Fred, Inc., and Herman Corporation formed a business combination on January 1, 2016, when Fred acquired a 60 percent interest in Herman’s common stock for $312,000 in cash. The book value of Herman’s assets and liabilities on that day totaled $300,000 and the fair value of the noncontrolling interest was $208,000. Patents being held by Herman (with a 12-year remaining life) were undervalued by $90,000 within the company’s financial records and a customer list (10-year life) worth $130,000 was also recognized as part of the acquisition-date fair value.

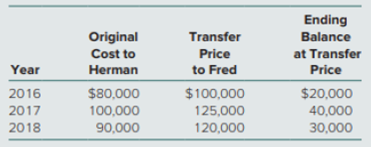

Intra-entity inventory transfers occur regularly between the two companies. Merchandise carried over from one year to the next is always sold in the subsequent period.

Fred had not paid for half of the 2018 inventory transfers by year-end.

On January 1, 2017, Fred sold $15,000 in land to Herman for $22,000. Herman is still holding this land.

On January 1, 2018, Herman acquired $20,000 (face value) of Fred’s bonds in the open market. These bonds had an 8 percent cash interest rate. On the date of repurchase, the liability was shown within Fred’s records at $21,386, indicating an effective yield of 6 percent. Herman’s acquisition price was $18,732 based on an effective interest rate of 10 percent.

Herman indicated earning a net income of $25,000 within its 2018 financial statements. The subsidiary also reported a beginning

- a. Prepare consolidation worksheet adjustments for 2018.

- b. Calculate the amount of consolidated net income attributable to the noncontrolling interest for 2018. In addition, determine the ending 2018 balance for noncontrolling interest in the consolidated balance sheet.

- c. Determine the consolidation worksheet adjustments needed in 2019 in connection with the intra-entity bonds.

a.

Prepare consolidation worksheet adjustments for 2018.

Explanation of Solution

| Entry *TL | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Investment in Company H | 7,000 | |||

| Land | 7,000 | |||

| (Being intra-entity gain eliminated)) | ||||

| Entry *G | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Retained earnings of Company H | 8,000 | |||

| Cost of goods sold | 8,000 | |||

| (being opening unrealized gross profit eliminated) | ||||

| Entry S | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Common stock | 100,000 | |||

| Retained earnings on 01/01/2017 | 292,000 | |||

| Investment in Company H | 235,200 | |||

| Non controlling interest | 156,800 | |||

| (being controlling and non-controlling interest recorded) | ||||

| Entry A | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Patents | 75,000 | |||

| Customer List | 104,000 | |||

| Investment in Company H | 107,400 | |||

| Non controlling interest | 71,600 | |||

| (being assets transferred to controlling and non-controlling interest) | ||||

| Entry I | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Investment income | 3,000 | |||

| Investment in Company H | 3,000 | |||

| (being intra-entity equity income eliminated) | ||||

| Entry D | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Investment in Company H | 2,400 | |||

| Dividend expense | 2,400 | |||

| (being intra-entity dividend expense eliminated) | ||||

| Entry E | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Amortization expense | 20,500 | |||

| Patents | 7,500 | |||

| Customer List | 13,000 | |||

| (being amortization expense of current year recorded) | ||||

| Entry P | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Accounts Payable | 60,000 | |||

| Accounts Receivable | 60,000 | |||

| (being intra-entity receivables and payables eliminated) | ||||

| Entry B | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Bond payable | 20,000 | |||

| Premium on Bond payable | 1,069 | |||

| Interest Income | 1,873 | |||

| Investment in Bonds | 19,005 | |||

| Interest expense | 1,283 | |||

| Gain on retirement of Bonds | 2,654 | |||

| (being the intra-entity bonds recognized) | ||||

| Entry TI | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Sales | 120,000 | |||

| Cost of goods sold | 120,000 | |||

| (being intra-entity sale eliminated) | ||||

| Entry G | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Cost of goods sold | 7,500 | |||

| Inventory | 7,500 | |||

| (being unrealized gross profit on ending inventory eliminated) | ||||

Table: (1)

b.

Calculate the amount of consolidated net income attributable to the non-controlling interest for 2018. In addition, determine the ending 2018 balance for non-controlling interest in the consolidated balance sheet.

Explanation of Solution

Computation of the amount of consolidated net income attributable to the non-controlling interest for 2018:

| Particulars | Amount |

| Net income reported by company H in 2018 | $ 25,000 |

| Excess fair value amortizations | $ (20,500) |

| Deferred gross profit recognized | $ 8,000 |

| Unrecognized gross profit deferred | $ (7,500) |

| Net income realized in 2018 | $ 5,000 |

| Ownership of non-controlling interest | 40% |

| Net income attributable to non-controlling interest | $ 2,000 |

Table: (2)

Computation of the ending 2018 balance for non-controlling interest in the consolidated balance sheet:

| Particulars | Amount |

| Non-controlling interest as on 01/01/2018 | $ 228,400 |

| Net income attributable to non-controlling interest | $ 2,000 |

| Share of non-controlling interest in dividend | $ (1,600) |

| Non-controlling interest as on 12/31/2018 | $ 228,800 |

Table: (3)

c.

Determine the consolidation worksheet adjustments needed in 2019 in connection with the intra-entity bonds.

Explanation of Solution

The consolidation worksheet adjustments needed in 2019 in connection with the intra-entity bonds:

| Entry *B | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| 12/31/2019 | Bond payable | 20,000 | ||

| Premium on Bond payable | 733 | |||

| Interest Income | 1,901 | |||

| Investment in Bonds | 2,064 | |||

| Interest expense | 19,306 | |||

| Gain on retirement of Bonds | 1,264 | |||

| (being the intra-entity bonds eliminated) | ||||

Table: (4)

Want to see more full solutions like this?

Chapter 6 Solutions

ADVANCED ACCOUNTING W/CONNECT>CUSTOM<

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT