Loose Leaf for Foundations of Financial Management Format: Loose-leaf

17th Edition

ISBN: 9781260464924

Author: BLOCK

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 18P

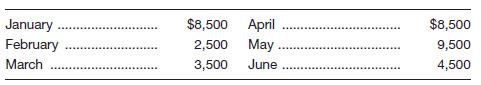

Carmen’s Beauty Salon has estimated monthly financing requirements for the next six months as follows:

Short-term financing will be utilized for the next six months. Here are the projected annual interest rates:

a. Compute total dollar interest payments for the six months. To convert an annual rate to a monthly rate, divide by 12. Then multiply this value times the monthly balance. To get your answer, add up the monthly interest payments.

b. If long-term financing at 12 percent had been utilized throughout the six months, would the total-dollar interest payments be larger or smaller? Compute the interest owed over the six months and compare your answer to that in part a.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Carmen’s Beauty Salon has estimated monthly financing requirements for the next six months as follows:

January

$

8,100

April

$

8,100

February

2,100

May

9,100

March

3,100

June

4,100

Short-term financing will be utilized for the next six months. Projected annual interest rates are:

January

5.0

%

April

12.0

%

February

6.0

%

May

12.0

%

March

9.0

%

June

12.0

%

a. Compute total dollar interest payments for the six months. (Round your monthly interest rate to 2 decimal places when expressed as a percent. Round your interest payments to the nearest whole cent.)

b-1. Compute the total dollar interest payments if long-term financing at 12 percent had been utilized throughout the six months? (Round your monthly interest rate to 2 decimal places when expressed as a percent. Round your interest payments to the nearest whole cent.)

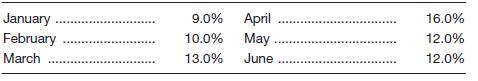

Carmen’s Beauty Salon has estimated monthly financing requirements for the next six months as follows:

January

$ 9,000

April

$ 9,000

February

3,000

May

10,000

March

4,000

June

5,000

Short-term financing will be utilized for the next six months. Projected annual interest rates are:

January

9.0%

April

16.0%

February

10.0%

May

12.0%

March

13.0%

June

12.0%

a. Compute total dollar interest payments for the six months.

Note: Round your monthly interest rate to 2 decimal places when expressed as a percent. Round your interest payments to the nearest whole cent.

b-1. Compute the total dollar interest payments if long-term financing at 12 percent had been utilized throughout the six months?

Note: Round your monthly interest rate to 2 decimal places when expressed as a percent. Round your interest payments to the nearest whole cent.

b-2. If long-term financing at 12 percent had been utilized throughout the six months, would the total-dollar interest payments be larger or…

Boatler Used Cadillac Company requires $980,000 in financing over the next two years. The firm can borrow the funds for two years at 10 percent interest per year. Ms. Boatler decides to do forecasting and predicts that if she utilizes short-term financing instead, she will pay 6.75 percent interest in the first year and 11.55 percent interest in the second year. Assume interest is paid in full at the end of each year.

Determine the total two-year interest cost under each plan.

Which plan is less costly?

multiple choice

Short-term variable-rate plan

Long-term fixed-rate plan

Chapter 6 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Ch. 6 - Prob. 1DQCh. 6 - Prob. 2DQCh. 6 - Prob. 3DQCh. 6 - Prob. 4DQCh. 6 - “The most appropriate financing pattern would be...Ch. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - Prob. 8DQCh. 6 - What are three theories for describing the shape...Ch. 6 - Since the mid-1960s, corporate liquidity has been...

Ch. 6 - Gary’s Pipe and Steel Company expects sales next...Ch. 6 - Prob. 2PCh. 6 - Tobin Supplies Company expects sales next year to...Ch. 6 - Antivirus Inc. expects its sales next year to be...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Boatler Used Cadillac Co. requires $850,000 in...Ch. 6 - Biochemical Corp. requires $550,000 in financing...Ch. 6 - Sauer Food Company has decided to buy a new...Ch. 6 - Assume that Hogan Surgical Instruments Co. has...Ch. 6 - Assume that Atlas Sporting Goods Inc. has $840,000...Ch. 6 - Colter Steel has $4,200,000 in assets. Short-term...Ch. 6 - Prob. 13PCh. 6 - Guardian Inc. is trying to develop an asset...Ch. 6 - Lear Inc. has $840,000 in current assets, $370,000...Ch. 6 - Using the expectations hypothesis theory for the...Ch. 6 - Using the expectations hypothesis theory for the...Ch. 6 - Carmen’s Beauty Salon has estimated monthly...Ch. 6 - Prob. 19PCh. 6 - Eastern Auto Parts Inc. has 15 percent of its...Ch. 6 - Bombs Away Video Games Corporation has forecasted...Ch. 6 - Esquire Products Inc. expects the following...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A department store has it’s own credit card facilities, for which it charges interest at a rateof 4% each month. Calculate the annual percentage rate (APR). Explain why this is not thesame as charging an annual interest rate of 48% and what is APR.b) A proposed investment costs $1500 today. The expected revenue flow is $ 3000 at theend of year 1, and $10,000 at the end of year 2. Find the internal rate of return, correct totwo decimal places. The market interest rate is 15%. Would you recommend thisinvestment? Explain the reason for your recommendation.arrow_forwardCompute the monthly payment on a car loan of $23,000 for 35 months, if the APR is 8.4%. Formula Excel Functon I need the formula as well as the excel function.arrow_forwardYou carry over a credit card balance of $500 wuth an APR of 18.99%. You make a minimum payment of 8% each month. Round all values to the nearest cent. A. What is the finance charge for this first month? B. What is the new balance? C. What is the minimum payment for this month? D. What is the carry over balance for the next month?arrow_forward

- A. DEF has total forecasted gross purchases of P4,500,000 relating to a major supplier for the coming year. The supplier is offering a credit term of 3/15, n/45. How much is the simple annual effective cost of paying on the 45th day? B. ABC can take a 45-day loan with a 15% interest deducted in advance, to be reapplied each time. How much is the simple annual cost of the loan? C. ABC’s bank offered a loan with conditions of a P5,000,000 face amount, 6-month term, 4% interest deducted in advance and bank charge of P30,000. How much is the compounded annual effective cost of the bank loan?arrow_forward(USING EXCEL FUNCTION PLEASE) You wish to plan your Bahamas Islands vacation. You estimate that it will be two years from now, and that it will cost $15,000. The monthly payment you should save in order to finance your vacation is $637.66 assuming that you make 24 monthly payments, starting today and ending 23 months from now. what is the annual percentage rate?arrow_forwardCray Computing needs a 5-month loan for $300,000. Its bank quotes a simple interest rate of 15% on the loan. What is the annual percentage rate (APR)?arrow_forward

- An auto dealer has designed a marketing gimmick. They are asking their customers tinky only $109 at the end of each month, for the first two years for a car priced at $10,000. The APR on the vehicle is 5.40% and the total term of the loan is 5 years. What is the monthly payment for the remaining three years? Interest is payable during the entire five year period.arrow_forwardA loan officer is preparing the documents for a commercial term loan. The borrower's risk profile suggests that an annualized return ( EAR) of 6.3% is appropriate. The loan will require semi - annual payments, i .e., one payment every six months. What APR (compounded semi - annually) should be used to compute the borrower's future payments? ( please show the results in excel spreadsheet also)arrow_forwardSuppose you take out a 36-month installment loan to finance a delivery van for $26,100. The payments are $985 per month, and the total finance charge is $9,360. After 25 months, you decide to pay off the loan. After calculating the finance charge rebate, find your loan payoff (in $) Round to the nearest centarrow_forward

- A loan of $15,000 requires monthly payments of $477 over a 36-month period of time. These payments include both principal and interest. Solve, (a) What is the nominal interest rate (APR) for this loan? (b) What is the effective interest rate per year? (c) Determine the amount of unpaid loan principal after 20 months.arrow_forward16. You borrow $27,000 to purchase a plane. The loan will be paid in monthly installments over one year at 30% interest annually. The first payment is due one month from today. What is the amount of each monthly payment? (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)arrow_forwardThe total purchase price of a new home entertainment system is $14,260. If the down payment is $2300band the balance is to be financed over 72 months at 6% add-on intrest, what is the monthy payment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY