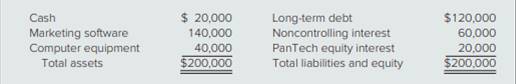

On December 31, 2017. PanTech Company invests $20,000 in SoftPlus, a variable interest entity. In contractual agreements completed on that date, PanTech established itself as the primary beneficiary of SoftPlus. Previously, PanTech had no equity interest in SoftPlus. Immediately after PanTech’s investment. SoftPlus presents the following balance sheet:

Each of the above amounts represents an assessed fair value at December 31, 2017, except for the marketing software. Accordingly the December 31 fair value of SoftPlus is assessed at $80,000.

a. If the marketing software was undervalued by $20,000, what amounts for SoftPlus would appear in PanTech’s December 31, 2017, consolidated financial statements?

b. If the marketing software was overvalued by $20,000, what amounts for SoftPlus would appear in PanTech’s December 31’ 2017, consolidated financial statements?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Soft Bound Version for Advanced Accounting 13th Edition

- Bloom Corporation purchased $1,000,000 of Taylor Company 5% bonds at par with the intent and ability to hold the bonds until they matured in 2020, so Bloom classifies its investment as HTM. Unfortunately, a combination of problems at Taylor Company and in the debt market caused the fair value of the Taylor investment to decline to $600,000 during 2016. Required: For each of the following scenarios, prepare appropriate entry(s) at December 31, 2016, and indicate how the scenario will affect the 2016 income statement (ignore income taxes). 1. Bloom now believes it is more likely than not that it will have to sell the Taylor bonds before the bonds have a chance to recover their fair value. Of the $400,000 decline in fair value, Bloom attributes $250,000 to credit losses, and $150,000 to noncredit losses. 2. Bloom does not plan to sell the Taylor bonds prior to maturity, and does not believe it is more likely than not that it will have to sell the Taylor bonds before the bonds have a…arrow_forwardOn January 1, 2020, the Pacita Corporation purchased equity securities for P2,000,000. The company also paid commission, taxes and other transaction costs amounting to P50,000. Because the securities were acquired not for immediate trading, Pacita exercised its option to measure the change in fair value through other comprehensive income. The securities had the following market values at December 31, 2020 and 2021, respectively: P1,750,000 and P2,100,000. No securities were sold during 2020 and 2021. What amount of unrealized gain or loss should be reported in December 31, 2021 statement of financial position as a component of shareholders’ equity?arrow_forwardIn early December of 2016, Kettle Corp purchased $50,000 of Icalc Company common stock, which constitutes less than 1% of Icalc’s outstanding shares. By December 31, 2016, the value of Icalc’s investment had fallen to $40,000, and Kettle recorded an unrealized loss. By December 31, 2017, the value of the Icalc investment had fallen to $25,000, and Kettle determined that it can no longer assert that it has both the intent and ability to hold the shares long enough for their fair value to recover, so Kettle recorded an OTT impairment. By December 31, 2018, fair value had recovered to $30,000. Required: Prepare appropriate entry(s) at December 31, 2016, 2017, and 2018, and for each year indicate how the scenario will affect net income, OCI, and comprehensive income.arrow_forward

- On January 1, 2020, investor X has an investment in 20% of the investee’s outstanding shares at a cost of USD 370. The investee’s net assets on that date were USD 1,600 and there was no difference between the carrying amount and fair values of the investee’s assets and liabilities except for Land, which fair value was USD150 higher than the carrying amount. Investor X analyzed and concluded that it has significant influence over the investee. During 2020, the investee distributed dividend of USD 80 on April 1, reported net profit of USD 250 and recognized revaluation surplus of USD 30 on property, plant, and equipment. On December 31, 2020, the fair value of the investment held by investor X in the investee’s shares is USD 400. Required: 1. How much is the goodwill in investor A’s investment? 2. Prepare the journal entry(s) for investor A’s investment in the investee during 2020.arrow_forwardRamirez Company has a held-for-collection investment in the 6%, 20-year bonds of Soto Company. The investment was originally purchased for $1,200,000 in 2016. Early in 2017, Ramirez recorded an impairment of $300,000 on the Soto investment, due to Soto’s financial distress. In 2018, Soto returned to profitability and the Soto investment was no longer impaired. What entry does Ramirez make in 2018 under (a) GAAP and (b) IFRS?arrow_forwardOn December 31, 2012, Columbia Company shows the data presented in the image with respect to its matured obligation. The company is threatened with a court suit if it could not pay its maturing debt. Accordingly, the company enters into an agreement with the creditor for the transfer of a non-cash asset in full settlement of the mortgage. The agreement provides for the transfer of real estate carried in the books of Columbia at P3,000,000. The real estate has a current fair market value of P4,500,000. What amount should Columbia recognize in profit or loss for the year 2012 as a result of this transaction? Notes Payable 5,000,000 Accrued Interest Payable 500,000 a. P500,000 b. P1,000,000 c. P1,500,000 d. P2,500,000arrow_forward

- Bloom Corporation purchased $1,000,000 of Taylor Company 5% bonds, at their face amount, with the intent and ability to hold the bonds until they matured in 2025, so Bloom classifies its investment as HTM. Unfortunately, a combination of problems at Taylor Company and in the debt securities market caused the fair value of the Taylor investment to decline to $600,000 during 2021.Required:For each of the following scenarios, prepare the appropriate entry(s) at December 31, 2021, and indicate how the scenario will affect the 2021 income statement (ignoring income taxes).1. Bloom now believes it is more likely than not that it will have to sell the Taylor bonds before the bonds have a chance to recover their fair value. Of the $400,000 decline in fair value, Bloom attributes $250,000 to credit losses, and $150,000 to noncredit losses.2. Bloom does not plan to sell the Taylor bonds prior to maturity, and does not believe it is more likely than not that it will have to sell the Taylor bonds…arrow_forwardSym Corporation, a wholly owned subsidiary of Paratec Corporation, leased equipment from its parent company on August 1, 2016. The terms of the agreement clearly do not require the lease to be accounted for as a capitallease. Both entities are accounting for the lease as an operating lease. The lease payment is $12,000 per year, paid in advance each August 1.Paratec purchased its investment in Sym on December 31, 2011, when Sym had a retained earnings balance of $150,000. Paratec is accounting for its investment in Sym under the cost method. Included in the original purchase price was a $50,000 premium attributable to Sym’s history of exceptional earnings.The December 31, 2018, trial balances of Paratec and its subsidiary are presented below. Paratec Corporation Sym CorporationCash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 190,000 40,000Accounts Receivable (net) . . . . . . . . . . . . .…arrow_forwardOn September 17, 2016, Ziltech, Inc., entered into an agreement to sell one of its divisions that qualifies as a component of the entity according to generally accepted accounting principles. By December 31, 2016, the company’s fiscal year-end, the division had not yet been sold, but was considered held for sale. The net fair value (fair value minus costs to sell) of the division’s assets at the end of the year was $11 million. The pretax income from operations of the division during 2016 was $4 million. Pretax income from continuing operations for the year totaled $14 million. The income tax rate is 40%. Ziltech reported net income for the year of $7.2 million. Required: Determine the book value of the division’s assets on December 31, 2016.arrow_forward

- On January 2, 2016, Sanborn Tobacco, Inc., bought 5% of Jackson Industry’s capital stock for $90 million as a temporary investment. Sanborn realized that these securities normally would be classified as available-forsale, but elected the fair value option to account for the investment. Jackson Industry’s net income for the year ended December 31, 2016, was $120 million. The fair value of the shares held by Sanborn was $98 million at December 31, 2016. During 2016, Jackson declared a dividend of $60 million. Required: 1. Would this investment be classified on Sanborn’s balance sheet as held-to-maturity securities, trading securities, available-for-sale securities, significant-influence investments, or other? Explain. 2. Prepare all appropriate journal entries related to the investment during 2016. 3. Indicate the effect of this investment on 2016 income before taxes.arrow_forwardOn July 1, 2018, ABC Company borrowed P1,000,000 on a 10% five-year note payable. OnDecember 31, 2018, the fair value of the note is determined to be P975,000 based on marketand interest factors. The entity has elected the fair value option for reporting the financialliability.Compute the following and show your solution:c. gain or loss to be recognized in 2018 as a result of the fair value optiond. discount on note payable presented on December 31, 2018arrow_forwardParker Company acquires an 80% interest in Sargent Company for $300,000 in cash on January 1, 2015, when Sargent Company has the following balance sheet: (attached)The excess of the price paid over book value is attributable to the fixed assets, which have a fair value of $250,000, and to goodwill. The fixed assets have a 10-year remaining life. Parker Company uses the simple equity method to record its investment in Sargent Company. The following trial balances of the two companies are prepared on December 31, 2015: Parker Sargent Current Assets . . . . . . . . . . . . . . . . . . . . . . . . 10,000 130,000 Depreciable Fixed A . . . . . . . . . . . . . . . . . . 400,000 200,000 Accumulated Depreciation . . . .. . . . . . . (106,000) (20,000) Investment in Sargent . .. .. . . . . . . . . . . . . 316,000 Current Liabilities. . . . . . . . . . . . . . . . . . . . . (60,000)…arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning