Concept explainers

Recording Cash Sales, Credit Sales, Sales Returns, and Sales Allowances and Analyzing Gross Profit Percentage

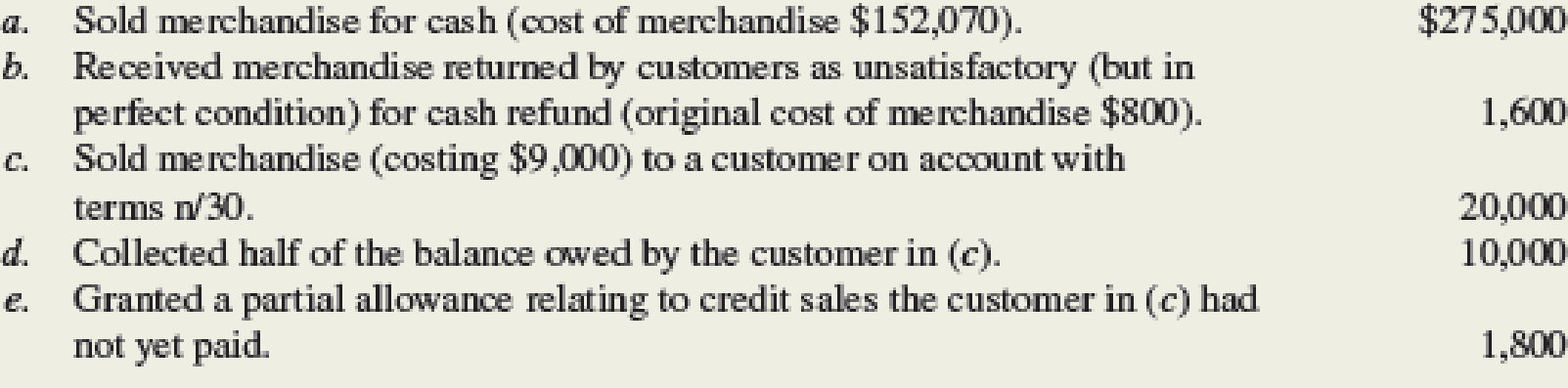

Campus Stop, Inc., is a student co-op. Campus Stop uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis:

Required:

- 1. Compute Net Sales and Gross Profit for Campus Stop. No additional sales returns/allowances are expected.

- 2. Compute the gross profit percentage (using the formula shown in this chapter and rounding to one decimal place).

- 3. Prepare

journal entries to record transactions (a)–(e). - 4. Campus Stop is considering a contract to sell merchandise to a campus organization for $15,000. This merchandise will cost Campus Stop $12,000. Would this contract increase (or decrease) Campus Stop’s dollars of gross profit and its gross profit percentage (round to one decimal place)?

TIP: The impact on gross profit dollars may differ from the impact on gross profit percentage.

1.

Calculate the net sales and gross profit of Company C.

Explanation of Solution

Net sales:

Net sales is the balance of remaining amount that is arrived after subtracting sales discounts, allowances for damaged goods and return of goods from sales.

Gross Profit:

Gross Profit is the difference between the net sales, and the cost of goods sold. Gross profit usually appears on the income statement of the company.

Calculate the net sales and gross profit of Company C as follows:

| Particulars | Amount($) |

| Sales Revenue (1) | 295,000 |

| Less: Sales Returns and Allowances(2) | (3,400) |

| Net Sales | 291,400 |

| Less: Cost of Goods Sold (3) | 160,270 |

| Gross Profit | 131,130 |

Table (1)

Working note 1:

Calculate the value of sales revenue:

Working note 2:

Calculate the sales returns and allowances

Working note 3:

Calculate the cost of goods sold

Therefore, the net sales and gross profit of Company C are $291,600 and $131,330 respectively.

2.

Compute the gross profit percentage of Company C.

Explanation of Solution

Gross Profit Percentage:

Gross profit is the financial ratio that shows the relationship between the gross profit and net sales. It represents gross profit as a percentage of net sales. Gross Profit is the difference between the net sales revenue, and the cost of goods sold. It can be calculated by dividing gross profit and net sales.

Compute the gross profit percentage of Company C as follows:

Thus, the gross profit percentage of Company C is 45.0%

3.

Prepare the journal entries to record transaction from (a) to (e).

Explanation of Solution

Prepare the journal entries to record transaction from (a) to (e) as follows:

a. Record the sales revenue and cost of goods sold:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Cash | 275,000 | ||

| Sales Revenue | 275,000 | ||

| (To record the sales revenue recognized in cash ) |

Table (1)

- Cash is an asset and it increases the value of assets. Therefore, debit cash by $275,000

- Sales revenue is component of stockholders’ equity and it increases the value of stockholder’s equity. Therefore, credit sales revenue by $275,000

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Cost of goods sold | 152,070 | ||

| Inventory | 152,070 | ||

| (To record the cost of goods sold incurred during the year) |

Table (2)

- Cost of goods sold is a component of stockholders’ equity and it is decreases the value of stockholder’s equity. Therefore, debit cost of goods sold by $152,070.

- Inventory is an asset and it decreases the value of asset. Therefore, credit inventory account by $152,070.

b. Record the sales return and the cost of inventory used for production.

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Sales revenue | 1,600 | ||

| Cash | 1,600 | ||

| (To record the sales returns from customer) |

Table (3)

- Sales revenue is a component of stockholders’ equity and it increases the value of stockholder’s equity. Therefore, debit sales revenue by $1,600

- Cash is an asset and it decreases the value of assets. Therefore, credit cash by $1,600

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Inventory | 800 | ||

| Cost of goods sold | 800 | ||

| (To record the cost of inventory used for production) |

Table (4)

- Inventory is an asset and it increases the value of assets. Therefore, debit inventory by $800.

- Cost of goods sold is a component of stockholders’ equity and it decreases the value of stockholder’s equity. Therefore, credit cost of goods sold by $800.

c. Record the sale of merchandise on account and put back of inventory from production:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Accounts Receivable | 20,000 | ||

| Sales Revenue | 20,000 | ||

| (To record the sales made on account) |

Table (5)

- Accounts receivable is an asset and it increases the value of assets. Therefore, debit accounts receivable by $20,000.

- Sales revenue is component of stockholders’ equity and it increases the value of stockholder’s equity. Therefore, credit sales revenue by $20,000.

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Cost of goods sold | 9,000 | ||

| Inventory | 9,000 | ||

| (To record the cost of inventory return) |

Table (6)

- Cost of goods sold is a component of stockholders’ equity and it decreases the value of stockholder’s equity. Therefore, debit cost of goods sold by $9,000.

- Inventory is an asset and it decreases the value of asset. Therefore, credit inventory by $9,000.

d. Record the cash received from credit customer.

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Cash | 10,000 | ||

| Accounts Receivable | 10,000 | ||

| (To record the cash received from the credit customer) |

Table (7)

- Cash is an asset and it increases the value of assets. Therefore, debit cash by $10,000.

- Accounts receivable is an asset and it decreases the value of assets. Therefore, credit accounts receivable by $10,000.

e. Record the sales return and allowances:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Sales revenue | 1,800 | ||

| Accounts receivable | 1,800 | ||

| (To record the sales returns and allowances ) |

Table (8)

- Sales revenue is a component of stockholders’ equity and it decreases the value of stockholder’s equity. Therefore, debit sales returns and allowances by $1,800

- Accounts receivable is an asset and it decreases the value of assets. Therefore, credit accounts receivable by $1,800

4.

Describe whether the given contract would increase the gross profit and gross profit percentage of Company C.

Explanation of Solution

Describe whether the given contract would increase the gross profit and gross profit percentage of Company C as follows:

In this case, the gross profit percentage is decreased from 45% to 43.8% (refer working note 5), because of the sale of contract.

Working note 4:

Calculate the gross profit for sale of contract:

Working note 5:

Calculate the gross profit percentage of Company after the sale of contract.

Want to see more full solutions like this?

Chapter 6 Solutions

FUND. OF FINANCIAL ACCT.-CONNECT ACCESS

- In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1. Carla Vista Co. enters sales and sales taxes separately on its cash register. On April 10, the register totals are sales $26,500 and sales taxes $1,325. 2. Wildhorse Co. does not segregate sales and sales taxes. Its register total for April 15 is $18,550, which includes a 6% sales tax. (a) Prepare the entry to record the sales transactions and related taxes for Carla Vista Co.. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Apr. 10 enter an account title to record the sales transactions and related taxes for Carla Vista Co. on April 10enter an account title to record the sales transactions and related taxes for Carla Vista Co. on April 10 enter a debit amountenter a debit amount enter a credit amountenter a…arrow_forwardIn performing accounting services for small businesses, you encounter the following situations per taining to cash sales. 1. Tamarisk, Inc. enters sales and sales taxes separately in its cash register. On April 10, the register totals are sales $37,500 and sales taxes $1,875. 2. Ivanhoe Company does not segregate sales and sales taxes. Its register total for April 15 is $24,610, which includes a 7% sales tax. Prepare the entry to record the sales transactions and related taxes for each client. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit Tamarisk, Inc. 1. choose a transaction date enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an account title enter a debit…arrow_forwardNevada Company provided services with a list price of $48,500 to Small Enterprises with terms 2/15, n/45. Nevada records sales at gross. Required: Question Content Area 1. Prepare the entry to record this sale in Nevada's journal 2. Prepare the entry for Nevada's journal to record receipt of cash in payment for the sale within the discount period. If an amount box does not require an entry, leave it blank. 3.Prepare the entry for Nevada's journal to record receipt of cash in payment for the sale after the discount period.arrow_forward

- [The following information applies to the questions displayed below.] Hughes Hair Design is a wholesaler of hair supplies. Hughes Hair Design uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $32,397). $ 57,600 b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $320). 350 c. Sold merchandise (costing $7,600) to a customer on account with terms n/60. 16,000 d. Collected half of the balance owed by the customer in (c). 8,000 e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. 180 f. Anticipate further returns of merchandise (costing $240) after year-end from sales made during the year. 360 Prepare journal entries to record transactions (a)–(f). (If no entry is required for a transaction/event, select "No Journal Entry Required"…arrow_forwardI. Solve the following problem using MS Excel In many situations, a retailer may not compile a profit or loss statement for individual departments. Suppose that you are a retail buyer, and you decide to recreate the statement for your own department using the following data: Gross sales of $72,300.00, net sales of $60,900.00, opening inventory of $13,900.00, ending inventory of $19,400.00, purchases of $14,000.00, inward freight of 2%, cash discounts of 5%, returns to vendors of $500.00, alterations and workroom costs of 3%, direct expenses of $19,600.00 and total expenses worth $35,000.00, complete the profit or loss statement.(Hint: Remember that freight and cash discount %’s are calculated as % of Purchases, while the alteration/workroom costs % is expressed as % of NS).arrow_forwardA store engaged in reselling jewelries would least likely employ which inventory system? a. EOQ b. Two-bin method c. Just in time d. ABC system 7. A grocery store owner selling low value items would be the most interested in this inventory management system: a. EOQ b. Two-bin method c. Just in time d. ABC system 8. Components of a firm’s cash conversion cycle include: a. Average collection period, average age of inventory b. Average payment period, average collection period c. Average age of inventory and average payment period d. Average of age inventory, average collection period and average payment period 9. Which of the following statements is correct with regard to the use of a lockbox system? a. It reduces mail float and clearing float but not payment float. b. It reduces all components of a float. c. It reduces payment and mail float but not clearing float. d. It increases all…arrow_forward

- In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1. Sunland Company enters sales and sales taxes separately on its cash register. On April 10, the register totals are sales $31,500 and sales taxes $1,575. 2. Crane Company does not segregate sales and sales taxes. Its register total for April 15 is $23,850, which includes a 6% sales tax. Prepare the entry to record the sales transactions and related taxes for Sunland Company. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Apr. 10 enter an account title to record the sales transactions and related taxes for Sunland Company on April 10 enter a debit amount enter a credit amount enter an account title to record the sales transactions and related taxes for Sunland Company on April 10 enter a debit amount enter a…arrow_forwardWalMart and other retailers have computerized cash registers to ring up sales. How does this feature help these firms manage inventory? Purchase prices change over time. When ordering inventory to replace what has been sold, the purchasing agent might find a price increase. Discuss and explain one of the following: First in First Out Last in First Out Weighted Average Cost Specific Identification Lower of Cost or Marketarrow_forwardIn performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1. Sandhill Co. enters sales and sales taxes separately on its cash register. On April 10, the register totals are sales $27,000 and sales taxes $1,350. 2. Carla Vista Co. does not segregate sales and sales taxes. Its register total for April 15 is $19,080, which includes a 6% sales tax. Prepare the entry to record the sales transactions and related taxes for Sandhill Co. Date Account Titles and Explanation Debit Credit Apr. 10 enter an account title to record the sales transactions and related taxes for Sandhill Co. on April 10enter an account title to record the sales transactions and related taxes for Sandhill Co. on April 10arrow_forward

- In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1. Poole Company enters sales and sales taxes separately on its cash register. On April 10, the register totals are sales $52,000 and sales taxes $2,600. 2. Waterman Company does not segregate sales and sales taxes. Its register total for April 15 is $25,380, which includes a 8% sales tax. Prepare the entry to record the sales transactions and related taxes for each client.arrow_forwardThe following data was taken from the Metropolitan University, Inc. Income Statement: Cost of good solds $30,000 Purchases returns and allowances 1,500 Sales returns and allowances 3,750 Gross profit 25,000 Selling expenses 9,000 Net income 10,750 Transportation-in 1,250 Purchases 35,000 Ending inventory 8,790 REQUIRE Compute (ignore taxes): a. Sales b. Bengining inventory c. General and administrative expensesarrow_forwardIn performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1. Pina Colada Corp. enters sales and sales taxes separately in its cash register. On April 10, the register totals are sales $37,000 and sales taxes $1,850. 2. Cullumber Company does not segregate sales and sales taxes. Its register total for April 15 is $22,896, which includes a 6% sales tax. Prepare the entry to record the sales transactions and related taxes for each client. Omit the cost of goods sold entry.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning