||||

| Union Dues Payable | 28 | 50.00 | ||||

| Cash | 11 | 4,894.41 | ||||

| (Record payment of wages and salaries and the employees’ withheld taxes) | ||||||

| 31 | Payroll Taxes | 55 | 639.33 | |||

| FICA Taxes Payable-OASDI | 20 | 375.72 | ||||

| FICA taxes Payable-HI | 21 | 87.87 | ||||

| FUTA Taxes Payable | 22 | 36.36 | ||||

| SUTA Taxes Payable | 23 | 139.38 | ||||

| (Record payroll taxes and the employer’s withheld taxes) | ||||||

| Page: 21 | ||||||

| June | 3 | Union Dues Payable | 28 | 105 | ||

| Cash | 11 | 105 | ||||

| (Record cash paid for the union dues) | ||||||

| 15 | Wages and Salaries | 51 | 6,380.00 | |||

| FICA Taxes Payable-OASDI | 20 | 395.56 | ||||

| FICA taxes Payable-HI | 21 | 92.51 | ||||

| Employees FIT Payable | 25 | 549.00 | ||||

| Employees SIT Payable | 26 | 128.70 | ||||

| Union Dues Payable | 28 | 50.00 | ||||

| Cash | 11 | 5,164.23 | ||||

| (Record payment of wages and salaries and the employees’ withheld taxes) | ||||||

| 15 | Payroll Taxes | 55 | 633.07 | |||

| FICA Taxes Payable-OASDI | 20 | 395.56 | ||||

| FICA taxes Payable-HI | 21 | 92.51 | ||||

| FUTA Taxes Payable | 22 | 30.00 | ||||

| SUTA Taxes Payable | 23 | 115.00 | ||||

| (Record payroll taxes and the employer’s withheld taxes) | ||||||

| 15 | FICA Taxes Payable-OASDI | 20 | 1,471.88 | |||

| FICA taxes Payable-HI | 21 | 344.24 | ||||

| Employees FIT Payable | 25 | 1,040.00 | ||||

| Cash | 11 | 2,856.12 | ||||

| (Record payment of taxes withheld on May 13th and 31st payrolls) | ||||||

| 30 | Wages and Salaries | 51 | 6,250.00 | |||

| FICA Taxes Payable-OASDI | 20 | 387.50 | ||||

| FICA taxes Payable-HI | 21 | 90.63 | ||||

| Employees FIT Payable | 25 | 538.00 | ||||

| Employees SIT Payable | 26 | 127.60 | ||||

| Union Dues Payable | 28 | 50.00 | ||||

| Cash | 11 | 5,056.27 | ||||

| (Record payment of wages and salaries and the employees’ withheld taxes) | ||||||

| 30 | Payroll Taxes | 55 | 616.46 | |||

| FICA Taxes Payable-OASDI | 20 | 387.50 | ||||

| FICA taxes Payable-HI | 21 | 90.63 | ||||

| FUTA Taxes Payable | 22 | 28.62 | ||||

| SUTA Taxes Payable | 23 | 109.71 | ||||

| (Record payroll taxes and the employer’s withheld taxes) | ||||||

Table (1)

Working Notes:

Compute FICA taxes, total deductions, and net pay for April 15th.

| Details | Amount ($) | Amount ($) | Amount ($) |

| Payroll | $6,105.00 | ||

| Deductions: | |||

| Taxable pay for OASDI | $6,105 | ||

| FICA–OASDI tax rate | × 6.2% | $378.51 | |

| Taxable pay for HI | $6,105 | ||

| FICA–HI tax rate | × 1.45% | 88.52 | |

| Federal income taxes withheld | 565.00 | ||

| State income taxes withheld | 107.32 | ||

| Union dues withheld | 50.00 | ||

| Total deductions | (1,189.35) | ||

| Net pay | $4,915.65 |

Table (2)

Compute total employer payroll taxes for April 15th.

| Details | Amount ($) | Amount ($) |

| Gross pay | $6,105 | |

| FICA-OASDI tax rate | × 6.2% | |

| FICA-OASDI tax expense | $378.51 | |

| Gross pay | $6,105 | |

| FICA-HI tax rate | × 1.45% | |

| FICA-HI tax expense | 88.52 | |

| Taxable pay | $6,105 | |

| FUTA tax rate | × 0.6% | |

| FUTA tax expense | 36.63 | |

| Taxable pay | $6,105 | |

| SUTA tax rate (state contribution rate) | × 2.3% | |

| SUTA tax expense | 140.42 | |

| Total employer’s payroll taxes | $644.08 |

Table (3)

Compute FICA taxes, total deductions, and net pay for April 29th.

| Details | Amount ($) | Amount ($) | Amount ($) |

| Payroll | $5,850.00 | ||

| Deductions: | |||

| Taxable pay for OASDI | $5,850 | ||

| FICA–OASDI tax rate | × 6.2% | $362.70 | |

| Taxable pay for HI | $5,850 | ||

| FICA–HI tax rate | × 1.45% | 84.83 | |

| Federal income taxes withheld | 509.00 | ||

| State income taxes withheld | 128.90 | ||

| Union dues withheld | 55.00 | ||

| Total deductions | (1,140.43) | ||

| Net pay | $4,709.57 |

Table (4)

Compute total employer payroll taxes for April 29th.

| Details | Amount ($) | Amount ($) |

| Gross pay | $5,850 | |

| FICA-OASDI tax rate | × 6.2% | |

| FICA-OASDI tax expense | $362.70 | |

| Gross pay | $5,850 | |

| FICA-HI tax rate | × 1.45% | |

| FICA-HI tax expense | 84.83 | |

| Taxable pay | $5,850 | |

| FUTA tax rate | × 0.6% | |

| FUTA tax expense | 35.10 | |

| Taxable pay | $5,850 | |

| SUTA tax rate (state contribution rate) | × 2.3% | |

| SUTA tax expense | 134.55 | |

| Total employer’s payroll taxes | $617.18 |

Table (5)

Compute FICA taxes, total deductions, and net pay for May 13th.

| Details | Amount ($) | Amount ($) | Amount ($) |

| Payroll | $5,810.00 | ||

| Deductions: | |||

| Taxable pay for OASDI | $5,810 | ||

| FICA–OASDI tax rate | × 6.2% | $360.22 | |

| Taxable pay for HI | $5,810 | ||

| FICA–HI tax rate | × 1.45% | 84.25 | |

| Federal income taxes withheld | 507.00 | ||

| State income taxes withheld | 125.05 | ||

| Union dues withheld | 55.00 | ||

| Total deductions | (1,131.52) | ||

| Net pay | $4,678.48 |

Table (6)

Compute total employer payroll taxes for May 13th.

| Details | Amount ($) | Amount ($) |

| Gross pay | $5,810 | |

| FICA-OASDI tax rate | × 6.2% | |

| FICA-OASDI tax expense | $360.22 | |

| Gross pay | $5,810 | |

| FICA-HI tax rate | × 1.45% | |

| FICA-HI tax expense | 84.25 | |

| Taxable pay | $5,810 | |

| FUTA tax rate | × 0.6% | |

| FUTA tax expense | 34.86 | |

| Taxable pay | $5,810 | |

| SUTA tax rate (state contribution rate) | × 2.3% | |

| SUTA tax expense | 133.63 | |

| Total employer’s payroll taxes | $612.96 |

Table (7)

Compute FICA taxes, total deductions, and net pay for May 31st.

| Details | Amount ($) | Amount ($) | Amount ($) |

| Payroll | $6,060.00 | ||

| Deductions: | |||

| Taxable pay for OASDI | $6,060 | ||

| FICA–OASDI tax rate | × 6.2% | $375.72 | |

| Taxable pay for HI | $6,060 | ||

| FICA–HI tax rate | × 1.45% | 87.87 | |

| Federal income taxes withheld | 533.00 | ||

| State income taxes withheld | 119.00 | ||

| Union dues withheld | 50.00 | ||

| Total deductions | (1,165.59) | ||

| Net pay | $4,894.41 |

Table (8)

Compute total employer payroll taxes for May 31st.

| Details | Amount ($) | Amount ($) |

| Gross pay | $6,060 | |

| FICA-OASDI tax rate | × 6.2% | |

| FICA-OASDI tax expense | $375.72 | |

| Gross pay | $6,060 | |

| FICA-HI tax rate | × 1.45% | |

| FICA-HI tax expense | 87.87 | |

| Taxable pay | $6,060 | |

| FUTA tax rate | × 0.6% | |

| FUTA tax expense | 36.36 | |

| Taxable pay | $6,060 | |

| SUTA tax rate (state contribution rate) | × 2.3% | |

| SUTA tax expense | 139.38 | |

| Total employer’s payroll taxes | $639.33 |

Table (9)

Compute FICA taxes, total deductions, and net pay for June 15th.

| Details | Amount ($) | Amount ($) | Amount ($) |

| Payroll | $6,380.00 | ||

| Deductions: | |||

| Taxable pay for OASDI | $6,380 | ||

| FICA–OASDI tax rate | × 6.2% | $395.56 | |

| Taxable pay for HI | $6,380 | ||

| FICA–HI tax rate | × 1.45% | 92.51 | |

| Federal income taxes withheld | 549.00 | ||

| State income taxes withheld | 128.70 | ||

| Union dues withheld | 50.00 | ||

| Total deductions | (1,215.77) | ||

| Net pay | $5,164.23 |

Table (10)

Compute total employer payroll taxes for June 15th.

| Details | Amount ($) | Amount ($) |

| Gross pay | $6,380 | |

| FICA-OASDI tax rate | × 6.2% | |

| FICA-OASDI tax expense | $395.56 | |

| Gross pay | $6,380 | |

| FICA-HI tax rate | × 1.45% | |

| FICA-HI tax expense | 92.51 | |

| Taxable pay | $5,000 | |

| FUTA tax rate | × 0.6% | |

| FUTA tax expense | 30.00 | |

| Taxable pay | $5,000 | |

| SUTA tax rate (state contribution rate) | × 2.3% | |

| SUTA tax expense | 115.00 | |

| Total employer’s payroll taxes | $633.07 |

Table (11)

Compute FICA taxes, total deductions, and net pay for June 30th.

| Details | Amount ($) | Amount ($) | Amount ($) |

| Payroll | $6,250.00 | ||

| Deductions: | |||

| Taxable pay for OASDI | $6,250 | ||

| FICA–OASDI tax rate | × 6.2% | $387.20 | |

| Taxable pay for HI | $6,250 | ||

| FICA–HI tax rate | × 1.45% | 90.63 | |

| Federal income taxes withheld | 538.00 | ||

| State income taxes withheld | 127.60 | ||

| Union dues withheld | 50.00 | ||

| Total deductions | (1,193.43) | ||

| Net pay | $5,056.57 |

Table (12)

Compute total employer payroll taxes for June 30th.

| Details | Amount ($) | Amount ($) |

| Gross pay | $6,250 | |

| FICA-OASDI tax rate | × 6.2% | |

| FICA-OASDI tax expense | $387.20 | |

| Gross pay | $6,250 | |

| FICA-HI tax rate | × 1.45% | |

| FICA-HI tax expense | 90.63 | |

| Taxable pay | $4,770 | |

| FUTA tax rate | × 0.6% | |

| FUTA tax expense | 28.62 | |

| Taxable pay | $4,770 | |

| SUTA tax rate (state contribution rate) | × 2.3% | |

| SUTA tax expense | 109.71 | |

| Total employer’s payroll taxes | $616.16 |

Table (13)

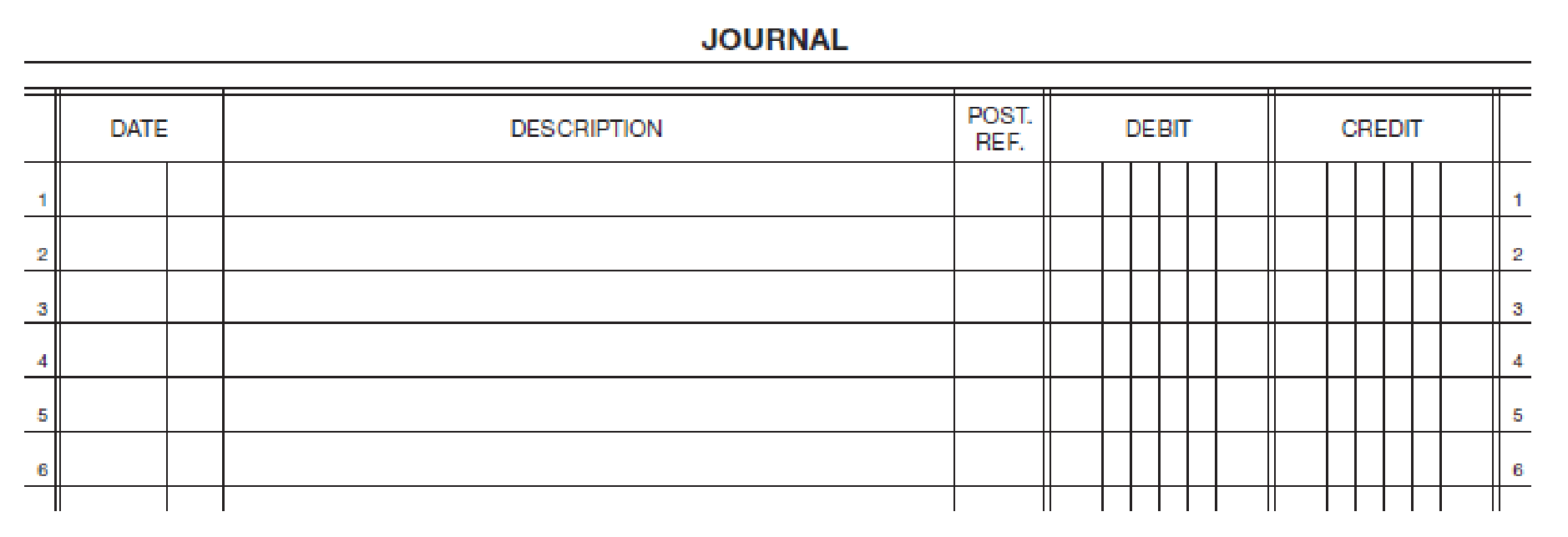

b.

Post the journalized transactions in the ledger accounts of the general ledger.

Explanation of Solution

Post the journalized transactions in the ledger accounts of the general ledger.

| ACCOUNT CASH ACCOUNT NO. 11 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 57,673.56 | |||

| 1 | J19 | 100.00 | 57,573.56 | ||||

| 15 | J19 | 4,915.65 | 52,657.91 | ||||

| 15 | J19 | 546.92 | 52,110.99 | ||||

| 15 | J19 | 2,442.86 | 49,668.13 | ||||

| 29 | J19 | 4,709.57 | 44,958.56 | ||||

| 29 | J19 | 571.78 | 44,386.78 | ||||

| May | 2 | J19 | 105.00 | 44,281.78 | |||

| 13 | J20 | 4,678.48 | 39,603.30 | ||||

| 16 | J20 | 2,903.12 | 36,700.18 | ||||

| 31 | J20 | 4,894.41 | 31,805.77 | ||||

| June | 3 | J21 | 105.00 | 31,700.77 | |||

| 15 | J21 | 5,164.23 | 26,536.54 | ||||

| 15 | J21 | 2,856.12 | 23,680.42 | ||||

| 30 | J21 | 5,056.27 | 18,624.15 | ||||

Table (14)

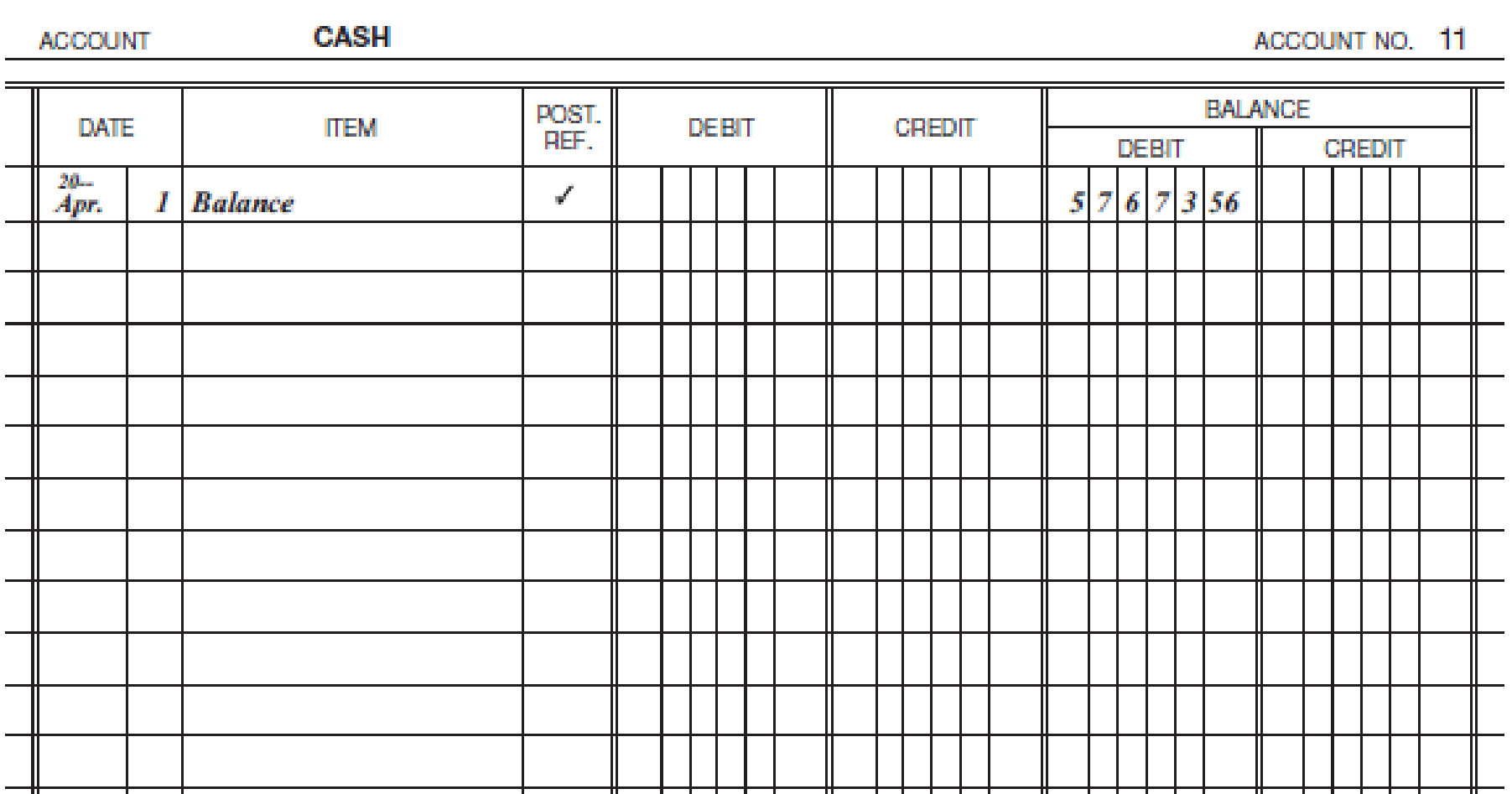

| ACCOUNT FICA TAXES PAYABLE-OASDI ACCOUNT NO. 20 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 1,068.88 | |||

| 15 | J19 | 378.51 | 1,447.39 | ||||

| 15 | J19 | 378.51 | 1,825.90 | ||||

| 15 | J19 | 1,068.88 | 757.02 | ||||

| 29 | J19 | 362.70 | 1,119.72 | ||||

| 29 | J19 | 362.70 | 1,482.42 | ||||

| May | 13 | J20 | 360.22 | 1,842.64 | |||

| 13 | J20 | 360.22 | 2,202.86 | ||||

| 16 | J20 | 1,482.42 | 720.44 | ||||

| 31 | J20 | 375.72 | 1,096.16 | ||||

| 31 | J20 | 375.72 | 1,471.88 | ||||

| June | 15 | J21 | 395.56 | 1,867.44 | |||

| 15 | J21 | 395.56 | 2,263.00 | ||||

| 15 | J21 | 1,471.88 | 791.12 | ||||

| 30 | J21 | 387.50 | 1,178.62 | ||||

| 30 | J21 | 387.50 | 1,566.12 | ||||

Table (15)

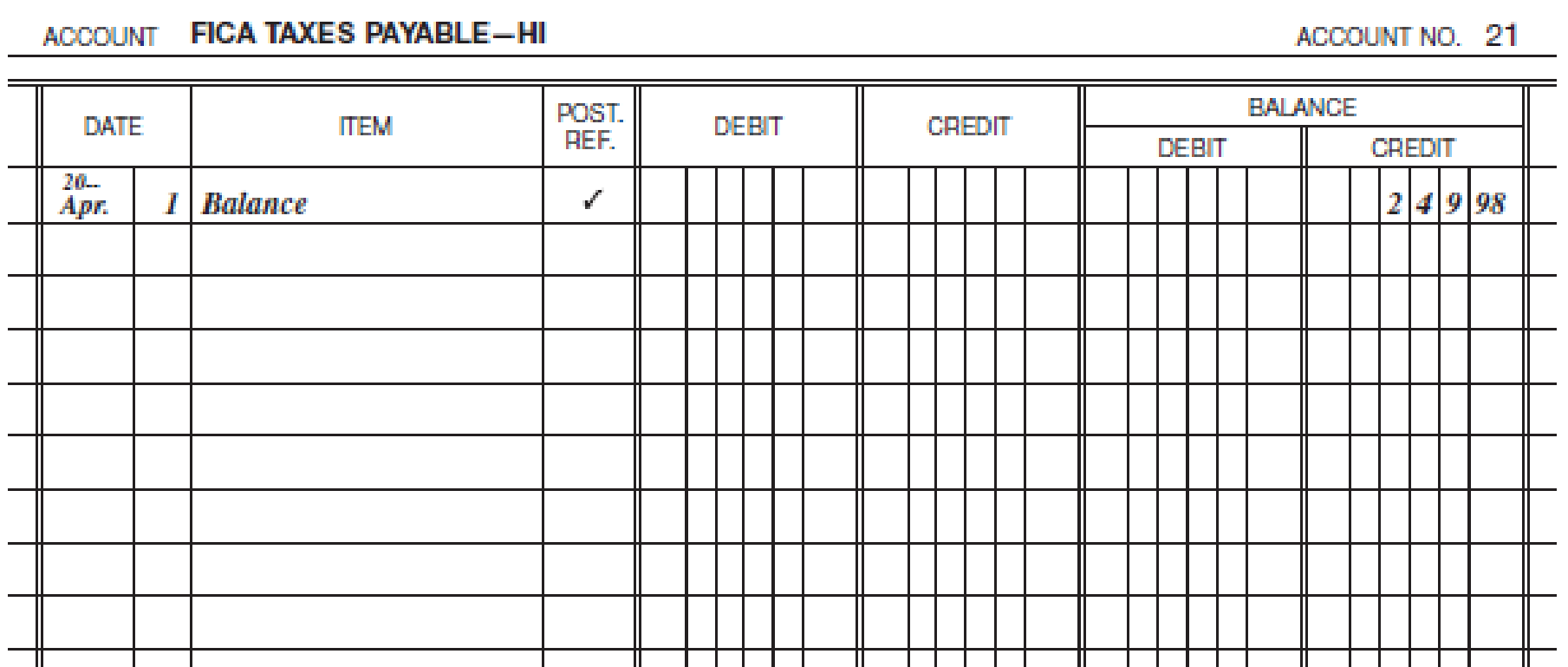

| ACCOUNT FICA TAXES PAYABLE-HI ACCOUNT NO. 21 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 249.98 | |||

| 15 | J19 | 88.52 | 338.50 | ||||

| 15 | J19 | 88.52 | 427.02 | ||||

| 15 | J19 | 249.98 | 177.04 | ||||

| 29 | J19 | 84.83 | 261.87 | ||||

| 29 | J19 | 84.83 | 346.70 | ||||

| May | 13 | J20 | 84.25 | 430.95 | |||

| 13 | J20 | 84.25 | 515.20 | ||||

| 16 | J20 | 346.70 | 168.50 | ||||

| 31 | J20 | 87.87 | 256.37 | ||||

| 31 | J20 | 87.87 | 344.24 | ||||

| June | 15 | J21 | 92.51 | 436.75 | |||

| 15 | J21 | 92.51 | 529.26 | ||||

| 15 | J21 | 344.24 | 185.02 | ||||

| 30 | J21 | 90.63 | 275.65 | ||||

| 30 | J21 | 90.63 | 366.28 | ||||

Table (16)

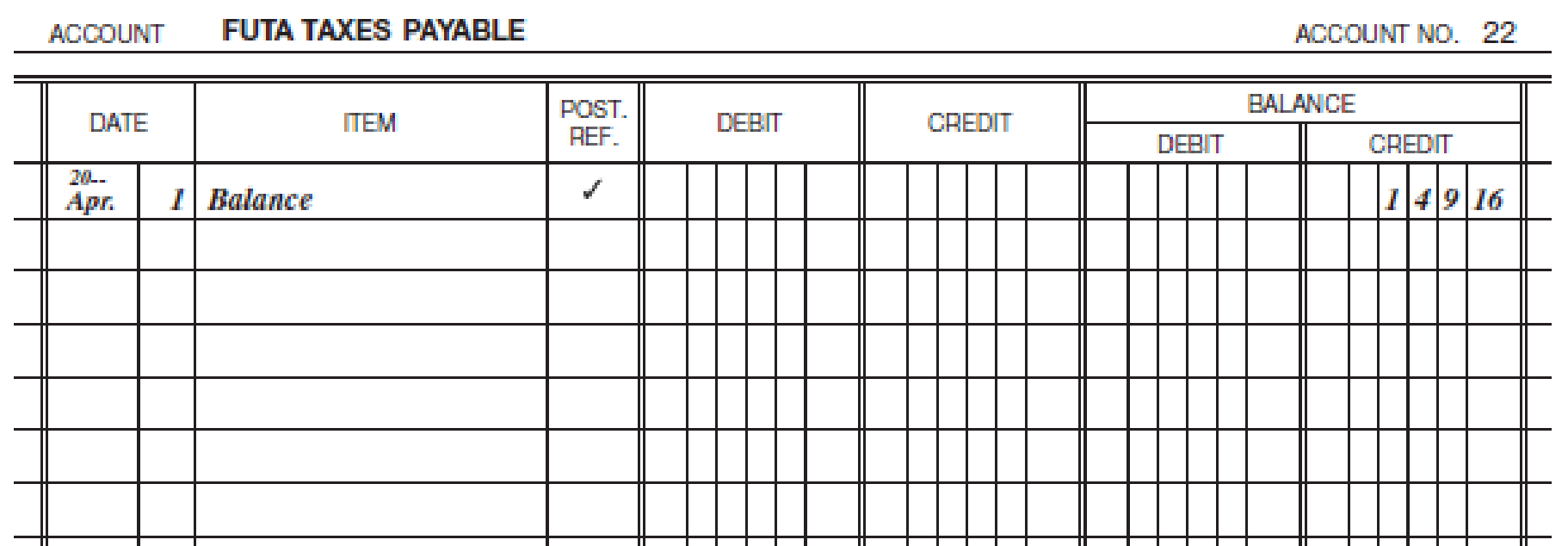

| ACCOUNT FUTA TAXES PAYABLE ACCOUNT NO. 22 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 149.16 | |||

| 15 | J19 | 36.63 | 185.79 | ||||

| 29 | J19 | 35.10 | 220.89 | ||||

| May | 13 | J20 | 34.86 | 255.75 | |||

| 31 | J20 | 36.36 | 292.11 | ||||

| June | 15 | J21 | 30.00 | 322.11 | |||

| 30 | J21 | 28.62 | 350.73 | ||||

Table (17)

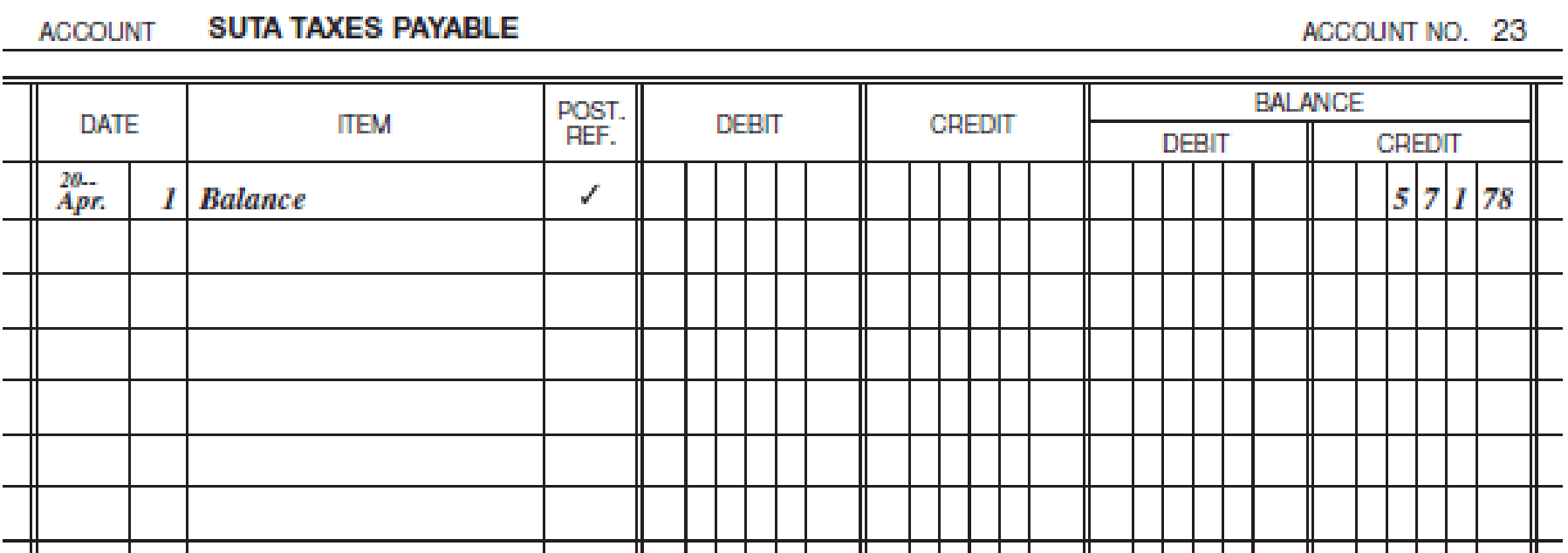

| ACCOUNT SUTA TAXES PAYABLE ACCOUNT NO. 23 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 571.78 | |||

| 15 | J19 | 141.45 | 713.23 | ||||

| 29 | J19 | 134.55 | 847.78 | ||||

| 29 | J19 | 571.78 | 276.00 | ||||

| May | 13 | J20 | 133.63 | 409.63 | |||

| 31 | J20 | 139.38 | 549.01 | ||||

| June | 15 | J21 | 115.00 | 664.01 | |||

| 30 | J21 | 109.71 | 773.72 | ||||

Table (18)

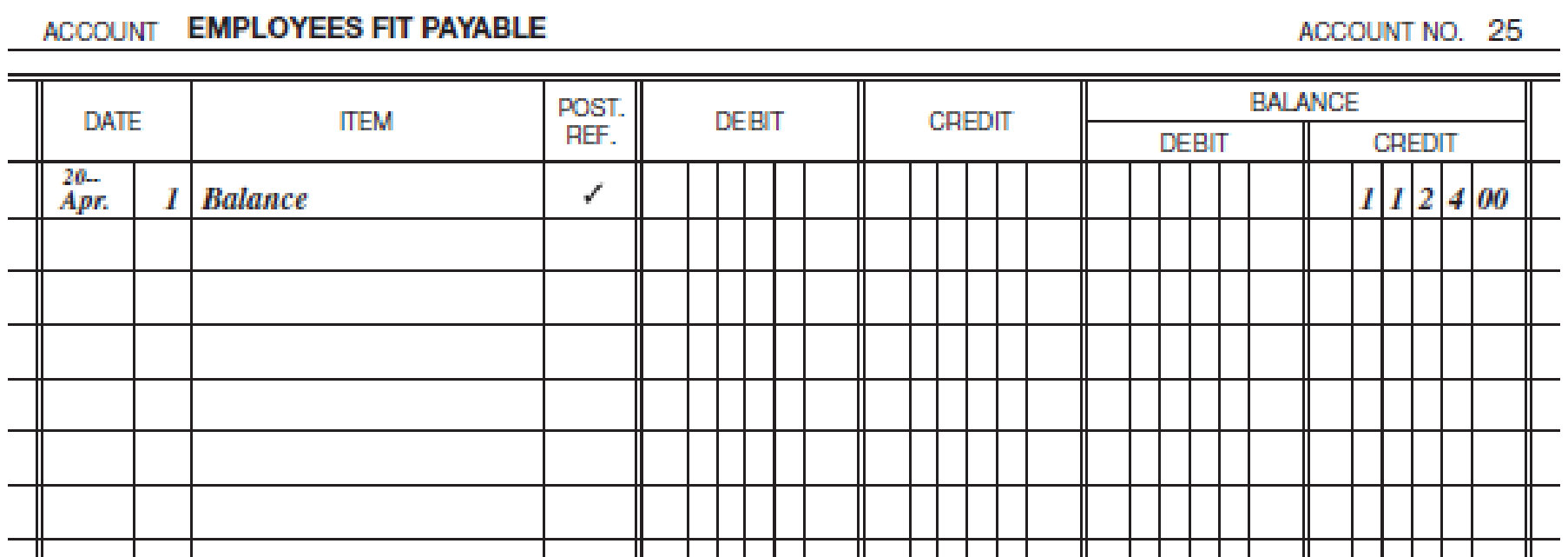

| ACCOUNT EMPLOYEES FIT PAYABLE ACCOUNT NO. 25 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 1,124 | |||

| 15 | J19 | 565 | 1,689 | ||||

| 15 | J19 | 1,124 | 565 | ||||

| 29 | J19 | 509 | 1,074 | ||||

| May | 13 | J20 | 507 | 1,581 | |||

| 16 | J20 | 1,074 | 507 | ||||

| 31 | J20 | 533 | 1,040 | ||||

| June | 15 | J21 | 549 | 1,589 | |||

| 15 | J21 | 1,040 | 549 | ||||

| 30 | J21 | 538 | 1,087 | ||||

Table (19)

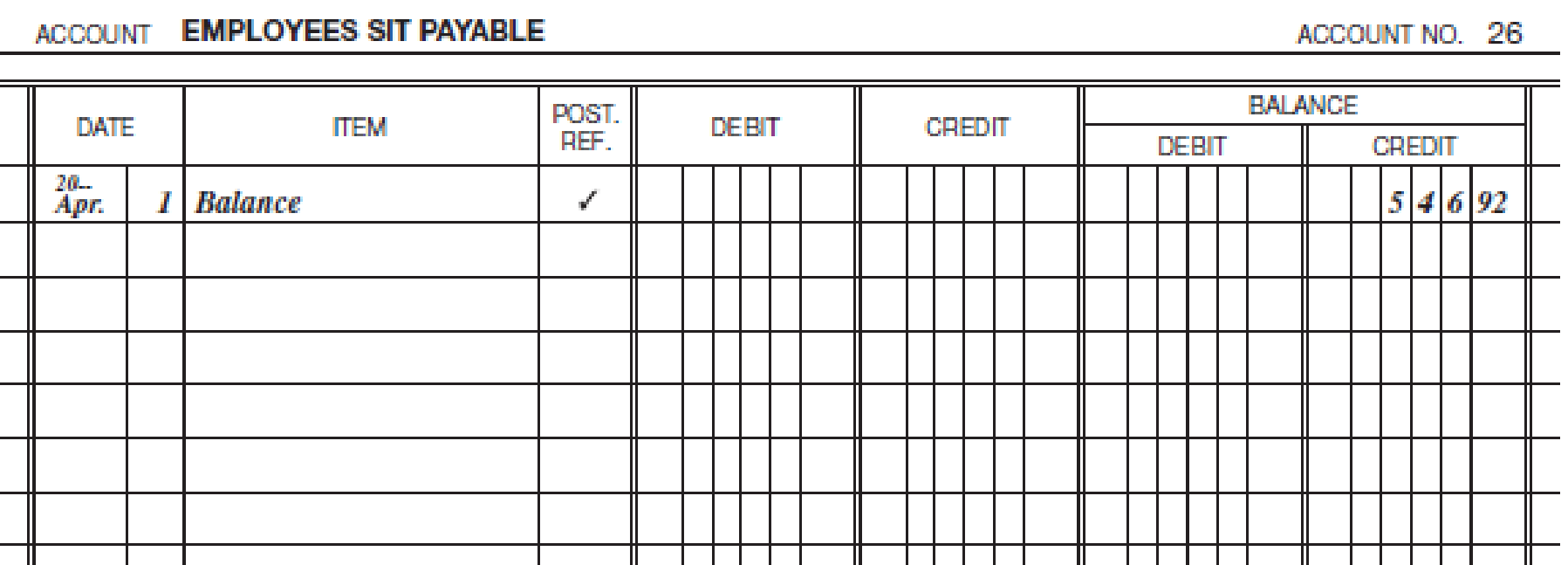

| ACCOUNT EMPLOYEES SIT PAYABLE ACCOUNT NO. 26 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 546.92 | |||

| 15 | J19 | 107.32 | 654.24 | ||||

| 15 | J19 | 546.92 | 107.32 | ||||

| 29 | J19 | 128.90 | 236.22 | ||||

| May | 13 | J20 | 125.05 | 361.27 | |||

| 31 | J20 | 119.00 | 480.27 | ||||

| June | 15 | J21 | 128.70 | 608.97 | |||

| 30 | J21 | 127.60 | 736.57 | ||||

Table (20)

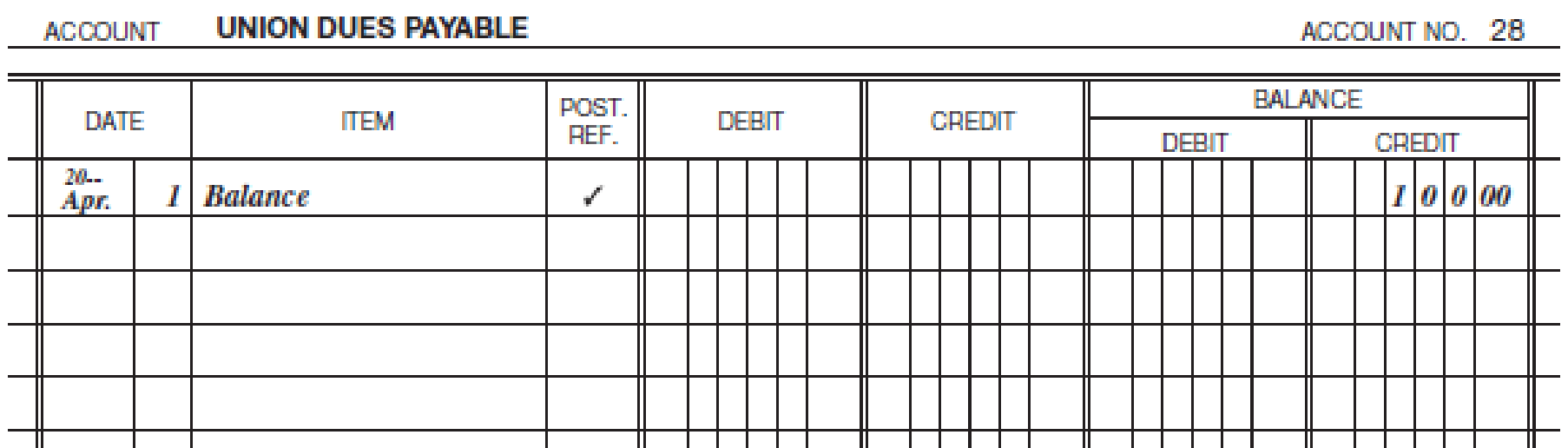

| ACCOUNT UNION DUES PAYABLE ACCOUNT NO. 28 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 100 | |||

| 1 | J19 | 100 | 0 | ||||

| 15 | J19 | 50 | 50 | ||||

| 29 | J19 | 55 | 105 | ||||

| May | 2 | J19 | 105 | 0 | |||

| 13 | J20 | 55 | 55 | ||||

| 31 | J20 | 50 | 105 | ||||

| June | 3 | J20 | 105 | 0 | |||

| 15 | J21 | 50 | 50 | ||||

| 30 | J21 | 50 | 100 | ||||

Table (21)

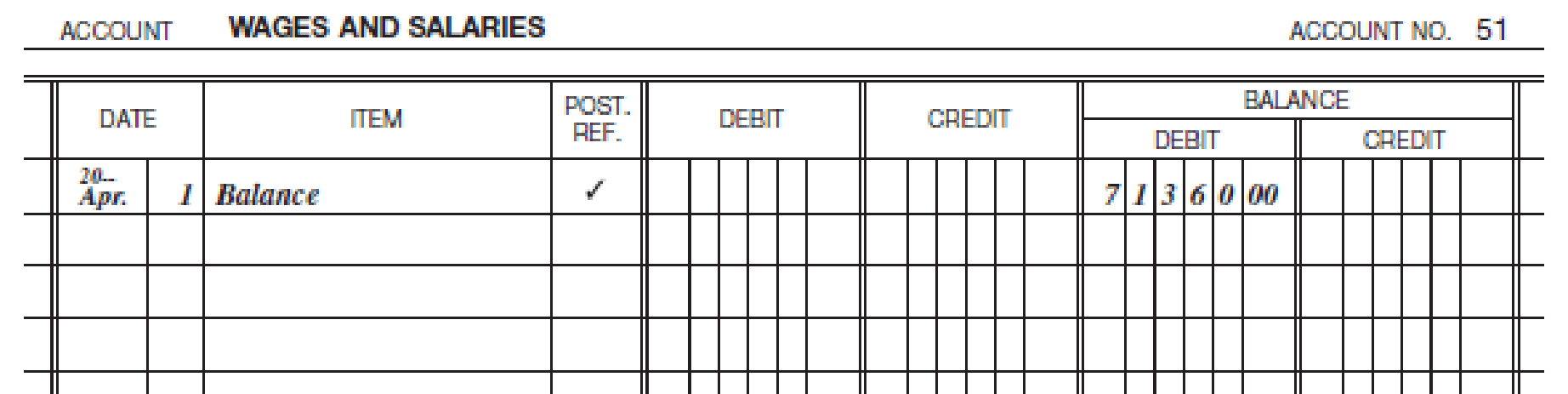

| ACCOUNT WAGES AND SALARIES ACCOUNT NO. 51 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 71,360 | |||

| 15 | J19 | 6,105 | 77,465 | ||||

| 29 | J19 | 5,850 | 83,315 | ||||

| May | 13 | J20 | 5,810 | 89,125 | |||

| 31 | J20 | 6,060 | 95,185 | ||||

| June | 15 | J21 | 6,380 | 101,565 | |||

| 30 | J21 | 6,250 | 107,815 | ||||

Table (22)

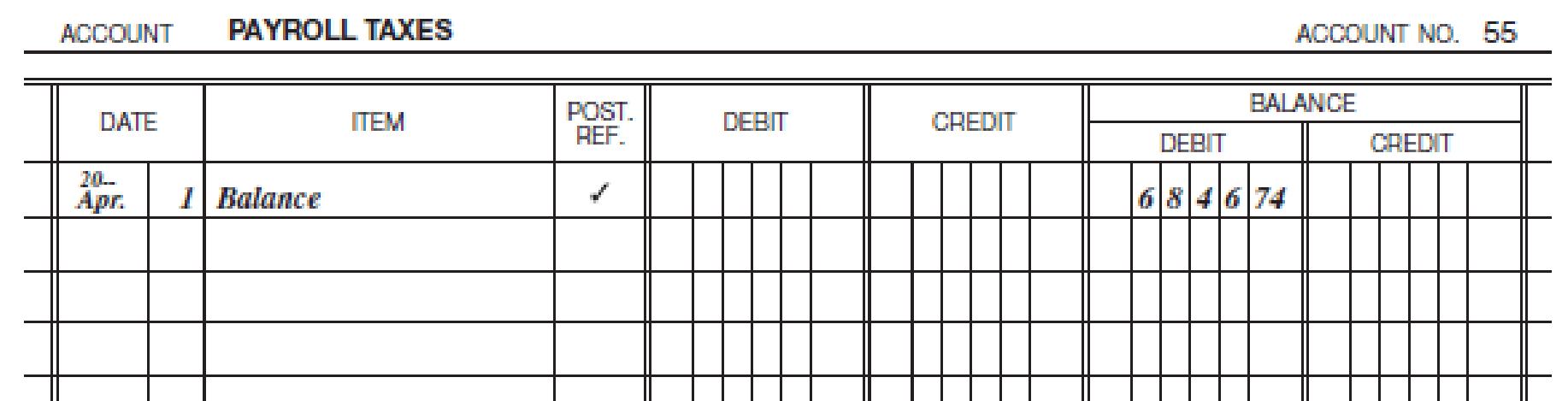

| ACCOUNT PAYROLL TAXES ACCOUNT NO. 55 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 6,846.74 | |||

| 15 | J19 | 645.11 | 7,491.85 | ||||

| 29 | J19 | 617.18 | 8,109.03 | ||||

| May | 13 | J20 | 612.96 | 8,721.99 | |||

| 31 | J20 | 639.33 | 9,361.32 | ||||

| June | 15 | J20 | 633.07 | 9,994.39 | |||

| 30 | J21 | 616.46 | 10,610.85 | ||||

Table (23)

c.

Indicate the correct answer against the given questions.

Explanation of Solution

Indicate the correct answer against the given questions 1 to 7.

| Question Number | Answer | Reference |

| 1. | $3,019.40 | The balances of FICA-OASDI, FICA-HI, and Employees FIT Payable as on June 30 are $1,566.12, $266.28, and $1,087 respectively. The sum is $3,019.40 (Refer Tables 3, 4, and 7 for the balances as on June 30). |

| 2. | 736.57 | Refer Table-8 for the value of state income taxes withheld. |

| 3. | 0 | The balance of FUTA Taxes Payable as on June 30 is $350.73. Since the accumulated amount as on June 30 is less than $500 threshold, the balance need not be deposited. |

| 4. | 773.72 | Refer Table-6 for the value of SUTA Taxes Payable. |

| 5. | 100.00 | Refer Table-9 for the value of Union Dues Payable. |

| 6. | 107,815.00 | Refer Table-10 for the value of wages and salaries expense. |

| 7. | 10,610.85 | Refer Table-11 for the value of payroll taxes expense. |

Table (24)

8.

Journalize the adjusting entry to record the vacation accrual.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Vacation Benefits Expense | 15,000 | |||||

| Vacation Benefits Payable | 15,000 | |||||

| (Record accrued vacation benefits) | ||||||

Table (25)

Description:

- Vacation Benefits Expense is an expense account. Since expenses and losses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Vacation Benefits Payable is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

Want to see more full solutions like this?

Chapter 6 Solutions

PAYROLL ACCT.,2019 ED.(LL)-TEXT

- JOURNALIZING AND POSTING PAYROLL ENTRIES Oxford Company has five employees, All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31. The accounts kept by Oxford Company include the following: The following transactions relating to payrolls and payroll taxes occurred during June and July: REQURED 1. Journalize the preceding transactions using a general journal. 2. Open accounts for the payroll expenses and liabilities. Enter the beginning balances and post the transactions recorded in the journal.arrow_forwardJOURNALIZING AND POSTING PAYROLL ENTRIES Cascade Company has four employees. All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31. The accounts kept by Cascade include the following: The following transactions relating to payrolls and payroll taxes occurred during June and July: REQUIRED 1. Journalize the preceding transactions using a general journal. 2. Open accounts for the payroll expenses and liabilities. Enter the beginning balances and post the transactions recorded in the journal.arrow_forwardJOURNALIZING AND POSTING PAYROLL ENTRIES Oxford Company has five employees. All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31. The accounts kept by Oxford Company include the following: The following transactions relating to payrolls and payroll taxes occurred during June and July: REQUIRED 1. Journalize the preceding transactions using a general journal. 2. Open T accounts for the payroll expenses and liabilities. Enter the beginning balances and post the transactions recorded in the journal.arrow_forward

- The totals line from Nix Companys payroll register for the week ended March 31, 20--, is as follows: Payroll taxes are imposed as follows: Social Security tax, 6.2%; Medicare tax, 1.45%; FUTA tax, 0.6%; and SUTA tax, 5.4%. REQUIRED 1. a. Prepare the journal entry for payment of this payroll on March 31, 20--. b. Prepare the journal entry for the employers payroll taxes for the period ended March 31, 20--. 2. Nix Company had the following balances in its general ledger before the entries for requirement ( 1 ) were made: a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15, 20--. b. Prepare the journal entry for payment of the liability for FUTA tax on April 30, 20--. c. Prepare the journal entry for payment of the liability for SUTA tax on April 30, 20--.arrow_forwardIn the space provided below, prepare the journal entry to record the November payroll for all employees assuming that the payroll is paid on November 30 and that Joness cumulative gross pay (cell I13) is 85,000.arrow_forwardThe totals from the payroll register of Olt Company for the week of January 25 show: Journalize the entry to record the payroll of January 25.arrow_forward

- Wallace Corporation summarizes the following information from its weekly payroll records during April. Prepare the two journal entries to record the payment of the payroll and the accrual of its payroll taxes for April. Assume an 8% FICA rate for both employees and the employer. Also assume a 5.4% state unemployment tax rate, a 0.6% federal unemployment tax rate, and that all wages are subject to all payroll taxes. Round to the nearest dollar.arrow_forwardAn analysis of the payroll for the month of November for CinMar Inc. reveals the information shown: All regular time Andrews, Lomax, and Herzog are production workers, and Dimmick is the plant manager. Hendrick is in charge of the office. Cumulative earnings paid (before deductions) in this calendar year prior to the payroll period ending November 8 were as follows: Andrews, 21,200; Lomax, 6,800; Herzog, 11,500; Dimmick, 116,200; and Hendrick, 32,800. The solution to this problem requires the following forms, using the indicated column headings: 1. Prepare an employee earnings record for each of the five employees. 2. Prepare a payroll record for each of the four weeks. 3. Prepare a labor cost summary for the month. 4. Prepare journal entries to record the following: a. The payroll for each of the four weeks. b. The payment of wages for each of the four payrolls. c. The distribution of the monthly labor costs per the labor cost summary. d. The company's payroll taxes covering the four payroll periods.arrow_forwardReviewing payroll records indicates that one-fifth of employee salaries that are due to be paid on the first payday in January, totaling $15,000, are actually for hours worked in December. There was no previous balance in the Salaries Payable account at that time. Based on the information provided, make the December 31 adjusting journal entry to bring the balances to correct.arrow_forward

- On September 30, Hilltop Companys selected payroll accounts are as follows: Prepare general journal entries to record the following:arrow_forwardOn September 30, Hilltop Companys selected payroll accounts are as follows: Prepare general journal entries to record the following: Oct. 15 Payment of federal tax deposit of FICA taxes and the federal income tax. 31 Payment of state unemployment tax. 31 Payment of federal unemployment tax.arrow_forwardA weekly payroll summary made from labor time records shows the following data for Pima Company: Overtime is payable at one-and-a-half times the regular rate of pay and is distributed to all jobs worked on during the period. a. Determine the net pay of each employee. The income taxes withheld for each employee amount to 15% of the gross wages. b. Prepare journal entries for the following: 1. Recording the payroll. 2. Paying the payroll. 3. Distributing the payroll. (Assume that the overtime premium will be charged to all jobs worked on during the period.) 4. The employers payroll taxes. (Assume that none of the employees has achieved the maximum wage bases for FICA and unemployment taxes.)arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning