a)

Case summary:

The federal government of Country U is the largest debtor in the world. The Country U’s intra-governmental bodies, foreign investors and the individuals accounts for about more than one-third of the debt due to which the government has a massive demand for external financing. It is issuing T-bills, debt securities to feed these demand. The treasury securities are still regarded as the safest investment to date.

To explain: The pros and cons of this strategy.

a)

Explanation of Solution

Pros and cons:

The treasury department of Country US will face many considerations similar to those where a company is considering the revision of the average debt maturity. The short-term bills are lower reducing the total financing costs. But, if the Treasury relies on the short-term rates and its rise, the cost of financing will become higher. There is a higher risk where the government is unable to get new buyers for the new treasury bills when the old ones began to mature. The excessive demand for short-term securities might push up the seasonal loans higher hindering the revenues of the firm.

The government also has to worry about tarnishing the high regard possesses by the treasury bills. It is the closest to get to risk-free rate in the real world. If the investment in short-term financing increases it will lead to an increase in Treasury bill rates.

b)

To explain: The impact on the

b)

Explanation of Solution

The debt that is priced at a par rate provides a payment in the form of a coupon which is enough to pay the

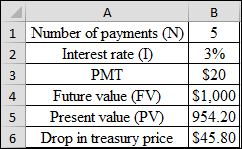

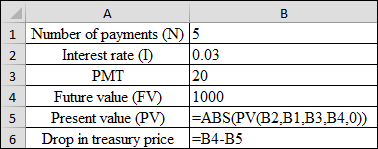

Excel formula:

The price of the Treasury has dropped by $45.80 or 4.58% and the new price is $954.20.

c)

To explain: The level of the market value of outstanding debt fall.

c)

Explanation of Solution

The $360 billion is the interest expense in 2012 and the national debt was about $15.8 trillion in 2012. The division of interest paid by the total debt has resulted in an interest rate of 2.28%. It is assumed that the treasuries are priced at par and it ends up being $22.80 being the annual payment required so that the treasuries are priced at par.

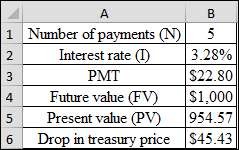

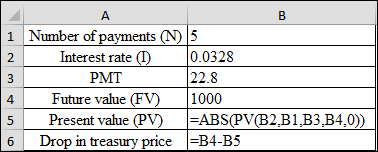

Excel formula:

The price of the Treasury has dropped by $45.43 or 4.5% and the new price is $954.57.

This will decrease the size of the federal debt by $756 billion (0.045 * $16.8 billion). If someone considers the size of the current budget as the deficit, there are incentives for the government to pursue policies which are leading to higher inflation. But, these higher prices will lead to higher cost of goods and other services in the future which are purchased by the government.

Want to see more full solutions like this?

Chapter 6 Solutions

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education