To determine:

Project Analysis:

Project analysis means analyzing the various related aspects of the project on the basis of the benchmarks previously decided by the firm and the deviations so located should be worked upon.

Net Present Value:

The net present value is the differential amount between the net

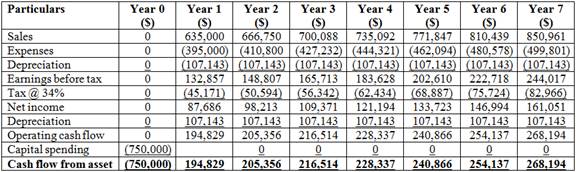

Explanation of Solution

Given,

The cost price of the facility is $750,000.

The estimated life of facility is 7 years.

The estimated revenue at the end of the first year is $635,000.

The current revenues are increased at 5% inflation rate per annum.

The estimated cost at the end of the first year of producing the units is $395,000.

The costs are increased at 4% per annum.

The real discount rate is 7%

The company falls under 34% of tax bracket.

Calculation of net present value,

| Net Present Value | |||

| Particulars | Present Value factor @ 12.35% |

Net Cash Flows ($) |

Present Value ($) |

| Initial investment | 1 | (750,000) | (750,000) |

| Year 1 | 0.89 | 194,829 | 173,398 |

| Year 2 | 0.792 | 205,356 | 162,642 |

| Year 3 | 0.705 | 216,514 | 152,642 |

| Year 4 | 0.628 | 228,337 | 143,396 |

| Year 5 | 0.559 | 240,866 | 134,644 |

| Year 6 | 0.497 | 254,137 | 126,306 |

| Year 7 | 0.443 | 268,194 | 118,810 |

| Net Present Value | 261,838 | ||

Table (1)

Working notes:

Calculation of annual sales revenue for year 2,

Calculation of annual sales revenue for year 3,

Calculation of annual sales revenue for year 4,

Calculation of annual sales revenue for year 5,

Calculation of annual sales revenue for year 6,

Calculation of annual sales revenue for year 7,

Calculation of annual expenses for year 2,

Calculation of annual expenses for year 3,

Calculation of annual expenses for year 4,

Calculation of annual expenses for year 5,

Calculation of annual expenses for year 6,

Calculation of annual expenses for year 7,

Calculation of annual

Calculation of nominal interest rate,

Calculation of annual cash flows,

Thus, the net present value is $261,838.

Want to see more full solutions like this?

Chapter 6 Solutions

CORPORATE FIN.(LL)-W/ACCESS >CUSTOM<

- REPLACEMENT ANALYSIS St. Johns River Shipyards is considering the replacement of an 8-year-old riveting machine with a new one that will increase earnings from 24,000 to 46,000 per year. The new machine will cost 80,000, and it will have an estimated life of 8 years and no salvage value. The new riveting machine is eligible for 100% bonus depreciation at the time of purchase. The applicable corporate tax rate is 25%, and the firms WACC is 10%. The old machine has been fully depreciated and has no salvage value. Should the old riveting machine be replaced by the new one? Explain your answer.arrow_forwardNet Present Value Talmage Inc. has just completed development of a new printer. The new product is expected to produce annual revenues of 2,700,000. Producing the printer requires an investment in new equipment costing 2,880,000. The printer has a projected life cycle of 5 years. After 5 years, the equipment can be sold for 360,000. Working capital is also expected to increase by 360,000, which Talmage will recover by the end of the new products life cycle. Annual cash operating expenses are estimated at 1,620,000. The required rate of return is 8%. Required: Prepare a schedule of the projected annual cash flows. Calculate the NPV using only discount factors from Exhibit 12B.1 (p. 670). Calculate the NPV using discount factors from both Exhibits 12B.1 and 12B.2 (p. 671).arrow_forwardDepreciation Jensen Inc., a graphic arts studio, is considering the purchase of computer equipment and software for a total cost of $18,000. Jensen can pay for the equipment and software over three years at the rate of $6,000 per year. The equipment is expected to last 10 to 20 years, but because of changing technology, Jensen believes it may need to replace the system in as soon as three to five years. A three-year lease of similar equipment and software is available for $6,000 per year. Jensens accountant has asked you to recommend whether the company should purchase or lease the equipment and software and to suggest the length of time over which to depreciate the software and equipment if the company makes the purchase. Required Ignoring the effect of taxes, would you recommend the purchase or the lease? Why or why not? Referring to the definition of depreciation, what appropriate useful life should be used for the equipment and software?arrow_forward

- Cost of Capital, Net Present Value Leakam Companys product engineering department has developed a new product that has a 3-year life cycle. Production of the product requires development of a new process that requires a current 100,000 capital outlay. The 100,000 will be raised by issuing 60,000 of bonds and by selling new stock for 40,000. The 60,000 in bonds will have net (after-tax) interest payments of 3,000 at the end of each of the 3 years, with the principal being repaid at the end of Year 3. The stock issue carries with it an expectation of a 17.5% return, expressed in the form of dividends at the end of each year (with 7,000 in dividends expected for each of the next 3 years). The sources of capital for this investment represent the same proportion and costs that the company typically has. Finally, the project will produce after-tax cash inflows of 50,000 per year for the next 3 years. Required: 1. Compute the cost of capital for the project. (Hint: The cost of capital is a weighted average of the two sources of capital, where the weights are the proportion of capital from each source.) 2. CONCEPTUAL CONNECTION Compute the NPV for the project. Explain why it is not necessary to subtract the interest payments and the dividend payments and appreciation from the inflow of 50,000 in carrying out this computation.arrow_forwardInflation Adjustments The Rodriguez Company is considering an average-risk investment in a mineral water spring project that has a cost of $150,000. The project will produce 1,000 cases of mineral water per year indefinitely. The current sales price is $138 per case, and the current cost per case is $105. The firm is taxed at a rate of 34%. Both prices and costs are expected to rise at a rate of 6% per year. The firm uses only equity, and it has a cost of capital of 15%. Assume that cash flows consist only of after-tax profits, because the spring has an indefinite life and will not be depreciated. Should the firm accept the project? (Hint: The project is a growing perpetuity, so you must use the constant growth formula to find its NPV.) Suppose that total costs consisted of a fixed cost of $10,000 per year plus variable costs of $95 per unit, and only the variable costs were expected to increase with inflation. Would this make the project better or worse? Continue to assume that the sales price will rise with inflation.arrow_forwardGardner Denver Company is considering the purchase of a new piece of factory equipment that will cost $420,000 and will generate $95,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further Instructions on internal rate of return in Excel, see Appendix C.arrow_forward

- Gallant Sports s considering the purchase of a new rock-climbing facility. The company estimates that the construction will require an initial outlay of $350,000. Other cash flows are estimated as follows: Assuming the company limits its analysis to four years due to economic uncertainties, determine the net present value of the rock-climbing facility. Should the company develop the facility if the required rate of return is 6%?arrow_forwardNet present value method for a service company Coast-to-Coast Inc. is considering the purchase of an additional delivery vehicle for 70,000 on January 1, 20Y1. The truck is expected to have a five-year life with an expected residual value of 15,000 at the end of five years. The expected additional revenues from the added delivery capacity are anticipated to be 65,000 per year for each of the next five years. A driver will cost 40,000 in 20Y1, with an expected annual salary increase of 2,000 for each year thereafter. The annual operating costs for the truck are estimated to be 6,000 per year. a. Determine the expected annual net cash flows from the delivery truck investment for 20Y120Y5. b. Compute the net present value of the investment, assuming that the minimum desired rate of return is 12%. Use the present value table appearing in Exhibit 2 of this chapter. c. Is the additional truck a good investment based on your analysis? Explain.arrow_forwardNew-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer’s base price is $1,080,000, and it would cost another $22,500 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $605,000. The MACRS rates for the first 3 years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $15,500. The sprayer would not change revenues, but it is expected to save the firm $380,000 per year in before-tax operating costs, mainly labor. Campbell’s marginal tax rate is 35%. What is the Year-0 cash flow? What are the net operating cash flows in Years 1, 2, and 3? What is the additional Year-3 cash flow (i.e., the after-tax salvage and the return of working capital)? If the project’s cost of capital is 12%, should the machine be purchased?arrow_forward

- The Rodriguez Company is considering an average-risk investment in a mineral water spring project that has an initial after-tax cost of 170,000. The project will produce 1,000 cases of mineral water per year indefinitely, starting at Year 1. The Year-1 sales price will be 138 per case, and the Year-1 cost per case will be 105. The firm is taxed at a rate of 25%. Both prices and costs are expected to rise after Year 1 at a rate of 6% per year due to inflation. The firm uses only equity, and it has a cost of capital of 15%. Assume that cash flows consist only of after-tax profits because the spring has an indefinite life and will not be depreciated. a. What is the present value of future cash flows? (Hint: The project is a growing perpetuity, so you must use the constant growth formula to find its NPV.) What is the NPV? b. Suppose that the company had forgotten to include future inflation. What would they have incorrectly calculated as the projects NPV?arrow_forwardAverage rate of returncost savings Maui Fabricators Inc. is considering an investment in equipment that will replace direct labor. The equipment has a cost of 125,000 with a 15,000 residual value and an eight-year life. The equipment will replace one employee who has an average wage of 28,000 per year. In addition, the equipment will have operating and energy costs of 5,150 per year. Determine the average rate of return on the equipment, giving effect to straight-line depreciation on the investment.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College